Nike Shares Hit 52-Week Low as Analysts Cut Targets, But Not Ratings

30 Setembro 2022 - 3:27PM

Dow Jones News

By Dean Seal

Shares of Nike Inc. fell more than 13% to a 52-week low of

$82.50 on Friday after delivering a downbeat outlook that pushed

Wall Street analysts to cut their price targets for the company,

though not their ratings of the stock.

The shoe manufacturer reported after the bell on Thursday that

its inventories were up 44% to $9.7 billion in the latest quarter

and its bottom line was pressured by higher discounts and freight

costs.

Shares started sliding in off-hours trading, and continued to

tumble in premarket trading on Friday as analysts cut their price

targets for Nike, but notably declined to downgrade the stock's

rating.

UBS analysts said in a research note that while Nike's latest

quarter shows some challenges in the near term, the company

continues to be a long-term outperformer as it accelerates its

consumer direct business and its business in China continues to

rebound.

Analysts at Credit Suisse trimmed their price target to reflect

Nike's conservative guidance, but noted that there is "opportunity

in the dip" that the company's stock is experiencing.

JPMorgan analysts cut their price target based on the company's

earnings expectations, but said its brand momentum across markets

has been sustainable and provides insulation to macroeconomic

volatility.

Analysts at Stifel said strong demand during the latest quarter

was overshadowed by Nike's inventory woes and foreign exchange

headwinds. But clearances pressures should reverse by fiscal year

2024, they said.

"Given Nike's track record for successfully navigating difficult

macro environments, we are comfortable extending our time horizon

for valuation to FY24," the Stifel analysts said in a note.

Wedbush analyst Tom Nikic also took on an optimistic tone. In a

note, he said that with Nike's latest guidance, the stock should

now move higher if growth in its Chinese business recovers,

inventory growth moderates, demand gets kick-started by upcoming

sporting events and consumers respond positively to new innovations

in its product lines.

"We do have confidence in [Nike's] ability to navigate choppy

waters and emerge more rapidly from the current disruption than

most other brands we cover," Mr. Nikic said.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

September 30, 2022 14:12 ET (18:12 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

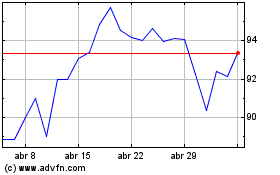

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

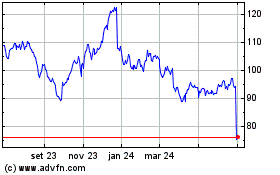

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024