UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

x ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED]

For the fiscal year ended December 31, 2021

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED]

for the transition period from to

Commission file number 1-16625

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Bunge Savings Plan – Supplement A

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Bunge Limited

1391 Timberlake Manor Parkway

Chesterfield, MO 63017

| | | | | | | | |

| TABLE OF CONTENTS | | |

| | |

| | Page |

| | |

| Report of Independent Registered Public Accounting Firm | | |

| | |

| | |

| Financial Statements | | |

| | |

| Statements of Net Assets Available for Benefits as of December 31, 2021 and 2020 | | |

| | |

| Statements of Changes in Net Assets Available for Benefits for the Years ended December 31, 2021 and 2020 | | |

| | |

| Notes to Financial Statements | | |

| | |

| Supplemental Schedule | | |

| | |

| Schedule H, Line 4i - Schedule of Assets (held at End of Year) as of December 31, 2021 | | |

| | |

| Exhibits | | |

| | |

| Signature | | |

| | |

| Exhibit 23.1 Consent of Independent Registered Public Accounting Firm | | |

| | |

Report of Independent Registered Public Accounting Firm

To the Participants, Administrator, and Investment

Committee of the Bunge Savings Plan - Supplement A

Saint Louis, Missouri

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Bunge Savings Plan - Supplement A (the “Plan”) as of December 31, 2021 and 2020, and the related statements of changes in net assets available for benefits for the years ended December 31, 2021 and 2020, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information contained in the Schedule of Assets (Held at End of Year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan’s auditor since 2011.

/s/ Armanino LLP

St. Louis, Missouri

June 15, 2022

| | | | | | | | | | | |

| BUNGE SAVINGS PLAN – SUPPLEMENT A | | |

| | | |

| STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS | | | |

| AS OF DECEMBER 31, 2021 AND 2020 | | | |

| | | |

| | | |

| 2021 | | 2020 |

| | | |

| INVESTMENTS, at fair value: | | | |

| Mutual funds | $ | 4,324,033 | | | $ | 3,928,857 | |

| Bunge Limited common shares | 142,403 | | | 119,002 | |

| Collective trust fund | 301 | | | 399 | |

| Common stock | 43,267 | | | 20,349 | |

| Non Interest bearing cash | 192 | | | 217 | |

| Interest bearing cash | 68,796 | | | 106,902 | |

| | | |

Total Plan interest in Bunge Defined Contribution Master Trust | 4,578,992 | | | 4,175,726 | |

| | | |

| RECEIVABLES: | | | |

| Notes receivable from participants | 128,614 | | | 59,726 | |

| | | |

| Total receivables | 128,614 | | | 59,726 | |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS | $ | 4,707,606 | | | $ | 4,235,452 | |

| | | |

| | | |

| See notes to financial statements. |

| | | | | | | | | | | | | | |

| BUNGE SAVINGS PLAN – SUPPLEMENT A | | | |

| | | |

| STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS |

| FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 | | |

| | | |

| | | |

| 2021 | | 2020 |

| | | |

| ADDITIONS: | | | |

| Participants’ contributions | $ | 251,567 | | | $ | 244,242 | |

| Employer contributions | | 1,551 | | | — | |

| Rollover contributions | — | | | 392 | |

| Interest income on notes receivable from participants | 3,859 | | | 3,522 | |

| Plan interest in Bunge Defined Contribution Master Trust: | | | |

| Investment income — dividends | 287,899 | | | 185,108 | |

| Investment income — interest | 24 | | | 296 | |

| Net appreciation in value of investments | 282,176 | | | 442,454 | |

| | | |

| Net appreciation of Plan interest in Bunge Defined Contribution Master Trust | 570,099 | | | 627,858 | |

| | | |

| Total Additions | 827,076 | | | 876,014 | |

| | | |

| DEDUCTIONS: | | | |

| Benefits paid to participants | 343,511 | | | 373,702 | |

| | | |

| Administrative expenses | 11,411 | | | 10,811 | |

| | | |

| Total Deductions | 354,922 | | | 384,513 | |

| | | |

| INCREASE IN NET ASSETS | 472,154 | | | 491,501 | |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS — Beginning of year | 4,235,452 | | | 3,743,951 | |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS — End of year | $ | 4,707,606 | | $ | 4,235,452 |

| | | |

| | | |

| See notes to financial statements. |

|

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

1.BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

The Bunge Savings Plan – Supplement A (the “Plan”) is a subplan of the Bunge Savings Plan (the “Savings Plan”), which was established on April 1, 1996. Prior to January 1, 2004, the Plan was a stand-alone plan known as the Central Soya 401(k) Plan for Hourly Employees. The Savings Plan was amended on January 1, 2004, to transfer the assets of the Central Soya 401(k) Plan for Hourly Employees to the Savings Plan and master trust. The Savings Plan was further amended to provide that the Plan provisions applicable to the participants in the Central Soya 401(k) Plan for Hourly Employees are set forth in a separate subplan known as the Bunge Savings Plan – Supplement A. On January 1, 2005, Bunge Limited (the parent of Bunge North America, Inc. (the "Company"), the plan sponsor) separated the Plan from the Savings Plan.

