Amended Annual and Transition Report (foreign Private Issuer) (20-f/a)

24 Junho 2022 - 5:33PM

Edgar (US Regulatory)

0001509223

false

--12-31

2021

FY

Non-accelerated Filer

false

0001509223

2021-01-01

2021-12-31

0001509223

dei:BusinessContactMember

2021-01-01

2021-12-31

0001509223

dei:AdrMember

2021-01-01

2021-12-31

0001509223

us-gaap:CommonClassAMember

2021-01-01

2021-12-31

0001509223

us-gaap:CommonClassAMember

2021-12-31

0001509223

us-gaap:CommonClassBMember

2021-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F/A

(Amendment No. 1)

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT

TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021.

OR

| ¨ | TRANSITION REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number: 001-35147

Renren Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

2828 N. Central Avenue Fl 7,

Phoenix, Arizona, 85004 USA

(Address of principal executive offices)

Chris Palmer, Chief Financial Officer

Telephone: +1-833-258-7482

Email: ir@renren-inc.com

2828 N. Central Avenue Fl 7,

Phoenix, Arizona, 85004 USA

(Name, Telephone, Email and/or Facsimile number

and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange

on which registered |

| American depositary shares, each representing 45 Class A ordinary shares |

|

RENN |

|

The New York Stock Exchange |

| Class

A ordinary shares, par value US$0.001 per share* |

|

true |

|

The New York Stock Exchange |

| * | Not for trading, but only in connection

with the listing on The New York Stock Exchange of American depositary shares (“ADSs”). |

Securities registered or to be registered pursuant

to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each

of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2021, 815,936,577 Class A

ordinary shares, par value US$0.001 per share (excluding the Class A ordinary shares issued to the depositary bank for bulk issuance

of ADSs reserved for future issuances upon the exercise or vesting of awards granted under our share incentive plans) and 305,388,450

Class B ordinary shares, par value US$0.001 per share, were issued and outstanding.

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

¨ No x

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934.

Yes

¨ No x

Note – Checking the box above will not relieve

any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations

under those Sections.

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§

232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such

files).

Yes x No ¨

Indicate by check mark whether the registrant is

a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large

accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ |

Non-accelerated filer x |

Emerging growth company ¨ |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the

Exchange Act. ¨

| |

† |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has

filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Yes

¨ No x

Indicate by check mark which basis of accounting

the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP x |

International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ |

Other ¨ |

If “Other” has been checked in response

to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17

¨ Item 18

¨

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has

filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent

to the distribution of securities under a plan confirmed by a court.

Yes

¨ No ¨

| Auditor Name | |

Auditor Location | |

Auditor Firm ID |

| Marcum Bernstein & Pinchuk LLP | |

New York, NY | |

5395 |

TABLE OF CONTENTS

EXPLANATORY NOTE

This Amendment No. 1 on Form 20-F/A (this “Amendment”)

is being filed by Renren Inc. (the “Company,” “we,” “our,” or “us”) to amend the Company’s

Annual Report on Form 20-F for the fiscal year ended December 31, 2021, originally filed with the U.S. Securities Exchange Commission

on May 2, 2022 (the “Original Filing”). This Amendment is being filed solely for the purpose of complying with Regulation

S-X, Rule 3-09. Rule 3-09 requires, among other things, that separate financial statements for unconsolidated subsidiaries and investees

accounted for by the equity method to be included in the Form 20-F when such entities are individually significant.

We have determined that our equity method investment

in Kaixin Auto Holdings (“Kaixin”), which is not consolidated in our financial statements, was significant under the income

test of Rule 1-02(w) of Regulation S-X in relation to our consolidated financial results for the year ended December 31, 2021. This Amendment

is therefore filed solely to supplement the Original Filing with the inclusion of the financial statements and related notes of Kaixin

as of December 31, 2020 and 2021 and for the fiscal years ended December 31, 2019, 2020, and 2021 (the “Kaixin Financial Statements”).

This Form 20-F/A consists solely of the cover page,

this explanatory note, the Kaixin Financial Statements, updated certifications of our chief executive officer and chief financial officer,

and consent of the independent auditor of Kaixin. This Amendment does not affect any other parts of, or exhibits to, the Original Filing,

nor does it reflect events occurring after the date of the Original Filing. Accordingly, this Amendment should be read in conjunction

with the Original Filing and with our filings with the U.S. Securities Exchange Commission subsequent to the Original Filing.

