Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-253421

|

|

GS Finance Corp.

$70,000,000

Autocallable Index-Linked Notes due 2025

guaranteed by

The Goldman Sachs Group, Inc.

|

The notes do not bear interest. The notes will mature on the stated maturity date (July 24, 2025) unless they are automatically called on the call observation date (January 27, 2023). Your notes will be automatically called on the call observation date if the closing level of each of the MSCI World Information Technology Index, the PHLX Semiconductor Sector IndexTM and the Russell 1000® Growth Index on such date is greater than or equal to its initial level (515.31 with respect to the MSCI World Information Technology Index, 3,494.751 with respect to the PHLX Semiconductor Sector IndexTM and 2,767.336 with respect to the Russell 1000® Growth Index), resulting in a payment on the call payment date (February 1, 2023) for each $1,000 face amount of your notes equal to $1,170.

The amount that you will be paid on your notes at maturity, if they have not been automatically called, is based on the performance of the lesser performing index (the index with the lowest index return). The index return for each index is the percentage increase or decrease in its final level (the closing level of such index on the determination date, July 21, 2025) from its initial level. If the final level of each index is greater than its initial level, the return on your notes will be positive and will equal 1.507 times the lesser performing index return. If the final level of any index is equal to or less than its initial level, but the final level of each index is greater than or equal to 80% of its initial level, you will receive the face amount of your notes. If the final level of any index is less than 80% of its initial level, the return on your notes will be negative and you could receive significantly less than the face amount of your notes.

At maturity, for each $1,000 face amount of your notes, you will receive an amount in cash equal to:

|

•

|

if the final level of each index is greater than its initial level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) 1.507 times (c) the lesser performing index return;

|

|

•

|

if the final level of each index is greater than or equal to 80% of its initial level but the final level of any index is equal to or less than its initial level, $1,000; or

|

|

•

|

if the final level of any index is less than 80% of its initial level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the lesser performing index return. You will receive less than 80% of the face amount of your notes.

|

If the index return for any index is less than -20%, the percentage of the face amount of your notes you will receive will be based on the performance of the index with the lowest index return. In such event, you will receive less than 80% of the face amount of your notes.

You should read the disclosure herein to better understand the terms and risks of your investment, including the credit risk of GS Finance Corp. and The Goldman Sachs Group, Inc. See page PS-11.

The estimated value of your notes at the time the terms of your notes are set on the trade date is equal to approximately $927 per $1,000 face amount. For a discussion of the estimated value and the price at which Goldman Sachs & Co. LLC would initially buy or sell your notes, if it makes a market in the notes, see the following page.

|

Original issue date:

|

January 25, 2022

|

Original issue price:

|

100% of the face amount

|

|

Underwriting discount:

|

3.75% of the face amount

|

Net proceeds to the issuer:

|

96.25% of the face amount

|

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman Sachs & Co. LLC

Pricing Supplement No. 5,111 dated January 20, 2022.

The issue price, underwriting discount and net proceeds listed above relate to the notes we sell initially. We may decide to sell additional notes after the date of this pricing supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return (whether positive or negative) on your investment in notes will depend in part on the issue price you pay for such notes.

GS Finance Corp. may use this prospectus in the initial sale of the notes. In addition, Goldman Sachs & Co. LLC or any other affiliate of GS Finance Corp. may use this prospectus in a market-making transaction in a note after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction.

|

Estimated Value of Your Notes

The estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by Goldman Sachs & Co. LLC (GS&Co.) and taking into account our credit spreads) is equal to approximately $927 per $1,000 face amount, which is less than the original issue price. The value of your notes at any time will reflect many factors and cannot be predicted; however, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would initially buy or sell notes (if it makes a market, which it is not obligated to do) and the value that GS&Co. will initially use for account statements and otherwise is equal to approximately the estimated value of your notes at the time of pricing, plus an additional amount (initially equal to $73 per $1,000 face amount).

Prior to May 20, 2022, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market, which it is not obligated to do) will equal approximately the sum of (a) the then-current estimated value of your notes (as determined by reference to GS&Co.’s pricing models) plus (b) any remaining additional amount (the additional amount will decline to zero on a straight-line basis from the time of pricing through May 19, 2022). On and after May 20, 2022, the price (not including GS&Co.’s customary bid and ask spreads) at which GS&Co. would buy or sell your notes (if it makes a market) will equal approximately the then-current estimated value of your notes determined by reference to such pricing models.

|

|

About Your Prospectus

The notes are part of the Medium-Term Notes, Series F program of GS Finance Corp. and are fully and unconditionally guaranteed by The Goldman Sachs Group, Inc. This prospectus includes this pricing supplement and the accompanying documents listed below. This pricing supplement constitutes a supplement to the documents listed below, does not set forth all of the terms of your notes and therefore should be read in conjunction with such documents:

•General terms supplement no. 2,913 dated June 17, 2021

•Prospectus supplement dated March 22, 2021

•Prospectus dated March 22, 2021

The information in this pricing supplement supersedes any conflicting information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply to your notes.

We refer to the notes we are offering by this pricing supplement as the “offered notes” or the “notes”. Each of the offered notes has the terms described below. Please note that in this pricing supplement, references to “GS Finance Corp.”, “we”, “our” and “us” mean only GS Finance Corp. and do not include its subsidiaries or affiliates, references to “The Goldman Sachs Group, Inc.”, our parent company, mean only The Goldman Sachs Group, Inc. and do not include its subsidiaries or affiliates and references to “Goldman Sachs” mean The Goldman Sachs Group, Inc. together with its consolidated subsidiaries and affiliates, including us. The notes will be issued under the senior debt indenture, dated as of October 10, 2008, as supplemented by the First Supplemental Indenture, dated as of February 20, 2015, each among us, as issuer, The Goldman Sachs Group, Inc., as guarantor, and The Bank of New York Mellon, as trustee. This indenture, as so supplemented and as further supplemented thereafter, is referred to as the “GSFC 2008 indenture” in the accompanying prospectus supplement.

The notes will be issued in book-entry form and represented by master note no. 3, dated March 22, 2021.

|

PS-2

Terms AND CONDITIONS

CUSIP / ISIN: 40057KT94 / US40057KT944

Company (Issuer): GS Finance Corp.

Guarantor: The Goldman Sachs Group, Inc.

Underliers (each individually, an underlier): the MSCI World Information Technology Index (current Bloomberg symbol: “MXWO0IT Index”), or any successor underlier, the PHLX Semiconductor Sector IndexTM (current Bloomberg symbol: “SOX Index”), or any successor underlier, and the Russell 1000® Growth Index (current Bloomberg symbol: “RLG Index”), or any successor underlier, as each may be modified, replaced or adjusted from time to time as provided herein

Face amount: $70,000,000 in the aggregate on the original issue date; the aggregate face amount may be increased if the company, at its sole option, decides to sell an additional amount on a date subsequent to the trade date

Authorized denominations: $1,000 or any integral multiple of $1,000 in excess thereof

Principal amount: Subject to redemption by the company as provided under “— Company’s redemption right (automatic call feature)” below, on the stated maturity date the company will pay, for each $1,000 of the outstanding face amount, an amount, if any, in cash equal to the cash settlement amount.

