UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2022

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

Summary

| 1. Individuals responsible for the Form |

7 |

| 1.1 – Declaration and identification of the individuals in charge |

7 |

| 1.1 – CEO’s Statement |

8 |

| 1.2 – Investor Relations Officer’s Statement |

9 |

| 1.3 – Statement of the CEO / Investor Relations Officer |

10 |

| 2. Independent auditors |

11 |

| 2.1/2.2 – Identification and remuneration of auditors |

11 |

| 2.3 – Other relevant information |

11 |

| 3. Selected financial information |

12 |

| 3.1 – Financial Information – Consolidated |

12 |

| 3.2 – Non-GAAP earnings |

12 |

| 3.3 – Subsequent events to the latest financial statements |

12 |

| 3.4 – Income allocation policy |

13 |

| 3.5 – Dividend payouts |

15 |

| 3.6 – Declaration of dividends to the withheld profits or the reserves account |

17 |

| 3.7 – Level of indebtedness |

17 |

| 3.8 – Obligations |

17 |

| 3.9 – Other relevant information |

18 |

| 4. Risk factors |

19 |

| 4.1 – Description of risk factors |

19 |

| 4.2 – Description of the main market risks |

33 |

| 4.3 – Non-confidential and relevant litigation, arbitration or adjudicatory proceedings |

39 |

| 4.4 – Non-confidential and relevant litigation, arbitration or adjudicatory proceedings whose appellees are managers, former managers,

controllers, former controllers or investors |

47 |

| 4.5 – Confidential relevant proceedings |

48 |

| 4.6 – Non-confidential and relevant joint litigation, arbitration or adjudicatory proceedings, recurring or ancillary |

48 |

| 4.7 – Other relevant contingencies |

49 |

| 4.8 – Rules of the country of origin and the country where the securities are guarded |

49 |

| 5. Risk management and internal controls |

50 |

| 5.1 Risk management policy |

50 |

| 5.2 – Market risk management policy |

57 |

| 5.3 – Description of the internal controls |

60 |

| 5.4 – Integrity Program |

62 |

| 5.5 – Significant changes |

66 |

| 5.6 – Other relevant information |

66 |

| 6. Issuer’s history |

67 |

| 6.1 / 6.2 / 6.4 – Establishment of the issuer, term of duration and date of registration at the CVM |

67 |

| 6.3 – Brief History |

67 |

| 6.5 – Bankruptcy information founded on relevant value or judicial or extrajudicial recovery |

68 |

| 6.6 – Other relevant information |

68 |

| 7. Issuer’s activities |

69 |

| 7.1 – Description of the main business activities of the issuer and its subsidiaries |

69 |

| 7.2 – Information on operating segments |

69 |

| 7.3 – Information on products and services relating to the operational segments |

73 |

| 7.4 – Clients responsible for more than 10% of the total net revenue |

102 |

| 7.5 – Relevant effects of the state regulation of activities |

102 |

| 7.6 – Relevant revenues coming from foreign countries |

137 |

| 7.7 – Effects of foreign control on activities |

137 |

| 7.8 – Socio-environmental policies |

138 |

| 7.9 – Other relevant information |

138 |

| 8. Extraordinary business |

139 |

| 8.1 – Extraordinary business |

139 |

| 8.2 – Significant alterations in the issuer’s manner of conducting business |

139 |

| 8.3 – Significant contracts not directly related to operating activities entered into by the issuer or by its subsidiaries |

139 |

| 8.4 – Other relevant information |

139 |

| 9. Relevant assets |

140 |

| 9.1 – Relevant non-current assets – others |

140 |

| 9.2 – Other relevant information |

142 |

| 10. Officers’ notes |

144 |

| 10.1 – General Financial and Equity Conditions |

144 |

| 10.2 – Financial and operating income |

167 |

| 10.3 – Events with relevant effects, occurred and expected, in the financial statements |

169 |

| 10.4 – Significant changes in accounting practices – Caveats and emphasis in the auditor’s opinion |

170 |

| 10.5 – Critical accounting Policies |

174 |

| 10.6 – Relevant Items not evidenced in the financial statements |

176 |

| 10.7 – Comments on other items not evidenced in the financial statements |

177 |

| 10.8 – Business plan |

177 |

| 10.9 – Other factors with relevant influence |

178 |

| 11. Projections |

179 |

| 11.1 – Disclosed projections and assumptions |

179 |

| 11.2 – Monitoring and changes to the disclosed projections |

181 |

| 12. Shareholders’ meeting and management |

183 |

| 12.1 Description of the administrative structure |

183 |

| 12.2 – Rules, policies and practices relating to Shareholders’ Meetings |

192 |

| 12.3 – Rules, policies and practices relating to the Board of Directors |

196 |

| 12.4 – Description of the arbitration clause to resolve conflict through arbitration |

197 |

| 12.5/6 – Composition and professional experience of the Management and Fiscal Council |

198 |

| 12.7/8 Composition of committees |

244 |

| 12.9 – Existence of a marital relationship, stable union or kinship up to the second degree related to issuer’s managers,

subsidiaries and controlling companies |

247 |

| 12.10 – Relationships of subordination, provision of service or control between managers, subsidiaries, controlling companies and

other |

248 |

| 12.11 – Agreements, including any insurance policies, for the payment or reimbursement of expenses incurred by Directors and Officers |

255 |

| 12.12 – Other relevant information |

256 |

| 13. Management remuneration |

257 |

| 13.1 – Description of the policy or compensation practice, including the Non-Statutory Board of Executive Officers |

257 |

| 13.2 – Total compensation of the Board of Directors, Statutory Board of Executive Officers and Fiscal Council |

265 |

| 13.3 – Variable compensation of the Board of Directors, Statutory Board of Executive Officers and Fiscal Council |

267 |

| 13.4 – Compensation plan based on shares of the Board of Directors and of the Statutory Board of Executive Officers |

269 |

| 13.5 – Compensation based on shares of the Board of Directors and of the Statutory Board of Executive Officers |

270 |

| 13.6 – Information on options (open) held by the Board of Directors and Statutory Board of Executive Officers |

270 |

| 13.7 – Options exercised and shares delivered related to compensation based on shares of the Board of Directors and of the

Statutory Board of Executive Officers |

270 |

| 13.8 – Information necessary for understanding the data disclosed in items 13.5 to 13.7 – Method of pricing the value

of shares and options |

270 |

| 13.9 – Number of shares, quotas and other securities convertible into shares held by managers and members of the Fiscal Council

– by body |

270 |

| 13.10 – Information on private pension plans granted to the members of the Board of Directors and of the Statutory Board

of Executive Officers |

271 |

| 13.11 – Highest, lowest and the average individual compensation for the Board of Directors, Statutory Board of Executive

Officers and Fiscal Council |

272 |

| 13.12 – Compensation or indemnity mechanisms for managers in case of removal from office or retirement |

272 |

| 13.13 – Percentage in total compensation held by Management and members of the Fiscal Council that are related parties to

the controlling companies |

272 |

| 13.14 – Compensation of managers and Fiscal Council’s members, grouped by body, received for any reason other than

the position they occupy |

272 |

| 13.15 – Compensation of managers and Fiscal Council’s members recognized in the income of the controlling shareholders,

direct or indirect, of companies under common control and of the issuer’s subsidiaries |

273 |

| 13.16 – Other relevant information |

273 |

| 14. Human resources |

274 |

| 14.1 – Description of human resources |

274 |

| 14.2 – Relevant changes – Human resources |

276 |

| 14.3 – Description of employee remuneration policy |

276 |

| 14.4 – Description of the relationship between the issuer and unions |

279 |

| 14.5 – Other relevant information |

279 |

| 15. Control and economic group |

280 |

| 15.1 / 15.2 – Equity Position |

280 |

| 15.3 – Capital Distribution |

284 |

| 15.4 – Organization chart of shareholders and economic group |

285 |

| 15.5 – Shareholders’ agreement filed at the headquarters of the issuer or of which the controlling shareholder is a part

of |

288 |

| 15.6 – Relevant changes in the shareholdings of members of the control group and the issuer’s managers |