Basis of Accounting — The accompanying financial statements of the Plan have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Investment Valuation and Income Recognition — The Plan’s investment in the Bunge Defined Contribution Master Trust (the “Trust”) is presented at fair value, which has been determined based on the fair value of the underlying investments of the Trust. The Trust’s investments include mutual funds, Bunge Limited common shares, interest bearing cash, non interest bearing cash, and other common stock holdings that are stated at estimated fair value based on quoted market prices.

The Collective trust fund is a stable value fund that is composed primarily of fully benefit-responsive investment contracts that are valued at the net asset value of units of the bank collective trust. See Note 10 - Investments Measured Using The Net Asset Value Per Share Practical Expedient, for investments held by the Trust for which fair value is measured using the net asset value per share practical expedient.

Sales and purchases of investments are accounted for on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Earnings on investments are allocated to participants based on daily account balances. See Note 9 - Fair Value Measurements for discussion of fair value measurements.

Payment of Benefits — Benefit payments are recorded when paid.

Administrative Expenses — Administrative expenses of the Plan are paid by the participants as provided in the Plan document. Certain expenses of maintaining the Plan are paid directly by the Company and are excluded from these financial statements.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires the Plan's management to make estimates and assumptions that affect the reported amounts of assets, liabilities, accompanying notes of the Plan financial statements, and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties — The Plan invests in the Trust which holds various securities, including mutual funds, Bunge Limited common shares, interest bearing cash, non interest bearing cash and other common stock holdings. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities may occur in the near term and that such changes could materially affect the amounts reported in the financial statements.

On March 27, 2020, the Coronavirus Aid, Relief and Economic Security (“CARES”) Act was enacted and signed into law. The CARES Act allowed qualifying COVID-19 pandemic impacted participants to defer

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

loan payments until December 31, 2020. The CARES Act also provided qualifying COVID-19 pandemic impacted participants with the option to take a coronavirus related distribution (“CRD”) from retirement savings that previously would have been inaccessible or subject to early withdrawal penalties. The CARES Act eliminated the need to take a required minimum distribution in calendar year 2020.

Subsequent Events - The Plan has evaluated subsequent events through June 15, 2022, the date the financial statements were available to be issued.

2. PLAN DESCRIPTION

The Plan is a defined contribution plan designed to qualify under Section 401(k) of the Internal Revenue Code (“IRC”) and is administered by the Investment Committee (the “Committee”) appointed by the Board of Directors of the Company. The Company has appointed Fidelity Management Trust Company (“Fidelity”) to serve as record keeper, administrator, and trustee of both the Plan and the Trust. The descriptions of Plan terms in the following notes to financial statements are provided for general information purposes only and are qualified in their entirety by reference to the Plan document. Participants should refer to the plan document for a more complete description of the applicable provisions of the Plan. All regular hourly employees of Bunge North America (East), L.L.C., whose terms and conditions of employment are subject to a collective bargaining agreement that bargained to participate in the Plan, are eligible participants. Individual accounts are maintained for each Plan participant. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

3. CONTRIBUTIONS AND WITHDRAWALS

Contribution limits for participants are based on their respective collective bargaining agreements. As determined by the IRC’s qualified retirement plan limits, the total amount which a participant could elect to contribute to the Plan on a pre-tax or Roth after-tax basis could not exceed $19,500. However, if a participant reached age 50 by December 31, they are able to contribute an additional $6,500 in “catch up” contributions to the Plan on a pre-tax or Roth after-tax basis.

The contribution amounts and allocation between pre-tax and post-tax basis of participant accounts are subject to IRC discrimination tests and limitations. The participants’ contributions, plus any actual earnings thereon, vest immediately.

