Silver Lake Consortium to Acquire Nasdaq-Listed Qualtrics

13 Março 2023 - 4:31AM

Dow Jones News

By Yi Wei Wong

U.S. private equity firm Silver Lake and Canada Pension Plan

Investment Board have agreed to acquire experience-management

software company Qualtrics International Inc. in a deal that values

the Nasdaq-listed company at around $12.5 billion.

The acquisition value includes purchasing all of SAP SE's

majority stake for approximately $7.7 billion, SAP said in a

statement Monday.

Under the terms of the agreement, Qualtrics shareholders,

including SAP, will receive $18.15 per share in cash, representing

a 73% premium to the 30-day volume-weighted average price on Jan.

25, the last full trading day prior to SAP's announcement to

explore a sale of its stake in Qualtrics.

Chief Executive Zip Serafin will continue to lead Qualtrics,

which will remain headquartered in Provo, Utah, and Seattle, the

company said.

The transaction will be financed by a mix of equity commitments

from Silver Lake and its co-investors, $1.75 billion in equity from

CPP Investments and $1.0 billion of debt.

Qualtrics's board of directors, a committee of independent

directors and major shareholder SAP have approved the

transaction.

The transaction is expected to close in the second half of 2023,

after which shares of Qualtrics will be delisted from Nasdaq, the

statement said.

Morgan Stanley & Co. acted as financial adviser to

Qualtrics, while Barclays is advising SAP.

Write to Yi Wei Wong at yiwei.wong@wsj.com

(END) Dow Jones Newswires

March 13, 2023 03:16 ET (07:16 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

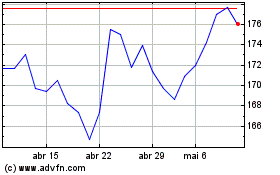

Sap (TG:SAP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Sap (TG:SAP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024