The FTSE 100 closed Friday up 0.04%, buoyed by China reopening

news, a relatively calm reaction to U.S. Producer Price Index data

and no doubt hopes of a year-end rally. China's reopening has a

long way to go, but it has been enough this week to provide a hope

of improvement in the outlook, and the FTSE 100 has benefited,

edging back up after fall to a one-week low, IG Group chief market

analyst Chris Beauchamp says in a research note. "InterContinental

Hotels Group PLC's 3% rise on hopes of more good news from China

has helped that move, helping to steady the index and put it on

course for a move up towards 7600 as the year heads to its close,"

Beauchamp says.

Companies News:

Associated British Foods Backs FY 2023 View Despite Cost

Inflation

Associated British Foods PLC said Friday that it backed its

full-year outlook, but that it was mindful of further significant

input cost inflation.

---

Berkeley Group 1H Profit Fell; Backs FY 2023 Guidance

Berkeley Group Holdings PLC said Friday that pretax profit and

revenue fell for the first half of fiscal 2023, and backed its

full-year expectations.

---

Anglo American Sees 2022 Production Down 3%

Anglo American PLC said Friday that 2022 production was down by

around 3% as the Quellaveco copper ramp-up and strong diamond

production was offset by ore grades in Chile and lower production

from Kumba and platinum group metals.

---

Hitachi-Thales Deal Could Push Up Fares for Passengers, UK

Watchdog Says

Hitachi Ltd.'s planned acquisition of Thales SA's

rail-infrastructure business could lessen competition and drive up

fares in the U.K., the country's financial regulator said Friday,

warning of an in-depth probe of the deal if its concerns aren't

addressed.

---

Pendragon Says Hedin Mobility Has Abandoned Takeover Offer

Pendragon PLC said Friday that Hedin Mobility Group AB has

decided not to make an offer for the company due to challenging

market conditions and an uncertain economic outlook.

---

Crestchic Agrees to GBP122 Mln Takeover by Aggreko

Crestchic PLC said Friday that it has agreed to a 122

million-pound ($149.3 million) takeover by privately-owned

temporary power supplier Aggreko Ltd.

---

Bonhill Gets GBP6.6 Mln Offer for UK, Asia Units; Cuts 2022

Guidance Further

Bonhill Group PLC said Friday that it has received a 6.6

million-pound ($8.1 million) offer for its U.K. and Asia

businesses, but further cut its guidance for 2022.

---

ProCook Group Sees FY 2023 Revenue of GBP60 Mln-GBP65 Mln Amid

Softer Consumer Demand

ProCook Group PLC said Friday that it has seen weaker sales

performance than expected in recent weeks amid softer consumer

demand and it now expects full-year revenue for fiscal 2023 to be

between 60 million pounds and 65 million pounds ($73.4

million-$79.5 million).

---

Gulf Marine Services Tightens 2022 Ebitda Guidance; Vessel

Utilization to Rise

Gulf Marine Services PLC on Friday tightened its 2022 Ebitda

guidance to between $70 million and $72 million, up on year, and

said vessel utilization is expected to rise.

---

Gemfields Gets $66.8 Mln from December Ruby Auction

Gemfields Group Ltd. on Friday said that it secured auction

revenue of $66.8 million for a ruby auction held from Nov. 21-Dec.

8.

---

Taylor Maritime 1H Pretax Profit Hit by Investment Loss

Taylor Maritime Investments Ltd. on Friday reported a

substantial drop in pretax profit and net asset value for the first

half of its fiscal 2023 as it booked a loss on the value of its

investments compared with a credit for the comparable period

---

Nanoco Placed First in Trial Schedule Against Samsung; Shares

Rise

Nanoco Group PLC shares rose Friday after the company said that

it has been placed first in a trial schedule starting Jan. 6, in

its case against Samsung Group for infringement of its intellectual

property.

---

Porvair Sees FY 2022 Revenue Up 18%, EPS Beating Forecasts;

Shares Rise

Shares of Porvair PLC rose as much as 13% on Friday after the

company said that it expects to report an 18% rise in revenue for

fiscal 2022 and to beat market forecasts for adjusted earnings per

share.

