Structured Investments

Leveraged Performance:

PLUSSM and Jump Securities

Summary

Morgan Stanley Wealth Management Structured Investments

offer investors a range of investment opportunities with varying features, both in terms of structure and underlying asset class exposure,

providing clients with the building blocks they need to pursue their specific financial goals.

TACTICAL

OFFERINGS

Leveraged Performance investments

can be used as alternatives to traditional investments that do not have leverage features.

|

|

|

Enhanced Yield Investments

|

|

|

|

Leveraged Performance Investments

|

|

|

|

Partial Principal at Risk Securities

|

|

|

|

Market-Linked Notes and Market-Linked

Deposits— FDIC Insured

|

Investing in

PLUSSM or Jump Securities involves risk.

See “Selected

Risk Considerations.”

This material

was not prepared by the research departments of Morgan Stanley or Morgan Stanley Wealth Management

and it should not

be regarded as a research report.

|

TABLE OF CONTENTS

|

|

2

|

Alternative Ways to Pursue Your Investment Strategy

|

|

3

|

Introduction to Leveraged Performance (PLUSSM)

|

|

4

|

Bull PLUSSM

|

|

6

|

Buffered PLUSSM

|

|

8

|

Bear PLUSSM

|

|

10

|

Trigger PLUSSM

|

|

12

|

Dual Directional Trigger PLUSSM

|

|

14

|

Introduction to Leveraged Performance Jump Securities

|

|

17

|

Who Should Consider Investing in PLUSSM or Jump Securities?

|

|

18

|

Selected Risk Considerations

|

Free Writing Prospectus

Registration Statement

Nos. 333-250103;333-250103-01

Dated January 19, 2022

Filed Pursuant To Rule 433

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Alternative Ways to Pursue

Your Investment Strategy

The Structured Investments team creates and delivers investments tailored

to meet different investment objectives for many types of investors — from those offerings that return par at maturity to those

that are more growth-oriented and expose investors to greater market risk. The features of these securities are represented by five basic

categories: Market-Linked Deposits (FDIC insured) and Market- Linked Notes, Partial Principal at Risk Securities, Enhanced Yield Investments,

Leveraged Performance Investments and Access Investments.

Structured Investments can be offered in a variety

of forms, such as certificates of deposit, units or warrants, but are most commonly offered as senior unsecured notes with returns linked

to the performance of individual or combinations of underlying assets, including equities, commodities, currencies and interest rates.

Some of these asset classes may be difficult for individual investors to access through traditional means. These notes, however, expose

investors to the credit risk of the issuer (and the guarantor, if applicable) and are not a direct investment in the underlying asset.

In this document, references to the credit risk of the issuer include the credit risk of the guarantor, if applicable.

In addition to the credit risk of the issuer, investing

in Structured Investments involves risks that are not associated with investments in ordinary fixed or floating rate debt securities.

Please read and consider the risk factors set forth under “Selected Risk Considerations” as well as the specific risk factors

contained in the offering documents for any specific Structured Investment.

Risk-Return

Spectrum

* Enhanced Yield Structured

Investments are often linked to a single stock, which increases risk in the underlying asset, but some Enhanced Yield structures can

pay par at maturity, which results in lower risk to the principal amount invested. Depending on the features of a particular offering,

Enhanced Yield and Leveraged Performance offerings are often equally as aggressive, as compared to Partial Principal at Risk Securities,

Market-Linked Deposits and Market-Linked Notes.

These strategies are usually

for income-oriented investors. Investing in Structured Investments involves risk, including the possibility of a total loss of principal.

Investors should read the security’s offering documentation prior to making an investment decision.

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Introduction to Leveraged

Performance PLUSSM

Performance Leveraged Upside SecuritiesSM (PLUSSM)

represent a Leveraged Performance strategy that can be used to achieve specific investment objectives through various risk-reward profiles.

Common applications include:

Using PLUSSM as an enhanced alternative

to traditional investments. PLUSSM offers investors an opportunity to enhance portfolio returns while being exposed to

similar downside market risk relative to a direct investment in the underlying asset, provided that the PLUSSM are held to

maturity. In exchange for leverage within a range of performance, most PLUSSM returns are subject to a maximum payment at

maturity, and all payments on the PLUSSM are subject to the credit risk of the issuer. This leverage feature may provide investors

with enhanced returns relative to a direct investment in the underlier. Similar to traditional investments, PLUSSM generally

have one-for-one downside exposure.

