MARKET MOVEMENTS:

--Brent crude oil edged up 0.2% to $85.62 a barrel.

--European benchmark gas rose 1.1% to EUR58 a megawatt hour.

--Gold futures were flat at $1,945.20 a troy ounce.

--LME copper fell 1.2% at $9,164.50 a metric ton.

--Wheat futures edged down 0.2% at $7.60 a bushel.

TOP STORY:

BP's CEO Plays Down Renewables Push

BP PLC Chief Executive Bernard Looney plans to dial back

elements of the oil giant's high-profile push into renewable

energy, he has said in recent discussions with people close to the

company.

Mr. Looney has said he is disappointed in the returns from some

of the oil giant's renewable investments and plans to pursue a

narrower green-energy strategy, according to people familiar with

the discussions. He has told some of the people that BP needs to do

more to convince shareholders of its strategy to maximize profit in

areas where it has a competitive advantage, including its legacy

oil-and-gas operations.

In some of the conversations, Mr. Looney has said he plans to

place less emphasis on so-called ESG goals--a catchall term for

environmental, social and governance--to help clarify that those

aren't distracting the company from its ability to deliver profits,

the people said.

OTHER STORIES:

OPEC+ Ministers Set to Stay the Course on Oil Production Amid

China Covid Woes

An OPEC+ panel will likely recommend keeping the group's current

oil-production policy unchanged Wednesday, delegates said, amid

uncertainties about demand in China and the impact of sanctions on

Russian crude supplies.

Maintaining the status quo will allow the Organization of the

Petroleum Exporting Countries and a group of producers led by

Russia--collectively known as OPEC+--to take more time to assess

consumption data from China, the world's biggest oil importer, and

determine how a resurgence of Covid-19 cases there and European

Union sanctions on Moscow have affected demand.

Delegates said that OPEC+ will remain conservative in their

approach until there are clearer signals that markets require

higher crude supplies.

---

Glencore 2022 Production Volumes in Line With Guidance

Glencore PLC said Wednesday that its 2022 production volumes

were in line with the guidance issued in October.

The FTSE 100-listed commodity mining and trading company said

that copper and zinc volumes reflected the base effect of asset

sales as well as geotechnical constraints and supply-chain

headwinds in Kazakhstan.

Glencore said its copper production fell 12% to 1.1 million

metric tons last year compared with guidance of 1.1 million metric

tons, plus or minus 20,000 tons.

Copper guidance for 2023 stands at 1.0 million metric tons, plus

or minus 30,000 tons.

MARKET TALKS:

Nickel Pricing Likely to Stay Volatile in 1H

1058 GMT - Nickel pricing is likely to remain volatile for the

first half of 2023 with the market still reeling from last year's

short squeeze and subsequent drop in trading volumes. "Increased

fragmentation of the nickel market, along with recurring attempts

to remedy this and a lack of transparency, suggest prices will

remain volatile," Bank of America Global Research says in a note. A

correction on the LME is likely later this year, but as

electric-vehicle demand for nickel grows, output will need to

increase, BofA says. "We think that may be difficult, so the nickel

market, both in terms of Class 1, refined and Class 2, non-refined

units, is set to flip back into deficit by 2026. This should

ultimately keep prices supported." (yusuf.khan@wsj.com)

---

Glencore's 2022 Production Disappoints, But Tailwinds Brighten

Outlook

1010 GMT - Although Glencore's share price has performed

strongly over the past six to 12 months, its 2022 output figures

will have disappointed shareholders, eToro analyst Mark Crouch says

in a note. Results were in line with its October guidance but the

slide in production reflects a range of issues including asset

sales, production problems, supply-chain issues as well as

underwhelming hauls at some sites with 2023 production guidance

fairly conservative, Crouch says. "Looking forward, though, there

are some tailwinds that might provide a demand boost for base

metals, such as the lifting of Covid-19 restrictions in China and a

brighter-than-expected outlook for the global economy," Crouch

says. Shares are down 0.2% at 540.40 pence.

(anthony.orunagoriainoff@dowjones.com)

---

Glencore's 2022 Production Update Unlikely to Change Outlook

0833 GMT - Although Glencore's better production numbers will

likely drive some small consensus earnings increases into year end

there was little in the release to change outlook as there was a

lack of new guidance for 2023, RBC Capital Markets analyst Tyler

Broda says in a note. "We continue to see Glencore as providing the

best risk/reward on a 6 to 12 month view in the sector, however

near-term pressure on coal prices, driven by falling [Japan Korea

LNG] gas prices, are likely to weigh in the short term," Broda

says. RBC rates the stock outperform and has a 520 pence target

price. Shares are up 0.6% at 544.30 pence.

(anthony.orunagoriainoff@dowjones.com)

---

Metals Slip Ahead of Fed Rate Decision

0836 GMT - Metals are slipping ahead of Wednesday's Federal

Reserve decision on interest rates, with the market largely

expecting a 25 basis-point hike today. Three-month copper is down

0.9% to $9,196 a metric ton while gold is 0.3% lower at $1,938.90 a

troy ounce. The market is entering an pivotal spot for risk

markets, with the Fed able to set the tone for the months ahead,

says Stephen Innes, managing partner at SPI Asset Management. While

the market is widely expecting a 25bp hike, a less hawkish outcome

would be welcomed by investors, he adds. (yusuf.khan@wsj.com)

---

Oil Ticks Higher Ahead of Fed, OPEC+ Meetings

0834 GMT - Oil prices edge higher ahead of meetings of the

Federal Reserve and an OPEC+ panel. Brent crude gains 0.3% to

$85.73 a barrel. While both meetings have the potential to move the

oil market, the likely outcomes have been well flagged ahead of

Wednesday. The OPEC+ panel is largely expected to recommend keeping

output levels unchanged while the Fed is broadly seen raising

interest rates by half a percentage point. The OPEC+ meeting will

not consist of all the group members and so is unlikely to see a

big change in policy, ING says in a note. "The meeting could shed

some more light on how the group sees the outlook evolving in the

months ahead," the bank notes. (william.horner@wsj.com)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

February 01, 2023 07:26 ET (12:26 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

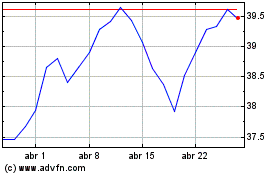

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

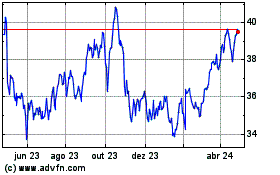

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024