Cash settlement amount:

|

•

|

if the final underlier level of each underlier is greater than its initial underlier level, (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the upside participation rate times (c) the lesser performing underlier return;

|

|

•

|

if the final underlier level of each underlier is greater than or equal to its trigger buffer level but the final underlier level of any underlier is equal to or less than its initial underlier level, $1,000; or

|

|

•

|

if the final underlier level of any underlier is less than its trigger buffer level, the sum of (i) $1,000 plus (ii) the product of (a) $1,000 times (b) the lesser performing underlier return

|

Company’s redemption right (automatic call feature): if a redemption event occurs, then the outstanding face amount will be automatically redeemed in whole and the company will pay an amount in cash on the call payment date, for each $1,000 of the outstanding face amount, equal to $1,170

Redemption event: a redemption event will occur if, as measured on the call observation date, the closing level of each underlier is greater than or equal to its initial underlier level

Initial underlier level: 515.31 with respect to the MSCI World Information Technology Index, 3,494.751 with respect to the PHLX Semiconductor Sector IndexTM and 2,767.336 with respect to the Russell 1000® Growth Index

Final underlier level: with respect to an underlier, the closing level of such underlier on the determination date, subject to adjustment as provided in “— Consequences of a market disruption event or non-trading day” and “— Discontinuance or modification of an underlier” below

Underlier return: with respect to an underlier, the quotient of (i) its final underlier level minus its initial underlier level divided by (ii) its initial underlier level, expressed as a percentage

Upside participation rate: 150.7%

Lesser performing underlier return: the underlier return of the lesser performing underlier

Lesser performing underlier: the underlier with the lowest underlier return

Trigger buffer level: for each underlier, 80% of its initial underlier level

Trade date: January 20, 2022

Original issue date: January 25, 2022

Determination date: July 21, 2025, unless the calculation agent determines that, with respect to any underlier, a market disruption event occurs or is continuing on that day or that day is not otherwise a trading day. In the event the originally scheduled determination date is a non-trading day with respect to any underlier, the determination date will be the first day thereafter that is a trading day for all underliers (the “first qualified trading day”) provided that no market disruption event occurs or is continuing with respect to an underlier on that day. If a market disruption event with respect to an underlier occurs or is continuing on the originally scheduled determination date or the first qualified trading day, the determination date will be the first following trading day on which the calculation agent determines that each underlier has had at least one trading day (from and including the originally scheduled determination date or the first qualified trading day, as applicable) on which no market disruption event has occurred or is continuing and the closing level of each underlier will be determined on or prior to the postponed

PS-3

determination date as set forth under “— Consequences of a market disruption event or a non-trading day” below. (In such case, the determination date may differ from the date on which the level of an underlier is determined for the purpose of the calculations to be performed on the determination date.) In no event, however, will the determination date be postponed to a date later than the originally scheduled stated maturity date or, if the originally scheduled stated maturity date is not a business day, later than the first business day after the originally scheduled stated maturity date, either due to the occurrence of serial non-trading days or due to the occurrence of one or more market disruption events. On such last possible determination date, if a market disruption event occurs or is continuing with respect to an underlier that has not yet had such a trading day on which no market disruption event has occurred or is continuing or if such last possible day is not a trading day with respect to such underlier, that day will nevertheless be the determination date

Stated maturity date: July 24, 2025, unless that day is not a business day, in which case the stated maturity date will be postponed to the next following business day. The stated maturity date will also be postponed if the determination date is postponed as described under “— Determination date” above. In such a case, the stated maturity date will be postponed by the same number of business day(s) from but excluding the originally scheduled determination date to and including the actual determination date.

Call observation date: January 27, 2023, unless the calculation agent determines that, with respect to any underlier, a market disruption event occurs or is continuing on that day or that day is not otherwise a trading day.

In the event the originally scheduled call observation date is a non-trading day with respect to any underlier, the call observation date will be the first day thereafter that is a trading day for all underliers (the “first qualified call trading day”) provided that no market disruption event occurs or is continuing with respect to an underlier on that day. If a market disruption event with respect to an underlier occurs or is continuing on the originally scheduled call observation date or the first qualified call trading day, the call observation date will be the first following trading day on which the calculation agent determines that each underlier has had at least one trading day (from and including the originally scheduled call observation date or the first qualified call trading day, as applicable) on which no market disruption event has occurred or is continuing and the closing level of each underlier for that call observation date will be determined on or prior to the postponed call observation date as set forth under “— Consequences of a market disruption event or a non-trading day” below. (In such case, the call observation date may differ from the date on which the level of an underlier is determined for the purpose of the calculations to be performed on the call observation date.) In no event, however, will the call observation date be postponed to a date later than the originally scheduled call payment date or, if the originally scheduled call payment date is not a business day, later than the first business day after the originally scheduled call payment date, either due to the occurrence of serial non-trading days or due to the occurrence of one or more market disruption events. On such last possible call observation date applicable to the relevant call payment date, if a market disruption event occurs or is continuing with respect to an underlier that has not yet had such a trading day on which no market disruption event has occurred or is continuing or if such last possible day is not a trading day with respect to such underlier, that day will nevertheless be the call observation date.

Call payment date: February 1, 2023, unless that day is not a business day, in which case the call payment date will be postponed to the next following business day. If the call observation date is postponed as described under “Call observation date” above, the call payment date will be postponed by the same number of business day(s) from but excluding the originally scheduled call observation date to and including the actual call observation date

Closing level: on any trading day, (i) with respect to the MSCI World Information Technology Index or the Russell 1000® Growth Index, the closing level of such underlier or any successor underlier reported by Bloomberg Financial Services, or any successor reporting service the company may select, on such trading day for that underlier (as of the trade date, whereas such underlier sponsor publishes the official closing level of such underlier to six decimal places, Bloomberg Financial Services reports the closing level to fewer decimal places) and (ii) with respect to the PHLX Semiconductor Sector IndexTM, the official closing level of such underlier or any successor underlier published by the underlier sponsor on such trading day for such underlier

Constituent index: with respect to the MSCI World Information Technology Index, any of the component country indices comprising such underlier

Trading day: (i) with respect to the MSCI World Information Technology index, a day on which the underlier is calculated and published by the underlier sponsor and (ii) with respect to the PHLX Semiconductor Sector IndexTM, or the Russell 1000® Growth Index, a day on which the respective principal securities markets for all of its underlier stocks are open for trading, the underlier sponsor is open for business and such underlier is calculated and published by the underlier sponsor

Successor underlier: with respect to an underlier, any substitute underlier approved by the calculation agent as a successor as provided under “— Discontinuance or modification of an underlier” below

Underlier sponsor: with respect to an underlier, at any time, the person or entity, including any successor sponsor, that determines and publishes such underlier as then in effect. The notes are not sponsored, endorsed, sold or

PS-4

promoted by any underlier sponsor or any affiliate thereof and no underlier sponsor or affiliate thereof makes any representation regarding the advisability of investing in the notes.