For PLUSSM linked to equities, the performance

of the equity underliers are typically calculated on a price-return basis, and therefore the payout on the PLUSSM will not

reflect any dividends paid on the underlier that you would receive with a direct investment in the equity. Accordingly, the

|

Key Features

|

Key Risks

|

|

1

|

Leveraged upside exposure within a range of price performance

|

1

|

Risk of loss of principal at maturity and increased loss if not held to maturity

|

|

2

|

Similar downside market risk to owning an investment directly with one-for-one downside exposure

|

2

|

All payments subject to the credit risk of the issuer

|

|

3

|

Most PLUSSM have maturities of approximately 6 to 36 months

|

3

|

No interest payments or dividends. Unless specified, PLUSSM linked to equities will be calculated on a price-return basis.

|

|

|

|

|

|

|

Investing in PLUSSM involves risks. See “Selected Risk Considerations.”

Asset allocation does not assure a profit or guarantee that you will not suffer a loss in declining financial markets.

|

|

|

|

performance comparisons

in this document are based on the price return of the underliers. If a specific PLUSSM is linked to an underlier calculated

on a total-return basis, it will be specified in the applicable offering document.

Using PLUSSM to diversify underlying

asset class exposure. To assist in portfolio allocation, Morgan Stanley Wealth Management regularly offers PLUSSM tied

to the performance of major benchmark indexes such as the S&P 500® Index, Dow Jones Industrial Average,SM

Nasdaq-100 Index®, MSCI Emerging Markets IndexSM and MSCI EAFE Index®, as well as more tactical

PLUSSM linked to current market themes and a variety of asset classes. However, PLUSSM are debt securities of the

applicable issuer, they do not

|

the most common PLUSSM structures (Bull, Buffered and Bear PLUS,SM Trigger PLUSSM and Dual Directional Trigger PLUSSM). Other variations of PLUSSM are possible, but they are not discussed in this material.

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Bull PLUSSM

For investors who believe markets will appreciate in the near term,

Bull PLUSSM generally pay double or triple the price return of the underlier up to a maximum payment at maturity. In moderately

bullish markets, the leverage feature can outperform a direct investment.

The leverage factor means fewer dollars may be allocated

to an underlying strategy to drive comparable upside returns, subject to the maximum payment at maturity — freeing up assets for

other investments. This approach of reducing the overall dollars invested in the underlier may help limit potential overall losses in

the investor’s portfolio if the underlier depreciates at maturity, although the full amount of the investor’s principal investment

will still be exposed to any declines in the underlier level.

|

Sample Terms

|

|

Maturity

|

15 Months

|

|

Upside leverage

|

200%

|

|

Maximum payment at maturity

|

116%

|

|

Downside risk

|

100%

|

This example is for hypothetical purposes only.

|

Enhanced upside exposure subject to a maximum payment at maturity, full downside risk.

|

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

|

Bull PLUSSM Sample Returns at Maturity

|

|

|

This example is for hypothetical purposes only

and does not cover the complete range of possible payouts at maturity.

|

* Excluding dividends

|

|

Similar to traditional investments, you could lose

some or all of your initial investment in Bull PLUSSM if the underlier depreciates.

Investors can use Bull PLUSSM to complement

existing long market exposure. For example, an investor may choose to replace 20% of an allocation in a broad market index

|

with a PLUSSM based on the same index. This strategy enables

an investor to enhance overall portfolio performance in moderately bullish markets while being exposed to similar downside market risk,

provided that the PLUSSM are held to maturity.

|

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Buffered PLUSSM

Investors who are not comfortable retaining full downside exposure

may want to consider Buffered PLUS.SM

Buffered PLUSSM provide a limited buffer

against a loss at maturity and enhanced upside exposure, subject to a maximum return at maturity. In exchange for this buffer against

a modest decline at maturity, Buffered PLUSSM tend to have lower maximum payments at maturity or lower upside leverage, as

compared to Bull PLUSSM with the same maturity and the same underlier.

HOW THE BUFFER FEATURE WORKS.

If the underlier has declined at maturity, as long

as it has not declined by more than the buffer amount (usually 10% to 20% of the underlier’s initial level), the Buffered PLUSSM

will redeem for par. However, if the underlier declines by more than the buffer amount, the Buffered PLUSSM will return

par minus any decline below the buffer amount. For example, if the buffer amount is set at 10% of the underlier’s initial level

and at maturity the underlier has declined by 25%, the Buffered PLUSSM will redeem for a 15% loss (or 85% of the amount initially

invested).

|

Sample Terms

|

|

Maturity

|

30 Months

|

|

Upside leverage

|

200%

|

|

Maximum payment at maturity

|

118%

|

|

Buffer amount

|

10%

|

This example is for hypothetical purposes only.

|

Enhanced upside exposure subject to a maximum payment at maturity,

limited buffer against loss at maturity.

|

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

|

Buffered PLUSSM Sample Returns at Maturity

|

|

|

This example is for hypothetical purposes only

and does not cover the complete range of possible payouts at maturity.

|

* Excluding dividends

|

Buffered PLUSSM can be used by investors who are moderately

bullish and wish to complement a long position with a more defensive strategy.

