UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) (Rule 14a-101) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

Celcuity

Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title

of each class of securities to which transaction applies: |

| | | |

| | | |

| (2) | Aggregate

number of securities to which transaction applies: |

| | | |

| | | |

| (3) | Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| (4) | Proposed

maximum aggregate value of transaction: |

| | | |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ | Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| (2) | Form,

Schedule or Registration Statement No.: |

| | | |

| | | |

CELCUITY

INC.

16305

36th Avenue North, Suite 100

Minneapolis,

MN 55446

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 1, 2022

TO

THE STOCKHOLDERS OF CELCUITY INC.:

Please

Take Notice that Celcuity Inc. (“Celcuity”)

will hold a Special Meeting of Stockholders (the “Special Meeting”) at the offices of Celcuity Inc., 16305 36th

Avenue North, Suite 100, Minneapolis, MN 55446, on September 1, 2022 at 9:00 a.m. local time. Celcuity is holding this meeting for the

purpose of considering and taking appropriate action with respect to the following:

| 1. | To

approve an amendment to our Certificate of Incorporation to increase the authorized number

of shares of common stock, $0.001 par value per share (“Common Stock”), from

30,000,000 shares to 65,000,000 shares (the “Authorized Share Increase”); |

| 2. | To

approve the adjournment of the Special Meeting to a later date and time, if necessary, to

permit further solicitation and vote of proxies if, based upon the tabulated vote at the

time of the Special Meeting, there are not sufficient votes to approve the Authorized Share

Increase; and |

| 3. | To

transact any other business as may properly come before the meeting or any adjournments thereof,

including matters incident to the conduct of the Special Meeting. |

Holders

of record of Celcuity Common Stock at the close of business on July 5, 2022 will be entitled to vote at the meeting or any adjournments

thereof. Your attention is directed to the Proxy Statement accompanying this Notice for a more complete statement of the matters to be

considered at the meeting.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Brian F. Sullivan |

| |

Chairman of the Board of Directors and |

| |

Chief Executive Officer |

| Date: July 19, 2022 |

|

Your

vote is important. To vote your shares, please vote by telephone or Internet, as directed in the Proxy Statement, or, if you received

a copy of the proxy card or voting instruction form by mail, please complete, sign, date and mail the proxy card or voting instruction

form promptly in the envelope provided. The prompt return of proxies will save Celcuity the expense of further requests for proxies.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 1, 2022:

This

Notice and the Proxy Statement are available at www.proxyvote.com and on the Investor Relations section of Celcuity’s website at

www.celcuity.com/home/investors/.

CELCUITY

INC.

16305

36th Avenue North, Suite 100

Minneapolis,

MN 55446

PROXY

STATEMENT

SPECIAL

MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 1, 2022

This

Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Celcuity

Inc., a Delaware corporation (“Celcuity,” the “Company,” “we,” “our” or “us”),

for use at the Special Meeting of Stockholders (the “Special Meeting”) to be held at the Celcuity corporate offices, 16305

36th Avenue North, Suite 100, Minneapolis, MN 55446, at 9:00 a.m. local time on September 1, 2022.

Purposes

of the Special Meeting

The

purposes of the Special Meeting are:

| 1. | To

approve an amendment to our Certificate of Incorporation to increase the authorized number

of shares of Common Stock from 30,000,000 shares to 65,000,000 shares (the “Authorized

Share Increase”); |

| 2. | To

approve the adjournment of the Special Meeting to a later date and time, if necessary, to

permit further solicitation and vote of proxies if, based upon the tabulated vote at the

time of the Special Meeting, there are not sufficient votes to approve the Authorized Share

Increase; and |

| 3. | To

transact any other business as may properly come before the meeting or any adjournments thereof,

including matters incident to the conduct of the Special Meeting. |

Action

may be taken on any one of the foregoing proposals on the date specified above for the Special Meeting, or on any date or dates to which

the Special Meeting may be adjourned.

Notice

and Access Delivery

In

accordance with the rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected

to provide our beneficial owners and stockholders of record access to our proxy materials over the Internet. Beneficial owners are stockholders

whose shares are held in the name of a broker, bank, or other nominee (i.e., in “street name”). Accordingly, a Notice of

Internet Availability of Proxy Materials (the “Notice”) will be mailed on or about July 19, 2022 to our beneficial owners

and stockholders of record who owned our Common Stock at the close of business on July 5, 2022.

Beneficial

owners and stockholders of record will have the ability to access the proxy materials on a website referred to in the Notice or to request

a printed set of the proxy materials be sent to them by following the instructions in the Notice. Beneficial owners and stockholders

of record who have previously requested to receive paper copies of our proxy materials will receive paper copies of the proxy materials

instead of a Notice. You can choose to receive our future proxy materials electronically by visiting www.proxyvote.com. Your choice to

receive proxy materials electronically will remain in effect until you instruct us otherwise by following the instructions contained

in your Notice and visiting www.proxyvote.com, sending an email to sendmaterial@proxyvote.com, or calling 1-800-579-1639.

