Current Report Filing (8-k)

07 Abril 2022 - 9:39AM

Edgar (US Regulatory)

0001590584false00015905842022-04-042022-04-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): April 4, 2022

____________________

Civeo Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| British Columbia, Canada | | 1-36246 | | 98-1253716 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| | Three Allen Center | | |

| | | | | |

| 333 Clay Street, | Suite 4980 |

| | | | | | | | | | | | | | |

| Houston, | Texas | 77002 | |

| (Address and zip code of principal executive offices) | |

Registrant’s telephone number, including area code: (713) 510-2400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Common Shares, no par value | CVEO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On April 7, 2022, Civeo Corporation (the “Company”) issued a press release with respect to the transactions described in Item 8.01 of this current report. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The information contained in this Item 7.01 and the exhibit hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any filings made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On April 4, 2022, the Company entered into a Stock Purchase Agreement (the “Agreement”) with Conversant Opportunity Master Fund L.P. (“Buyer”), Torgerson Family Trust (the “Trust”) and 989677 Alberta Ltd. (together with the Trust, the “Sellers”) pursuant to which the Sellers sold to the Buyer an aggregate of 958,475 common shares, no par value, of the Company. Following consummation of the sale, the Sellers continue to hold 750,000 common shares (the “Escrow Shares”) in escrow with the Company, as more fully described in the Company’s annual report on Form 10-K for the year ended December 31, 2021, subject to release in June 2022 and June 2023 based on certain conditions related to customer contracts of Noralta Lodge Ltd., which the Company acquired in 2018, remaining in place.

Pursuant to the Agreement, the Sellers have granted the Company and the Buyer a right of first refusal until April 3, 2023 with respect to sales of the 375,000 Escrow Shares subject to release in June 2022 (the “ROFR Shares”). The Agreement provides that, if prior to April 3, 2023 the Sellers desire to sell ROFR Shares, the Company will have the right, but not the obligation, to purchase all or any portion of such shares within the period, at the price and upon the terms set forth in the Agreement. If the Company does not exercise its right of first refusal for all of the shares, any remaining shares must be offered to the Buyer for purchase on the same terms. The 375,000 Escrow Shares subject to release from escrow in June 2023 and the common shares issuable upon conversion of the Class A preferred shares held by the Sellers are not subject to the rights of first refusal described above.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

Exhibit

Number | Description of Document |

99.1 | |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: April 7, 2022

CIVEO CORPORATION

By: /s/ Carolyn J. Stone ,

Name: Carolyn J. Stone

Title: Senior Vice President, Chief Financial Officer and Treasurer

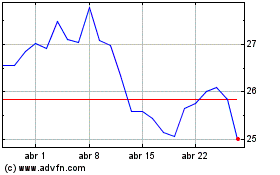

Civeo (NYSE:CVEO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Civeo (NYSE:CVEO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024