Underlier stocks: with respect to an underlier, at any time, the stocks that comprise such underlier as then in effect, after giving effect to any additions, deletions or substitutions

Market disruption event: With respect to any given trading day, any of the following will be a market disruption event with respect to an underlier:

|

●

|

a suspension, absence or material limitation of trading in underlier stocks constituting 20% or more, by weight, of such underlier on their respective primary markets, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion,

|

|

●

|

a suspension, absence or material limitation of trading in option or futures contracts relating to such underlier or to underlier stocks constituting 20% or more, by weight, of such underlier in the respective primary markets for those contracts, in each case for more than two consecutive hours of trading or during the one-half hour before the close of trading in that market, as determined by the calculation agent in its sole discretion, or

|

|

●

|

underlier stocks constituting 20% or more, by weight, of such underlier, or option or futures contracts, if available, relating to such underlier or to underlier stocks constituting 20% or more, by weight, of such underlier do not trade on what were the respective primary markets for those underlier stocks or contracts, as determined by the calculation agent in its sole discretion,

|

and, in the case of any of these events, the calculation agent determines in its sole discretion that such event could materially interfere with the ability of the company or any of its affiliates or a similarly situated person to unwind all or a material portion of a hedge that could be effected with respect to this note.

The following events will not be market disruption events:

|

●

|

a limitation on the hours or numbers of days of trading, but only if the limitation results from an announced change in the regular business hours of the relevant market, and

|

|

●

|

a decision to permanently discontinue trading in option or futures contracts relating to such underlier or to any underlier stock.

|

For this purpose, an “absence of trading” in the primary securities market on which an underlier stock is traded, or on which option or futures contracts relating to such underlier or an underlier stock are traded, will not include any time when that market is itself closed for trading under ordinary circumstances. In contrast, a suspension or limitation of trading in an underlier stock or in option or futures contracts, if available, relating to such underlier or an underlier stock in the primary market for that stock or those contracts, by reason of:

|

●

|

a price change exceeding limits set by that market,

|

|

●

|

an imbalance of orders relating to that underlier stock or those contracts, or

|

|

●

|

a disparity in bid and ask quotes relating to that underlier stock or those contracts,

|

will constitute a suspension or material limitation of trading in that stock or those contracts in that market.

A market disruption event with respect to one underlier will not, by itself, constitute a market disruption event for any unaffected underlier.

Consequences of a market disruption event or a non-trading day: With respect to any underlier, if a market disruption event occurs or is continuing on a day that would otherwise be the call observation date or the determination date, or such day is not a trading day, then such call observation date or the determination date will be postponed as described under “— Call observation date” or “— Determination date” above. If any call observation date or the determination date is postponed to the last possible date due to the occurrence of serial non-trading days, the level of each underlier will be the calculation agent’s assessment of such level, in its sole discretion, on such last possible postponed call observation date or determination date, as applicable. If any call observation date or the determination date is postponed due to a market disruption event with respect to any underlier, the closing level of each underlier with respect to such call observation date or the final underlier level with respect to the determination date, as applicable, will be calculated based on (i) for any underlier that is not affected by a market disruption event on (A) the applicable originally scheduled call observation date or the first qualified call trading day thereafter (if applicable) or (B) the originally scheduled determination date or the first qualified trading day thereafter (if applicable), the closing level of the underlier on that date, (ii) for any underlier that is affected by a market disruption event on (A) the applicable originally scheduled call observation date or the first qualified call trading day thereafter (if applicable) or (B) the originally scheduled determination date or the first qualified trading day thereafter (if applicable), the closing level of the underlier on the first following trading day on which no market disruption event exists for such underlier and (iii) the calculation agent’s assessment, in its sole discretion, of the level of any underlier on the last possible postponed call observation date or determination date, as applicable, with respect to such underlier as to which a market disruption event continues through the last

PS-5

possible postponed call observation date or determination date. As a result, this could result in the closing level on any call observation date or final underlier level on the determination date of each underlier being determined on different calendar dates. For the avoidance of doubt, once the closing level for an underlier is determined for the call observation date or determination date, the occurrence of a later market disruption event or non-trading day will not alter such calculation.

Discontinuance or modification of an underlier: If an underlier sponsor discontinues publication of an underlier and such underlier sponsor or anyone else publishes a substitute underlier that the calculation agent determines is comparable to such underlier and approves as a successor underlier, or if the calculation agent designates a substitute underlier, then the calculation agent will determine the amount payable on the call payment date or the amount in cash on the stated maturity date, as applicable, by reference to such successor underlier.

If the calculation agent determines that the publication of an underlier is discontinued and there is no successor underlier, the calculation agent will determine the amount payable on the call payment date or on the stated maturity date, as applicable, by a computation methodology that the calculation agent determines will as closely as reasonably possible replicate such underlier.

If the calculation agent determines that (i) an underlier, the underlier stocks comprising such underlier or the method of calculating such underlier is changed at any time in any respect — including any addition, deletion or substitution and any reweighting or rebalancing of such underlier or the underlier stocks and whether the change is made by the underlier sponsor under its existing policies or following a modification of those policies, is due to the publication of a successor underlier, is due to events affecting one or more of the underlier stocks or their issuers or is due to any other reason — and is not otherwise reflected in the level of the underlier by the underlier sponsor pursuant to the then-current underlier methodology of the underlier or (ii) there has been a split or reverse split of the underlier, then the calculation agent will be permitted (but not required) to make such adjustments in such underlier or the method of its calculation as it believes are appropriate to ensure that the levels of such underlier used to determine the amount payable on the call payment date or the stated maturity date, as applicable, is equitable.

All determinations and adjustments to be made by the calculation agent with respect to an underlier may be made by the calculation agent in its sole discretion. The calculation agent is not obligated to make any such adjustments.

Calculation agent: Goldman Sachs & Co. LLC (“GS&Co.”)

Tax characterization: The holder, on behalf of itself and any other person having a beneficial interest in this note, hereby agrees with the company (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to characterize this note for all U.S. federal income tax purposes as a pre-paid derivative contract in respect of the underliers.

Overdue principal rate: the effective Federal Funds rate

PS-6

HYPOTHETICAL EXAMPLES

The following examples are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and are intended merely to illustrate the impact that the various hypothetical closing levels of the underliers on the call observation date and on the determination date could have on the amount of cash payable on the call payment date or on the stated maturity date, as the case may be, assuming all other variables remain constant.

The examples below are based on a range of underlier levels that are entirely hypothetical; no one can predict what the closing level of any underlier will be on any day throughout the life of your notes, what the closing level of any underlier will be on the call observation date or what the final underlier level of the lesser performing underlier will be on the determination date. The underliers have been highly volatile in the past — meaning that the underlier levels have changed substantially in relatively short periods — and their performance cannot be predicted for any future period.

