Abrdn Swung to 2022 Pretax Loss on Adjusting Items

28 Fevereiro 2023 - 5:20AM

Dow Jones News

By Anthony O. Goriainoff

Abrdn PLC said Tuesday that it swung to a pretax loss for 2022

due to adjusting items, missing consensus, and that it intends to

return capital to shareholders in 2023 on a level similar to

2022.

The FTSE 100 investment company said pretax loss for the year

was 615 million pounds ($742 million) compared with a pretax profit

of GBP1.2 billion for 2021. The company said this was mostly due to

adjusting items of GBP868 million. Two analysts polled by FactSet

had a pretax profit forecast of GBP223.2 million for the year.

Adjusted operating profit--the company's preferred metric, which

strips out exceptional and other one-off items--was GBP263 million

compared with GBP323 million the year before. The company said this

was due "to 4% lower revenue as a result of lower market levels

which particularly impacted high yielding equities."

Net operating revenue fell to GBP1.46 billion from GBP1.52

billion the year prior.

Assets under management and administration at the end of 2022

fell 8% to GBP500 billion.

Total net outflows were GBP37.9 billion compared with net

outflows of GBP6.2 billion in 2021.

The board declared a final dividend of 7.3 pence a share, taking

the full year dividend to 14.6 pence.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

February 28, 2023 03:05 ET (08:05 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

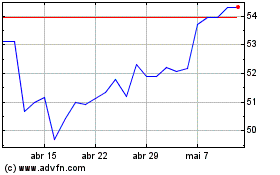

Lloyds Banking (LSE:LLOY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

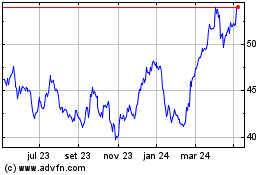

Lloyds Banking (LSE:LLOY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024