Amended Tender Offer Statement by Third Party (sc To-t/a)

28 Dezembro 2021 - 11:59AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 6)

CoreSite

Realty Corporation

(Name of Subject Company (Issuer))

Appleseed Merger Sub LLC

(Offeror)

American

Tower Corporation

American Tower Investments LLC

Appleseed Holdco LLC

(Parents of Offeror)

(Names of Filing Persons)

Common Stock, Par Value $0.01 Per Share

(Title of Class of Securities)

21870Q105

(Cusip Number

of Class of Securities)

Edmund DiSanto, Esq.

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

c/o American Tower Corporation

116 Huntington Avenue

Boston, Massachusetts 02116

(617) 375-7500

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Benet J.

O’Reilly

Kimberly R. Spoerri

Michael Saliba

Cleary

Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, New York 10006

212-225-2000

CALCULATION OF FILING FEE

|

|

|

|

|

Transaction Valuation*

|

|

Amount of Filing Fee**

|

|

$7,526,200,220.00

|

|

$697,678.76

|

|

|

|

*

|

Estimated solely for purposes of calculating the filing fee pursuant to

Rule 0-11(d) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Transaction Valuation was calculated on the basis of the sum of (i) the product of (x)

43,672,637 shares of common stock of CoreSite Realty Corporation (“CoreSite”) issued and outstanding (other than shares subject to restricted stock awards of CoreSite and performance stock awards of CoreSite) and (y) the offer price

of $170.00 per share, (ii) the product of (x) 80,710 shares of common stock issuable pursuant to outstanding restricted stock units of CoreSite and (y) the offer price of $170.00 per share, and (iii) the product of (x) 518,419 shares

of common stock subject to outstanding restricted stock awards of CoreSite and performance stock awards of Coresite and (y) the offer price of $170.00 per share. The calculation of the filing fee is based on information provided by CoreSite as

of November 23, 2021.

|

|

**

|

The filing fee was calculated in accordance with Rule 0-11 under

the Exchange Act and Fee Rate Advisory #1 for fiscal year 2022, effective October 1, 2021, by multiplying the transaction value by 0.00009270.

|

|

☒

|

Check box if any part of the fee is offset as provided by Rule

0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

Amount Previously Paid:

|

|

$697,678.76

|

|

Filing Party:

|

|

Appleseed Merger Sub LLC

|

|

|

|

|

|

|

|

American Tower Corporation

|

|

|

|

|

|

|

|

American Tower Investments LLC

|

|

|

|

|

|

|

|

Appleseed Holdco LLC

|

|

Form or Registration No.:

|

|

Schedule TO

|

|

Date Filed:

|

|

November 29, 2021

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☒

|

third-party tender offer subject to Rule 14d-1.

|

|

|

☐

|

issuer tender offer subject to Rule 13e-4.

|

|

|

☐

|

going-private transaction subject to Rule 13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☒

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

☐

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

☐

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Amendment No. 6 (this “Amendment”) amends and supplements the Tender Offer

Statement on Schedule TO filed by Appleseed Merger Sub LLC, a Maryland limited liability company (“Purchaser”), and a wholly owned direct subsidiary of Appleseed Holdco LLC, a Delaware limited liability company (“Holdco”),

and a wholly owned indirect subsidiary of American Tower Investments LLC, a California limited liability company (“Parent”), and a wholly owned indirect subsidiary of American Tower Corporation, a Delaware corporation (“ATC”),

with the Securities and Exchange Commission on November 29, 2021 (together with any subsequent amendments and supplements thereto, including this Amendment, the “Schedule TO”). The Schedule TO relates to the offer by Purchaser to

purchase all of the outstanding shares of common stock, $0.01 par value per share (“Shares”), of CoreSite Realty Corporation, a Maryland corporation (“CoreSite”), at a price of $170.00 per Share, without interest and subject to

any applicable withholding taxes, net to the seller in cash, upon the terms and subject to the conditions described in the Offer to Purchase dated November 29, 2021 (together with any amendments or supplements thereto, the “Offer to

Purchase”) and in the accompanying Letter of Transmittal (together with any amendments or supplements thereto and with the Offer to Purchase, the “Offer”), which are annexed to and filed with the Schedule TO as

Exhibits (a)(1)(A) and (a)(1)(B), respectively.