The information in the following examples reflects hypothetical rates of return on the offered notes assuming that they are purchased on the original issue date at the face amount and held to the call payment date or the stated maturity date, as the case may be. If you sell your notes in a secondary market prior to the call payment date or the stated maturity date, as the case may be, your return will depend upon the market value of your notes at the time of sale, which may be affected by a number of factors that are not reflected in the examples below such as interest rates, the volatility of the underliers, the creditworthiness of GS Finance Corp., as issuer, and the creditworthiness of The Goldman Sachs Group, Inc., as guarantor. In addition, the estimated value of your notes at the time the terms of your notes are set on the trade date (as determined by reference to pricing models used by GS&Co.) is less than the original issue price of your notes. For more information on the estimated value of your notes, see “Additional Risk Factors Specific to Your Notes — The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes” on page PS-11 of this pricing supplement. The information in the examples also reflects the key terms and assumptions in the box below.

|

Key Terms and Assumptions

|

|

Face amount

|

$1,000

|

|

Upside participation rate

|

150.7%

|

|

Trigger buffer level

|

with respect to each underlier, 80% of its initial underlier level

|

|

The notes are not automatically called, unless otherwise indicated below

Neither a market disruption event nor a non-trading day occurs on any originally scheduled call observation date or the originally scheduled determination date

No change in or affecting any of the underlier stocks or the method by which the applicable underlier sponsor calculates any underlier

Notes purchased on original issue date at the face amount and held to the call payment date or the stated maturity date

|

For these reasons, the actual performance of the underliers over the life of your notes, particularly on the call observation date and the determination date, as well as the amount payable on the call payment date or at maturity, if any, may bear little relation to the hypothetical examples shown below or to the historical underlier levels shown elsewhere in this pricing supplement. For information about the underlier levels during recent periods, see “The Underliers — Historical Closing Levels of the Underliers” on page PS-40. Before investing in the notes, you should consult publicly available information to determine the underlier levels between the date of this pricing supplement and the date of your purchase of the notes.

Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your notes, tax liabilities could affect the after-tax rate of return on your notes to a comparatively greater extent than the after-tax return on the underlier stocks.

PS-7

Hypothetical Amount in Cash Payable on the Call Payment Date

The example below shows the hypothetical amount that we would pay on the call payment date with respect to each $1,000 face amount of the notes if the closing level of each underlier is greater than or equal to its initial underlier level on the call observation date.

If your notes are automatically called on the call observation date (i.e., on the call observation date the closing level of each underlier is greater than or equal to its initial underlier level), the amount in cash that we would deliver for each $1,000 face amount of your notes on the call payment date would be $1,170. If, for example, the closing level of each underlier was determined to be 130% of its initial underlier level, your notes would be automatically called and the amount in cash that we would deliver on your notes on the corresponding call payment date would be 117% of the face amount of your notes or $1,170 for each $1,000 of the face amount of your notes.

Hypothetical Payment at Maturity

If the notes are not automatically called on the call observation date (i.e., on the call observation date the closing level of any underlier is less than its initial underlier level), the cash settlement amount we would deliver for each $1,000 face amount of your notes on the stated maturity date will depend on the performance of the lesser performing underlier on the determination date, as shown in the table below. The table below assumes that the notes have not been automatically called on the call observation date and reflects hypothetical cash settlement amounts that you could receive on the stated maturity date.

The levels in the left column of the table below represent hypothetical final underlier levels of the lesser performing underlier and are expressed as percentages of the initial underlier level of the lesser performing underlier. The amounts in the right column represent the hypothetical cash settlement amounts, based on the corresponding hypothetical final underlier level of the lesser performing underlier, and are expressed as percentages of the face amount of a note (rounded to the nearest one-thousandth of a percent). Thus, a hypothetical cash settlement amount of 100.000% means that the value of the cash payment that we would deliver for each $1,000 of the outstanding face amount of the offered notes on the stated maturity date would equal 100.000% of the face amount of a note, based on the corresponding hypothetical final underlier level of the lesser performing underlier and the assumptions noted above.

The Notes Have Not Been Automatically Called

|

|

|

|

Hypothetical Final Underlier Level of the Lesser Performing Underlier

|

Hypothetical Cash Settlement Amount

|

|

(as Percentage of Initial Underlier Level)

|

(as Percentage of Face Amount)

|

|

200.000%

|

250.700%

|

|

175.000%

|

213.025%

|

|

150.000%

|

175.350%

|

|

125.000%

|

137.675%

|

|

100.000%

|

100.000%

|

|

99.999%

|

100.000%

|

|

90.000%

|

100.000%

|

|

85.000%

|

100.000%

|

|

80.000%

|

100.000%

|

|

79.999%

|

79.999%

|

|

75.000%

|

75.000%

|

|

50.000%

|

50.000%

|

|

25.000%

|

25.000%

|

|

10.000%

|

10.000%

|

|

0.000%

|

0.000%

|

If, for example, the notes have not been automatically called on the call observation date and the final underlier level of the lesser performing underlier were determined to be 25.000% of its initial underlier level, the cash settlement amount that we would deliver on your notes at maturity would be 25.000% of the face amount of your notes, as shown in the table above. As a result, if you purchased your notes on the original issue date at the face amount and held them to the stated maturity date, you would lose 75.000% of your investment (if you purchased your notes at a premium to face amount you would lose a correspondingly higher percentage of your investment). If the notes have not been automatically called on the call observation date and the final underlier level of the lesser performing underlier were determined to be 85.000% of its initial underlier level, the cash settlement amount that we would deliver on your notes at maturity would be 100.000% of the face amount of your notes, as shown in the table above.

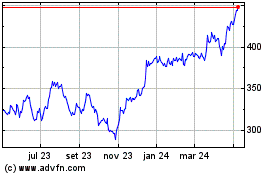

The following chart also shows a graphical illustration of the hypothetical cash settlement amounts that we would pay on your notes on the stated maturity date, if the final underlier level of the lesser performing underlier were any of the hypothetical levels shown on the horizontal axis. The chart shows that any hypothetical final underlier level of the lesser performing underlier of less than 80.000% (the section left of the 80.000% marker on the horizontal axis)

PS-8

would result in a hypothetical cash settlement amount of less than 80.000% of the face amount of your notes (the section below the 80.000% marker on the vertical axis) and, accordingly, in a loss of principal on your notes.

The amounts shown above are entirely hypothetical; they are based on market prices for the underlier stocks that may not be achieved on the determination date and on assumptions that may prove to be erroneous. The actual market value of your notes on the stated maturity date or at any other time, including any time you may wish to sell your notes, may bear little relation to the hypothetical amounts shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered notes. The hypothetical amounts on notes held to the stated maturity date in the examples above assume you purchased your notes at their face amount and have not been adjusted to reflect the actual issue price you pay for your notes. The return on your investment (whether positive or negative) in your notes will be affected by the amount you pay for your notes. If you purchase your notes for a price other than the face amount, the return on your investment will differ from, and may be significantly lower than, the hypothetical returns suggested by the above examples. Please read “Additional Risk Factors Specific to Your Notes — The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” on page PS-13.

