WeWork in Deal for Capital Injection, Debt Conversion

17 Março 2023 - 11:18AM

Dow Jones News

By Chris Wack

WeWork Inc. said Friday that it has entered into a series of

agreements with an ad hoc group representing more than 60% of its

public bonds, a third-party investor, and SoftBank's Vision Fund

II, which will provide it with an improved and sustainable balance

sheet.

The company said the ad hoc group includes funds and accounts

managed by King Street Capital Management L.P., funds and accounts

managed by BlackRock, funds and accounts managed by Brigade Capital

Management, and other leading financial institutions.

Collectively, the transactions will reduce WeWork's net debt by

$1.5 billion at closing, extend a significant maturity wall from

2025 to 2027, and result in new funding and new and rolled capital

commitments of more than $1 billion, once completed.

The transactions will deliver $540 million in new funding, $175

million in new capital commitments, and $300 million in rolled

capital commitments, totaling more than $1 billion, as well as net

incremental liquidity of more than $500 million after cancellation

of SoftBank's prior $500 million senior secured note purchase

agreement.

WeWork shares are up 2% at $1 in early Friday trade, and are

down 84% in the past 12 months.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

March 17, 2023 10:03 ET (14:03 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

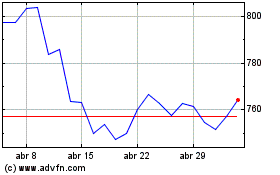

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024