BP 1Q Underlying Replacement Cost Profit Rose on Quarter, Exceeding Expectations

02 Maio 2023 - 3:52AM

Dow Jones News

By Joe Hoppe

BP on Tuesday reported a rise in first-quarter underlying

replacement cost profit, beating expectations, and declared an

additional $1.75 billion share buyback.

The British oil-and-gas major made an underlying replacement

cost profit of $4.96 billion in the three months through to the end

of March, up from $4.81 billion in the previous quarter but below

the $6.25 billion in the first quarter of 2022.

This was above a market consensus of $4.27 billion, provided by

the company and averaged from the forecasts of 25 analysts.

BP attributed this to an exceptional gas marketing and trading

result, a lower level of refinery turnaround activity and a strong

oil trading result, partially offset by lower liquids and gas

realizations and lower refining margins.

The company posted a net income of $8.22 billion. This compares

with a net profit of $10.8 billion in the immediately prior

quarter, it added.

The FTSE 100 energy group also said it plans to launch a $1.75

billion share buyback program, prior to announcing its

second-quarter results.

BP added that the board remains committed to using 60% of 2023

surplus cash flow for share buybacks. Based on current oil price

forecasts, it expects to be able to deliver buybacks of around $4.0

billion a year.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

May 02, 2023 02:37 ET (06:37 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

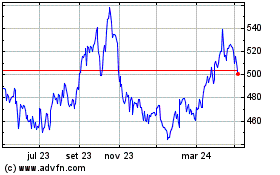

Bp (LSE:BP.)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

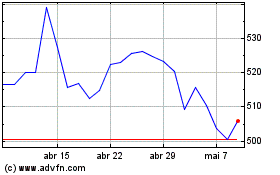

Bp (LSE:BP.)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024