Commencing as of September 13, 2021, the Plan was modified to allow a select employer match at the Indianapolis, Indiana facility and is subject to participant collective bargaining agreements. For each payroll period, matching contributions are made by the Company. Participant contributions are matched at the rate of 100% of the first 2% of compensation contributed by the participant on a pre-tax or Roth after-tax basis. Such matching contributions are credited to individual participants’ accounts, and vest at a rate of 20% per year and all matching contributions become 100% vested following five years of continuous service. Participants will forfeit any non-vested portion of their account balance upon leaving the Company’s employment for any reason other than normal retirement. Any such forfeited amounts shall be used to pay reasonable Plan expenses and/or to reduce employer matching contributions to the Plan.

Plan participants may select from a number of investment alternatives for their contributions. Investment choices include various mutual funds, common stock, and the Bunge Common Stock Fund (subject to certain limits) (the "Bunge Fund”). The Bunge Fund pools a participant’s money with that of other employees to buy common shares of Bunge Limited as well as short-term investments designed to allow participants to buy or sell without the usual trade settlement period for individual stock transactions. The value of the participant investment in the Bunge Fund will vary depending on the performance of Bunge

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

Limited, the overall stock market, and the performance and amount of short-term investments held by the Bunge Fund, less any expenses accrued against the Bunge Fund. All dividends and interest earned in the Bunge Fund are reinvested in the Bunge Fund. Participant’s ownership in the Bunge Fund is measured in units of the Bunge Fund instead of common shares.

Participants may not withdraw pre-tax contributions except as provided for hardship withdrawals or for participants at the Decatur, Indiana facility age 59½ withdrawals permitted by the Plan. Following normal retirement or termination of employment, participants may withdraw their entire account balances in a lump sum or any other form of payment allowed by the Plan prior to April 1 following the calendar year in which the participant attains age 72. Participants with account balances less than or equal to $5,000 upon retirement or termination must withdraw their entire account balances in a lump sum or any other form of payment allowed by the Plan on the date the participant terminates employment. Withdrawals by participants are recorded upon distribution.

The Plan allows participants the option of making qualified (as defined by the Plan document and the IRC) rollover contributions into the Plan. A participant may withdraw all or any portion of their after-tax contribution account including earnings, at any time.

In 2020, as part of the CARES Act, the Plan allowed all eligible employees to take a CRD of up to $100,000, without penalty. Eligible employees are not required to repay this distribution, but the Plan allows for them to repay their Plan account within three years of the date they received their distribution.

4. NOTES RECEIVABLE FROM PARTICIPANTS

Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum of the lesser of $50,000 or 50% of their vested account balance. Loan terms range from one to five years with the exception of loans for the purchase of a primary residence, which may have a longer term and participants can have no more than two loans outstanding at any given time. The loans are secured by the balance in the participant’s account and bear interest at rates commensurate with the prevailing interest rate charged on similar commercial loans by lending institutions as determined by the plan administrator. Loan payments, including interest due, are paid ratably through payroll deductions. As of December 31, 2021, participant loans bear interest rate of 3.75% to 6.00%, and mature through December 2026. No allowance for credit losses has been recorded as of December 31, 2021 or 2020. Notes receivable from participants are measured at their unpaid principal balance plus any accrued, but unpaid interest. Fees related to the administration of notes receivable from participants are charged directly to the participant's account and are included in the administrative expense.

In 2020, as part of the CARES Act, the Plan allowed for a suspension of loan payments for all eligible employees until December 31, 2020. The suspended loan payments were restarted after January 1, 2021. Suspended loans were re-amortized, with new payment amounts and payoff dates.

5. PLAN TERMINATION

Although it has not expressed any intention to do so, the Company has the right under the Plan to terminate the Plan subject to the provisions set forth in ERISA. In the event the Plan is terminated, participants will become 100% vested in their employer contributions.

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

6. FEDERAL INCOME TAX STATUS

The Plan obtained its latest determination letter from the Internal Revenue Service on March 31, 2016, stating that the Plan and related trust were designed and in compliance with the applicable sections of the IRC. Although the Plan has been amended since receiving the determination letter, the plan administrator believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC and the Plan and related trust continue to be tax exempt. Accordingly, no provision for income taxes has been recorded in the Plan’s financial statements.

GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the state and federal taxing authorities. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2021, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

7. EXEMPT PARTY-IN-INTEREST TRANSACTIONS

Certain of the Trust’s investments are in shares of funds offered by Fidelity. Therefore, these transactions qualify as exempt party-in-interest transactions under ERISA. Fees paid by the Plan were $11,411 and $10,811 for the years ended December 31, 2021 and 2020, respectively.

Personnel and facilities of the Company have been used by the Plan for its accounting and other activities at no charge to the Plan.