Item 19. Exhibits

Exhibit

Number |

|

Description of Document |

| |

|

|

| 1.1 |

|

Amended and Restated Memorandum and Articles of Association of the Registrant (incorporated by reference to Exhibit 3.2 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 2.1 |

|

Specimen American depositary receipt of the Registrant (incorporated by reference to Exhibit 4.1 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 2.2 |

|

Specimen Class A ordinary share certificate of the Registrant (incorporated by reference to Exhibit 4.2 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 2.3 |

|

Deposit Agreement, dated as of May 4, 2011, by and among the Registrant, Citibank, N.A., as depositary, and the holders of the American Depositary Receipts (incorporated by reference to Exhibit 4.3 to our Registration Statement on Form S-8 (file no. 333-177366), filed with the SEC on October 18, 2011) |

| |

|

|

| 2.4 |

|

Amended and Restated Investors’ Rights Agreement between the Registrant and other parties therein, dated as of April 4, 2008, as amended (incorporated by reference to Exhibit 4.6 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 2.5 |

|

Description of Securities (incorporated herein by reference to Exhibit 2.6 of our Annual Report on Form 20-F filed with the Securities and Exchange Commission on July 7, 2020 (file no. 001-35147)) |

| |

|

|

| 4.1 |

|

2006 Equity Incentive Plan (incorporated by reference to Exhibit 10.1 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.2 |

|

2008 Equity Incentive Plan (incorporated by reference to Exhibit 10.2 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.3 |

|

2009 Equity Incentive Plan (incorporated by reference to Exhibit 10.3 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.4 |

|

2011 Share Incentive Plan (as amended by Amendment No.1 to the 2011 Share Incentive Plan) (incorporated by reference to Exhibit 10.1 to our Registration Statement on Form S-8 (file no. 333-209734), filed with the SEC on February 26, 2016) |

| |

|

|

| 4.5 |

|

2016 Share Incentive Plan (incorporated by reference to Exhibit 10.2 to our Registration Statement on Form S-8 (file no. 333-209734), filed with the SEC on February 26, 2016) |

| |

|

|

| 4.6 |

|

2018 Share Incentive Plan (incorporated by reference to Exhibit 10.1 to our Registration Statement on Form S-8 (file no. 333-227886), filed with the SEC on October 19, 2018) |

| |

|

|

| 4.7 |

|

2021 Share Incentive Plan (incorporated by reference to Exhibit 99.2 to our Current Report on Form 6-K (file no. 001-35147), filed with the SEC on November 4, 2021) |

| |

|

|

| 4.8 |

|

Form of Indemnification Agreement between the Registrant and its directors and officers (incorporated by reference to Exhibit 10.5 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.9 |

|

Form of Employment Agreement between the Registrant and the officers of the Registrant (incorporated by reference to Exhibit 10.6 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

Exhibit

Number |

|

Description of Document |

| |

|

|

| 4.10 |

|

Business Operations Agreement, dated as of December 23, 2010, between Qianxiang Shiji, Qianxiang Tiancheng and the shareholders of Qianxiang Tiancheng (incorporated by reference to Exhibit 10.7 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.11 |

|

Amended and Restated Equity Option Agreements, dated as of December 23, 2010, between Qianxiang Shiji and the shareholders of Qianxiang Tiancheng (incorporated by reference to Exhibit 10.8 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.12 |

|

Amended and Restated Equity Interest Pledge Agreements, dated as of December 23, 2010, between Qianxiang Shiji and the shareholders of Qianxiang Tiancheng (incorporated by reference to Exhibit 10.9 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.13 |

|

Power of Attorney, dated as of December 23, 2010, by the shareholders of Qianxiang Tiancheng (incorporated by reference to Exhibit 10.10 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.14 |

|

Amended and Restated Exclusive Technical Service Agreement, dated as of December 23, 2010, between Qianxiang Shiji and Qianxiang Tiancheng (incorporated by reference to Exhibit 10.13 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.15 |

|

Amended and Restated Intellectual Property Right License Agreement, dated as of December 23, 2010, between Qianxiang Shiji and Qianxiang Tiancheng (incorporated by reference to Exhibit 10.14 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.16 |

|

Spousal Consents, dated as of December 23, 2010, by the shareholders of Qianxiang Tiancheng (incorporated by reference to Exhibit 10.11 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.17 |

|

Amended and Restated Loan Agreements, dated as of December 23, 2010, between Qianxiang Shiji and the shareholders of Qianxiang Tiancheng (incorporated by reference to Exhibit 10.12 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 4.18 |

|

Automobile Consumer Loan Cooperation (Framework) Agreement between Ping An Bank Co., Ltd. Shanghai Branch and Shanghai Jieying Automobile Sales Co., Ltd., dated April 17, 2017 (incorporated by reference to Exhibit 4.71 to our annual report on Form 20-F (file no. 001-35147), filed with the SEC on May 15, 2019) |

| |

|

|

| 4.19 |

|

Supplementary Agreement of Auto Consumer Loan Cooperation (Framework) Agreement between Ping An Bank Co., Ltd. Shanghai Branch and Shanghai Jieying Automobile Sales Co., Ltd., dated June 1, 2017 (incorporated by reference to Exhibit 4.72 to our annual report on Form 20-F (file no. 001-35147), filed with the SEC on May 15, 2019) |

| |

|

|

| 4.20 |

|

Master Transaction Agreement among the Registrant, CM Seven Star Acquisition Corporation and Kaixin Auto Group, dated April 30, 2018 (incorporated by reference to Exhibit 4.73 to our annual report on Form 20-F (file no. 001-35147), filed with the SEC on May 15, 2019) |

| |

|

|

| 4.21 |

|

Non-Competition Agreement between the Registrant and Kaixin Auto Group, dated April 30, 2018 (incorporated by reference to Exhibit 4.74 to our annual report on Form 20-F (file no. 001-35147), filed with the SEC on May 15, 2019) |