Payments on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on the notes are economically equivalent to a combination of an interest-bearing bond bought by the holder and one or more options entered into between the holder and us (with one or more implicit option premiums paid over time). The discussion in this paragraph does not modify or affect the terms of the notes or the U.S. federal income tax treatment of the notes, as described elsewhere in this pricing supplement.

PS-9

|

We cannot predict the actual closing levels of the underliers on any day, the final underlier levels or what the market value of your notes will be on any particular trading day, nor can we predict the relationship between the closing levels of the underliers and the market value of your notes at any time prior to the stated maturity date. The actual amount that you will receive on the call payment date or the stated maturity date, if any, and the rate of return on the offered notes will depend on whether or not the notes are automatically called and on the actual closing levels of the underliers on the call observation date and the actual final underlier levels determined by the calculation agent as described above. Moreover, the assumptions on which the hypothetical examples are based may turn out to be inaccurate. Consequently, the amount in cash to be paid in respect of your notes on the call payment date or the stated maturity date, as applicable, may be very different from the information reflected in the examples above.

|

PS-10

ADDITIONAL RISK FACTORS SPECIFIC TO YOUR NOTES

|

An investment in your notes is subject to the risks described below, as well as the risks and considerations described in the accompanying prospectus, in the accompanying prospectus supplement and under “Additional Risk Factors Specific to the Notes” in the accompanying general terms supplement no. 2,913. You should carefully review these risks and considerations as well as the terms of the notes described herein and in the accompanying prospectus, the accompanying prospectus supplement and the accompanying general terms supplement no. 2,913. Your notes are a riskier investment than ordinary debt securities. Also, your notes are not equivalent to investing directly in the underlier stocks, i.e., with respect to an underlier to which your notes are linked, the stocks comprising such underlier. You should carefully consider whether the offered notes are appropriate given your particular circumstances.

|

Risks Related to Structure, Valuation and Secondary Market Sales

The Estimated Value of Your Notes At the Time the Terms of Your Notes Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Notes

The original issue price for your notes exceeds the estimated value of your notes as of the time the terms of your notes are set on the trade date, as determined by reference to GS&Co.’s pricing models and taking into account our credit spreads. Such estimated value on the trade date is set forth above under “Estimated Value of Your Notes”; after the trade date, the estimated value as determined by reference to these models will be affected by changes in market conditions, the creditworthiness of GS Finance Corp., as issuer, the creditworthiness of The Goldman Sachs Group, Inc., as guarantor, and other relevant factors. The price at which GS&Co. would initially buy or sell your notes (if GS&Co. makes a market, which it is not obligated to do), and the value that GS&Co. will initially use for account statements and otherwise, also exceeds the estimated value of your notes as determined by reference to these models. As agreed by GS&Co. and the distribution participants, this excess (i.e., the additional amount described under “Estimated Value of Your Notes”) will decline to zero on a straight line basis over the period from the date hereof through the applicable date set forth above under “Estimated Value of Your Notes”. Thereafter, if GS&Co. buys or sells your notes it will do so at prices that reflect the estimated value determined by reference to such pricing models at that time. The price at which GS&Co. will buy or sell your notes at any time also will reflect its then current bid and ask spread for similar sized trades of structured notes.

In estimating the value of your notes as of the time the terms of your notes are set on the trade date, as disclosed above under “Estimated Value of Your Notes”, GS&Co.’s pricing models consider certain variables, including principally our credit spreads, interest rates (forecasted, current and historical rates), volatility, price-sensitivity analysis and the time to maturity of the notes. These pricing models are proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, the actual value you would receive if you sold your notes in the secondary market, if any, to others may differ, perhaps materially, from the estimated value of your notes determined by reference to our models due to, among other things, any differences in pricing models or assumptions used by others. See “— The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” below.

The difference between the estimated value of your notes as of the time the terms of your notes are set on the trade date and the original issue price is a result of certain factors, including principally the underwriting discount and commissions, the expenses incurred in creating, documenting and marketing the notes, and an estimate of the difference between the amounts we pay to GS&Co. and the amounts GS&Co. pays to us in connection with your notes. We pay to GS&Co. amounts based on what we would pay to holders of a non-structured note with a similar maturity. In return for such payment, GS&Co. pays to us the amounts we owe under your notes.

In addition to the factors discussed above, the value and quoted price of your notes at any time will reflect many factors and cannot be predicted. If GS&Co. makes a market in the notes, the price quoted by GS&Co. would reflect any changes in market conditions and other relevant factors, including any deterioration in our creditworthiness or perceived creditworthiness or the creditworthiness or perceived creditworthiness of The Goldman Sachs Group, Inc. These changes may adversely affect the value of your notes, including the price you may receive for your notes in any market making transaction. To the extent that GS&Co. makes a market in the notes, the quoted price will reflect the estimated value determined by reference to GS&Co.’s pricing models at that time, plus or minus its then current bid and ask spread for similar sized trades of structured notes (and subject to the declining excess amount described above).

Furthermore, if you sell your notes, you will likely be charged a commission for secondary market transactions, or the price will likely reflect a dealer discount. This commission or discount will further reduce the proceeds you would receive for your notes in a secondary market sale.

There is no assurance that GS&Co. or any other party will be willing to purchase your notes at any price and, in this regard, GS&Co. is not obligated to make a market in the notes. See “Additional Risk Factors Specific to the Notes

PS-11

— Your Notes May Not Have an Active Trading Market” on page S-7 of the accompanying general terms supplement no. 2,913.

The Notes Are Subject to the Credit Risk of the Issuer and the Guarantor

Although the return on the notes will be based on the performance of each underlier, the payment of any amount due on the notes is subject to the credit risk of GS Finance Corp., as issuer of the notes, and the credit risk of The Goldman Sachs Group, Inc., as guarantor of the notes. The notes are our unsecured obligations. Investors are dependent on our ability to pay all amounts due on the notes, and therefore investors are subject to our credit risk and to changes in the market’s view of our creditworthiness. Similarly, investors are dependent on the ability of The Goldman Sachs Group, Inc., as guarantor of the notes, to pay all amounts due on the notes, and therefore are also subject to its credit risk and to changes in the market’s view of its creditworthiness. See “Description of the Notes We May Offer — Information About Our Medium-Term Notes, Series F Program — How the Notes Rank Against Other Debt” on page S-5 of the accompanying prospectus supplement and “Description of Debt Securities We May Offer — Guarantee by The Goldman Sachs Group, Inc.” on page 67 of the accompanying prospectus.

