Amended Statement of Ownership: Solicitation (sc 14d9/a)

28 Dezembro 2021 - 10:57AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 5)

CoreSite Realty

Corporation

(Name of Subject Company)

CoreSite Realty

Corporation

(Name of Person Filing Statement)

COMMON STOCK, PAR VALUE $0.01 PER SHARE

(Title of Class of Securities)

21870Q105

(CUSIP Number of Class of Securities)

Jeffery S. Finnin

Chief Financial Officer

CoreSite Realty Corporation

1001 17th Street, Suite 500

Denver, CO 80202

(866) 777-2673

(Name, address and telephone numbers of person

authorized to receive notices and communications

on behalf of the persons filing statement)

With copies to:

Adam O. Emmerich

Zachary S. Podolsky

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

(212) 403-1000

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

This Amendment No. 5 amends and supplements the

Solicitation/Recommendation Statement on Schedule 14D-9 (as amended or supplemented from time to time, the “Schedule

14D-9”) previously filed by CoreSite Realty Corporation (the “Company”), a corporation organized

under the laws of Maryland, with the Securities and Exchange Commission on November 29, 2021, relating to the tender offer by Appleseed

Merger Sub LLC, a Maryland limited liability company (“Purchaser”) and a wholly owned subsidiary of Appleseed

Holdco LLC, a Delaware limited liability company (“Holdco”) and a wholly owned subsidiary of American Tower

Investments LLC, a California limited liability company (“Parent”) and a subsidiary of American Tower Corporation,

a Delaware corporation (“American Tower”), to purchase all of the outstanding shares of the Company’s

common stock, par value $0.01 per share (the “Shares” and each, a “Share”) at a price

per Share of $170.00, without interest and subject to any applicable withholding taxes, net to the seller in cash, upon the terms and

subject to the conditions set forth in the Offer to Purchase, dated November 29, 2021, as it may be amended or supplemented from time

to time, and the related Letter of Transmittal, as it may be amended or supplemented from time to time (together with the Offer to Purchase,

the “Offer”). Any capitalized term used and not otherwise defined herein shall have the meaning ascribed to

such term in the Schedule 14D-9.

Except as otherwise set forth below, the information

set forth in the Schedule 14D-9 remains unchanged and is incorporated herein by reference to the extent relevant to the items in this

Amendment No. 5. This Amendment No. 5 is being filed to reflect certain updates as set forth below.

|

Item 8.

|

ADDITIONAL INFORMATION

|

Item 8 “Additional Information”

of the Schedule 14D-9 is hereby amended and supplemented by adding the following paragraphs under a new section entitled “Expiration

of the Offering Period” before the heading “Cautionary Note Regarding Forward-Looking Statements” on page 35 of the

Schedule 14D-9:

“The Offer expired at one minute after 11:59

p.m., Eastern Time, on December 27, 2021. American Stock Transfer & Trust Company, LLC, the depositary and paying agent for the Offer,

advised Purchaser that, as of the expiration of the Offer, a total of 31,443,126 Shares were validly tendered and not validly withdrawn,

representing approximately 71.15% of the Shares outstanding as of the expiration of the Offer.

As of the expiration of the Offer, the number of

Shares validly tendered and not validly withdrawn pursuant to the Offer satisfied the minimum tender condition set forth in the Merger

Agreement, and all other conditions to the Offer were satisfied or waived. After the expiration of the Offer, Purchaser irrevocably accepted

for payment, and will promptly pay for, all Shares validly tendered and not validly withdrawn pursuant to the Offer.

As a result of its acceptance of the Shares tendered

pursuant to the Offer and in accordance with Section 3-106.1 of the MGCL, Purchaser owns a number of Shares that is greater than the percentage

of Shares that would be required to approve the Company Merger (which percentage is equal to a majority of the total number of outstanding

Shares entitled to vote on the Company Merger). Accordingly, pursuant to the Merger Agreement, American Tower and Purchaser will complete

the acquisition of the Company on December 28, 2021 by consummating the Company Merger pursuant to the Merger Agreement without a vote

or consent of the Company’s stockholders in accordance with Section 3-106.1 of the MGCL. At the effective time of the Company Merger,

each Share issued and outstanding immediately prior to such time (other than (i) certain restricted Shares and (ii) any Shares owned by

the Parent Parties) will be converted into the right to receive an amount in cash equal to the Offer Price.

Following consummation of the Company Merger,

the Shares will be delisted and will cease to trade on the New York Stock Exchange. The Company and American Tower will take steps to

cause the Shares to be deregistered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

as promptly as practicable.”

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

CORESITE REALTY CORPORATION

|

|

Date: December 28, 2021

|

By:

|

/s/ Jeffrey S. Finnin

|

|

|

Name:

|

Jeffrey S. Finnin

|

|

|

Title:

|

Chief Financial Officer

|

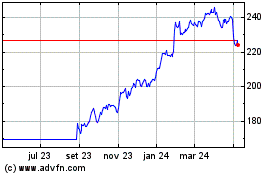

Cencora (NYSE:COR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

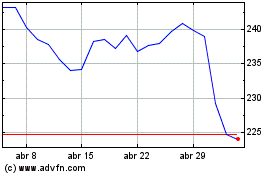

Cencora (NYSE:COR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024