BP, Shell Shareholders Warn Against 'Meddling' Windfall Tax -- Financial News

06 Maio 2022 - 6:35AM

Dow Jones News

By David Ricketts

Of Financial News

Bumper profits at Shell PLC and BP PLC have reignited calls for

a windfall tax on oil giants to combat soaring energy bills, but

shareholders say the move would be "short-term meddling" by the

government.

"I'm not that wild on governments intervening in markets on an

ad hoc basis, particularly in businesses like this when lead times

on investments are very long," one top 20 shareholder in BP and

Shell told Financial News. "Anything that discourages long-term

planning--and short-term intervention would discourage long-term

investment--would be very problematic."

Shell and BP posted record profits for the first three months of

2022 this week. BP's more than doubled to $6.2 billion, up from

$2.6 billion last year--despite losing more than 20 billion pounds

($24.7 billion) after pulling its shareholding in Russian oil giant

Rosneft Oil Co.

Shell recorded a $9.1 billion profit during the first quarter,

almost three times the $3.2 billion it made last year.

The sharp increase in profit for both oil giants comes as energy

bills soar and the war in Ukraine pushes oil prices higher.

The record profits have led to calls from some politicians for

oil and gas giants to be slapped with a one-off levy to offset

spiralling costs for households.

Following Shell's results, shadow energy secretary Ed Miliband,

tweeted: "Another day, another oil and gas company making billions

in profits, and yet another day when the Conservatives shamefully

refuse to act with a windfall tax to bring down bills."

However, fund managers are unconvinced it is the right

approach.

"I don't think it is fair to dip into company profits when they

are good," said the top 20 shareholder. "Both of the big oil

companies are at pains to set out what their longer-term strategies

are, to be more diversified energy companies. It will be a long

process and it isn't in the interests of shareholders or society if

there is short-term meddling."

BP said it plans to invest up to GBP18 billion in the U.K.'s

energy system by 2030, including offshore wind and electric vehicle

charging points. The planned investment from BP comes as asset

managers with active fossil fuel stakes tout their ESG credentials,

highlighting how their investment in heavy carbon emitters could

actually help them cut greenhouse gases.

Steve Clayton, a fund manager at Hargreaves Lansdown who holds

both BP and Shell across the HL Select UK Income fund, said: "We

cannot support windfall taxes on companies going about their

ordinary course of business."

"BP and Shell lost money, hand over fist, when energy prices

were weak. A bumper year isn't a windfall if it comes after or

precedes a drought year."

He added: "President Putin has engineered an extraordinary price

environment and currently producers are reaping the benefit. But if

Europe and the West are serious about displacing Russian energy

permanently from their supply base, then investment levels will

have to rise sharply."

Another top 20 shareholder in BP added: "North Sea oil activity

is so limited these days that a windfall UK tax wouldn't have that

much of an impact on the kind of results that BP have announced. It

would just put them off any future investment."

U.K. Prime Minister Boris Johnson has so far rejected calls for

a windfall levy on oil and gas companies, telling ITV on May 3 that

it would "discourage them from making investments we want to see,

that in the end will keep prices lower for everybody."

Mr. Clayton said: "It is always tempting for governments to

consider taking money from an industry that is making high profits

at any given moment. But it is rarely wise for them to do so."

"After all, for a productive economy, money must seek out the

best possible returns. Take those opportunities away and less

productive investments will be made and our growth potential

reduced."

Website: www.fnlondon.com

(END) Dow Jones Newswires

May 06, 2022 05:20 ET (09:20 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

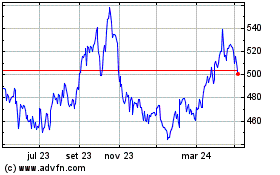

Bp (LSE:BP.)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

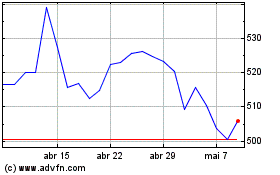

Bp (LSE:BP.)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024