288 |

| 15.7 – Main corporate transactions |

289 |

| 15.8 – Other relevant information |

292 |

| 16. Transactions with related parties |

293 |

| 16.1 – Description of the rules, policies and practices of the issuer with regard to the realization of transactions with related

parties |

293 |

| 16.2 – Information about transactions with related parties |

293 |

| 16.3 – Identification of measures taken to deal with conflicts of interest and the demonstration of strictly commutative conditions

agreed or of the appropriate compensatory payment made |

305 |

| 16.4 – Other relevant information |

306 |

| 17. Share capital |

307 |

| 17.1 – Information on the share capital |

307 |

| 17.2 – Capital Increases |

307 |

| 17.3 – Information about developments, grouping and share bonuses |

308 |

| 17.4 – Information on the share capital |

309 |

| 17.5 – Other relevant information |

309 |

| 18. Securities |

310 |

| 18.1 – Share Rights |

310 |

| 18.2 – Description of any statutory rules that significantly limit the voting rights of shareholders or that lead them to carry

out public offering |

311 |

| 18.3 – Description of the exceptions and suspense clauses that relate to political or economic rights laid down in the Bylaws |

311 |

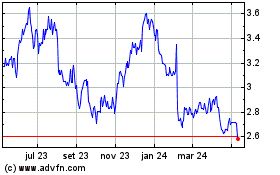

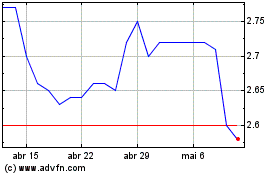

| 18.4 – Volume of negotiations and major and minor quotes of traded securities |

311 |

| 18.5 – Other securities issued in Brazil |

312 |

| 18.6 – Brazilian markets in which securities are admitted to trading |

312 |

| 18.7 – Information about class and the kinds of securities admitted for trading in foreign markets |

312 |

| 18.8 – Securities issued abroad |

314 |

| 18.9 – Distribution of public offerings made by the issuer or by third parties, including controlling and affiliated companies

and subsidiaries, relating to the securities of the issuer |

315 |

| 18.10 – Use of proceeds from public offerings for distribution and any deviations |

316 |

| 18.11 – Description of the takeover bids made by the issuer in respect of shares issued by third parties |

316 |

| 18.12 – Other relevant information |

316 |

| 19. Repurchase plans/Treasury |

333 |

| 19.1 – Information on the issuer’s share buyback |

333 |

| 19.2 – Movement of securities held in Treasury |

334 |

| 19.3 – Other relevant information |

337 |

| 20. Trading policy |

338 |

| 20.1 – Information about the securities trading policy |

338 |

| 20.2 – Other relevant information |

340 |

| 21. Disclosure policy |

341 |

| 21.1 – Description of the standards, or internal procedures or charters relating to the disclosure of information |

341 |

| 21.2 – Description of the policy for disclosure of material act or fact and any procedures concerning the maintenance of secrecy

regarding undisclosed relevant information |

342 |

| 21.3 – Managers responsible for the implementation, maintenance, evaluation and supervision of the policy for disclosure of information |

342 |

| 21.4 – Other relevant information |

342 |

1. Individuals responsible for the form |

1.

Individuals responsible for the Form

1.1

– Declaration and identification of the individuals in charge

Name

of the person in charge of the form’s contents: Octavio de Lazari Junior

Position:

Chief Executive Officer

Name

of the person in charge of the form’s contents: Leandro de Miranda Araújo

Position:

Investor Relations Officer

The

aforementioned Officers hereby state:

| a) | to have revised the reference form of Banco Bradesco S.A. – “Bradesco”, “Company”,

“Organization”, or “Corporation”; |

| b) | that all information contained in the form meets the provisions of CVM (Securities and Exchange Commission)

Resolution No. 80, particularly those set out in articles 15 to 20; and |

| c) | that the set of information contained therein is a true, accurate, and complete description of the issuer’s

economic financial outcomes and of the risks inherent to its activities and securities issued. |

7 – Reference Form – 2021 |

| | 1. Individuals responsible for the form |

1.1

– CEO’s Statement

S T A

T E M E N T

Cidade de

Deus, Osasco/SP, May 31, 2022.

I,

Octavio de Lazari Junior – CEO of Banco Bradesco S.A., declare that:

1.

I have reviewed Banco Bradesco S.A.’s annual reference form for 2021;

2.

All of the information in the form complies with the CVM Resolution No. 80 in particular with articles

15 to 20; and

3.

The information herein provides a true, accurate and complete picture of the issuer’s financial

situation and the risks inherent in its activities and its issue of securities.

Octavio de Lazari Junior

CEO

8 – Reference Form – 2021 |

| | 1. Individuals responsible for the form |

1.2

– Investor Relations Officer’s Statement

S T A

T E M E N T

Cidade de

Deus, Osasco/SP, May 31, 2022.

I, Leandro

de Miranda Araujo – Managing Officer and Investor Relations Officer of Banco Bradesco S.A., declare that:

| 1. | I have reviewed Banco Bradesco S.A.’s annual reference form for 2021; |

| 2. | All of the information in the form complies with the CVM Resolution No.

80 in particular with articles 15 to 20; and |

| 3. | The information herein provides a true, accurate and complete picture of the issuer’s financial

situation and the risks inherent to its activities and its issue of securities. |

Leandro de Miranda Araujo

Managing Officer

and Investor Relations Officer

9 – Reference Form – 2021 |

| | 1. Individuals responsible for the form |

1.3

– Statement of the CEO / Investor Relations Officer

The

individual statements of the CEO and of the Investor Relations Officer are described, respectively, in items 1.1 and 1.2 of this Reference

Form.

10 – Reference Form – 2021 |

2.

Independent auditors

2.1/2.2

– Identification and remuneration of auditors

| Identification and remuneration of Auditors |

| Is there an auditor? |

Yes |

| CVM Code |

418-9 |

| Type of auditor |

Local |

| Name/Corporate name |

KPMG Auditores Independentes |

| CPF/CNPJ [Individual/Corporate Taxpayer's Registry] |

57.755.217/0022-53 |

| Service period |

March 21, 2011 |

Description of contracted services

(last three fiscal years)

|

The services referring to the fiscal year of 2021, 2020 and 2019, include accounting certification reports requested by our management, issue of comfort letters for placement of securities abroad, procedures for issuance of due diligence, for assurance, technical consultancy and previously agreed procedures reports |

| Total amount of compensation of independent auditors divided by service |

Auditing services contracted in 2021: R$49,755 thousand

Other Services: R$2,208 thousand

Total: R$51,963 thousand |

| Justification for the replacement |

Not Applicable |

| Reason presented by the auditor in case of disagreement with the justification provided by the issuer |

Not Applicable |

| Service period |

01/01/2019 to 12/31/2020 |

| Name of the technician in charge |

André Dala Pola |

| CPF [Individual Taxpayer's Registry] |

261.954.908-65 |

| Address |

500 Dionysia Alves Barreto avenue - Conj. 1001, 10º andar, Centro, Osasco, SP, Brasil, CEP 06086-050, Phone +55 (011) 2856-5300, Email: apola@kpmg.com.br |

| Service period |

January 1, 2021 |

| Name of the technician in charge |

Cláudio Rogélio Sertório |

| CPF [Individual Taxpayer's Registry] |

094.367.598-78 |

| Address |

1,400 Verbo Divino street, - CONJ 101 PTS 201 301 401, Chacara Santo Antonio, São Paulo, SP, Brasil, CEP 04719-911, Phone +55 (011) 3940-1500, E-mail:csertorio@kpmg.com.br |

2.3

– Other relevant information

The

Audit Committee recommends to the Board of Directors for approval, the entity to be hired to provide us and our subsidiaries independent

audit services, and their compensation, as well as its replacement. The engagement of an independent auditor for non-audit services is

not subject to the Board of Directors. However, it must be previously reviewed by the Audit Committee in respect to compliance with independence

rules.

