UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

INFORMATION

STATEMENT PURSUANT TO SECTION14(c)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Check

the appropriate box:

| ☒ | Preliminary

Information Statement |

| ☐ | Definitive

Information Statement |

| ☐ | Confidential

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

VNUE,

Inc.

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☐ | Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| (1) | Title

of each class of securities to which transaction applies: |

| (2) | Aggregate

number of securities to which transaction applies: |

| (3) | Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined): |

| (4) | Proposed

maximum aggregate value of transaction: |

| ☐ | Fee

previously paid with preliminary materials. |

| ☐ | Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount

previously paid: |

| (2) | Form,

Schedule or Registration Statement No.: |

VNUE,

Inc.

104

West 29th Street, 11th Floor

New

York, NY 10001

Tel.

(833) 937-5493

NOTICE

OF ACTION BY WRITTEN CONSENT OF HOLDERS OF

A

MAJORITY OF THE OUTSTANDING VOTING STOCK OF VNUE, INC.

June

8, 2022

Dear

VNUE, Inc. Stockholder:

The

enclosed Information Statement is being distributed to the holders of record of common stock, par value $0.001 per share (“Common

Stock”), Series A Preferred Stock (“Series A Preferred”), Series B Preferred Stock (“Series B Preferred”)

and Series C Preferred Stock (“Series C Preferred”) of VNUE, Inc., a Nevada corporation (the “Company”

or “we”), as of the close of business on May 27, 2022 (the “Record Date”) under Rule 14c-2 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). The purpose of the enclosed Information Statement

is to inform our stockholders of action taken by written consent by the holders of a majority of our outstanding voting stock. The enclosed

Information Statement shall be considered the notice required under Section 78.370 of the Nevada Revised Statues.

The

following action was authorized by written consent of a majority of our outstanding voting stock (the “Written Consent”):

| |

● |

Approval of

an amendment to the Company’s Articles of Incorporation (the “Amendment”) to increase total number of authorized

shares of our Common Stock from two billion (2,000,000,000) shares to four billion (4,000,000,000) shares. |

The

Written Consent constitutes the only stockholder approval required under the Nevada Revised Statues, our Articles of Incorporation and

Bylaws to approve the Amendment. Our Board of Directors is not soliciting your consent or your proxy in connection with this action,

and no consents or proxies are being requested from stockholders. The Amendment, as approved by the Written Consents, will not become

effective until 20 calendar days after the enclosed Information Statement is first mailed or otherwise delivered to our stockholders

entitled to receive notice thereof.

THIS

IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS, AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED

HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED

HEREIN PURSUANT TO SECTION 14(C) OF THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION 14C. WE ARE

NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

By

order of the Board of Directors

| /s/

Zach Bair |

|

| Zach Bair |

|

| Chief Executive Officer and Director |

|

VNUE,

Inc.

104

West 29th Street, 11th Floor

New

York, NY 10001

Tel.

(833) 937-5493

INFORMATION

STATEMENT

WE

ARE NOT ASKING YOU FOR A CONSENT OR PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A CONSENT OR PROXY.

INTRODUCTION

This

Information Statement advises stockholders of the approval by the Company’s Board of Directors, and by Written Consent of

the holders a majority of the Company’s voting stock of an Amendment to increase the total number of authorized shares of the Company’s

Common Stock, from two billion (2,000,000,000) shares to four billion (4,000,000,000) shares. A copy of the Amendment is attached to

this Information Statement as Exhibit A.

The

increase of the Company’s authorized shares of Common Stock will become effective upon the filing of the Amendment with the Secretary

of State of Nevada, which filing will occur no less than 20 days after the date of the mailing of this Information Statement to our stockholders.

AUTHORIZATION

BY THE BOARD OF DIRECTORS AND THE MAJORITY STOCKHOLDERS

Under

the Nevada Revised Statutes and the Company’s Bylaws, any action that can be taken at an annual or special meeting of stockholders

may be taken without a meeting, without prior notice and without a vote if the holders of outstanding stock having not less than the

minimum number of votes necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present

and voted consent to such action in writing. Accordingly, approval of the Amendment required the affirmative vote or written consent

of a majority of the issued and outstanding shares of the Company’s Common Stock, Series A Preferred, Series B Preferred and Series

C Preferred.

