Shell to Reverse up to $4.5 Billion in Impairments on Assets

07 Julho 2022 - 4:13AM

Dow Jones News

By Joe Hoppe

Shell PLC said Thursday it will reverse previous aftertax

impairments of up to $3.5 billion to $4.5 billion to its upstream

and integrated gas assets in the second quarter.

The oil major said it had raised its mid- and long-term oil and

gas commodity prices outlook in the second quarter to reflect the

current macroeconomic environment as well as updated energy-market

demand and supply fundamentals.

The company also said it expects its integrated gas production

to be between 930,000 and 980,000 barrels of oil equivalent per

day, and liquid natural gas liquefaction volumes to be between 7.4

million and 8.0 million metric tons. Trading and optimization

results for integrated gas is expected to slip on-quarter in the

second quarter.

Shell further expects one-off charges of around $200 million in

the second quarter, including well write-offs, provisions and

commercial settlements.

Second-quarter marketing earnings are expected to rise

on-quarter, to be in-line compared with the second quarter of

2021.

The company expects its chemicals and products division's

trading and optimization results to be strong in the second

quarter, though to be lower than the first quarter.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

July 07, 2022 02:58 ET (06:58 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

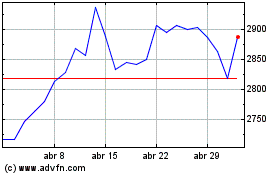

Shell (LSE:SHEL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Shell (LSE:SHEL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024