FedEx Shares Rise After Fiscal-Year Guidance Ahead of Views

24 Junho 2022 - 4:12PM

Dow Jones News

By Michael Dabaie

FedEx Corp. shares were up 7.1%, to $243, in Friday afternoon

trading after quarterly revenue increased and earnings guidance

came in ahead of analyst views.

"Revenue management actions drove our growth which was partially

offset by lower shipment demand. FedEx Ground and FedEx Express

generated year-over-year revenue growth of 4% and 6% respectively

despite lower volume levels," Chief Customer Officer Brie Carere

said on the transportation, e-commerce and business services

company's earnings call.

After the bell Thursday, the company reported fourth-quarter

revenue of $24.4 billion and adjusted earnings per share of $6.87.

Both metrics were shy of FactSet consensus, but higher compared

with the same period last year.

The company also guided for adjusted earnings per share for

fiscal-year 2023 of $22.50 to $24.50, better than FactSet consensus

for $22.21.

Chief Financial Officer Mike Lenz on the call said "we enter

fiscal 2023 with a strong foundation for driving improved

profitability and returns. We are mindful of the uncertainty across

many fronts, including the pace of global economic activity,

inflation, energy prices, additional pandemic developments and

further geopolitical risk. We are actively adjusting to these

changing circumstances."

"We anticipate consumers will keep spending and their spending

will continue tilting towards services from goods. We expect more

consumers to return to stores. With this backdrop, we do expect

pressure on B2C volumes," Ms. Carere said on the call.

"We remain focused on revenue quality as one of the key levers

to help offset the ongoing macroeconomic pressures and driving

improved margins going forward," Chief Executive Raj Subramaniam

said on the call.

Oppenheimer analysts Scott Schneeberger and Daniel Hultberg in a

note said that FedEx's improving business trends are anticipated to

persist as the company remains focused on revenue management as

labor shortage and cost issues normalize.

Patrick Tyler Brown and David Hicks, analysts at Raymond James,

in a research note said "while FDX continues to lean into pricing

and the environment remains relatively constructive as the company

closed out FY2022, we believe FDX squarely remains a 'show me'

story that will largely be driven by an improvement in its Ground

segment & improving [free cash flow] profile."

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

June 24, 2022 14:57 ET (18:57 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

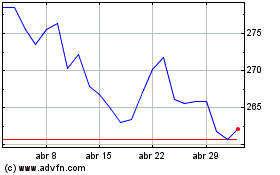

FedEx (NYSE:FDX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

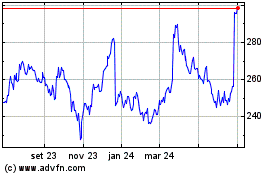

FedEx (NYSE:FDX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024