As

of May 27, 2022, the record date for the determination of stockholders entitled to notice of the approval of the Amendment and to receive

a copy of this Information Statement (the “Record Date”), we had 1,474,473,903 shares of Common Stock, 4,250,579 shares of

Series A Preferred, 1,795 shares of Series B Preferred and 3,000 shares of Series C Preferred outstanding. Each holder of Common Stock

is entitled to one vote per share of Common Stock held. Each holder of Series A Preferred is entitled to 100 votes per share of Series

A Preferred held. Each holder of Series B Preferred is entitled to vote on an as converted basis, provided the vote may not exceed 4.99%

of our outstanding shares. Each holder of Series C Preferred is entitled to 1,000,000 votes per share of Series C Preferred held. As

of the Record Date, outstanding shares represented 4,899,531,803 votes, consisting of 1,474,473,903 attributable to Common Stock, 425,057,900

attributable to Series A Preferred, an insignificant amount attributable to Series B Preferred and 3,000,000,000 attributable to Series

C Preferred.

Our

Board of Directors unanimously adopted resolutions approving the Amendment, subject to stockholder approval, by unanimous written

consent on May 27, 2022, and, on May 27, 2022 we received the Written Consent from holders of our Series C Preferred representing

3,000,000,000 voting shares, or approximately 61% of our outstanding voting class, approving the Amendment.

The

following table sets forth the name of the holder of the Series C Preferred that voted in favor of the Amendment, the number of shares

Series C Preferred held by such holder, the total number of votes that such holder voted in favor of the Amendment and the percentage

of the issued and outstanding voting equity of the Company that voted in favor thereof:

| Name

of Voting Stockholder |

Number

of Series C Preferred held |

Number

of Votes held by such Voting Stockholder |

Number

of Votes that Voted in Favor of the Amendment |

Percentage

of the Voting Equity that Voted in Favor of the Amendment |

| Zach

Bair |

1,000 |

1,000,000,000 |

1,000,000,000 |

20.4% |

| Anthony

Cardenas |

1,000 |

1,000,000,000 |

1,000,000,000 |

20.4% |

| Lou

Mann |

1,000 |

1,000,000,000 |

1,000,000,000 |

20.4% |

Accordingly,

we have obtained all necessary corporate approval in connection with the Amendment. We are not seeking written consent from any other

stockholder, and the other stockholders will not be given an opportunity to vote with respect to the actions described in this Information

Statement. This Information Statement is furnished solely for the purposes of advising stockholders of the action approved by written

consent and giving stockholders notice of the Amendment and forthcoming increase to out authorized Common Stock as required by the Nevada

Revised Statutes and the Exchange Act.

As

the Amendment was approved by written consent of the holders a majority of the Company’s voting stock, there will be no stockholders’

meeting, and representatives of the principal accountants for the current year and for the most recently completed fiscal year will not

have the opportunity to make a statement if they desire to do so and will not be available to respond to appropriate questions from our

stockholders.

We

will, following the expiration of the 20-day period mandated by Rule 14c of the Exchange Act and the provisions of the Nevada Revised

Statutes, file the Amendment with the Nevada Secretary of State’s Office. The Amendment will become effective upon such filing

and we anticipate that such filing will occur approximately 20 days after this Information Statement is first mailed to our stockholders.

AMENDMENT

TO OUR ARTICLES OF INCORPORATION

Purpose

of and Rationale for the Amendment

We

are currently authorized to issue a total of two billion (2,000,000,000) shares of Common Stock. Of this amount, 1,474,473,903 shares

of Common Stock were outstanding as of May 27, 2022.

We

are also required to reserve sufficient shares of Common Stock for issuance upon conversion or exercise of our outstanding debt and equity

securities. As of the Record Date we have reserved with our transfer agent 588,232,876 shares of

Common Stock for these conversions and exercises, and recent transactions require that we reserve even more share. The total outstanding

combined with the amount held in reserve, totals 2,062,706,779 shares of Common Stock.

Our

Board of Directors has determined that it is in our best interest to increase the number of authorized shares of Common Stock to cover

the aforementioned shortage. In addition, the Board of Directors believes that the Amendment will provide us with greater flexibility

by increasing our authorized capital to allow us to issue additional shares of Common Stock as the Board of Directors deems necessary

or advisable. While we have no current plans to issue shares of our Common Stock, aside from the equity and debt conversions and to fulfill

obligations to issue shares in connection with consultants and employees and our recent merger with Stage It Corp., we feel it appropriate

to increase our authorized number of Common Stock in the event we encounter a potential financing transaction that requires the issuance

of shares.

