SSE Raises Fiscal Year 2023 Adjusted EPS Guidance to More than 150p

20 Janeiro 2023 - 4:49AM

Dow Jones News

By Joe Hoppe

SSE PLC said Friday that it has raised fiscal 2023 adjusted

earnings per share expectations to more than 150 pence ($1.86) from

at least 120 pence, reflecting the strength of its business mix and

certainty from strong operational performance.

The FTSE 100 energy company said it is on track to report a

capital expenditure in excess of GBP2.5 billion for the fiscal

year.

The net debt to earnings before interest, taxes, depreciation

and amortization ratio is expected to be well below the target of

4.5 times for the year after the completion of a minority stake

sale of SSEN Transmission in November.

The company also said total renewables output in the nine months

ended Dec. 31 rose to 7,065 gigawatt hours from 6,076 gigawatt

hours a year earlier, but missed targets due to project delays and

unseasonably calm and dry weather.

The board proposed a full-year dividend of 85.7 pence a share,

plus retail price index. However, the dividend would be rebased to

60 pence in fiscal 2024, to support investment and growth plans,

and then increased by at least 5% a year.

"SSE is performing well in a shifting and volatile energy

landscape, underlining the strength of our balanced business mix

and the quality of our assets, and we are well placed to deliver a

strong financial performance for the full year," Finance Director

Gregor Alexander said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

January 20, 2023 02:34 ET (07:34 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

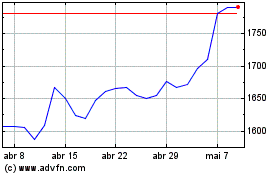

Sse (LSE:SSE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Sse (LSE:SSE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024