Current Report Filing (8-k)

09 Maio 2022 - 5:39PM

Edgar (US Regulatory)

0001099590

false

0001099590

2022-05-04

2022-05-04

0001099590

MELI:CommonStock0.001ParValuePerShareMember

2022-05-04

2022-05-04

0001099590

MELI:Sec2.375SustainabilityNotesDue2026Member

2022-05-04

2022-05-04

0001099590

MELI:Sec3.125NotesDue2031Member

2022-05-04

2022-05-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 4, 2022

MercadoLibre, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

001-33647 |

98-0212790 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

WTC Free Zone

Dr. Luis Bonavita 1294, Of. 1733, Tower II

Montevideo, Uruguay, 11300

(Address of Principal Executive Offices) (Zip Code)

+598-2-927-2770

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240-14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

MELI |

Nasdaq Global Select Market |

| 2.375% Sustainability Notes due 2026 |

MELI26 |

The Nasdaq Stock Market LLC |

| 3.125% Notes due 2031 |

MELI31 |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

Establishment of Performance Goals under the 2022 Bonus Program

On May 4, 2022, the Board of Directors (the “Board”) of MercadoLibre, Inc. (the

“Company”) established the performance goals for the Company’s bonus program for the 2022 fiscal year (the “2022

Bonus Program”). Under the 2022 Bonus Program, the bonus payout for each person who was a “named executive officer”

in the Company’s proxy statement for its most recent Annual Meeting (referred to below as “NEOs”) is based on achievement

of Net Revenue, Income from operations, the number of transactions using Mercado Pago (including payments on the marketplace platform,

off-platform online payments, wallet, mobile point of sale, credit card and prepaid card transactions) and the Company’s weighted

compound Net Promoter Score. The Board has determined a target bonus for each NEO and applies an adjustment of up to + 50% or -50% to

each bonus based upon the individual performance of each NEO.

The Board set each NEO’s target bonus under the 2022 Bonus Program as four months of base

salary (33.33% of each NEO’s annual base salary).

Adoption of the 2022 Long Term Retention Program

On May 4, 2022, the Board approved the adoption of the 2022 Long Term Retention Program (the

“2022 LTRP”) and established the target award for each NEO under the 2022 LTRP. The 2022 LTRP provides the NEOs, along with

other members of senior management, with the opportunity to receive cash payments annually for a period of six years (with the first payment

occurring between January 1, 2023 and April 30, 2023, as determined by the Company), subject to continued employment on each payment date

(other than in specified circumstances). Under the 2022 LTRP, each NEO shall receive:

| |

• |

|

16.66% of half of his or her target 2022 LTRP award annually for a period of six years (with the first payment occurring between January 1, 2023 and April 30, 2023) (the “Annual Fixed Payment”); and |

| |

• |

|

on each date the Company pays the Annual Fixed Payment, each NEO will also receive a payment equal to the product of (i) 16.66% of half of the NEO’s target 2022 LTRP award and (ii) the quotient of (a) the Applicable Year Stock Price (as defined below) over (b) the average closing price of the Company’s common stock on NASDAQ during the final 60 trading days of 2021. For purposes of the 2022 LTRP, the “Applicable Year Stock Price” is the average closing price of the Company’s common stock on NASDAQ during the final 60 trading days of the fiscal year preceding the fiscal year in which the applicable payment date occurs, for so long as our common stock is listed on NASDAQ. |

The target 2022 LTRP awards for our NEOs are set forth below.

| Name |

|

Title |

|

Target 2022 LTRP Award |

| Marcos Galperin |

|

President & Chief Executive Officer |

|

$6,139,585 |

|

| Pedro Arnt |

|

Executive Vice President & Chief Financial Officer |

|

$1,700,000 |

|

| Ariel Szarfsztejn |

|

Executive Vice President - Commerce |

|

$1,800,000 |

|

| Osvaldo Giménez |

|

Fintech President |

|

$2,400,000 |

|

| Daniel Rabinovich |

|

Executive Vice President & Chief Operating Officer |

|

$2,200,000 |

|

The foregoing description of the 2022 LTRP does not purport to be complete and is qualified

in its entirety by reference to the full text of the 2022 LTRP, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and

is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

The following exhibits are filed herewith.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MercadoLibre, Inc. |

|

| |

|

|

|

|

Dated: May 9, 2022

|

By: |

/s/ Pedro Arnt |

|

| |

Name: |

Pedro Arnt |

|

| |

Title: |

Chief Financial Officer |

|

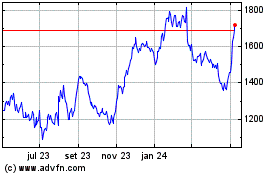

MercadoLibre (NASDAQ:MELI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

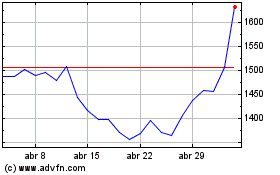

MercadoLibre (NASDAQ:MELI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024