As

a result, our current authorized shares of 2,000,000,000 is insufficient to cover the shares necessary for issuance upon exercise or

conversion of our equity and debt securities to fulfill obligations and to plan for future financings. Consequently, the Amendment

to increase our authorized shares of Common Stock is necessary in order to validly issue shares of common stock upon the conversion or

exercise of these securities. In addition, the Amendment to increase our authorized Common Stock will provide us with additional authorized

but unissued shares for general corporate purposes, including raising additional capital through equity and/or convertible debt financings.

The

Board of Directors believes that an increase in the total number of shares of authorized Common Stock will give us greater flexibility

in responding quickly to advantageous financing and business opportunities that involve the direct or indirect issuance of additional

shares of common stock and attracting and retaining key personnel through the issuance of stock incentive awards. The Amendment to increase

our authorized Common Stock will not have any immediate effect on the rights of existing stockholders. However, our Board of Directors

will have the authority to issue authorized common stock or other securities convertible into or exercisable or exchangeable for common

stock without requiring future stockholder approval of such issuances, except as may be required by our Articles of Incorporation or

applicable law. To the extent that additional authorized shares are issued in the future, they may decrease the existing stockholders’

percentage equity ownership and, depending on the price at which they are issued, could be dilutive to the existing stockholders. The

increase in the authorized number of shares of Common Stock and the subsequent issuance of such shares could have the effect of delaying

or preventing a change in control of our company without further action by our stockholders. Shares of authorized and unissued Common

Stock could, within the limits imposed by applicable law, be issued in one or more transactions which would make a change in control

of our company more difficult, and therefore less likely. Any such issuance of additional stock could have the effect of diluting the

earnings per share and book value per share of outstanding shares of Common Stock and such additional shares could be used to dilute

the stock ownership or voting rights of a person seeking to obtain control of our company. The Board of Directors is not currently aware

of any attempt to take over or acquire our company. While it may be deemed to have potential anti-takeover effects, the amendment is

not prompted by any specific effort or takeover threat currently perceived by management.

One

of the effects of the increase in authorized share capital, if adopted, however, may be to enable the Board to render it more difficult

to or discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest or otherwise, and thereby

protect the continuity of present management. The Board would, unless prohibited by applicable law, have additional shares of Common

Stock available to effect transactions (including private placements) in which the number of the Company’s outstanding shares would be

increased and would thereby dilute the interest of any party attempting to gain control of the Company. Such action, however, could discourage

an acquisition of the Company, which the stockholders of the Company might view as desirable.

Effect

on Outstanding Common Stock

The

additional shares of Common Stock authorized by the Amendment will have the same privileges as the shares of Common Stock currently authorized

and issued. Stockholders do not have preemptive rights under our Articles of Incorporation and will not have such rights with respect

to the additional authorized shares of Common Stock. The increase in authorized shares would not affect the terms or rights of holders

of existing shares of Common Stock. All outstanding shares of Common Stock will continue to have one vote per share on all matters to

be voted on by our stockholders, including the election of directors.

The

issuance of any additional shares of Common Stock may, depending on the circumstances under which those shares are issued, reduce stockholders’

equity per share and, unless additional shares are issued to all stockholders on a pro rata basis, will reduce the percentage ownership

of Common Stock of existing stockholders. In addition, if our Board of Directors elects to issue additional shares of Common Stock, such

issuance could have a dilutive effect on the earnings per share, voting power and shareholdings of current stockholders. We expect, however,

to receive consideration for any additional shares of Common Stock issued, thereby reducing or eliminating any adverse economic effect

to each stockholder of such dilution.

The

Amendment will not otherwise alter or modify the rights, preferences, privileges or restrictions of the Common Stock.

Interests

of Certain Persons in the Action

Aside

from the security holders that may convert their equity and debt into Common Stock, we do not believe that there are stockholders with

interests in the Amendment that are different from or greater than those of any other of our stockholders.