| |

|

|

| 4.22 |

|

Transitional Services Agreement between the Registrant and Kaixin Auto Group, dated April 30, 2018 (incorporated by reference to Exhibit 4.75 to our annual report on Form 20-F (file no. 001-35147), filed with the SEC on May 15, 2019) |

| |

|

|

| 4.23 |

|

Investor Rights Agreement among CM Seven Star Acquisition Corporation, Shareholder Value Fund and the Registrant, dated April 30, 2019 (incorporated by reference to Exhibit 10.27 to Kaixin Auto Holdings’ current report on Form 8-K (File No. 001-38261), as amended, initially filed with the SEC on May 6, 2019) |

Exhibit

Number |

|

Description of Document |

| 4.24 |

|

Escrow Agreement concerning earnout shares among the Registrant, CM Seven Star Acquisition Corporation and Vistra Corporate Services (HK) Limited, an escrow agent, dated April 30, 2019 (incorporated by reference to Exhibit 10.28 to Kaixin Auto Holdings’ current report on Form 8-K (File No. 001-38261), as amended, initially filed with the SEC on May 6, 2019) |

| |

|

|

| 4.25 |

|

Share Exchange Agreement dated November 2, 2018, by and among Kaixin Auto Group, the Registrant and CM Seven Star Acquisition Corp. (incorporated by reference to Exhibit 99.1 to our Current Report on Form 6-K (file no. 001-35147), filed with the SEC on November 6, 2018) |

| |

|

|

| 4.26 |

|

Convertible Loan Agreement dated January 28, 2019, by and among Kaixin Auto Group, the Registrant, CM Seven Star Acquisition Corp., and Kunlun Tech Limited (incorporated by reference to Exhibit 99.2 to our Current Report on Form 6-K (file no. 001-35147), filed with the SEC on January 29, 2019) |

| |

|

|

| 4.27 |

|

Power of Attorney, dated as of December 22, 2020, by the shareholders of Qianxiang Tiancheng (incorporated by reference to Exhibit 4.26 to our annual report on Form 20-F (file no. 001-35147), filed with the SEC on May 27, 2021) |

| |

|

|

| 4.28 |

|

Share Purchase Agreement, dated December 31, 2020, among Kaixin Auto Holdings and shareholders of Haitaoche Limited (incorporated by reference to Exhibit 4.27 to our annual report on Form 20-F (file no. 001-35147), filed with the SEC on May 27, 2021) |

| |

|

|

| 4.29 |

|

Securities Purchase Agreement, dated March 31, 2021, between the Registrant and Kaixin Auto Holdings (incorporated by reference to Exhibit 4.28 to our annual report on Form 20-F (file no. 001-35147), filed with the SEC on May 27, 2021) |

| |

|

|

| 4.30 |

|

Stipulation of Settlement, dated October 7, 2021, entered into between and among the parties to In Re Renren, Inc. Derivative Litigation. (incorporated by reference to Exhibit 99.2 to our Current Report on Form 6-K (file no. 001-35147), filed with the SEC on October 8, 2021) |

| |

|

|

| 4.31 |

|

Software License Agreement between SaaS Logistics US, Inc. and Guangzhou Yupu Software Technology Co., Ltd. (incorporated by reference to Exhibit 99.2 to our Current Report on Form 6-K (file no. 001-35147), filed with the SEC on April 8, 2022) |

| |

|

|

| 8.1† |

|

List of Principal Subsidiaries and Consolidated Affiliated Entities |

| |

|

|

| 11.1 |

|

Code of Business Conduct and Ethics of the Registrant (incorporated by reference to Exhibit 99.1 to our Registration Statement on Form F-1 (file no. 333-173548), as amended, initially filed with the SEC on April 15, 2011) |

| |

|

|

| 12.1* |

|

Certification of Chief Executive Officer pursuant to Exchange Act Rules 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 12.2* |

|

Certification of Chief Financial Officer pursuant to Exchange Act Rules 13a-14(a) and 15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 13.1** |

|

Certifications of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 13.2** |

|

Certifications of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 15.1† |

|

Consent of Marcum Bernstein & Pinchuk LLP |

| |

|

|

| 15.2† |

|

Consent of Commerce & Finance Law Offices |

| † | Filed with the Original Filing |

SIGNATURES

The registrant hereby certifies that it meets

all of the requirements for filing its annual report on Form 20-F/A and that it has duly caused and authorized the undersigned to

sign this annual report on its behalf.

| |

Renren Inc. |

| |

|

| |

By: |

/s/ Joseph Chen |

| |

|

Name: |

Joseph Chen |

| |

|

Title: |

Chairman of the Board of Directors and Chief Executive Officer |

| |

|

|

| Dated: June 24, 2022 |

|

|

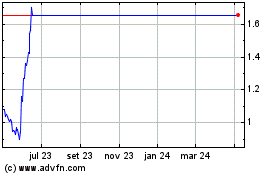

Renren (NYSE:RENN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Renren (NYSE:RENN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024