---

Glantus CFO Grainne McKeown Steps Down; Diane Gray-Smith Takes

on Interim Role

Glantus Holdings PLC said Friday that Chief Financial Officer

Grainne McKeown has stepped down and left the company for personal

reasons.

---

Man Group Launches $125 Mln Share Buyback Program

Man Group PLC said Friday that it is launching a $125 million

share buyback program, in line with its policy to distribute

capital to shareholders while maintaining a prudent balance

sheet.

---

GreenRoc Mining Raises GBP315,000 to Develop Greenland Graphite

Project

GreenRoc Mining PLC said Friday that it has raised 315,000

pounds ($385,402) via a discounted placing, with the proceeds to be

used toward developing the Amitsoq graphite project.

---

International Public Partnerships Buys New Zealand Portfolio for

$128 Mln

International Public Partnerships Ltd. said Friday that it has

agreed to acquire five infrastructure investments in New Zealand

for around 200 million New Zealand dollars ($127.6 million) from

Morrison & Co managed Public Infrastructure Partners.

---

Thales's Transport-Systems Sale to Hitachi Likely Delayed Amid

UK Antitrust Concerns

A sale of Thales SA's transportation-systems business to Japan's

Hitachi Ltd. is likely to be delayed by months until the second

half of next year amid antitrust concerns in the U.K, the French

aerospace-and-defense group said Friday.

---

Global Invacom Group Executive Chairman Tony Taylor Steps

Down

Global Invacom Group Ltd. said Friday that Executive Chairman

Tony Taylor is stepping down from the company after 16 years'

service, and that Gordon Blaikie will become interim chief

executive officer while the board looks for a replacement.

---

VTB Bank's UK Arm Placed Into Administration

The U.K. arm of Russia's VTB Bank has been placed in

administration in London, its administrators said Friday in a

statement, after being hit with sanctions on the onset of Russia's

invasion of Ukraine.

---

Autolus Therapeutics ADSs Tumble Premarket on Public Offering

>AUTL

American depositary shares of Autolus Therapeutics PLC tumbled

in premarket trading Friday after the clinical-stage

biopharmaceutical company said it was raising $150 million in a

dilutive public offering.

---

Penguin Random House CEO Resigns Weeks After Simon &

Schuster Deal Was Blocked -- Update

By Jeffrey A. Trachtenberg

---

FBD Holdings CFO John O'Grady to Retire at End of 2023

FBD Holdings PLC said Friday that Chief Financial Officer John

O'Grady plans to retire from the company and FBD Insurance PLC at

the end of next year.

Market Talk:

K3 Capital Takeover Offer From Sun Capital Partners Seems

Modest

1412 GMT - K3 Capital's takeover proposal from Sun Capital

Partners is a modest one and it is surprising management is backing

it unless they are pessimistic about future trading, says Shore

Capital analyst Jamie Murray. Shore Capital is unsure the offer is

high enough to represent good value and that with the share price

currently below the 350 pence-a-share proposal, adds to uncertainty

any deal will take place. Shore Capital has cut its rating on the

stock to hold from buy and trimmed its target price to 350 pence

from 410 pence. Shares fall 2.3% at 317.50 pence, paring some of

Thursday's gains. (elena.vardon@wsj.com)

Contact: London NewsPlus, Dow Jones Newswires;

(END) Dow Jones Newswires

December 09, 2022 11:52 ET (16:52 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

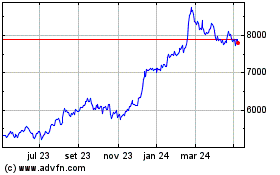

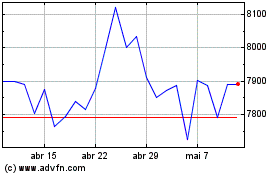

Intercontinental Hotels (LSE:IHG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Intercontinental Hotels (LSE:IHG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024