Anti-Takeover

Effects

Although

the Amendment is not motivated by anti-takeover concerns and is not considered by our Board of Directors to be an anti-takeover measure,

the availability of additional authorized shares of Common Stock could enable the Board of Directors to issue shares defensively in response

to a takeover attempt or to make an attempt to gain control of the Company more difficult or time-consuming. For example, shares of Common

Stock could be issued to purchasers who might side with management in opposing a takeover bid that the Board of Directors determines

is not in our best interests, thus diluting the ownership and voting rights of the person seeking to obtain control of the Company. In

certain circumstances, the issuance of Common Stock without further action by the stockholders may have the effect of delaying or preventing

a change in control of the Company, may discourage bids for our Common Stock at a premium over the prevailing market price and may adversely

affect the market price of our Common Stock. As a result, increasing the authorized number of shares of our Common Stock could render

more difficult and less likely a hostile takeover, tender offer or proxy contest, assumption of control by a holder of a large block

of our stock, and the possible removal of our incumbent management. We are not aware of any proposed attempt to take over the Company

or of any present attempt to acquire a large block of our Common Stock.

DISSENTER’S

RIGHTS

Under

the Nevada Revised Statutes, holders of our capital stock are not entitled to dissenter’s rights of appraisal with respect to a

proposed amendment to our Articles of Incorporation, or to the adoption of the Amendment.

DISTRIBUTION

AND COSTS

We

will pay the cost of preparing, printing and distributing this Information Statement. Only one Information Statement will be delivered

to multiple stockholders sharing an address, unless contrary instructions are received from one or more of such stockholders. Upon receipt

of a written request at the address noted above, we will deliver a single copy of this Information Statement and future stockholder communication

documents to any stockholders sharing an address to which multiple copies are now delivered.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table set forth the ownership, as of the Record Date, of our voting securities held by each person known by us to be the beneficial

owner of more than 5% of our outstanding voting securities, our directors, and our executive officers and directors as a group. To the

best of our knowledge, the persons named have sole voting and investment power with respect to such shares, except as otherwise noted.

There are not any pending or anticipated arrangements that may cause a change in control.

The

information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of

the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person

is deemed to be a “beneficial owner” of a security if that person has or shares the power to vote or direct the voting of

the security or the power to dispose or direct the disposition of the security even though they may not rightfully “own”

those shares. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting

or investment power within 60 days through the conversion or exercise of any convertible security, warrant, option, or other right. More

than one person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as

of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares

as to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding

as of such date plus the number of shares as to which such person has the right to acquire voting or investment power within 60 days.

Consequently, the denominator used for calculating such percentage may be different for each beneficial owner. Except as otherwise indicated

below, we believe that the beneficial owners of our common stock listed below have sole voting and investment power with respect to the

shares shown. The mailing address for all persons is at 104 W. 29th Street, 11th Floor, New York, NY

10001.

This

table is based upon information derived from our stock records. The shareholder named in this table has sole or shared voting and investment

power with respect to the shares indicated as beneficially owned. Applicable percentages are based upon 1,474,473,903 shares of common

stock, 4,250,579 shares of Series A Preferred Stock and 3,000 shares of Series C Preferred Stock outstanding as of May 27, 2022.

| | |

Common Stock | | |

Series A

Preferred Stock | | |

Series C

Preferred Stock | |

| | |

Number of

Shares

Owned | | |

Percent of

Class(1)(2) | | |

Number of

Shares

Owned | | |

Percent of

Class(1)(2) | | |

Number of

Shares

Owner | | |

Percentage of

Class | |

| Zach Bair | |

| 105,000,980 | (1) | |

| 7.1 | % | |

| 1,497,347 | | |

| 35.2 | % | |

| 1,000 | | |

| 33.3 | % |

| Anthony Cardenas | |

| 14,001,000 | (2) | |

| * | | |

| 260,000 | | |

| 6.1 | % | |

| 1,000 | | |

| 33.3 | % |

| Louis Mann | |

| 52,501,021 | (3) | |

| 3.6 | % | |

| 748,429 | | |

| 17.6 | % | |

| 1,000 | | |

| 33.3 | % |

| All Directors and Executive Officers as a Group (3 persons) | |

| 171,503,001 | (4) | |

| 11.6 | % | |

| 2,505,776 | | |

| 59.0 | % | |

| 3,000 | | |

| 100 | % |

| 5% Holders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Thomas Jackson Weaver III | |

| 52,500,000 | (5) | |

| 3.6 | % | |

| 1,050,000 | | |

| 24.7 | % | |

| - | | |

| - | |

| (1) | Includes

30,082,630 shares of common stock, 1,498,347 Series A Preferred Stock which converts into 74,917,350 shares of common stock and 1,000

shares of Series C Preferred Stock owned by Mr. Bair converts into 1,000 shares of common stock. |