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Bear PLUSSM

Bear PLUSSM are designed to generate positive returns in

a declining market. Bear PLUSSM typically pay a return equal to two or three times any market decline, subject to a maximum

payment at maturity. If the underlier appreciates at maturity, Bear PLUSSM will redeem for a loss.

Traditional “short” strategies may be

difficult for individuals to implement and may expose investors to unlimited potential loss. Bear PLUSSM can be an effective

way for investors to execute a bear market view or hedge a portfolio. Bear PLUSSM limit investor loss to a percentage of the

amount invested, 90%, for example, but never more than the original investment. Having paid for the Bear PLUSSM at issuance,

an investor in Bear PLUSSM is not required to post any collateral that might be required to invest in a traditional short strategy.

|

Sample Terms

|

|

Maturity

|

6 Months

|

|

Downside leverage

|

200%

|

|

Maximum payment at maturity

|

115%

|

|

Maximum loss at maturity

|

90%

|

This example is for hypothetical purposes only.

|

Leveraged inverse exposure subject to a maximum payment at maturity, with downside risk.

|

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

|

Bear PLUSSM Sample Returns at Maturity

|

|

|

This example is for hypothetical purposes only

and does not cover the complete range of possible payouts at maturity.

|

* Excluding dividends

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Trigger PLUSSM

Investors who are able to withstand full downside exposure, but seek

the repayment of principal in the event of a decline of the underlier up to (or, up to or including, as applicable) a specified level,

may want to consider the Trigger PLUS.SM

Trigger PLUSSM provide for enhanced

upside exposure, subject to a maximum return at maturity, and provide for the repayment of principal, provided that the underlier does

not depreciate to (or to or below, as applicable) the specified trigger level at maturity. Trigger PLUSSM tend to have lower

maximum payments at maturity as compared to the Bull PLUS,SM but may have higher maximum payments at maturity as compared

to the Buffered PLUSSM with the same maturities and underliers.

HOW THE TRIGGER FEATURE WORKS.

If the underlier has declined at maturity

but it has not declined to (or to or below, as applicable) the trigger level (usually 15% to 30% below the underlier’s initial

level), the Trigger PLUSSM will redeem for par. However, if the underlier has declined to (or to or below, as applicable)

the trigger level, the Trigger PLUSSM will return par minus the full decline of the underlier from its initial level. For

example, if the trigger level is set 25% below the underlier’s initial level and at maturity the underlier has declined by less

than (or, less than or equal to, as applicable) 25%, the Trigger PLUSSM will redeem for par. However, if the underlier has

declined by 25% or more (or, more than 25%, as applicable), for example, 32%, then the Trigger PLUSSM will redeem for

|

Enhanced upside exposure subject to a maximum payment at maturity, repayment of principal up to a trigger level and full downside risk beyond the trigger level.

|

|

|

Sample Terms

|

|

|

|

Maturity

|

60 Months

|

|

Maximum Payment at Maturity

|

130%

|

|

Upside leverage

|

200%

|

|

Trigger level

|

85%

|

|

This example is for hypothetical purposes only

|

|

|

|

a 32% loss (or 68% of the amount initially invested).Therefore, the full principal is at risk.

Trigger PLUSSM can be used by investors who are moderately

|

bullish and do not anticipate that the underlier will decline to (or

to or below, as applicable) the stated trigger level at maturity.

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

|

Trigger PLUSSM Sample Returns at Maturity

|

|

|

This example is for hypothetical purposes only

and does not cover the complete range of possible payouts at maturity.

|

* Excluding dividends

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Dual Directional Trigger PLUSSM

Investors who are able to withstand full downside exposure, but seek

positive returns for a limited amount of negative performance of the underlier, provided that the value of the underlier is greater than

(or, greater than or equal to, as applicable) the specified trigger level at maturity, may want to consider the Dual Directional Trigger

PLUS.SM

Dual Directional Trigger PLUSSM provide

for enhanced upside exposure, subject to a maximum return at maturity, and provide for the potential to receive unleveraged positive

returns for a limited range of negative performance of the underlier, provided that the underlier does not depreciate to (or to or below,

as applicable) the specified trigger level at maturity. Dual Directional Trigger PLUSSM tend to have lower maximum payments

at maturity as compared to the Bull PLUSSM, the Buffered PLUSSM and the Trigger PLUSSM with the same

maturities and underliers.