Except as otherwise set forth in this Amendment, the information set forth in the Schedule TO

remains unchanged and is incorporated herein by reference to the extent relevant to the items in this Amendment. Capitalized terms used but not defined herein have the meanings ascribed to them in the Schedule TO.

|

ITEMS

|

1 THROUGH 9 and ITEM 11.

|

The information set forth in the Offer to Purchase and Items 1 through 9 and Item 11 of the Schedule TO (to the extent such Items incorporate by reference the

information contained in the Offer to Purchase), is hereby amended and supplemented by adding the following paragraphs:

“Consummation of the

Offer and the Mergers.

The Offer expired at one minute after 11:59 p.m., Eastern Time, on December 27, 2021. The Depositary advised Purchaser

that, as of the expiration of the Offer, a total of 31,443,126 Shares were validly tendered and not validly withdrawn, representing approximately 71.15% of the Shares outstanding as of the expiration of the Offer.

As of the expiration of the Offer, the number of Shares validly tendered and not validly withdrawn pursuant to the Offer satisfied the Minimum Tender

Condition, and all other conditions to the Offer were satisfied or waived. Purchaser has irrevocably accepted for payment all Shares validly tendered and not validly withdrawn pursuant to the Offer.

ATC, Parent, Holdco and Purchaser expect to complete the acquisition of CoreSite on December 28, 2021 by (a) consummating the REIT Merger in

accordance with Section 3-106.1 of the MGCL, (b) substantially concurrently with the REIT Merger, consummating the OP Merger and (c) following the REIT Merger and the OP Merger, consummating the

Holdco Merger, in each case, pursuant to and in accordance with the terms of the Merger Agreement. At the effective time of the REIT Merger, each Share issued and outstanding immediately prior to such time (other than (i) certain restricted

Shares and (ii) Shares held by the Parent Parties) will be converted into the right to receive an amount in cash equal to the Offer Price. At the effective time of the OP Merger, each partnership unit issued and outstanding and held by a

limited partner of the OP (excluding CoreSite) will be converted into the right to receive an amount in cash equal to the Offer Price.

Following

consummation of the REIT Merger, the Shares will be delisted and will cease trading on the NYSE.

ATC, Parent, Holdco and Purchaser intend to take steps

to cause the termination of the registration of the Shares under the Exchange Act and to suspend all of CoreSite’s reporting obligations under the Exchange Act as promptly as practicable.

The full text of the press release issued by ATC on December 28, 2021 in connection with the expiration of the Offer and the Mergers is attached hereto

as Exhibit (a)(5)(H) and is incorporated herein by reference.”

Item 12 of the Schedule TO is amended and supplemented by adding the following:

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

Dated: December 28, 2021

|

|

|

|

|

|

|

APPLESEED MERGER SUB LLC

|

|

|

|

|

By:

|

|

/s/ Edmund DiSanto

|

|

|

|

Name:

|

|

Edmund DiSanto

|

|

|

|

Title:

|

|

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

|

|

|

|

APPLESEED HOLDCO LLC

|

|

|

|

|

By:

|

|

/s/ Edmund DiSanto

|

|

|

|

Name:

|

|

Edmund DiSanto

|

|

|

|

Title:

|

|

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

|

|

|

|

AMERICAN TOWER INVESTMENTS LLC

|

|

|

|

|

By:

|

|

/s/ Edmund DiSanto

|

|

|

|

Name:

|

|

Edmund DiSanto

|

|

|

|

Title:

|

|

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

|

|

|

|

AMERICAN TOWER CORPORATION

|

|

|

|

|

By:

|

|

/s/ Edmund DiSanto

|

|

|

|

Name:

|

|

Edmund DiSanto

|

|

|

|

Title:

|

|

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

|

|

|

|

|

(a)(1)(A)

|

|

Offer to Purchase, dated November 29, 2021.*

|

|

|

|

|

(a)(1)(B)

|

|

Form of Letter of Transmittal.*

|

|

|

|

|

(a)(1)(C)

|

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.*

|

|

|

|

|

(a)(1)(D)

|

|

Form of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.*

|

|

|

|

|

(a)(1)(E)

|

|

Form of Summary Advertisement, published November 29, 2021 in The Wall Street Journal.*

|

|

|

|

|

(a)(5)(A)

|

|

Presentation made available by American Tower Corporation on its website to investors on November

