Volkswagen's 3Q Results Weighed by Costs; Flags Supply-Chain Issues -- Update

28 Outubro 2022 - 6:57AM

Dow Jones News

By Kim Richters

Volkswagen AG on Friday posted third-quarter operating profit

that missed analysts' estimates as it was dragged by one-off costs,

while the car maker cut its vehicle sales outlook due to continued

supply-chain constraints.

The German auto maker said operating profit rose to 4.27 billion

euros ($4.26 billion) from EUR2.60 billion with the corresponding

return on sales increasing to 6.0% from 4.6%.

However, profit was hit by nonrecurring costs of around EUR1.6

billion related to its activities in Russia and the Porsche AG IPO,

and missed consensus estimates of EUR4.71 billion, according to a

Factset forecast.

Other burdens in the quarter included a EUR1.9 billion noncash

impairment charge connected to the withdrawal from the Argo AI

investment, the company said.

Quarterly revenue rose 24% to EUR70.71 billion, supported by the

performance of its premium, sport and luxury segments, and slightly

higher than analysts' forecast of EUR70.36 billion, according to

consensus estimates from FactSet.

Volkswagen confirmed it plans to reach the upper end of the

7.0%-8.5% operating-margin guidance and also the higher end of its

revenue-growth target this year.

However, the car maker cut its vehicle sales outlook for the

year and now expects deliveries similar to last year due to

continued supply-chain constraints. It previously expected a 5%-10%

increase. It also said other challenges include increasing

competitive intensity and stricter emissions-related

requirements.

At 0926 GMT, preferred shares in Volkswagen were down 2.7% at

EUR127.14.

Write to Kim Richters at kim.richters@wsj.com

(END) Dow Jones Newswires

October 28, 2022 05:42 ET (09:42 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

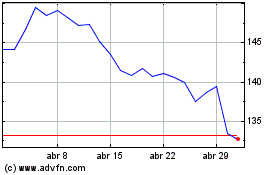

Volkswagen (TG:VOW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Volkswagen (TG:VOW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024