HOW THE DUAL DIRECTIONAL

TRIGGER FEATURE WORKS. If the underlier has declined at maturity, but it has not declined to

(or to or below, as applicable) the trigger level (usually 20% to 40% below the underlier’s initial level), the Dual Directional

Trigger PLUSSM will redeem for par plus a 1% positive return for every 1% decline of the underlier. However, if the underlier

has declined to (or to or below, as applicable) the trigger level, the Dual Directional Trigger PLUSSM will return par minus

the full decline of the underlier from its initial level. For example, if the

|

Enhanced upside exposure subject to a maximum return at maturity, unleveraged positive returns for a limited range of negative performance of the underlier up to a trigger level and full downside risk beyond the trigger level.

|

|

|

|

|

Sample Terms

|

|

|

|

Maturity

|

36 Months

|

|

Maximum Payment at Maturity

|

150%

|

|

Upside leverage

|

125%

|

|

Trigger level

|

70%

|

|

|

|

|

|

|

|

This example is for hypothetical purposes only

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

|

Dual Directional Trigger PLUSSM Sample Returns at Maturity

|

|

|

This example is for hypothetical purposes only

and does not cover the complete range of possible payouts at maturity.

|

* Excluding dividends

|

|

trigger level is set 25% below the underlier’s initial level and

at maturity the underlier has declined by 20%, the Dual Directional Trigger PLUSSM will redeem for a gain of 20% (or 120% of

the amount initially invested). However, if the underlier has declined by 25% or more (or, more than 25%, as applicable), for example,

32%, then

|

the Dual Directional Trigger PLUSSM will redeem for a 32%

loss (or 68% of the amount initially invested).

Dual Directional Trigger PLUSSM can be

used by investors to enhance returns and potentially outperform the underlier in

moderately bullish scenarios and moderately bearish scenarios, provided

that the underlier does not decline by more than (or, more than or equal to, as applicable) the stated trigger level at maturity.

|

moderately bullish scenarios and moderately bearish scenarios, provided

that the underlier does not decline by more than (or, more than or equal to, as applicable) the stated trigger level at maturity.

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Introduction to Leveraged

Performance Jump Securities

Jump Securities represent a Leveraged Performance strategy that can

be used to achieve specific investment objectives through various risk-reward profiles.

Common applications include:

Using Jump Securities as an enhanced alternative

to traditional investments. Jump Securities offer investors an opportunity to enhance portfolio returns while being exposed to similar

downside market risk relative to a direct investment in the underlying asset, provided that the Jump Securities are held to maturity.

In exchange for a fixed return if the underlying asset has appreciated, most Jump Securities returns are subject to a fixed, limited upside

return, and all payments on the Jump Securities are subject to the credit risk of the issuer. This fixed payment feature may provide investors

with enhanced returns relative to a direct investment in the underlier within a certain range of performance. Similar to traditional investments,

Jump Securities generally have one-for-one downside exposure. For Jump Securities linked to equities, the performance of the equity underliers

are typically calculated on a price-return basis, and therefore the payout on the Jump Securities will not reflect any dividends paid

on the underlier that you would receive with a direct investment in the equity.

|

Key Features

|

Key Risks

|

|

1

|

Provides a fixed return if the underlier appreciates at maturity

|

1

|

Risk of loss of principal at maturity and increased loss if not held until maturity

|

|

2

|

Similar downside market risk to owning an investment directly with one-for-one downside exposure

|

2

|

All payments subject to the credit risk of the issuer

|

|

3

|

Most Jump Securities have maturities of 15 to 60 months

|

3

|

No interest payments or dividends

|

|

|

|

|

|

|

|

|

|

|

|

Accordingly,

the performance comparisons in this document are based on the price return of the underliers. If specific Jump Securities are linked

to an underlier calculated on a total-return basis, it will be specified in the applicable offering document.