| (2) | Includes

1,000,000 shares of common stock, 260,000 Series A Preferred Stock owned by Mr. Cardenas converts into 13,000,000 shares of common stock

and 1,000 shares of Series C Preferred Stock owned by Mr. Cardenas that converts into 1,000 shares of common stock. |

| (3) | Includes

15,078,571 shares of common stock, 748,429 shares of Series A Preferred Stock owned by Mr. Louis Mann that convert into 37,421,450 shares

of common stock and 1,000 shares of Series C Preferred Stock owned by Mr. Louis Mann convert into 1,000 shares of common stock. |

| (4) | Includes

all common stock held by such directors or officers as a group, as well as the voting power of all Series A Preferred Stock owned by

such persons. |

| (5) | Includes

the voting power of 1,050,000 shares of Series A Preferred Stock which convert into 52,500,000 shares of common stock. |

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING

AN ADDRESS

We will only deliver one information

statement to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of the stockholders.

Also, we will promptly deliver a separate copy of this information statement and future stockholder communication documents to any stockholder

at a shared address to which a single copy of this information statement was delivered, or deliver a single copy of this information statement

and future stockholder communication documents to any stockholder or stockholders sharing an address to which multiple copies are now

delivered, upon written request to us at our address noted above. Stockholders may also address future requests regarding delivery of

information statements and/or annual reports by contacting us at the address noted above.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and special reports, proxy statements and other information with the SEC. The periodic reports and other information we have filed with

the SEC, may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington DC 20549. You may obtain

information as to the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a Web site that

contains reports, proxy statements and other information about issuers, like the Company, who file electronically with the SEC. The address

of that site is www.sec.gov. Copies of these documents may also be obtained by writing our secretary at the address specified above.

By Order of the Board of Directors

June 8, 2022

| /s/ Zach Bair |

|

| Zach Bair |

|

| Chief Executive Officer – Director |

|

Exhibit A

CERTIFICATE OF AMENDMENT

TO

ARTICLES OF INCORPORATION

OF

VNUE, INC.

VNUE,

Inc., a Nevada corporation (the “Corporation”), does hereby certify that:

FIRST:

This Certificate of Amendment amends the provisions of the Corporation’s Articles of Incorporation (the “Articles of Incorporation”).

SECOND:

The terms and provisions of this Certificate of Amendment have been duly adopted in accordance with Section 78.380 of the Nevada Revised

Statutes and shall become effective immediately upon filing this Certificate of Amendment.

THIRD:

The Article III of the Articles of Incorporation is hereby amended in its entirety and replaced with the following:

ARTICLE III

CAPITAL STOCK

Section 1. Authorized

Shares. The aggregate number of shares which the Corporation shall have authority to issue is four billion twenty million (4,020,000,000)

shares, consisting of two classes to be designated, respectively, “Common Stock” and “Preferred Stock,” with all of

such shares having a par value of $.001 per share. The total number of shares of Common Stock that the Corporation shall have authority

to issue is four billion (4,000,000,000) shares. The total number of shares of Preferred Stock that the Corporation shall have authority

to issue is twenty million (20,000,000) shares. The Preferred Stock may be issued in one or more series, each series to be appropriately

designated by a distinguishing letter or title, prior to the issuance of any shares thereof. The voting powers, designations, preferences,

limitations, restrictions, and relative, participating, optional and other rights, and the qualifications, limitations, or restrictions

thereof, of the Preferred Stock shall hereinafter be prescribed by resolution of the board of directors pursuant to Section 3 of this

Article III.

Section 2. Common

Stock.

(a) Dividend

Rate. Subject to the rights of holders of any Preferred Stock having preference as to dividends and except

as otherwise provided by these Articles of Incorporation, as amended from time to time (hereinafter, the “Articles”)

or the Nevada Revised Statues (hereinafter, the “NRS”), the holders of Common Stock shall be entitled to receive dividends

when, as and if declared by the board of directors out of assets legally available therefor.

(b) Voting

Rights. Except as otherwise provided by the NRS, the holders of the issued and outstanding shares of Common

Stock shall be entitled to one vote for each share of Common Stock. No holder of shares of Common Stock shall have the right to cumulate

votes.

(c) Liquidation

Rights. In the event of liquidation, dissolution, or winding up of the affairs of the Corporation, whether

voluntary or involuntary, subject to the prior rights of holders of Preferred Stock to share ratably in the Corporation’s assets, the

Common Stock and any shares of Preferred Stock which are not entitled to any preference in liquidation shall share equally and ratably

in the Corporation’s assets available for distribution after giving effect to any liquidation preference of any shares of Preferred Stock.