You May Lose Your Entire Investment in the Notes

You can lose your entire investment in the notes. Assuming your notes are not automatically called, the cash settlement amount on your notes, if any, on the stated maturity date will be based on the performance of the lesser performing of the underliers as measured from their initial underlier levels to their closing levels on the determination date. If the final underlier level of any underlier is less than its trigger buffer level, you will have a loss for each $1,000 of the face amount of your notes equal to the product of the lesser performing underlier return times $1,000. Thus, you may lose your entire investment in the notes, which would include any premium to face amount you paid when you purchased the notes.

Also, the market price of your notes prior to the call payment date or the stated maturity date, as the case may be, may be significantly lower than the purchase price you pay for your notes. Consequently, if you sell your notes before the stated maturity date, you may receive far less than the amount of your investment in the notes.

The Amount You Will Receive on the Call Payment Date Will Be Capped

Regardless of the closing levels of the underliers on the call observation date, the amount in cash that you may receive on the call payment date is capped. Even if the closing level of each underlier on the call observation date exceeds its initial underlier level, causing the notes to be automatically called on such day, the amount in cash payable on the call payment date will be capped, and you will not benefit from the increases in the closing levels of the underliers above their initial underlier levels on the call observation date. If your notes are automatically called on the call observation date, the maximum payment you will receive for each $1,000 face amount of your notes will be $1,170.

The Return on Your Notes May Change Significantly Despite Only a Small Change in the Level of the Lesser Performing Underlier

If your notes are not automatically called and the final underlier level of the lesser performing underlier is less than its trigger buffer level, you will receive less than the face amount of your notes and you could lose all or a substantial portion of your investment in the notes. This means that while a decrease in the final underlier level of the lesser performing underlier to its trigger buffer level will not result in a loss of principal on the notes, a decrease in the final underlier level of the lesser performing underlier to less than its trigger buffer level will result in a loss of a significant portion of the face amount of the notes despite only a small change in the level of the lesser performing underlier.

Your Notes Are Subject to Automatic Redemption

We will automatically call and redeem all, but not part, of your notes on the call payment date if, as measured on the call observation date, the closing level of each underlier is greater than or equal to its initial underlier level. Therefore, the term for your notes may be reduced. You may not be able to reinvest the proceeds from an investment in the notes at a comparable return for a similar level of risk in the event the notes are automatically called prior to maturity. For the avoidance of doubt, if your notes are automatically called, no discounts, commissions or fees described herein will be rebated or reduced.

The Amount In Cash That You Will Receive on the Call Payment Date or on the Stated Maturity Date is Not Linked to the Closing Levels of the Underliers at Any Time Other Than on the Call Observation Date or on the Determination Date, as the Case May Be

The amount in cash that you will receive on the call payment date, if any, will be paid only if the closing level of each underlier on the call observation date is equal to or greater than its initial underlier level. Therefore, the closing levels of the underliers on dates other than the call observation date will have no effect on any amount paid in respect of your notes on the call payment date. In addition, the cash settlement amount you will receive on the

PS-12

stated maturity date, if any, will be based on the closing levels of the underliers on the determination date (which is subject to postponement in case of market disruption events or non-trading days), and therefore not the simple performance of the underliers over the life of your notes. Therefore, if the closing level of an underlier dropped precipitously on the determination date, the cash settlement amount for your notes may be significantly less than it would have been had the cash settlement amount been linked to the closing levels of the underliers prior to such drop.

The Cash Settlement Amount Will Be Based Solely on the Lesser Performing Underlier

If the notes are not automatically called, the cash settlement amount will be based on the lesser performing underlier without regard to the performance of the other underliers. As a result, you could lose all or some of your initial investment if the lesser performing underlier return is negative, even if there is an increase in the level of the other underliers. This could be the case even if the other underliers increased by an amount greater than the decrease in the lesser performing underlier.

The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors

When we refer to the market value of your notes, we mean the value that you could receive for your notes if you chose to sell them in the open market before the stated maturity date. A number of factors, many of which are beyond our control, will influence the market value of your notes, including:

|

•

|

the levels of the underliers;

|

|

•

|

the volatility - i.e., the frequency and magnitude of changes - in the closing levels of the underliers;

|

|

•

|

the dividend rates of the underlier stocks;

|

|

•

|

economic, financial, regulatory, political, military, public health and other events that affect stock markets generally and the underlier stocks, and which may affect the closing level of the underlier or underliers;

|

|

•

|

interest rates and yield rates in the market;

|

|

•

|

the time remaining until your notes mature; and

|

|

•

|

our creditworthiness and the creditworthiness of The Goldman Sachs Group, Inc., whether actual or perceived, and including actual or anticipated upgrades or downgrades in our credit ratings or the credit ratings of The Goldman Sachs Group, Inc. or changes in other credit measures.

|

Without limiting the foregoing, the market value of your notes may be negatively impacted by increasing interest rates. Such adverse impact of increasing interest rates could be significantly enhanced in notes with longer-dated maturities, the market values of which are generally more sensitive to increasing interest rates.

These factors may influence the market value of your notes if you sell your notes before maturity, including the price you may receive for your notes in any market making transaction. If you sell your notes prior to maturity, you may receive less than the face amount of your notes. You cannot predict the future performance of the underliers based on their historical performance.

If You Purchase Your Notes at a Premium to Face Amount, the Return on Your Investment Will Be Lower Than the Return on Notes Purchased at Face Amount and the Impact of Certain Key Terms of the Notes Will Be Negatively Affected

The amount in cash that you will be paid for your notes on the stated maturity date, if any, or the amount you will be paid on the call payment date will not be adjusted based on the issue price you pay for the notes. If you purchase notes at a price that differs from the face amount of the notes, then the return on your investment in such notes held to the call payment date or the stated maturity date will differ from, and may be substantially less than, the return on notes purchased at face amount. If you purchase your notes at a premium to face amount and hold them to the call payment date or the stated maturity date, the return on your investment in the notes will be lower than it would have been had you purchased the notes at face amount or a discount to face amount.

If the Levels of the Underliers Change, the Market Value of Your Notes May Not Change in the Same Manner

Your notes may trade quite differently from the performance of the underliers. Changes in the levels of the underliers may not result in a comparable change in the market value of your notes. Even if the level of each underlier increases above its initial underlier level during the life of the notes, the market value of your notes may not increase by the same amount. We discuss some of the reasons for this disparity under “- The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” above.

You Have No Shareholder Rights or Rights to Receive Any Underlier Stock

Investing in your notes will not make you a holder of any of the underlier stocks. Neither you nor any other holder or owner of your notes will have any rights with respect to the underlier stocks, including any voting rights, any right to

PS-13

receive dividends or other distributions, any rights to make a claim against the underlier stocks or any other rights of a holder of the underlier stocks. Your notes will be paid in cash and you will have no right to receive delivery of any underlier stocks.