Using Jump Securities to diversify underlying asset

class exposure. To assist in portfolio allocation, Morgan Stanley Wealth Management regularly offers Jump Securities tied to the performance

of major benchmark indexes such as the S&P 500® Index, Dow Jones Industrial Average,SM The EURO STOXX 50®

Index, MSCI Emerging Markets IndexSM and MSCI EAFE Index®, as well as more tactical Jump Securities linked

to current market themes and a variety of asset classes. However, Jump

Securities are debt securities of the

|

applicable

issuer, they do not provide investors with ownership of the underlying assets and all payments on the Jump Securities are subject to

the credit risk of that issuer. This material addresses the most common Jump Securities structure. Other variations of Jump Securities

are possible (i.e., inclusion of a trigger feature or a dual directional trigger feature as discussed in the PLUSSM section),

but they are not discussed in detail in this section of the material.

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Jump Securities

Investors who are able to withstand full downside exposure, but seek

a fixed positive return if the underlier appreciates (or remains unchanged or appreciates, as applicable), may want to consider Jump Securities.

Jump Securities provide for enhanced upside exposure,

subject to a fixed return at maturity, provided that the underlier does not depreciate at maturity. Jump Securities tend to have lower

maximum payments at maturity as compared to the Bull PLUSSM with the same maturities and underliers.

HOW THE

JUMP FEATURE WORKS.

If the underlier has appreciated (or remained unchanged or appreciated,

as applicable) at maturity, the Jump Securities will redeem for par plus a fixed return. For example, if the underlier has appreciated

by any amount, e.g., 5%, at maturity, the Jump Securities will return par plus a fixed amount of 13%. However, if the underlier has appreciated

by more than 13%, in this example, e.g., 25%, the Jump Securities will return par plus the fixed amount of 13% and will underperform a

direct investment. However, at maturity, if the underlier has declined below its initial level, the Jump Securities will return par minus

the full decline of the underlier from its initial level. For example, if the underlier has depreciated by 30%, the Jump Securities will

redeem for a 30% loss (or 70% of the amount initially invested).

Jump Securities can be used by investors who are

moderately bullish, but do not anticipate that the underlier will appreciate (or remain unchanged or appreciate, as applicable) by more

than the stated fixed return amount.

|

Enhanced upside exposure subject to a fixed return at maturity; full downside risk.

|

|

|

Sample Terms

|

|

|

Maturity

|

24 Months

|

|

|

|

Potential fixed return

|

13%

|

|

|

|

This example is for hypothetical purposes only

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

|

Jump Securities Sample Returns at Maturity

|

|

|

This example is for hypothetical purposes only

and does not cover the complete range of possible payouts at maturity.

|

* Excluding dividends

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Who Should Consider Investing in PLUSSM or Jump Securities?

|

While investors’ risk tolerance

and market views vary, PLUSSM or

Jump Securities may provide an opportunity

to customize the market

risk and return profile of a traditional

investment portfolio.

|

|

|

A market leader in equity, currency, fixed income and commodity

markets, Morgan Stanley Wealth Management is well-positioned to deliver innovative solutions to help meet our clients’ specific

investment needs. We continue to extend our range of Structured Investments offerings beyond traditional asset classes, and today our

product platform includes Structured Investments that cover many segments of the financial markets, giving you the opportunity to diversify

underlying asset class exposure. However, all payments on the PLUSSM and Jump Securities are subject to the credit risk of

the relevant issuer.

|

Your Financial Advisor can help you determine how

PLUSSM or Jump Securities might work best in your portfolio, based on your unique investment goals, time horizon and risk tolerance.

|

For more information on PLUS,SM Jump

Securities or other Morgan Stanley Structured Investments offerings, please contact your Financial Advisor.

|

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Selected

Risk Considerations

An investment in Structured Investments

involves risks and the market price of the PLUSSM or Jump Securities may be influenced by many unpredictable factors.

These factors can include, but are not limited

to:

|

|

·

|

Changes in the value of the underlying asset at any time

|

|

|

·

|

The volatility (frequency and magnitude of changes in value) of the underlying asset

|

|

|

·

|

The dividend yield on the underlier

|

|

|

·

|

Geopolitical conditions and other events

|

|

|

·

|

Changes in the interest and yield rates in the market

|

|

|

·

|

Time remaining to maturity

|

|

|

·

|

Any actual or anticipated changes in the issuer’s credit ratings or credit spreads

|

The PLUSSM or Jump Securities

will not be listed on any securities exchange and secondary trading may be limited.

The PLUSSM or Jump Securities will

not be listed on any securities exchange and there may be little or no secondary market for the PLUSSM or Jump Securities.