A merger, conversion, exchange or consolidation of the Corporation with or into any other person or sale or transfer of all or any part

of the assets of the Corporation (which shall not in fact result in the liquidation of the Corporation and the distribution of assets

to stockholders) shall not be deemed to be a voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

(d) No

Conversion, Redemption, or Preemptive Rights. The holders of Common Stock shall not have any conversion, redemption,

or preemptive rights.

(e) Consideration

for Shares. The Common Stock authorized by this Article shall be issued for such consideration as shall be

fixed, from time to time, by the board of directors.

Section 3. Preferred

Stock.

(a) Designation. The

board of directors is hereby vested with the authority from time to time to provide by resolution for the issuance of shares of Preferred

Stock in one or more series not exceeding the aggregate number of shares of Preferred Stock authorized by these Articles, and to prescribe

with respect to each such series the voting powers, if any, designations, preferences, and relative, participating, optional, or other

special rights, and the qualifications, limitations, or restrictions relating thereto, including, without limiting the generality of the

foregoing: the voting rights relating to the shares of Preferred Stock of any series (which voting rights, if any, may be full or limited,

may vary over time, and may be applicable generally or only upon any stated fact or event); the rate of dividends (which may be cumulative

or noncumulative), the condition or time for payment of dividends and the preference or relation of such dividends to dividends payable

on any other class or series of capital stock; the rights of holders of Preferred Stock of any series in the event of liquidation, dissolution,

or winding up of the affairs of the Corporation; the rights, if any, of holders of Preferred Stock of any series to convert or exchange

such shares of Preferred Stock of such series for shares of any other class or series of capital stock or for any other securities, property,

or assets of the Corporation or any subsidiary (including the determination of the price or prices or the rate or rates applicable to

such rights to convert or exchange and the adjustment thereof, the time or times during which the right to convert or exchange shall be

applicable, and the time or times during which a particular price or rate shall be applicable); whether the shares of any series of Preferred

Stock shall be subject to redemption by the Corporation and if subject to redemption, the times, prices, rates, adjustments and other

terms and conditions of such redemption. The powers, designations, preferences, limitations, restrictions and relative rights may be made

dependent upon any fact or event which may be ascertained outside the Articles or the resolution if the manner in which the fact or event

may operate on such series is stated in the Articles or resolution. As used in this section “fact or event” includes, without

limitation, the existence of a fact or occurrence of an event, including, without limitation, a determination or action by a person, government,

governmental agency or political subdivision of a government. The board of directors is further authorized to increase or decrease (but

not below the number of such shares of such series then outstanding) the number of shares of any series subsequent to the issuance of

shares of that series. Unless the board of directors provides to the contrary in the resolution which fixes the characteristics of a series

of Preferred Stock, neither the consent by series, or otherwise, of the holders of any outstanding Preferred Stock nor the consent of

the holders of any outstanding Common Stock shall be required for the issuance of any new series of Preferred Stock regardless of whether

the rights and preferences of the new series of Preferred Stock are senior or superior, in any way, to the outstanding series of Preferred

Stock or the Common Stock.

(b) Certificate. Before

the Corporation shall issue any shares of Preferred Stock of any series, a certificate of designation setting forth a copy of the resolution

or resolutions of the board of directors, and establishing the voting powers, designations, preferences, the relative, participating,

optional, or other rights, if any, and the qualifications, limitations, and restrictions, if any, relating to the shares of Preferred

Stock of such series, and the number of shares of Preferred Stock of such series authorized by the board of directors to be issued shall

be made and signed by an officer of the corporation and filed in the manner prescribed by the NRS.

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its officers thereunto duly authorized this

8th day of June 2022.

| By: |

/s/ Zach Bair |

|

| Name: |

Zach Bair |

|

| Title: |

Chief Executive Officer |

|

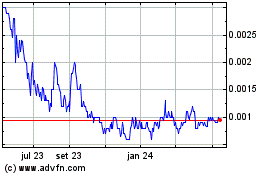

VNUE (PK) (USOTC:VNUE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

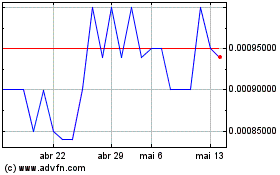

VNUE (PK) (USOTC:VNUE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024