Solicitation

This

solicitation is made by Celcuity, and Celcuity will pay the cost of soliciting proxies for the Special Meeting. In addition to soliciting

proxies by mail, we may solicit proxies personally or by telephone, email, facsimile or other means of communication by our directors,

officers and employees. These persons will not specifically be compensated for these activities, but they may be reimbursed for reasonable

out-of-pocket expenses in connection with this solicitation. We will not specifically engage any employees or paid solicitors for the

purpose of soliciting proxies for the Special Meeting. We will arrange with brokerage firms and other custodians, nominees and fiduciaries

to forward solicitation materials to the beneficial owners of shares held of record by these persons. We will reimburse these brokerage

firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection with this solicitation.

Record

Date and Shares Outstanding

Only

holders of record of our Common Stock at the close of business on July 5, 2022 will be entitled to vote at the Special Meeting or any

adjournments thereof. As of July 5, 2022, there were 14,941,334 shares of our Common Stock outstanding and entitled to vote. Each share

of Common Stock entitles the holder thereof to one vote upon each matter to be presented at the Special Meeting.

If

you are a stockholder of record, you may vote in person at the Special Meeting, vote by proxy using the enclosed proxy card (if you received

paper copies of the proxy materials), vote by proxy over the telephone, or vote by proxy over the Internet. Whether or not you plan to

attend the Special Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Special Meeting and

vote in person even if you have already voted by proxy.

| ● | To

vote in person, come to the Special Meeting and we will give you a ballot when you arrive. |

| ● | If

you received paper copies of the proxy materials, to vote using the proxy card, simply complete,

sign and date the enclosed proxy card and return it promptly in the envelope provided. If

you return your signed proxy card to us before the Special Meeting, we will vote your shares

as you direct. |

| ● | To

vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow

the recorded instructions. Please have available the 16-Digit Control Number from the enclosed

proxy card, if you received one, or from your Notice. Your vote must be received by 11:59

p.m., Eastern Time (10:59 p.m., Central Time) on August 31, 2022, to be counted. |

| ● | To

vote over the Internet, go to www.proxyvote.com to complete an electronic proxy card. Please

have available the 16-Digit Control Number from the enclosed proxy card, if you received

one, or from your Notice. Your vote must be received by 11:59 p.m., Eastern Time (10:59 p.m.,

Central Time) on August 31, 2022, to be counted. |

We

are providing Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and

correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access,

such as usage charges from Internet access providers and telephone companies.

If

you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you may have received a proxy card

and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card

to ensure that your vote is submitted to your broker. Alternatively, you may vote by telephone or over the Internet as instructed by

your broker. To vote in person at the Special Meeting, you must obtain a valid proxy from your broker. Follow the instructions from your

broker included with these proxy materials or contact your broker to request a proxy form.

Quorum

A

quorum, consisting of a majority of the outstanding shares of our Common Stock entitled to vote at the Special Meeting, must be present

in person or by proxy before any action can be taken by the stockholders at the Special Meeting. Abstentions and withheld votes are counted

as present and entitled to vote for purposes of determining a quorum.

If

you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you may instruct the organization

that holds your shares how to vote. Such organization is bound by the rules of the New York Stock Exchange regarding whether or not it

can exercise discretionary voting power for any particular proposal in the absence of voting instructions from you. Brokers have the

authority to vote shares for which their customers do not provide voting instructions on certain “routine” matters. A broker

non-vote occurs when a nominee who holds shares for another does not vote on a particular matter because the nominee does not have discretionary

voting authority for that item and has not received instructions from the owner of the shares or when the broker for its own internal

reasons elects not to vote uninstructed shares. Broker non-votes will be considered present for quorum purposes at the Special Meeting.

So

long as a quorum is present at the beginning of the Special Meeting, the stockholders present may continue to transact business until

adjournment, even if enough stockholders have left the Special Meeting to leave less than a quorum, and even if any stockholder present

in person or by proxy refuses to vote or participate in the Special Meeting. If the Special Meeting is adjourned for any reason, the

approval of the proposals may be considered and voted upon by stockholders at the subsequent reconvened meeting. All proxies will be

voted in the same manner as they would have been voted at the original Special Meeting except for any proxies that have been properly

withdrawn or revoked.