Past Underlier Performance is No Guide to Future Performance

The actual performance of the underliers over the life of the notes, as well as the amount payable at maturity, may bear little relation to the historical closing levels of the underliers or to the hypothetical return examples set forth elsewhere in this pricing supplement. We cannot predict the future performance of the underliers.

The Return on Your Notes Will Not Reflect Any Dividends Paid on the Underlier Stocks

The applicable underlier sponsor calculates the level of an underlier by reference to the prices of the underlier stocks, without taking account of the value of dividends paid on those underlier stocks. Therefore, the return on your notes will not reflect the return you would realize if you actually owned the underlier stocks included in each underlier and received the dividends paid on those underlier stocks. You will not receive any dividends that may be paid on any of the underlier stocks by the underlier stock issuers. See “- You Have No Shareholder Rights or Rights to Receive Any Underlier Stock” above for additional information.

We May Sell an Additional Aggregate Face Amount of the Notes at a Different Issue Price

At our sole option, we may decide to sell an additional aggregate face amount of the notes subsequent to the date of this pricing supplement. The issue price of the notes in the subsequent sale may differ substantially (higher or lower) from the issue price you paid as provided on the cover of this pricing supplement.

Your Notes Do Not Bear Interest

You will not receive any interest payments on your notes. As a result, even if the amount payable for your notes on the call payment date or the stated maturity date, as applicable, exceeds the face amount of your notes, the overall return you earn on your notes may be less than you would have earned by investing in a non-indexed debt security of comparable maturity that bears interest at a prevailing market rate.

Additional Risks Related to the Underliers

The Policies of an Underlier Sponsor and Changes That Affect an Underlier or the Underlier Stocks Could Affect the Payment Amount on Your Notes and Their Market Value

The policies of an underlier sponsor concerning the calculation of the level of an underlier, additions, deletions or substitutions of the underlier stocks and the manner in which changes affecting such underlier stocks or their issuers, such as stock dividends, reorganizations or mergers, are reflected in the level of such underlier could affect the level of such underlier and, therefore, the cash settlement amount on your notes on the stated maturity date and the market value of your notes before that date. The cash settlement amount on your notes and their market value could also be affected if an underlier sponsor changes these policies, for example, by changing the manner in which it calculates the level of such underlier or the method by which it constructs such underlier, or if the underlier sponsor discontinues or suspends calculation or publication of the level of such underlier, in which case it may become difficult to determine the market value of your notes. If events such as these occur, or if the closing level of an underlier is not available on the determination date because of a market disruption event or for any other reason, the calculation agent - which initially will be GS&Co., our affiliate - may determine the closing level of the underlier on the determination date - and thus the cash settlement amount on the stated maturity date - in a manner it considers appropriate, in its sole discretion. We describe the discretion that the calculation agent will have in determining the closing levels of the underliers on the determination date and the cash settlement amount on your notes more fully under “Discontinuance or Modification of an Underlier” above.

There Is No Affiliation Between the Underlier Stock Issuers or the Underlier Sponsors and Us

We are not affiliated with the issuers of the underlier stocks or the underlier sponsors. As we have told you above, however, we or our affiliates may currently or from time to time in the future own securities of, or engage in business with the underlier sponsors or the underlier stock issuers. Neither we nor any of our affiliates have participated in the preparation of any publicly available information or made any “due diligence” investigation or inquiry with respect to the underliers or any of the underlier stock issuers. You, as an investor in your notes, should make your own investigation into the underliers and the underlier stock issuers. See “The Underliers” below for additional information about the underliers.

Neither the underlier sponsors nor any of the underlier stock issuers are involved in the offering of your notes in any way and none of them have any obligation of any sort with respect to your notes. Thus, neither the underlier sponsors nor any of the underlier stock issuers have any obligation to take your interests into consideration for any reason, including in taking any corporate actions that might affect the market value of your notes.

PS-14

Additional Risks Related to the MSCI World Information Technology Index

The MSCI World Information Technology Index Is Concentrated in the Information Technology Sector and Does Not Provide Diversified Exposure

The MSCI World Information Technology Index is not diversified. The MSCI World Information Technology Index’s assets are concentrated in the information technology sector, which means the MSCI World Information Technology Index is more likely to be more adversely affected by any negative performance of the information technology sector than an underlier that has more diversified holdings across a number of sectors. Companies in the information technology sector may be adversely affected by the failure to obtain, or delays in obtaining, financing or regulatory approval, intense competition, both domestically and internationally, product compatibility, consumer preferences, corporate capital expenditure, rapid obsolescence and competition for the services of qualified personnel. Companies in the information technology sector also face competition or potential competition with numerous alternative technologies. In addition, the highly competitive information technology sector may cause the prices for these products and services to decline in the future. Information technology companies may have limited product lines, markets, financial resources or personnel. Companies in the information technology sector are heavily dependent on patent and intellectual property rights. The loss or impairment of these rights may adversely affect the profitability of these companies. The information technology sector is subject to rapid and significant changes in technology that are evidenced by the increasing pace of technological upgrades, evolving industry standards, ongoing improvements in the capacity and quality of digital technology, shorter development cycles for new products and enhancements, developments in emerging wireless transmission technologies and changes in customer requirements and preferences. The success of sector participants depends substantially on the timely and successful introduction of new products.

An Investment in the Offered Notes Is Subject to Risks Associated with Foreign Securities

The value of your notes is linked, in part, to an underlier that is comprised of stocks from one or more foreign securities markets. Investments linked to the value of foreign equity securities involve particular risks. Any foreign securities market may be less liquid, more volatile and affected by global or domestic market developments in a different way than are the U.S. securities market or other foreign securities markets. Both government intervention in a foreign securities market, either directly or indirectly, and cross-shareholdings in foreign companies, may affect trading prices and volumes in that market. Also, there is generally less publicly available information about foreign companies than about those U.S. companies that are subject to the reporting requirements of the U.S. Securities and Exchange Commission. Further, foreign companies are subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies.

The prices of securities in a foreign country are subject to political, economic, financial and social factors that are unique to such foreign country's geographical region. These factors include: recent changes, or the possibility of future changes, in the applicable foreign government's economic and fiscal policies; the possible implementation of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign companies or investments in foreign equity securities; fluctuations, or the possibility of fluctuations, in currency exchange rates; and the possibility of outbreaks of hostility, political instability, natural disaster or adverse public health developments. The United Kingdom ceased to be a member of the European Union on January 31, 2020 (an event commonly referred to as “Brexit”). The effects of Brexit are uncertain, and, among other things, Brexit has contributed, and may continue to contribute, to volatility in the prices of securities of companies located in Europe (or elsewhere) and currency exchange rates, including the valuation of the euro and British pound in particular. Any one of these factors, or the combination of more than one of these factors, could negatively affect such foreign securities market and the price of securities therein. Further, geographical regions may react to global factors in different ways, which may cause the prices of securities in a foreign securities market to fluctuate in a way that differs from those of securities in the U.S. securities market or other foreign securities markets. Foreign economies may also differ from the U.S. economy in important respects, including growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency, which may have a positive or negative effect on foreign securities prices.