More

information on the Audit Committee’s duties is available in item 12.1.a of this Reference Form.

11 – Reference Form – 2021 |

| | 3. Selected financial information |

3.

Selected financial information

3.1

– Financial Information – Consolidated

| (In accordance with International Accounting Standards - IFRS) In R$ |

Fiscal Year |

Fiscal Year |

Fiscal Year |

| 12/31/2021 |

12/31/2020 |

12/31/2019 |

| Shareholders’ Equity |

150,228,707,000.00 |

146,117,374,000.00 |

135,543,574,000.00 |

| Total Assets |

1,675,572,193,000.00 |

1,604,653,790,000.00 |

1,378,527,685,000.00 |

| Net revenue / Revenue from financial intermediation / Gains from insurance premiums |

252,512,815,000.00 |

224,342,248,000.00 |

233,386,698,000.00 |

| Gross earnings |

32,852,367,000.00 |

4,075,295,000.00 |

13,381,078,000.00 |

| Net earnings |

23,380,804,000.00 |

16,033,961,000.00 |

21,173,207,000.00 |

| Number of shares, excluding Treasury |

9,689,534,572 |

8,835,526,885 |

8,032,297,167 |

| Share equity value (Reais per unit) |

15.50 |

16.54 |

16.87 |

| Basic Earnings per Share |

2.27 |

1.71 |

2.27 |

| Diluted Earnings per Share |

2.27 |

1.71 |

2.27 |

3.2

– Non-GAAP earnings

The

non-GAAP earnings were not disclosed in the course of the last fiscal year.

3.3

– Subsequent events to the latest financial statements

There

were no subsequent events that need to be adjusted or disclosed for the consolidated financial statements that were closed on December

31, 2021.

12 – Reference Form – 2021 |

| | 3. Selected financial information |

3.4

– Income allocation policy

| (R$ thousand) |

Income Allocation |

| 2021 |

2020 |

2019 |

| A) Rules on withholding profits |

Legal

reserve

The allocation

of a portion of the net income, for legal reserves, is set out by Article 193 of Law No. 6,404/76 and is intended to ensure the integrity

of the share capital, and may only be used to offset losses or to increase capital.

The net income

for the year, five percent (5%), shall be applied before any other allocation, in the constitution of the legal reserve, which shall not

exceed twenty percent (20%) of the share capital.

The legal

reserve may no longer be constituted in the year in which the balance of this reserve, increased by the amount of the capital reserves

provided for in paragraph 1 of Article 182, exceeds thirty percent (30%) of the share capital.

Statutory

Reserves

Article 194

of Law No. 6,404/76 regulates the creation of statutory reserves. Pursuant to such legal document, the Company’s bylaws may create

reserves based on the following specific conditions:

- the purpose

is accurately and completely indicated;

- the criteria

for determining the portion of annual net income that will be allocated for its constitution is established; and

- the maximum

reserve limit is set.

Pursuant

to applicable laws, Article 28 of the Bylaws sets out that the balance of the net income, after every statutory allocation, will have

the allocation proposed by the Board of Executive Officers, approved by the Board and deliberated in the Shareholders’ Meeting,

and one hundred percent (100%) of this balance may be allocated to the Profits Reserve – Statutory, aimed at keeping the operating

margin compatible with the development of active operations of the Company, up to the limit of ninety-five percent (95%) of the value

of the paid-in share capital.

In case a

proposal by the Board of Executive Officers, on the allocation of the Net Income for the year, includes the payout of dividends and/or

the payment of interest on own capital in an amount greater than the mandatory dividend established in Article 27, item III, of the Bylaws,

and/or the withholding of profits in accordance with Article 196 of Law No. 6,404/76, the balance of Net Income for purposes of constituting

this reserve will be determined after the full deduction of these allocations. |

| Amounts referring to the Withholding of Profits (R$ thousand) |

Net Income for the Year |

21,945,688 |

16,546,577 |

22,582,615 |

| Legal Reserve |

1,097,285 |

827,328 |

1,129,131 |

| Statutory Reserves |

11,608,314 |

10,171,278 |

13,589,708 |

| Gross Interest on Own Capital |

7,240,089 |

5,547,971 |

7,372,858 |

| Dividends (1) |

2,000,000 |

- |

8,490,918 |

| (1) Payment of extraordinary dividends in the amount of R$8 billion, occurred on October 23, 2019, using part of the balance of the “Profit Reserves – Statutory” account and R$490,918 thousand in complementary dividends related to the fiscal year of 2019. |

13 – Reference Form – 2021 |

| | 3. Selected financial information |

| B) Rules on Dividends and/or Interest on Own Capital payouts |

With the

advent of Law No. 9,249/95, which entered into force on January 1, 1996, companies can pay interest on own capital, to be imputed, net

of withholding income tax, to the amount of the minimum mandatory dividend.

Minimum

Mandatory Dividend

In accordance

with item III of Article 27 of Bradesco’s Bylaws, shareholders are entitled to thirty percent (30%) of the net income as minimum

mandatory dividends, in each fiscal year, adjusted by reducing or increasing the values specified in items I, II and III of Article 202

of Law No. 6,404/76 (Brazilian Corporate Act). Therefore, the minimum percentage of thirty percent (30%), established in the Bylaws, is

above the minimum percentage of twenty-five percent (25%), which is established in paragraph 2 of Article 202 of Law No. 6,404/76.

Shareholders

Holding Preferred Shares

Preferred

shares grant their holders dividends of ten percent (10%) higher than those that are attributed to common shares (letter “b”

of paragraph 2 of Article 6 of the corporate Bylaws).

Re-Application

of Dividends and/or Interest on Own Capital

The Re-application

of Dividends and/or Interest on Own Capital is a product that allows Bradesco’s depositor shareholders, registered in the Bradesco

Corretora, either individuals or legal entities, to invest the amount received, credited to checking accounts, in new shares (currently

only for preferred shares), thereby increasing shareholding interest.

Shareholders

have the option of re-applying the monthly and/or special (complementary and intermediary) dividends. There is no ceiling for this re-application

and the minimum limit should be enough for the acquisition of at least one (1) share. |

| C) Frequency of Dividends and/or Interest on Own Capital payouts |

Bradesco

has distributed Dividends and/or Interest on Own Capital (from January 1, 1996 with the advent of Law No. 9,249/95) on a monthly basis

since 1970, becoming the first Brazilian financial institution to adopt such a practice.

Interim

Dividends

The Board

of Executive Officers, upon approval by the Board of Directors, is authorized to declare and pay interim Dividends, twice a year or on

a monthly basis, to the existing Accrued Profits or Profit Reserves accounts (Article 27, paragraph 1 of the Bylaws).

They may

also authorize the distribution of Interest on Own Capital to replace interim dividends, either integrally or partially (Article 27, paragraph

2 of the Bylaws).

Dividends

and/or Interest on Own Capital Monthly Payment System

For the purposes

set out in Article 205 of Law No. 6,404/76, shareholders that are entered into the records of the Company on the date of the statement,

which occurs on the first business day of each month, shall be deemed beneficiaries.

