Shell Upgrades Asset Values on Energy-Price Rise -- Update

07 Julho 2022 - 4:45AM

Dow Jones News

By Joe Hoppe

Shell PLC said Thursday that it would reverse previous

impairments of up to $4.5 billion to its upstream and integrated

gas assets in the second quarter after it raised its energy-prices

outlook.

The oil major said it had raised its mid- and long-term oil and

gas commodity prices outlook in the second quarter to reflect the

current macroeconomic environment as well as updated energy-market

demand and supply fundamentals.

The company also said it expects its integrated gas production

to be between 930,000 and 980,000 barrels of oil equivalent a day,

and liquid natural gas liquefaction volumes to be between 7.4

million and 8.0 million metric tons. Its trading and optimization

result for integrated gas is expected to slip on-quarter in the

second quarter.

The company expects to report a hit of $300 million to $350

million following the derecognition of its Sakhalin assets in

Russia, after a presidential decree in that country changed the

ownership structure of the project.

Shell further expects one-off charges of around $200 million in

the second quarter to its integrated gas assets, including well

write-offs, provisions and commercial settlements.

Production in its upstream assets are expected to be between

1.85 billion and 1.95 billion barrels of oil equivalent per day,

reflecting higher scheduled maintenance.

Second-quarter marketing earnings are expected to rise

on-quarter, to be in-line compared with the second quarter of

2021.

The company expects its chemicals and products division's

trading and optimization results to be strong in the second

quarter, though to be lower than the first quarter.

Improvements to the refining margin--which rose to $28.04 a

barrel from $10.23 a barrel in the first quarter--are expected to

add between $800 million and $1.2 billion to the second-quarter

results when compared to the first quarter of 2022.

The renewables-and-energy solutions division expects to post

second-quarter earnings of $400 million to $900 million, benefiting

from higher trading and optimization margins.

Shares at 0708 GMT were up 44.8 pence, or 2.3% at 2,019.0

pence.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

July 07, 2022 03:30 ET (07:30 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

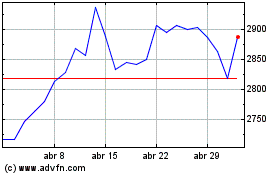

Shell (LSE:SHEL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Shell (LSE:SHEL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024