The issuer of the PLUSSM or Jump Securities may, but is not obligated to, make a market in the PLUSSM or Jump Securities,

and, if it once chooses to make a market, may cease doing so at any time. When it does make a market, it will generally do so for transactions

of routine secondary market size at prices based on its estimate of the current value of the PLUSSM or Jump Securities, taking

into account its bid/offer spread, the issuer’s credit spreads, market volatility, the notional size of the proposed sale, the

cost of unwinding any related hedging positions, the time remaining to maturity and the likelihood that it will be able to resell the

PLUSSM or Jump Securities. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade

or sell the PLUSSM or Jump Securities easily. Since other broker-dealers may not participate significantly in the secondary

market for the PLUSSM or Jump Securities, the price at which you may be able to trade your PLUSSM or Jump Securities

is likely to depend on the price, if any, at which the issuer is willing to transact. If the issuer does not make a market in the PLUSSM

or Jump Securities, it is likely that there will not be a secondary market for the PLUSSM or Jump Securities. Accordingly,

you should be willing to hold your PLUSSM or Jump Securities to maturity.

The PLUSSM or Jump Securities

are subject to the credit risk of the issuer, and any actual or anticipated changes to its credit ratings or credit spreads may adversely

affect the market value of the PLUSSM or Jump Securities.

You are dependent on the issuer’s ability

to pay all amounts due on the PLUSSM or Jump Securities at maturity, and, therefore, you are subject to the credit risk of

the issuer. If the issuer defaults on its obligations under the PLUSSM or Jump Securities, your investment would be at risk

and you could lose some or all of your investment. As a result, the market value of the PLUSSM or Jump Securities prior to

maturity will be affected by changes in the market’s view of the issuer’s creditworthiness. Any actual or anticipated decline

in the issuer’s credit ratings or increase in the credit spreads charged by the market for taking the issuer’s credit risk

is likely to adversely affect the market value of the PLUSSM or Jump Securities.

The rate the issuer is willing to pay for

securities of this type, maturity and issuance size is likely to be lower than the rate implied by the issuer’s secondary market

credit spreads and advantageous to us. Both the lower rate and the inclusion of costs associated with issuing, selling, structuring and

hedging the PLUSSM or Jump Securities in the original issue price reduce the economic terms of the PLUSSM or Jump

Securities, cause the estimated value of the PLUSSM or Jump Securities to be less than the original issue price and will adversely

affect secondary market prices.

Assuming no change in market conditions or any

other relevant factors, the prices, if any, at which dealers may be willing to purchase the PLUSSM or Jump Securities in secondary

market transactions will likely be significantly lower than the original issue price, because secondary market prices will exclude the

issuing, selling, structuring and hedging-related costs that are included in the original issue price and borne by you and because the

secondary market prices will reflect

the issuer’s secondary market credit

spreads and the bid-offer spread that any dealer would charge in a secondary market transaction of this type as well as other factors.

The inclusion of the costs of issuing, selling,

structuring and hedging the PLUSSM or Jump Securities in the original issue price and the lower rate the issuer is willing

to pay as the issuer make the economic terms of the PLUSSM or Jump Securities less favorable to you than they otherwise would

be.

However, because the costs associated with

issuing, selling, structuring and hedging the PLUSSM or Jump Securities are not fully deducted upon issuance, for a period

following the issue date, to the extent that the agent may buy or sell the PLUSSM or Jump Securities in the secondary market,

absent changes in market conditions, including those related to the underlying shares, and to the issuer’s secondary market credit

spreads, it would do so based on values higher than the estimated value, and the issuer expects that those higher values will also be

reflected in your brokerage account statements.

In addition, the costs included in the original

issue price of a structured investment will include a fee paid to LFT Securities, LLC, an entity in which an affiliate of Morgan Stanley

Wealth Management has an ownership interest, for providing certain electronic platform services with respect to the offering.

The estimated value of the PLUSSM

or Jump Securities is determined by reference to the issuer’s pricing and valuation models, which may differ from those of

other dealers and is not a maximum or minimum secondary market price.

These pricing and valuation models are proprietary

and rely in part on subjective views of certain market inputs and certain assumptions about future events, which may prove to be incorrect.

As a result, because there is no market-standard way to value these types of securities, the issuer’s models may yield a higher

estimated value of the PLUSSM or Jump Securities than those generated by others, including other dealers in the market, if

they attempted to value the PLUSSM or Jump Securities. In addition, the estimated value on the pricing date does not represent

a minimum or maximum price at which dealers, including the issuer’s affiliate, would be willing to purchase your PLUSSM

or Jump Securities in the secondary market (if any exists) at any time. The value of your PLUSSM or Jump Securities at any

time after the date of the applicable pricing supplement will vary based on many factors that cannot be predicted with accuracy, including

the issuer’s creditworthiness and changes in market conditions. See also “An investment in Structured Investments involves

risks and the market price of the PLUSSM or Jump Securities may be influenced by many unpredictable factors” above.