Payments

are made on the first business day of the subsequent month, one month in advance of the mandatory dividend, by credit into the account

that has been informed by the shareholder or provided to the Company. |

| D) Any restrictions on the distribution of dividends, imposed by special laws or regulations applicable to the issuer, as well as contracts, judicial or administrative decisions or arbitration. |

There are no restrictions on the distribution of dividends. |

| E) If the issuer has a policy of destination of results formally approved, they should inform the body responsible for the approval, the date of approval and, if the issuer discloses the policy, the locations on the global computer network where the document can be consulted |

The Company has a document entitled “Practices for the Payment of Dividends and/or Interest on Own Capital of Banco Bradesco S.A.” approved by the Board of Directors on April 1, 2015 and publicly available on the site of the Securities and Exchange Commission (Comissão de Valores Mobiliários – CVM) (www.cvm.gov.br), of B3 S.A. – Brazilian Exchange & OTC (www.b3.com.br) and on the Company’s Investor Relations website (www.bradescori.com.br), which establishes, among other aspects, the periodicity for the payment of dividends and the parameter of reference to be used to define the amount that will be distributed. In the specific case of Bradesco, the Company establishes the payment of Dividends and/or Interest on Own Capital on a monthly basis. |

14 – Reference Form – 2021 |

| | 3. Selected financial information |

3.5

– Dividend payouts

| In R$ |

Fiscal Year |

Fiscal Year |

Fiscal Year |

| 12/31/2021 |

12/31/2020 |

12/31/2019 |

| Adjusted Net Income |

20,848,403,024.01 |

15,719,247,557.48 |

21,453,484,504.85 |

| Dividends distributed in relation to adjusted net income |

44.320371 |

35.294118 |

73.944987 |

| Rate of return in relation to the equity of the issuer |

14.170922 |

10.938733 |

16.043201 |

| Total distributed dividends |

9,240,089,514.23 |

5,547,969,704.75 |

15,863,776,318.38 |

| Withheld net income |

12,705,597,879.47 |

11,182,625,536.97 |

14,718,838,952.60 |

| Date of approval of the withholding |

3/10/2022 |

3/10/2021 |

3/10/2020 |

| Withheld net income |

Amount |

Dividend Payout |

Amount |

Dividend Payout |

Amount |

Dividend Payout |

| Mandatory Dividend |

| Common |

954,094,119.14 |

12/30/2021 |

|

|

|

|

| Preferred |

1,045,905,887.04 |

12/30/2021 |

|

|

|

|

| Common |

|

|

234,327,039.70 |

2/28/2020 |

|

|

| Preferred |

|

|

256,591,287.09 |

2/28/2020 |

|

|

| Common |

|

|

|

|

3,818,591,022.46 |

10/23/2019 |

| Preferred |

|

|

|

|

4,181,408,977.53 |

10/23/2019 |

15 – Reference Form – 2021 |

| | 3. Selected financial information |

| Withheld net income |

Amount |

Dividend Payout |

Amount |

Dividend Payout |

Amount |

Dividend Payout |

| Interest on Shareholders’ Equity |

| Common |

76,377,956.86 |

2/1/2021 |

|

|

|

|

| Common |

76,377,942.71 |

3/1/2021 |

|

|

|

|

| Common |

76,377,925.45 |

4/1/2021 |

|

|

|

|

| Common |

76,377,941.00 |

5/3/2021 |

|

|

|

|

| Common |

84,015,915.18 |

6/1/2021 |

|

|

|

|

| Common |

83,992,334.41 |

7/1/2021 |

|

|

|

|

| Common |

2,386,251,120.51 |

7/12/2021 |

|

|

|

|

| Common |

83,910,718.70 |

8/2/2021 |

|

|

|

|

| Common |

83,837,070.91 |

9/1/2021 |

|

|

|

|

| Common |

83,725,632.65 |

10/1/2021 |

|

|

|

|

| Common |

83,714,104.55 |

11/1/2021 |

|

|

|

|

| Common |

83,714,097.43 |

12/1/2021 |

|

|

|

|

| Common |

81,178,711.33 |

1/3/2022 |

|

|

|

|

| Common |

95,409,410.94 |

12/30/2021 |

|

|

|

|

| Preferred |

83,632,841.53 |

2/1/2021 |

|

|

|

|

| Preferred |

83,632,772.15 |

3/1/2021 |

|

|

|

|

| Preferred |

83,632,728.93 |

4/1/2021 |

|

|

|

|

| Preferred |

83,632,829.83 |

5/3/2021 |

|

|

|

|

| Preferred |

91,995,135.02 |

6/1/2021 |

|

|

|

|

| Preferred |

91,978,522.12 |

7/1/2021 |

|

|

|

|

| Preferred |

2,613,748,879.49 |

7/12/2021 |

|

|

|

|

| Preferred |

91,911,000.19 |

8/2/2021 |

|

|

|

|

| Preferred |

91,842,408.03 |

9/1/2021 |

|

|

|

|

| Preferred |

91,780,047.95 |

10/1/2021 |

|

|

|

|

| Preferred |

91,766,428.90 |

11/1/2021 |

|

|

|

|

| Preferred |

91,766,411.29 |

12/1/2021 |

|

|

|

|

| Preferred |

88,918,037.14 |

1/3/2022 |

|

|

|

|

| Preferred |

104,590,589.19 |

12/30/2021 |

|

|

|

|

| Common |

|

|

69,434,974.18 |

2/3/2020 |

|

|

| Common |

|

|

69,434,961.35 |

3/2/2020 |

|

|

| Common |

|

|

69,434,936.91 |

4/1/2020 |

|

|

| Common |

|

|

69,434,861.16 |

5/4/2020 |

|

|

| Common |

|

|

76,378,152.40 |

6/1/2020 |

|

|

| Common |

|

|

76,378,117.88 |

7/1/2020 |

|

|

| Common |

|

|

76,378,058.50 |

8/3/2020 |

|

|

| Common |

|

|

76,378,008.01 |

9/1/2020 |

|

|

| Common |

|

|

76,377,965.36 |

10/1/2020 |

|

|

| Common |

|

|

76,377,934.91 |

11/3/2020 |

|

|

| Common |

|

|

76,377,933.60 |

12/1/2020 |

|

|

| Common |

|

|

76,377,971.02 |

1/4/2021 |

|

|

| Common |

|

|

1,671,591,099.52 |

1/4/2021 |

|

|

| Common |

|

|

87,835,790.70 |

3/8/2021 |

|

|

| Preferred |

|

|

76,030,838.40 |

2/3/2020 |

|

|

| Preferred |

|

|

76,030,738.48 |

3/2/2020 |

|

|

| Preferred |

|

|

76,030,658.83 |

4/1/2020 |

|

|

| Preferred |

|

|

76,030,429.11 |

5/4/2020 |

|

|

| Preferred |

|

|

83,633,666.29 |

6/1/2020 |

|

|

| Preferred |

|

|

83,633,468.00 |

7/1/2020 |

|

|

| Preferred |

|

|

83,633,226.18 |

8/3/2020 |

|

|

| Preferred |

|

|

83,632,970.95 |

9/1/2020 |

|

|

| Preferred |

|

|

83,632,770.62 |

10/1/2020 |

|

|

| Preferred |

|

|

83,632,639.36 |

11/3/2020 |

|

|

| Preferred |

|

|

83,632,678.77 |

12/1/2020 |

|

|

| Preferred |

|

|

83,632,879.05 |

1/4/2021 |

|

|

| Preferred |

|

|

1,830,412,919.04 |

1/4/2021 |

|

|

| Preferred |

|

|

96,179,056.17 |

3/8/2021 |

|

|

16 – Reference Form – 2021 |

| | 3. Selected financial information |

| Withheld net income |

Amount |

Dividend Payout |

Amount |

Dividend Payout |

Amount |

Dividend Payout |

| Interest on Shareholders’ Equity |

| Common |

|

|

|

|

57,862,437.78 |

2/1/2019 |

| Common |

|

|

|

|

57,862,433.69 |

3/1/2019 |

| Common |

|

|

|

|

57,862,426.83 |

4/1/2019 |

| Common |

|

|

|

|

69,435,024.96 |

5/2/2019 |

| Common |

|

|

|

|

69,435,018.41 |

6/3/2019 |

| Common |

|

|

|

|

69,435,015.87 |

7/1/2019 |

| Common |

|

|

|

|

694,506,242.08 |

7/15/2019 |

| Common |

|

|

|

|

69,435,013.97 |

8/1/2019 |

| Common |

|

|

|

|

69,435,001.07 |

9/2/2019 |

