Glencore Reports Mixed 1st Half Production, Cuts 2022 Copper Guidance -- Commodity Comment

29 Julho 2022 - 5:58AM

Dow Jones News

Glencore PLC on Friday reported mixed production for the first

half of the year and cut its copper output guidance while keeping

other forecasts unchanged. Here's what the commodity mining and

trading company had to say:

On copper production:

"Own sourced copper production of 510,200 tons was 87,700 tons

(15%) lower than 1H 2021 due to ongoing geotechnical constraints at

Katanga (35,500 tons), the basis change arising from the sale of

Ernest Henry in January 2022 (21,900 tons), Collahuasi mine

sequencing (18,100 tons) and lower copper units produced within

Glencore's zinc business."

On zinc production:

"Own sourced zinc production of 480,700 tons was 101,000 tons

(17%) lower than 1H 2021 reflecting progressive reduction in the

South American portfolio through disposals and closures (49,600

tons), Covid-19 related absenteeism leading to lower development

rates and sequence changes at Mount Isa (34,800 tons) and somewhat

lower Antamina production."

On nickel Production:

"Own sourced nickel production of 57,800 tons was 10,100 tons

(21%) higher than 1H 2021 reflecting Koniambo operating both

production lines in 2022 and Murrin stable operations compared to

maintenance in base period."

On coal production:

"Coal production of 55.4 million tons was 6.7 million tons (14%)

higher than 1H 2021, mainly reflecting higher attributable

production from Cerrejon, following the acquisition in January 2022

of the remaining two-thirds interest that Glencore did not already

own."

On ferrochrome production:

"Attributable ferrochrome production of 786,000 tons was 13,000

tons (2%) higher than 1H 2021, reflecting consistent smelter

performance."

On oil production:

"Entitlement interest oil production of 3.1 million barrels of

oil equivalent was 0.6 million barrels (22%) higher than 1H 2021,

due to commencement of the gas phase of the Alen project in

Equatorial Guinea from March 2021."

On guidance:

"Our full year production guidance remains unchanged with the

exception of copper, where the ongoing geotechnical constraints

relating to Katanga's open pit and continued management of higher

levels of acid-consuming ore, largely account for the reduced

guidance of 1,060kt (previously 1,110kt)."

Shares at 0812 GMT were up 10.30 pence, or 2.3%, at 459.65

pence.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

July 29, 2022 04:43 ET (08:43 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

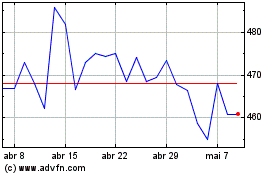

Glencore (LSE:GLEN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

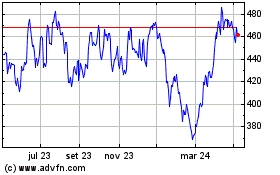

Glencore (LSE:GLEN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024