The Plan allows for participants to invest in the Bunge Fund (subject to certain limits) which holds Bunge Limited common shares, as well as, short-term investments. Bunge Limited is the parent company of the sponsoring Company. The Bunge Fund held 128,553 and 144,214 common shares of Bunge Limited at December 31, 2021 and 2020, respectively of which 1,525 and 1,814 shares were allocated to the Plan at December 31, 2021 and 2020, respectively. During 2021 and 2020, the Plan recorded dividend income of $3,673 and $3,436, respectively, and net appreciation in fair value of $47,346 and $17,208, respectively, from Bunge Limited common shares.

8. INTEREST IN BUNGE DEFINED CONTRIBUTION MASTER TRUST

The Plan’s investment assets are held in the Trust which was established for the investment of the combined assets of the Plan and other defined contribution plans sponsored by the Company. The assets of the Trust are held, managed, and administered by Fidelity pursuant to the terms of the Bunge Defined Contribution Master Trust. Investment income and administrative expenses relating to the Trust are allocated to the individual participants in the plans based upon individual participant activity. Each participating retirement plan has a divided interest in the Trust.

The Trust is required to maintain separate accounts reflecting the equitable share of each participating plan in the Trust. The Plan’s equitable share of the Trust cannot be used for the payments of expenses or benefits allocable to any other participating plan.

At December 31, 2021 and 2020, the Plan's interest in the net assets of the Trust was approximately 1.0%.

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

The investments of the Trust at December 31, 2021 and 2020 are summarized as follows:

| | | | | | | | | | | | | | | | | |

| 2021 | | 2020 |

| Bunge Defined Contribution Master Trust | Plan's Interest in Master Trust | | Bunge Defined Contribution Master Trust | Plan's Interest in Master Trust |

| | | | | |

| Cash | $ | 4,220,157 | | $ | 68,988 | | | $ | 4,163,996 | | $ | 107,119 | |

| Investments - at fair value: | | | | | |

| Mutual funds | 453,498,094 | 4,324,033 | | | 402,786,608 | | 3,928,857 | |

| Bunge Limited common shares | 12,001,708 | 142,403 | | | 9,457,554 | | 119,002 | |

| Collective trust fund | 7,598,145 | 301 | | | 8,391,052 | | 399 | |

| Common stock | 10,181,371 | 43,267 | | | 7,237,925 | | 20,349 | |

| Total investments, at fair value | 483,279,318 | | 4,510,004 | | | 427,873,139 | | 4,068,607 | |

| | | | | |

| Receivables | | | | | |

| Notes receivable from participants | 4,387,756 | | 128,614 | | | 4,922,474 | | 59,726 | |

| Employer contributions | 416,968 | | — | | | 330,502 | | — | |

| Total receivables | 4,804,724 | | 128,614 | | | 5,252,976 | | 59,726 | |

| | | | | |

| Total | $ | 492,304,199 | | $ | 4,707,606 | | | $ | 437,290,111 | | $ | 4,235,452 | |

| | | | | |

| | | | | |

| | | | | |

The following are net appreciation in the fair value of investments and investment income for the Bunge Defined Contribution Master Trust for the years ended December 31, 2021 and 2020.

| | | | | | | | |

| 2021 | 2020 |

| | |

| Net appreciation in fair value of investments | $ | 36,448,953 | | $ | 52,456,688 | |

| Investment income | 28,073,629 | | 19,806,691 | |

| Total | $ | 64,522,582 | | $ | 72,263,379 | |

9. FAIR VALUE MEASUREMENTS

ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), established a single authoritative definition of fair value, set a framework for measuring fair value, and requires additional disclosures about fair value measurements.

The various inputs that may be used to determine the value of the Plan’s and Trust’s investments are summarized in three broad levels. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. There have been no changes in methodologies or investment levels during the years ended December 31, 2021 and 2020.

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

Level 1 — Quoted prices (unadjusted) in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following tables set forth by level within the fair value hierarchy a summary by category of equity securities held by the Trust measured at fair value on a recurring basis at December 31, 2021 and 2020. The tables do not include the Trust’s cash of $4,220,157 and $4,163,996, respectively, in accordance with the disclosure requirements of ASC 820, or the Collective trust fund value of $7,598,145 and $8,391,052 at December 31, 2021 and 2020, respectively, in accordance with the disclosure requirements of ASC 820-10 for certain investments measured at net asset value per share (or its equivalent).