| Common |

|

|

|

|

69,434,986.35 |

10/1/2019 |

| Common |

|

|

|

|

69,434,985.16 |

11/1/2019 |

| Common |

|

|

|

|

69,434,976.84 |

12/2/2019 |

| Common |

|

|

|

|

2,026,239,860.85 |

12/30/2019 |

| Common |

|

|

|

|

69,434,971.29 |

1/2/2020 |

| Preferred |

|

|

|

|

63,358,870.41 |

2/1/2019 |

| Preferred |

|

|

|

|

63,358,863.41 |

3/1/2019 |

| Preferred |

|

|

|

|

63,358,846.02 |

4/1/2019 |

| Preferred |

|

|

|

|

76,031,175.51 |

5/2/2019 |

| Preferred |

|

|

|

|

76,031,131.54 |

6/3/2019 |

| Preferred |

|

|

|

|

76,031,127.07 |

7/1/2019 |

| Preferred |

|

|

|

|

760,493,757.92 |

7/15/2019 |

| Preferred |

|

|

|

|

76,031,103.38 |

8/1/2019 |

| Preferred |

|

|

|

|

76,030,996.49 |

9/2/2019 |

| Preferred |

|

|

|

|

76,030,934.45 |

10/1/2019 |

| Preferred |

|

|

|

|

76,030,902.57 |

11/1/2019 |

| Preferred |

|

|

|

|

76,030,871.50 |

12/2/2019 |

| Preferred |

|

|

|

|

2,218,760,202.60 |

12/30/2019 |

| Preferred |

|

|

|

|

76,030,813.57 |

1/2/2020 |

3.6

– Declaration of dividends to the withheld profits or the reserves account

In 2019,

extraordinary dividends were declared / paid in the amount of R$8 billion, occurred on October 23, 2019, using part of the balance of

the “Profit Reserves – Statutory” account.

In relation

to years of 2021 and 2020, no dividends were declared against retained earnings or reserves recorded in previous fiscal years.

3.7

– Level of indebtedness

| Fiscal Year * |

Sum of Current and Non-Current Liabilities |

Index type |

Level of indebtedness |

Description and reason for the use of other indexes |

| 12/31/2021 |

1,525,343,486,000.00 |

Level of indebtedness |

10.1534754 |

- |

| *In accordance with International Accounting Standards - IFRS |

3.8

– Obligations

| Fiscal year December 31, 2020 (In accordance with International Accounting Standards-IFRS) |

| Type of Obligation |

Type of Guarantee |

Other guarantees or privileges |

Less than one year |

One to three years |

Three to five years |

More than five years |

Total |

| Loans |

Unsecured |

- |

26,546,104,000.00 |

- |

- |

- |

26,546,104,000.00 |

| Debt Security |

Unsecured |

- |

970,320,859,000.00 |

366,948,667,000.00 |

60,369,885,000.00 |

32,288,855,000.00 |

1,429,928,266,000.00 |

| Total |

|

- |

996,866,963,000.00 |

366,948,667,000.00 |

60,369,885,000.00 |

32,288,855,000.00 |

1,456,474,370,000.00 |

Note:

The information refers to the Consolidated Financial Statements. It is important to stress that the financial institutions operate, basically, as financial mediators, raising funds from clients, and sharing these funds with clients. Therefore, the obligations informed as “Debt Securities” in item 3.8 are composed basically, of (i) Captures, that include: (a) Deposits; (b) Debentures; (c) On-lending operations; (d) Obligations through the Issuance of Bonds and Securities and (e) Subordinated debt, besides the (ii) Provisions for insurance and pension plans. |

17 – Reference Form – 2021 |

| | 3. Selected financial information |

3.9

– Other relevant information

The

selected financial information described in Section 3 refers to consolidated financial statements.

Item

3.1:

| i. | Composition of Net Income – Consolidated |

| Composition (In accordance with International Accounting Standards-IFRS) |

2021 |

2020 |

2019 |

| Revenue from financial intermediation |

138,223,346,000.00 |

119,743,371,000.00 |

124,417,705,000.00 |

| Fees and Commission income |

26,033,007,000.00 |

24,936,454,000.00 |

25,337,676,000.00 |

| Income from insurance and pension plans |

76,221,161,000.00 |

68,410,501,000.00 |

71,191,410,000.00 |

| Result from investment in affiliated companies and joint ventures |

421,504,000.00 |

444,858,000.00 |

1,201,082,000.00 |

| Other operating income |

18,004,494,000.00 |

16,139,105,000.00 |

17,566,864,000.00 |

| Contribution for Social Security Financing - COFINS |

(4,437,822,000) |

(3,599,115,000) |

(4,377,130,000) |

| Service Tax - ISS |

(1,257,987,000) |

(1,138,490,000) |

(1,224,157,000) |

| Social Integration Program (PIS) contribution |

(694,888,000) |

(594,436,000) |

(726,752,000) |

| Total |

252,512,815,000.00 |

224,342,248,000.00 |

233,386,698,000.00 |

| ii. | Number of Shares, Ex-Treasury (Units) |

The

number of shares presented was adjusted to reflect the share split, approved at the Special Shareholders’ Meeting of March 10, 2021,

in the proportion of one new share for every 10 possessed.

| iii. | Basic Result per Share and Result Diluted per Share |

The

basic earnings per share is calculated by dividing the net income, attributable to the controlling shareholders, by the weighted average

of shares that are in circulation during the year, excluding the average number of shares that are acquired by Bradesco and held in treasury.

The diluted income per share does not differ from the basic earnings per share, because there are no potential dilutable instruments.

Items

3.4 and 3.5: Dividend payouts and the withholding of net income

We highlight

the fact that the financial statements used for the policy of allocating incomes and for the dividends and interest on own capital payouts,

pursuant to items 3.4 and 3.5, respectively, were prepared in accordance with accounting practices adopted in Brazil, which are applicable

to institutions authorized to operate by the Central Bank of Brazil.

In 2021,

in item 3.5, R$7,040 billion of interest on equity and R$2,200 billion of complementary dividends/interest on equity were paid/provisioned,

totaling R$9,240 billion.

On October

23, 2019, in item 3.5, there was a declaration / payment of extraordinary dividends in the amount of R$8 billion, using part of the balance

of the “Profit Reserve – Statutory” account, of which R$3,818,591,022.46 intended for payment in common shares and R$4,181,408,977.53

in preferred shares.

18 – Reference Form – 2021 |

4.

Risk factors

4.1

– Description of risk factors

Below

are the main risk factors that the Organization considers relevant, on the date of this Reference Form, and that could influence the decision

of investment. If they materialize, these risks could have an adverse effect on our business, our financial situation and equity, and

the price of our securities. Therefore, possible investors could evaluate the risks described below thoroughly, as well as other information

contained in this Reference Form.

We observed

that the risks described below are not the only risks to which the Organization is subject. Other risks that we are not aware of, in case

they materialize, can generate similar effects to those mentioned previously.