Investing in the PLUSSM or

Jump Securities is not equivalent to investing in the underlying asset.

Investing in the PLUSSM or Jump

Securities is not equivalent to investing in the underlying asset. As an investor in the PLUSSM or Jump Securities, you will

not have voting rights or rights to receive dividends or other distributions or any other rights with respect to the underlying asset.

Governmental regulatory actions, such as sanctions,

could adversely affect your investment in the PLUSSM or Jump Securities. Governmental regulatory actions, including, without

limitation, sanctions-related actions by the U.S. or a foreign government, could prohibit or otherwise restrict persons from holding particular

PLUSSM or Jump Securities or the underlying asset, or engaging in transactions in them, and any such action could adversely

affect the value of the underlying asset. These regulatory actions could result in restrictions on particular PLUSSM or Jump

Securities and could result in the loss of a significant portion or all of your initial investment in such PLUSSM or Jump Securities,

including if you are forced to divest such PLUSSM or Jump Securities due to the government mandates, especially if such divestment

must be made at a time when the value of such PLUSSM or Jump Securities has declined.

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

Risk Considerations Applicable to PLUSSM

Generally, PLUSSM do not

pay interest or guarantee return of principal.

The terms of the PLUSSM differ

from those of ordinary debt securities in that the issuer does not guarantee to pay you the principal amount of the PLUSSM

at maturity and generally do not pay you interest on the PLUSSM. Instead, at maturity you will receive for each PLUSSM

that you hold an amount in cash based on the final value of the underlying asset. If the final value of the underlying asset is

less than its initial value, in the case of bull market PLUS,SM or is greater than its initial value, in the case of bear

market PLUS,SM you will lose some or all of your investment.

Your appreciation potential is limited.

Risk Considerations Applicable to Jump Securities

Generally, Jump Securities do not pay interest

or guarantee return of principal.

The terms of the Jump Securities differ from

those of ordinary debt securities in that issuer does not guarantee to pay you the principal amount of the Jump Securities at maturity

and generally do not pay you interest on the Jump Securities. Instead, at maturity you will receive for each Jump Security that you hold

an amount in cash based on the final value of the underlying asset. If the final value of the underlying asset is less than its initial

value, you will receive an amount in cash that is less than the stated principal amount of each Jump Security by an amount proportionate

to the decline in the closing value of the underlying asset, and you will lose money on your investment.

Your appreciation potential is limited.

The appreciation potential of the Jump Securities

is generally limited by the maximum payment at maturity. You will not benefit from any significant appreciation of the underlier.

Important Information and Qualifications

This material was prepared by sales, trading

or other nonresearched personnel of Morgan Stanley Smith Barney LLC (together with its affiliates, “Morgan Stanley Wealth Management”).

This material was not produced by a Morgan Stanley & Co. LLC (“Morgan Stanley & Co.”) or Morgan Stanley Wealth Management

research analyst, although it may refer to a Morgan Stanley & Co. or Morgan Stanley Wealth Management research analyst or report.

Unless otherwise indicated, these views (if any) are the author’s and may differ from those of the aforementioned research departments

or others in the firms.

An investment in structured investments may

not be appropriate for all investors. These investments involve substantial risks. The appropriateness of a particular investment or

strategy will depend on an investor’s individual circumstances and objectives. This material does not provide individually tailored

investment advice nor does it offer tax, regulatory, accounting or legal advice.

We remind investors that these investments are

subject to market risk and will fluctuate in value. The investments discussed or recommended in this communication may not be appropriate

for investors depending upon their specific investment objectives and financial position. No representation or warranty is made that

any returns indicated will be achieved. Potential investors should be aware that certain legal, accounting and tax restrictions, margin

requirements, commissions and other transaction costs may significantly affect the economic consequences of the transactions discussed

herein. The information and analyses contained herein are not intended as tax, legal or investment advice and may not be appropriate

for your specific circumstances.

Hypothetical performance results have inherent

limitations. There are frequently sharp differences between hypothetical and actual performance results subsequently achieved by any particular

trading strategy. Hypothetical performance results do not represent actual trading and are generally designed with the benefit of hindsight.

They cannot account for all factors associated with risk, including the impact of financial risk in actual trading or the ability to withstand

losses or to adhere to a particular trading strategy in the face of trading losses. There are numerous other factors related to the markets

in general or to the implementation of any specific trading strategy that cannot be fully accounted for in the preparation of hypothetical

performance results and all of which can adversely affect actual trading results.

