Axa Posts Rise in 1Q Revenue Boosted by Property and Casualty Business

15 Maio 2023 - 2:38AM

Dow Jones News

By Pierre Bertrand

Axa on Monday reported a rise in its first-quarter revenue

driven by growth at its property and casualty business.

The French insurer's total gross revenue came to 31.8 billion

euros ($34.51 billion) in the quarter, a 2% rise compared with

EUR31.17 billion a year ago.

Revenue for the period rose 6% at its property and casualty

business, while revenue fell 4% at both its life and health and its

asset management units, Axa said.

Within property and casualty, commercial lines revenue grew 7%

due to favorable prices and higher volumes, while personal-lines

revenue grew 4%, again driven by prices.

Life and health revenue declined due to lower premiums, the

insurer said.

Asset management saw net inflows of more than a billion euros,

but revenue decreased 4%, driven by lower management fees due to a

lower average asset base. Average assets under management at the

end of the first quarter decreased 7% to EUR736 billion, Axa

said.

The insurer's Solvency II ratio--a measure of an insurer's

financial strength--was 217% in the first quarter, up 2 percentage

points from Dec. 31, 2022.

Axa added that it expects Solvency II normalized operating

capital generation of between 25 to 30 points this year and that it

is confident it can achieve more than EUR7.5 billion underlying

earnings in 2023.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

May 15, 2023 01:23 ET (05:23 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

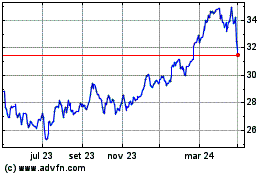

Axa (EU:CS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

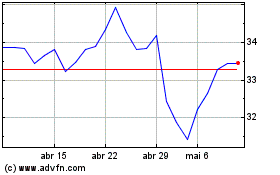

Axa (EU:CS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024