It is

important to highlight that the order in which the risks are presented reflect a criterion of relevance established by the Organization.

| a) | Risks relating to the issuer |

Our

financial and operating performance may be adversely affected by epidemics, natural disasters and other catastrophes, such as the current

Covid-19 pandemic, which had a significant impact on our 2020 and 2021 results.

The outbreak

of contagious diseases, such as the outbreak of Covid-19 on a global scale, which began in December 2019 and was declared a pandemic by

the World Health Organization on March 11, 2020, may affect investment decisions and result in sporadic volatility in international and/or

Brazilian markets. Such outbreaks may result, and have resulted at different levels, in the adoption of governmental and private measures,

including restrictions, in whole or in part, on the movement and transport of people, goods and services and, consequently, the closure

of public establishments and offices, interruptions in the supply chain, reduction of consumption in general by the population and volatility

in the price of raw materials and other inputs.

In addition,

governments have been acting on a global scale with greater intervention in their economies, including through regulations and availability

of resources, in response to the economic situation resulting from the advance of the Covid-19 pandemic.

These

events have had, or may have a negative and significant effect on the global and Brazilian economy, and include or may include.

•

Reduction of the level of economic activity;

•

Devaluation of the currency;

•

Increase in fiscal deficit and decrease in the Federal Government’s capacity of investing and making payments and hiring services

or purchasing goods;

•

Decrease of available liquidity in the international and/or Brazilian market; and

•

Delays in judicial, arbitral and/or administrative proceedings, especially in cases that are not electronic.

The occurrence

of such events and their duration may have a materially adverse effect on the global and/or Brazilian economy and impact the liquidity

and market value of our preferred shares and common shares; they may also result in: long-range socioeconomic impacts, including a possible

drop in revenue in Brazil and an increase in demand for public spending in key sectors, a scenario in which legislative amendments can

be used to impose, even temporarily, a more costly tax treatment of our commercial activities, which can adversely affect our business

and operating income.

As of

the date of this report, it is not possible to guarantee that our assessment of the actual and potential impacts (and related losses)

of the Covid-19 pandemic is not compromised, which can impact our operations and financial condition. We cannot guarantee that other regional

and/or global outbreaks may not occur and, if they occur, we cannot guarantee that we will be able to take the necessary steps to avoid

a negative impact on our

business. In addition, our operations can be negatively impacted by the emergence of new strains of the coronavirus and setbacks in the

implementation of vaccination programs.

19 – Reference Form – 2021 |

By the

end of 2020 and throughout 2021, the resurgence of the Covid-19 pandemic, in Brazil and in the world, increased the short-term risks of

the economic activity. Although vaccination rates have been high in Brazil, the dissemination of new variants, such as the Omicron variant,

may lead governments to implement additional measures to reduce the spread of the virus. This may generate negative impacts on the business,

especially in the service sector, employment, income and banking delinquency, with possible adverse consequences on our operating income

and financial condition.

The extent

to which Covid-19 can continue to impact our operations, liquidity, financial condition, and operating income will depend on future developments,

including, but not limited to the duration and dissemination of the pandemic, its severity, actions to contain the virus or treat its

impact, and duration, the time and severity of the impact on global financial markets and the condition of the Brazilian economy, all

highly uncertain and cannot be predicted. We will continue monitoring and evaluating closely the nature and extent of the impact of Covid-19

on our operations, liquidity, financial condition, operating income and prospects. We may also take other measures that alter our business

operations, as required by local authorities, or that we determine to be of the best interest to our employees, suppliers and clients.

Adverse

conditions in the credit and capital global markets, just like the value and/or perception of value of Brazilian government securities,

may adversely affect our ability to access funding in a cost effective and/or timely manner.

Volatility

and uncertainties in the credit and capital global markets have generally decreased liquidity, with increased costs of funding for financial

institutions. These conditions may impact our ability to replace, in a cost effective and/or timely manner, maturing liabilities and/or

access funding to execute our growth strategy.

Part

of our funding originates from repurchase agreements for sales (repo operations), which are largely guaranteed by Brazilian government

securities. These types of transactions are generally short-term and volatile in terms of volume, as they are directly impacted by market

liquidity. As these transactions are typically guaranteed by Brazilian government securities, the value and/or perception of value of

the Brazilian government securities may be significant for the availability of funds. For example, if the quality of the Brazilian government

securities used as collateral is adversely affected, due to the worsening of the credit risk of the Brazilian government, the cost of

these transactions can increase, making this source of funding inefficient for us.

If the

market decreases, which could cause a reduction in volume, or if there is increased collateral credit risk and we are forced to take and/or

pay unattractive interest rates, our financial condition and the results of our operations may be adversely affected.

The

increasingly competitive environment in the Brazilian banking and insurance segments may have a negative impact on our business prospects.

The

markets for financial, banking and insurance services in Brazil are highly competitive. We face significant competition in all of our

main areas of operation from other large banks and insurance companies, both public and private, based in Brazil and abroad, in addition

to new players, such as fintechs and startups that begin to operate with a differentiated and reduced level of regulation. It should be

noted that major technology companies “bigtechs” are also strong competitors, seeking to invest in online payment systems

and financial transactions tools by means of various types of applications. In addition, we note that the implementation of Open Banking

in Brazil may further intensify this competition through the possibility of sharing information between institutions.

This

competitive environment combined with the accelerated process of digital innovation observed in the sector may impact our speed of adaptation

to this ecosystem and consequently the performance of certain lines of business, which may negatively affect our financial condition,

the result of our operations and the market value of our shares.

20 – Reference Form – 2021 |

We

may experience increases in our level of non-performing loans as our loans and advances portfolio becomes more seasoned.

Historically,

our loans and advances portfolio to clients registered an increase, interrupted in 2017 due to the recession in the Brazilian economy

and with resuming growth in 2018. Any corresponding rise in our level of non-performing loans and advances may lag behind the rate of

loan growth, as loans typically do not have due payments for a short period of time after their origination. Levels of non-performing

loans are normally higher among our Individual customers than our Corporate customers.

Our

delinquency ratio, which is defined as the total loans overdue for over ninety days in relation to the total loans and advances portfolio,

increased to 2.8% as of December 31, 2021, compared to 2.2% as of December 31, 2020. This increase in our delinquency rate is related

to the normalization of the economic conditions after the actions we adopted during 2020 to provide liquidity to clients and to adjust

the values due to us in the short term during the Covid-19 pandemic.

However,

the rapid loan growth may also reduce our ratio of non-performing loans to total loans until growth slows or the portfolio becomes more

seasoned. Adverse economic conditions and a slower growth rate for our loans and advances to clients may result in increases in our impairment

of loans and advances and our ratio of non-performing loans and advances to total loans and advances, which may have an adverse effect

on our business, financial condition and results of operations.

Losses

in our investments in financial assets at fair value through profit or loss and at fair value through other comprehensive income may have

a significant impact on our results of operations and are not predictable.

The

fair value of certain investments in financial assets may decrease significantly and may fluctuate over short periods of time. As of December

31, 2021, the investments classified as “fair value through profit or loss” and as “fair value through other comprehensive

income” represented 31.6% of our assets, and realized and unrealized gains and losses originating from these investments have had

and may continue to have a significant impact on the results of our operations.

Eventually,

investment prices in financial assets, which are supported by models, may not predict some more sharp fluctuations in market movements,

so that the profitability of these operations is likely to, at certain times, cause negative effects on our operating income, despite

the fact that they reflect our investment policies, asset and liability management and appetite for risks.

Our

trading activities and derivatives transactions may produce material losses.

We engage

in the trading of securities, buying debt and equity securities principally to sell them in the short term with the objective of generating

profits on short-term differences in price. These investments could expose us to the possibility of material financial losses in the future,

as securities are subject to fluctuations in value. In addition, we enter into derivatives transactions, mainly, to manage our exposure

to interest rate and exchange rate risk. Such derivatives transactions are designed to protect us against increases or decreases in exchange

rates or interest rates. However, these investments and transactions may also expose us to the possibility of significant financial losses

in the future, since they are subject to fluctuations in value.