| | | | | | | | | | | | | | |

| Fair Value Measurements

at December 31, 2021, Using |

| |

| Quoted Prices | | | |

| in Active | Significant | | |

| Markets for | Other | Significant | |

| Identical | Observable | Unobservable | |

| Assets | Inputs | Inputs | |

| (Level 1) | (Level 2) | (Level 3) | Total |

| | | | |

| Mutual funds | $ | 453,498,094 | | $ | — | | $ | — | | $ | 453,498,094 | |

Bunge Limited common shares | 12,001,708 | | — | | — | | 12,001,708 | |

| Common stock | 10,181,371 | | — | | — | | 10,181,371 | |

| | | | |

Total | $ | 475,681,173 | | $ | — | | $ | — | | $ | 475,681,173 | |

| Fair Value Measurements

at December 31, 2020, Using |

|

|

| Quoted Prices | | | |

| in Active | Significant | | |

| Markets for | Other | Significant | |

| Identical | Observable | Unobservable | |

| Assets | Inputs | Inputs | |

| (Level 1) | (Level 2) | (Level 3) | Total |

| | | | |

| Mutual funds | $ | 402,786,608 | | $ | — | | $ | — | | $ | 402,786,608 | |

Bunge Limited common shares | 9,457,554 | | — | | — | | 9,457,554 | |

| Common stock | 7,237,925 | | — | | — | | 7,237,925 | |

| | | | |

Total | $ | 419,482,087 | | $ | — | | $ | — | | $ | 419,482,087 | |

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

10. INVESTMENTS MEASURED USING THE NET ASSET VALUE PER SHARE PRACTICAL EXPEDIENT

The following table summarizes investments held by the Trust for which fair value is measured using the net asset value per share practical expedient as of December 31, 2021 and 2020. There are no participant redemption restrictions for these investments; the redemption notice period is applicable only to the Plan.

| | | | | | | | | | | | | | | | | | | | |

| Fair Value at December 31, | Unfunded Commitments at December 31, | | |

| Investment Type | 2021 | 2020 | 2021 | 2020 | Redemption Frequency | Redemption Notice Period |

| Collective trust fund | $ | 7,598,145 | | $ | 8,391,052 | | $ | — | | $ | — | | Daily | Daily1 |

(1) Withdrawals made on the collective trust can be initiated daily. Plan Sponsor terminations of the contracts can be initiated daily. Disbursements of the funds for Plan Sponsor terminations will be provided as soon as practicable within twelve months following written notice.

11. DIFFERENCES BETWEEN FINANCIAL STATEMENTS AND FORM 5500

The following is a reconciliation of net assets available for benefits per the financial statements to Form 5500 as of December 31, 2021 and 2020:

| | | | | | | | |

| 2021 | 2020 |

| Net assets available for benefits per the financial statements | $ | 4,707,606 | | $ | 4,235,452 | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts | 3 | | 14 | |

| Net assets available for benefits per Form 5500 | $ | 4,707,609 | | $ | 4,235,466 | |

The following is a reconciliation of net increase in net assets available for benefits per the financial statements to the Form 5500 for the years ended December 31, 2021 and 2020:

| | | | | | | | |

| 2021 | 2020 |

| Net increase in net assets available for benefits per the financial statements | $ | 472,154 | | $ | 491,501 | |

| Change in adjustment from contract value to fair value for fully benefit-responsive investment contracts | (10) | | 14 | |

| Net increase in net assets available for benefits per the Form 5500 | $ | 472,144 | | $ | 491,515 | |

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

As of December 31, 2021

| | | | | | | | | | | |

| (A) | (B)

Identity of issue, borrower, lessor, or similar party | (C)

Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (E)

Current Value |

| * | Participant Loans | Participant Loans | $ | 128,614 | |

| * | Interest Held in Master Trust | Various (includes Registered Investment Companies, Self directed Brokerage, etc.) | 4,578,992 | |

| | TOTAL | $ | 4,707,606 | |

*Investment with party-in-interest to the Plan

| | |

| BUNGE SAVINGS PLAN - SUPPLEMENT A |

|

| NOTES TO FINANCIAL STATEMENTS |

| AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the plan administrator of the Bunge Savings Plan – Supplement A has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| Bunge Savings Plan – Supplement A | |

| | | | |

| | | | |

Date: June 16, 2022 | By: | /s/ Lisa Ware-Alexander | |

| | Lisa Ware-Alexander | |

| | Plan Administrator | |

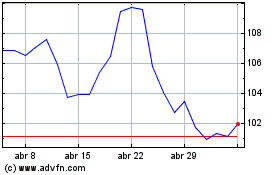

Bunge Global (NYSE:BG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Bunge Global (NYSE:BG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024