The appreciation potential of the PLUSSM

is generally limited by the maximum payment at maturity. Although the leverage factor provides increased exposure to any increase,

in the case of a bull market PLUS,SM or decrease, in the case of a bear market PLUS,SM in the value of the underlying

asset at maturity, the payment at maturity will never exceed the maximum payment at maturity, which will be a fixed percentage over the

original public offering price per PLUS.SM

Further, except for certain Buffered PLUS,SM

you will be fully exposed to any decrease, in the case of a bull market PLUS,SM or increase, in the case of a bear market PLUS,SM

in the value of the underlying asset at maturity. As a result, you may lose some or all of your investment in the PLUS.SM

These materials may not be distributed in any

jurisdiction where it is unlawful to do so. The products described in this communication may not be marketed or sold or be available

for offer or sale in a number of jurisdictions where it is unlawful to do so. This publication is disseminated in Japan by Morgan Stanley

Japan Limited; in Hong Kong by Morgan Stanley Dean Witter Asia Limited; in Singapore by Morgan Stanley Dean Witter Asia (Singapore) Pte.,

regulated by the Monetary Authority of Singapore, which accepts responsibility for its contents; in Australia by Morgan Stanley Dean

Witter Australia Limited A.B.N. 67 003 734 576, a licensed dealer, which accepts responsibility for its contents; in Canada by Morgan

Stanley Canada

Limited, which has approved of, and has agreed

to take responsibility for, the contents of this publication in Canada; in Spain by Morgan Stanley, S.V., S.A., a Morgan Stanley group

company, which is supervised by the Spanish Securities Markets Commission (CNMV) and states that this document has been written and distributed

in accordance with the rules of conduct applicable to financial research as established under Spanish regulations; in the United States

by Morgan Stanley & Co., which accepts responsibility for its contents; and in the United Kingdom, this publication is approved by

Morgan Stanley & Co. International PLC, solely for the purposes of section 21 of the Financial Services and Markets Act 2000 and

is distributed in the European Union by Morgan Stanley & Co. International PLC, except as provided above. Private UK investors should

obtain the advice of their Morgan Stanley & Co. International PLC representative about the investments concerned. In Australia, this

publication, and any access to it, is intended only for “wholesale clients” within the meaning of the Australian Corporations

Act. Third-party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness

of the data they provide and shall not have liability for any damages of any kind relating to such data.

Any estimates, projections or predictions (including

in tabular form) given in this communication are intended to be forward-looking statements. Although Morgan Stanley Wealth Management

believes that the expectations in such forward-looking statements are reasonable, it can give no assurance that any forward-looking statements

will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause

actual results to differ materially from those projected.

These forward-looking statements speak only as

of the date of this communication. Morgan Stanley Wealth Management expressly disclaims any obligation or undertaking to update or revise

any forward-looking statement contained herein to reflect any change in its expectations or any change in circumstances upon which such

statement is based.

This material was not intended or written to be

used, and it cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer under US federal

tax laws. Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal,

tax, regulatory and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics

and consequences, of the transaction.

Each relevant issuer has separately filed a registration

statement (including a prospectus), and will file a pricing supplement, with the SEC for any offering to which this communication relates.

Before you invest in any offering, you should read the prospectus in that registration statement, the applicable pricing supplement and

other

STRUCTURED INVESTMENTS LEVERAGED PERFORMANCE: PLUSSM AND JUMP SECURITIES

documents such issuer has filed with the SEC for

more complete information about that issuer and that offering. You may get these documents free of charge by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, the relevant issuer, any underwriter or any dealer participating in any offering will arrange to

send you the prospectus if you request it by calling toll- free 1-(800)-584-6837.

The trademarks and service marks contained herein

are the property of their respective owners. Additional information on recommended securities discussed herein is available on request.

This communication or any portion hereof, may not be reprinted, resold or redistributed without the prior written consent of Morgan Stanley.

Bull PLUSSM

Buffered PLUSSM

Trigger PLUSSM

Dual Directional Trigger PLUSSM

Investments and services offered through Morgan

Stanley Smith Barney LLC. Member SIPC.

© 2022 Morgan Stanley Smith Barney LLC CRC

4117473 1/22

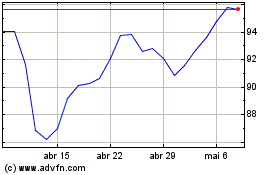

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

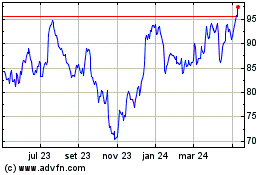

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024