15, 2021 (incorporated by reference to Exhibit 99.1 to the Schedule TO-C filed by ATC, Holdco and Purchaser with the SEC on November 15, 2021).*

|

|

|

|

|

(a)(5)(B)

|

|

Joint Press Release issued by American Tower Corporation and CoreSite Realty Corporation on November

15, 2021 (incorporated by reference to Exhibit 99.2 to the Schedule TO-C filed by ATC, Holdco and Purchaser with the SEC on November 15, 2021).*

|

|

|

|

|

(a)(5)(C)

|

|

Notice of Merger issued by Appleseed Merger Sub LLC, dated November

26, 2021 (incorporated by reference to Exhibit 99.1 to the Schedule TO-C filed by ATC, Parent, Holdco and Purchaser with the SEC on November 26, 2021).*

|

|

|

|

|

(a)(5)(D)

|

|

Transcript of American Tower Corporation investor call on November

15, 2021 (incorporated by reference to Exhibit 99.1 to the Schedule TO-C filed by ATC, Holdco and Purchaser with the SEC on November 16, 2021).*

|

|

|

|

|

(a)(5)(E)

|

|

Press Release issued by American Tower Corporation on November 29, 2021.*

|

|

|

|

|

(a)(5)(F)

|

|

Excerpts of the transcript of an interview with an executive of ATC at the Fifth Annual Virtual Wells Fargo TMT Summit on December 1,

2021, available on ATC’s external website.*

|

|

|

|

|

(a)(5)(G)

|

|

Transcript of an interview with an executive of ATC at the UBS Global TMT Conference on December

6, 2021, available on ATC’s external website.*

|

|

|

|

|

(a)(5)(H)

|

|

Press Release issued by American Tower Corporation on December 28, 2021.

|

|

|

|

|

(b)(1)

|

|

Commitment Letter, dated as of November 14, 2021, between ATC and JPMorgan Chase Bank, N.A.*

|

|

|

|

|

(b)(2)

|

|

Third Amended and Restated Multicurrency Revolving Credit Agreement, dated as of December

8, 2021, by and among ATC, as borrower, Toronto Dominion (Texas) LLC, as administrative agent, and the lenders party thereto.*

|

|

|

|

|

(b)(3)

|

|

Fourth Amended and Restated Revolving Credit Agreement, dated as of December

8, 2021, by and among ATC, as borrower, Toronto Dominion (Texas) LLC, as administrative agent, and the lenders party thereto.*

|

|

|

|

|

(b)(4)

|

|

Second Amended and Restated Term Loan Agreement, dated as of December

8, 2021, by and among ATC, as borrower, Mizuho Bank, Ltd., as administrative agent, and the lenders party thereto.*

|

|

|

|

|

(b)(5)

|

|

364-Day Term Loan Agreement, dated as December

8, 2021, by and among ATC, as borrower, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders party thereto.*

|

|

|

|

|

(b)(6)

|

|

2-Year Term Loan Agreement, dated as December

8, 2021, by and among ATC, as borrower, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders party thereto.*

|

|

|

|

|

(d)(1)

|

|

Agreement and Plan of Merger, dated as of November

14, 2021, among Parent, Holdco, Purchaser, Appleseed OP Merger Sub LLC, CoreSite, CoreSite, L.P. and ATC (incorporated by reference to Exhibit 2.1 to the Current Report on Form

8-K filed by ATC with the Securities and Exchange Commission on November 15, 2021).*

|

|

|

|

|

(d)(2)

|

|

Mutual Confidential Disclosure Agreement, dated as of September

4, 2021, between CoreSite and American Tower LLC (incorporated by reference to Exhibit (e)(2) to the Schedule

14D-9 filed by CoreSite with the Securities and Exchange Commission on November 29, 2021).*

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

|

|

|

(h)

|

|

Not applicable.

|

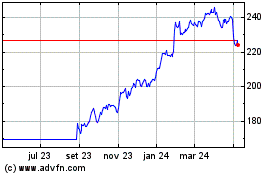

Cencora (NYSE:COR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

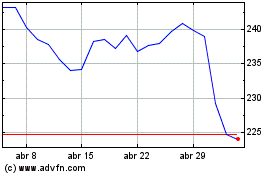

Cencora (NYSE:COR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024