Imperial Brands Sees Flat 1st Half Profit; On Track to Meet Full-Year Guidance -- Update

13 Abril 2023 - 4:33AM

Dow Jones News

By Kyle Morris

Imperial Brands PLC said Thursday that it is on track to meet

2023 guidance, and that first-half adjusted group operating profit

should be roughly flat on year on a constant-currency basis.

The tobacco group said that, excluding the impact of its exit

from Russia, first-half group net revenue is seen at a similar

level to the prior-year period at constant currency, with strong

combustible pricing offset by volume declines as the prior period

benefited from Covid-19-related changes in buying patterns. It sees

a stronger net revenue performance in the second half, driven by

normalization of volume trends.

For the full year, the company sees low single-digit constant

currency net revenue growth, in line with expectations.

First-half group adjusted operating profit is expected to be at

a similar level to last year on a constant currency basis.

For the first half of 2022, revenue was 15.36 billion pounds

($19.18 billion) and adjusted operating profit was GBP1.59

billion.

Aggregate share in its top five markets at the half year is

anticipated at a similar level to the prior period. The U.S., Spain

and Australia are anticipated to show growing or stable market

share, offsetting declines in Germany and the U.K.

First-half next generation products revenue is expected ahead of

the prior-year period, driven by strong growth in Europe and

offsetting a decline in the U.S. mainly related to uncertainty

caused by the marketing denial order for myblu.

Foreign exchange is expected to be an around 6.5% tailwind on

first-half earnings per share, and a roughly 2.5%-3.5% tailwind on

full-year earnings per share.

Write to Kyle Morris at kyle.morris@dowjones.com

(END) Dow Jones Newswires

April 13, 2023 03:18 ET (07:18 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

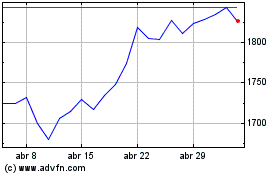

Imperial Brands (LSE:IMB)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Imperial Brands (LSE:IMB)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024