Lloyds Banking Backs 2023 Guidance After 1Q Pretax Profit Beat

03 Maio 2023 - 3:55AM

Dow Jones News

By Elena Vardon

Lloyds Banking Group PLC on Wednesday maintained its full-year

guidance as it posted better-than-expected pretax profit for its

first quarter on strong net income and capital generation.

The U.K. lender posted a pretax profit of 2.26 billion pounds

($2.82 billion) for the three months to March 31, compared with

GBP1.54 billion for the same period a year earlier. It beat

expectations taken from a company-compiled consensus that had

estimated GBP1.95 billion.

Costs increased 5% on year in the period to GBP2.2 billion on

higher planned strategic investment, new business costs and

inflationary effects, it said.

The FTSE 100-listed bank's net interest income rose to GBP3.535

billion from GBP2.95 billion for the first quarter of 2022. It was

anticipated to rise to GBP3.59 billion for the period by consensus.

This was mainly driven by its banking net interest margin, which

was stable at 3.22% from the previous quarter.

Lloyds said customer deposits at GBP473.1 billion were down

GBP2.2 billion in the quarter on seasonal outflows and a more

competitive market.

The bank closed the period with a common equity Tier 1 ratio--a

key measure of balance-sheet strength--of 14.1%, in line with

views. Its return on tangible equity came in at 19.1%, beating

expectations of 15.9%.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

May 03, 2023 02:40 ET (06:40 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

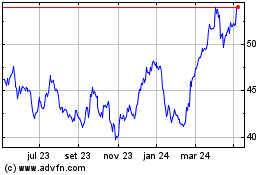

Lloyds Banking (LSE:LLOY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

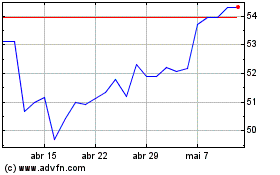

Lloyds Banking (LSE:LLOY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024