A

failure in our technological infrastructure and systems or those of our suppliers could temporarily interrupt our businesses and cause

losses.

Our

operations depend on the efficient and uninterrupted operation of our information technology systems. However, any unavailability of infrastructure,

software, or telecommunications networks can impact the processing of transactions performed by our clients, which can lead to financial

losses, regulatory fines, penalties, interventions, reimbursements, and other damage-related costs. These factors can have an adverse

material effect on our business, reputation and operating income.

Furthermore,

due to the nature of our operations, the wide range of products and services offered, the significant volume of activities and operations

performed and the global digital transformation context that requires platform integration and a growing use of cloud computing, we may

face some additional risks.

•

the need for continuous redesign and evolution of our information technology architecture and applications;

21 – Reference Form – 2021 |

•

need to upgrade and integrate legacy systems with emerging technology models in a timely manner;

•

the increasing dependence of service providers due to the migration of certain services to the cloud, which demands robust governance

and new ways of mitigating security and continuity risks beyond our control environment;

•

the broad use of internet solutions and connectivity; and

•

the growing difficulty in attracting and retaining IT specialized personnel in a competitive market.

Any

of these events can cause disruption, increased costs, delays in information processing and/or loss of transmission of critical data,

which can affect our business, reputation, and operating and financial conditions.

We

may incur penalties in case of non-compliance with data protection laws.

In August

2018, Law No. 13,709/18 – General Data Protection Law (LGPD, in Portuguese) was enacted, which creates a set of rules for the use,

protection and transfer of personal data in Brazil, in the private and public spheres, and establishes responsibilities and penalties

in the civil sphere. In addition to including existing rules on the subject, the LGPD followed the global trend of strengthening the protection

of personal data, restricting its unjustified use, and guaranteeing a series of rights to holders of data, as well as imposing important

obligations on so-called “treatment agents”. In particular, the LGPD was inspired by recent European legislation on the subject,

reproducing central points of the Directive No. 95/46/EC and of the General Data Protection Regulation (GDPR).

The

impact of this law has been significant as any processing of personal data will be subject to the new rules, whether physical or digital,

by any entity established in Brazil, any entity who has collected personal data in Brazil, any individual located in Brazil – even

if not residents – or any entity that offers goods and services to Brazilian consumers. In short, the adaptation to the LGPD required

structural changes in our customer relationship, business partners, service providers and employees, and in virtually all internal areas

of Brazilian companies. The LGPD has been in force since December 28, 2018 as regards the creation of the National Data Protection Authority

(Autoridade Nacional de Proteção de Dados or ANPD), the public administrative body responsible for ensuring, implementing

and supervising compliance with the LGPD and the National Council for the Protection of Personal Data and Privacy, created by Provisional

Measure converted in 2019 into Law No. 13,583/19. The remainder of the law came fully into force without administrative sanctions on September

18, 2020. As a result of the Covid-19 pandemic, the National Congress approved Law No. 14,010/20, which postponed the entry into force

of Articles 52, 53 and 54 of Law No. 13,583/19 until August 1, 2021, concerning administrative penalties.

We operate

in a preventive, detective and corrective manner in order to protect our own and our customers’ information. As a result, we have

evolved our security framework in light of the new digital environment, with a focus on cyber security being key and a pillar of the technology

and processes to establish data protection for our customers, resiliency, and structure for threat identification, detection, and response

and recovery procedures in cases of cyber-attacks.

However,

possible failures or attacks on our systems and processes of prevention and/or detection and/or correction in the fight against fraud

and in providing information security, and the consequent non-compliance with applicable legislation, which may in turn negatively affect

our reputation, our financial condition, the result of our operations and the market value of our shares.

Failure

to adequately protect us from cyber security risks can affect us materially and adversely.

We are

exposed to failures, deficiency or inadequacy of our internal processes, human error or misconduct and cyber attacks. While we have procedures

and controls to protect our information technology systems and platforms, we are subject to cyber security risks that can affect us materially

and adversely in the event of failures to adequately protect our assets and people.

Like

other large corporations, we are heavily dependent on technology and information, which exposes us to internal and external events that

can affect the availability of our information technology systems and infrastructure. These events can also occur in our third-party service

providers, who are part of our supply chain and have the potential to adversely affect our business and activities.

22 – Reference Form – 2021 |

Risks

that can directly or indirectly impact us or our third-party service providers include, but are not limited to: penetration of information

technology systems and platforms by malicious individuals; infiltration of malware such as computers with viruses into our systems; intentional

or accidental contamination of our networks and systems or those of our third-party service providers that we exchange data with, unauthorized

access to confidential customer data, and/or organization data, and cyber attacks that may cause service degradation and/or outage that

can result in business losses.

Failure

to adequately protect us from cyber security risks can affect us materially and adversely.

Cyber

security and its risks are addressed at the highest strategic level within our Organization. The possibility of loss, theft or alteration

of data processed and stored by us or our third-party service providers was considered an aggravating factor in our risk analysis due

to the potential exploitation of vulnerabilities and weaknesses in systems, devices, networks or other digital media in our information

technology environment and our third-party service providers (i.e., ransomware).

Our

Corporate Security Department performs a prior and periodical analysis in the control environment of third-party providers. New contracts

and/or renewal of relevant services regarding data processing and storage and cloud computing contain specific cyber security clauses

for the protection of information, even after termination of the contract.

Brazilian

regulatory agencies have also intensified regulation, including through LGPD, CVM Instruction No. 612/19 and CMN Resolution No. 4,893/21.

LGPD imposes large fines in the event of data leakage in the event of non-compliance with the LGPD terms and conditions. As a result,

any failure to protect personal information can adversely affect us, our operating income, and our financial condition and reputation.

Although we have procedures and controls to protect personal information in our possession, unauthorized disclosures or security breaches

may subject us to legal actions and administrative sanctions, as well as damages that may have material and adverse effect on our operating

income, financial condition, prospects and reputation. In addition, we may be required to report events related to cyber security issues,

events where customer information may be compromised, unauthorized access, and other security breaches to the relevant regulatory authority.

As a

result of the Covid-19 pandemic, we quickly increased the number of employees working remotely. While we have strengthened our information

technology environment, this can cause increased downtime for our systems and infrastructure, disruption of telecommunications services,

widespread system failures, and greater vulnerability to cyber attacks. Consequently, our ability to conduct our business may be adversely

affected.

Although

we have not experienced any relevant cyber security incidents during 2021 and until the date of this annual report, failure to adequately

protect us against cyber security risks can affect us materially and adversely.

The

Brazilian Supreme Court (STF) is currently deciding cases relating to the application of inflation adjustments which may increase our

costs and cause losses.

The

STF, which is the highest court in Brazil and is responsible for judging constitutional matters, is currently deciding whether savings

account holders have the right to obtain adjustments for inflation related to their deposits due to the economic plans Bresser, part of

Verão, Collor I and Collor II, implemented in the 1980s and 1990s, before the Plano Real, in 1994. The trial began in November

2013 but was interrupted without any pronouncement on the merits of the subject under discussion by their Members. According to the associations

representing the savings account holders, banks misapplied the monetary adjustments when those economic plans were implemented, and should

be required to indemnify the savings account holders for the non-adjustment of those amounts.

The

STF decided that the ruling of class actions proposed by associations questioning inflationary readjustments only benefits consumers who:

(i) were associated with the associations at the time of filing of the class action; and (ii) authorized the filing of the class action.