Government Regulatory Action, Including Legislative Acts and Executive Orders, Could Result in Material Changes to the Composition of an Underlier with Underlier Stocks from One or More Foreign Securities Markets and Could Negatively Affect Your Investment in the Notes

Government regulatory action, including legislative acts and executive orders, could cause material changes to the composition of an underlier with underlier stocks from one or more foreign securities markets and could negatively affect your investment in the notes in a variety of ways, depending on the nature of such government regulatory action and the underlier stocks that are affected. For example, recent executive orders issued by the United States Government prohibit United States persons from purchasing or selling publicly traded securities of certain companies that are determined to operate or have operated in the defense and related materiel sector or the

PS-15

surveillance technology sector of the economy of the People’s Republic of China, or publicly traded securities that are derivative of, or that are designed to provide investment exposure to, those securities (including indexed notes). If the prohibitions in those executive orders (or prohibitions under other government regulatory action) become applicable to underlier stocks that are currently included in an underlier or that in the future are included in an underlier, such underlier stocks may be removed from an underlier. If government regulatory action results in the removal of underlier stocks that have (or historically have had) significant weight in an underlier, such removal could have a material and negative effect on the level of such underlier and, therefore, your investment in the notes. Similarly, if underlier stocks that are subject to those executive orders or subject to other government regulatory action are not removed from an underlier, the value of the notes could be materially and negatively affected, and transactions in, or holdings of, the notes may become prohibited under United States law. Any failure to remove such underlier stocks from an underlier could result in the loss of a significant portion or all of your investment in the notes, including if you attempt to divest the notes at a time when the value of the notes has declined.

Your Investment in the Notes Will Be Subject to Foreign Currency Exchange Rate Risk

Because the MSCI World Information Technology Index is a U.S. dollar denominated index whose underlier stock prices are converted by the underlier sponsor into U.S. dollars for purposes of calculating the level of the underlier, investors in the notes will be exposed to currency exchange rate risk with respect to each of the currencies represented in the underlier which are converted in such manner. An investor’s net exposure will depend on the extent to which the currencies represented in the underlier strengthen or weaken against the U.S. dollar and the relative weight of each relevant currency represented in the overall underlier. If, taking into account such weighting, the dollar strengthens against the component currencies, the level of the underlier will be adversely affected and the amount payable on the notes may be reduced.

Regulators Are Investigating Potential Manipulation of Published Currency Exchange Rates

It has been reported that the U.K. Financial Conduct Authority and regulators from other countries are in the process of investigating the potential manipulation of published currency exchange rates. If such manipulation has occurred or is continuing, certain published exchange rates may have been, or may be in the future, artificially lower (or higher) than they would otherwise have been. Any such manipulation could have an adverse impact on any payments on, and the value of, your notes and the trading market for your notes. In addition, we cannot predict whether any changes or reforms affecting the determination or publication of exchange rates or the supervision of currency trading will be implemented in connection with these investigations. Any such changes or reforms could also adversely impact your notes.

Additional Risks Related to the PHLX Semiconductor Sector IndexTM

The PHLX Semiconductor Sector IndexTM Is Concentrated in the Semiconductor Sector and Does Not Provide Diversified Exposure

The underlier stocks comprising the PHLX Semiconductor Sector IndexTM are not diversified and are concentrated in the semiconductor sector, which means the PHLX Semiconductor Sector IndexTM is more likely to be more adversely affected by any negative performance of the semiconductor sector than an index that includes more diversified stocks across a number of sectors. Competitive pressures may have a significant effect on the financial condition of companies in the semiconductor sector. The underlier is subject to the risk that companies that are in the semiconductor sector may be similarly affected by particular economic or market events. As product cycles shorten and manufacturing capacity increases, these companies may become increasingly subject to aggressive pricing, which hampers profitability.

Semiconductor companies are vulnerable to wide fluctuations in securities prices due to rapid product obsolescence. Many semiconductor companies may not successfully introduce new products, develop and maintain a loyal customer base or achieve general market acceptance for their products, and failure to do so could have a material adverse effect on their business, results of operations and financial condition. Reduced demand for end-user products, underutilization of manufacturing capacity, and other factors could adversely impact the operating results of companies in the semiconductor sector. Semiconductor companies typically face high capital costs and such companies may need additional financing, which may be difficult to obtain. They also may be subject to risks relating to research and development costs and the availability and price of components. Moreover, they may be heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Some of the companies involved in the semiconductor sector are also engaged in other lines of business unrelated to the semiconductor business, and they may experience problems with these lines of business, which could adversely affect their operating results.

The international operations of many semiconductor companies expose them to risks associated with instability and changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, competition from subsidized foreign competitors with lower production costs and other risks inherent to international business. The semiconductor sector is highly cyclical, which may cause the operating results of many

PS-16

semiconductor companies to vary significantly. Companies in the semiconductor sector also may be subject to competition from new market entrants. The stock prices of companies in the semiconductor sector have been and will likely continue to be extremely volatile compared to the overall market.

Further, the information technology sector (an industry category that is broader than, and includes, the semiconductor sector) represents a significant portion of the PHLX Semiconductor Sector IndexTM and, to the extent that continues, the PHLX Semiconductor Sector IndexTM is more likely to be more adversely affected by any negative performance of the information technology sector than an index that includes more diversified stocks across a number of sectors. Market or economic factors impacting information technology companies could have a major effect on the PHLX Semiconductor Sector IndexTM stocks. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Information technology companies may have limited product lines, markets, financial resources or personnel. The products of information technology companies may face product obsolescence due to rapid technological developments and frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. Companies in the information technology sector are heavily dependent on patent protection and the expiration of patents may adversely affect the profitability of these companies.

As Compared to Other Index Sponsors, Nasdaq, Inc. Retains Significant Control and Discretionary Decision-Making Over the PHLX Semiconductor Sector IndexTM, Which May Have an Adverse Effect on the Level of the PHLX Semiconductor Sector IndexTM and on Your Notes

Pursuant to the PHLX Semiconductor Sector IndexTM methodology, Nasdaq, Inc. retains the right, from time to time, to exercise reasonable discretion as it deems appropriate in order to ensure PHLX Semiconductor Sector IndexTM integrity, including, but not limited to, changes to quantitative inclusion criteria. Nasdaq, Inc. may also, due to special circumstances, apply discretionary adjustments to ensure and maintain quality of the PHLX Semiconductor Sector IndexTM. Although it is unclear how and to what extent this discretion could or would be exercised, it is possible that it could be exercised by Nasdaq, Inc. in a manner that materially and adversely affects the level of the PHLX Semiconductor Sector IndexTM and therefore your notes. Nasdaq, Inc. is not obligated to, and will not, take account of your interests in exercising the discretion described above.

Additional Risks Related to the Russell 1000® Growth Index

There Is No Guarantee That the Russell 1000® Growth Index Methodology Will Be Successful