This reduced the number of beneficiaries in class actions because, until then, it was understood that these decisions should benefit all

consumers affected by the practices (i.e., all consumers that are checking account holders and that had suffered losses related to inflationary

purges, irrespective of whether those losses were associated with the association, plaintiff of the class action).

23 – Reference Form – 2021 |

In connection

with a related sentence, the Brazilian Supreme Court of Justice (STJ) decided, in May 2014, that the starting date for counting default

interest for compensating savings account holders must be the date of summons of the related lawsuit (rather than the date of settlement

of the judgment), therefore increasing the amount of possible losses for the affected banks in the event of an unfavorable decision by

the STF.

In December

2017, with the mediation of the Executive branch’s attorney (Advocacia Geral da União or AGU) and the intervention of the

Central Bank of Brazil, the representatives of the banks and the savings account holders entered into an agreement related to the economic

plans aiming to finalize the claims, establishing a timeline and conditions for the savings account holders to accede to such agreement.

The STF affirmed the agreement on March 1, 2018. This approval determined the suspension of legal actions in progress for the duration

of the collective bargaining agreement (24 months). On March 11, 2020, the signatories to the Collective Bargaining Agreement agreed to

an amendment extending the agreement for a further 60 months. The amendment was taken to the Supreme Court for approval, its extension

was approved by the plenary of the court, on May 28, 2020, for a period of 30 months (renewable for a further 30 months), from March 12,

2020, to adhere to the terms of the agreement by means of a digital platform specially created for this purpose. As this is a voluntary

settlement, which does not oblige the savings account holder to join, we are unable to predict how many savings account holders will accede

to it.

The

STF is deciding on cases related to inflationary purges, which may raise our costs and cause losses, which may negatively affect our financial

condition, the result of our operations and the market value of our shares.

We

may incur losses associated with counterparty exposures.

We face

the possibility that a derivative counterparty will be unable to honor its contractual obligations. Counterparties may default on their

obligations due to bankruptcy, lack of liquidity, operational failure or other reasons. This risk may arise, for example, as a result

of entering into swap or other derivative contracts under which counterparties have obligations to make payments to us, executing currency

or other trades that fail to settle at the required time due to non-delivery by the counterparty or systems failure by clearing agents,

exchanges, clearing houses or other financial intermediaries. Such counterparty risk is more acute in complex markets where the risk of

default by counterparties is higher.

Our

risk management structure may not be fully effective.

Our

objective is to fully incorporate the risk management process into all of our activities, developing and implementing methodologies, models

and other tools for the measurement and control of risks, looking to continuously improve them in order to mitigate the risks that we

identify. However, there may be limitations to this risk management framework in foreseeing and mitigating all the risks to which we are

subject, or may in the future become, subject. If our risk management structure is not completely effective in adequately preventing or

mitigating risks, we could suffer material unexpected losses, adversely affecting our financial condition and the expected results of

operations.

We

may face significant challenges in possessing and realizing value from collateral with respect to loans in default.

If we

are unable to recover sums owed to us under secured loans in default through extrajudicial measures such as restructurings, our last recourse

with respect to such loans may be to enforce the collateral secured in our favor by the applicable borrower. Depending on the type of

collateral provided, we either have to enforce such collateral through the courts or through extrajudicial measures. However, even where

the enforcement mechanism is duly established by the law, Brazilian law allows borrowers to challenge the enforcement

in the courts, even if such challenge is unfounded, which can delay the realization of value from the collateral. Our secured claims under

Brazilian law will in certain cases rank below those of preferred creditors such as employees and tax authorities. As a result, we may

not be able to realize value from the collateral, or may only be able to do so to a limited extent or after a significant period, thereby

potentially adversely affecting our financial condition and results of our operations.

24 – Reference Form – 2021 |

We

may incur losses due to impairments on goodwill from acquired businesses.

We record

goodwill from acquisitions of investments whose value is based on estimates of future profitability pertaining to business plans and budgets.

Annually, we assess the basis and estimates of profitability of the Cash-Generating Units (Unidades Geradoras de Caixa or UGC) in respect

of which goodwill is allocated. These evaluations are made through cash flow projections based on growth rates and discount rates, with

those projections then being compared to the value of goodwill in order to conclude whether there is a basis to record impairments in

relation to these assets. However, given the inherent uncertainty in relation to predictions of future cash flow projections, we cannot

provide assurances that our evaluation of goodwill will not require impairments to be recorded in future, which may negatively affect

the result of our operations, our financial condition and the market value of our shares.

We

may be subject to negative consequences in the event of an adverse conclusion in the judicial process arising from Operação

Zelotes (“Zealots Operation”).

There

is a criminal proceeding against two former members of Bradesco’s Board of Executive Officers received by the 10th Federal Court

of Judicial Section of the Federal District. This proceeding is a result of the so-called Operação Zelotes, an investigation

of the alleged improper performance of members of Administrative Council of Tax Appeals (CARF). The investigation phase of the process

was already completed, and is currently waiting for the decision of the first-degree court. We are not part of this process.

Our

Management conducted an internal evaluation of records and documents related to the matter and found no evidence of any irregular conduct

practiced by our former representatives.

As

a result of Operação Zelotes, the Corregedoria Geral do Ministério da Fazenda (General Internal Affairs of the Ministry

of Finance) promoted an investigative administrative procedure to verify the need for the establishment of an Administrative Accountability

Process (Processo Administrativo de Responsabilização or PAR). The filing decision

of the related procedure was published in Section 2 of the Diário Oficial da União (Federal Official Gazette) on February

3, 2020. The decision given by the Disciplinary Board of the Ministry of Economy accepted in full the Final Report of the Processing Committee,

the Opinion of the National Treasury Attorney General’s Office and the Joint Order of the General Coordination of Management and

Administration/ the Advisory and Judgment Head Division, which confirmed, expressly recognizing, the lack of evidence that we have promised,

offered or given, directly or indirectly, an unfair advantage to public agents involved in the related operation, in accordance with the

provisions laid down in Article 5, section I, of Law No. 12,846/13.

The

progress of Operação Zelotes and other on-going investigations or investigations that may be initiated in the future, any

consequent events and the possibility of new accusations may negatively affect our reputation and our financial condition.

Financial

institutions, such as us, may be subject to legal proceedings arising from certain actions by third parties related to anticorruption,

money laundering and terrorism financing (AMLTF).

We are

subject to Brazilian anti-corruption legislation and of prevention of money laundering and terrorist financing (AMLTF), and legislation

with a similar focus of other countries where we have branches and operations, as well as other anti-corruption and AMLTF laws and transnational

regulatory regimes. These laws require the adoption of integrity procedures to mitigate the risk that (i) anyone acting on our behalf

may give undue advantage to the public agent to gain benefits of any nature; and (ii) or officers, employees, and third parties may use

financial systems inappropriately for any actions related to AMLTF. Legislation of transnational scope, such as the U.S. Foreign Corrupt

Practices Act and the U.K. Bribery Act, as well as the Brazilian law, oblige us, among other things, to maintain policies and procedures

aimed at preventing any illegal or improper activities related to AMLTF and corruption of governmental entities and officials in order to

ensure any commercial advantage, and they require us to maintain accurate records and a system of internal controls to ensure the accuracy

of our records and avoid illegal activities.

If our

policies and procedures to prevent bribery, AMLTF and other corrupt practices are not able to prevent voluntary or inadvertent actions

by our executives, employees or third parties representing corruption, government regulatory agencies to which we are accountable have

the power and authority to impose fines and other penalties.

25 – Reference Form – 2021 |

Involvement

in these actions, a risk inherent in the activities of financial institutions, may result in negative publicity for us, and any adverse

decision in an administrative or judicial process may adversely affect our financial situation, operating income, and the market value

of our shares and ADSs. In addition, the perception or allegation that we, our employees, our affiliates or other people or entities associated