Board

Recommendation and Voting of Proxies

The

Board recommends a vote:

| ● | FOR

the Authorized Share Increase (Proposal 1). |

| ● | FOR

the adjournment of the Special Meeting to a later date and time, if necessary, to permit

further solicitation and vote of proxies if, based upon the tabulated vote at the time of

the Special Meeting, there are not sufficient votes to approve the Authorized Share Increase

(Proposal 2). |

If

you complete and submit your proxy before the Special Meeting, the persons named as proxy agents will vote the shares represented by

your proxy in accordance with your instructions. If you submit a proxy without giving voting instructions, your shares will be voted

in the manner recommended by the Board on all matters presented in this Proxy Statement. If any other matters are properly presented

for consideration at the Special Meeting, including, among other things, consideration of a motion to adjourn the Special Meeting to

another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named as proxy agents

will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any other matters

will be raised at the Special Meeting.

Vote

Required

For

the approval of the amendment to our Certificate of Incorporation increasing the authorized number of shares of the Company’s Common

Stock from 30,000,000 shares to 65,000,000 shares, you have the option to vote “For,” “Against” or “Abstain”

from voting. The affirmative vote of the holders of a majority of the outstanding shares of Common Stock of Celcuity entitled to vote

at the Special Meeting, either in person or by proxy, is required to approve the amendment to our Certificate of Incorporation. If you

“Abstain” from voting with respect to this proposal, your shares will be counted as present and entitled to vote and your

vote will have the same effect as a vote against the proposal. If you hold your shares in “street name” and do not provide

instructions to your broker, your broker will have discretionary authority to vote your shares with respect to this proposal.

For

the approval of the adjournment of the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote

of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the Authorized

Share Increase, you have the option to vote “For,” “Against” or “Abstain” from voting. Assuming a

quorum is present, the affirmative vote of the holders of a majority of the shares of Common Stock of Celcuity represented at the Special

Meeting, either in person or by proxy, and entitled to vote is required to approve the adjournment of the Special Meeting. If you “Abstain”

from voting with respect to this proposal, your shares will be counted as present and entitled to vote and your vote will have the same

effect as a vote against the proposal. If you hold your shares in “street name” and do not provide instructions to your broker,

your broker will have discretionary authority to vote your shares with respect to this proposal.

Revocability

of Proxies

Any

person giving a proxy for the Special Meeting has the power to revoke it at any time before it is voted. If you are a record holder of

your shares, you may revoke your proxy in any one of the following ways: (1) sending a written notice of revocation dated after the date

of the proxy to our Corporate Secretary, Celcuity Inc., 16305 36th Avenue North, Suite 100, Minneapolis, MN 55446; (2) submitting

a properly signed proxy with a later date; (3) submitting a new vote by telephone or Internet; or (4) attending the Special Meeting and

voting in person. Attendance at the Special Meeting will not, in and of itself, constitute a revocation of a proxy.

If

you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you must contact them to find out

how to revoke your proxy.

Householding

The

SEC has adopted rules that permit companies and brokers, banks and other nominees to satisfy the delivery requirements for proxy statements

and annual reports, with respect to two or more stockholders sharing the same address and who do not participate in electronic delivery

of proxy materials, by delivering a single copy of such documents addressed to those stockholders. This process, which is commonly referred

to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

Brokers,

banks and other nominees may be “householding” Company proxy materials. This means that only one copy of the proxy materials

may have been sent to multiple stockholders in a household. If, at any time, you no longer wish to participate in householding and would

prefer to receive a separate proxy statement and annual report from the other stockholder(s) sharing your address, please: (i) notify

your broker, bank or other nominee, (ii) direct your written request to our Chief Financial Officer, Celcuity Inc., 16305 36th Avenue

North, Suite 100, Minneapolis, MN 55446, or (iii) contact us at (763) 392-0123. The Company will undertake to deliver promptly, upon

any such oral or written request, a separate copy of the proxy materials to a stockholder at a shared address to which a single copy

of these documents was delivered. Stockholders who currently receive multiple copies of proxy materials at their address and would like

to request householding of their communications should notify their broker, bank or other nominee, or contact us at the above address

or phone number.

Other

Business

Our

Board currently has no knowledge of any matters to be presented at the Special Meeting other than those referred to in this Proxy Statement.

The solicited proxies give discretionary authority to the proxy agents named therein to vote in accordance with the recommendation of

the Board if any other matters are presented.

Interest

of Officers and Directors in Matters to Be Acted Upon

Other

than as described in Proposal 1 to this Proxy Statement soliciting shareholder approval of the Authorized Share Increase, none of our

officers or directors have any interest in any of the matters to be acted upon at the Special Meeting.

PROPOSAL

1

APPROVAL

OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK

Our

Board has adopted, subject to stockholder approval, an amendment to our Certificate of Incorporation to increase the number of authorized

shares of our Common Stock from 30,000,000 shares to 65,000,000 shares. There will be no change to the number of shares of Series A Preferred

Stock or undesignated preferred stock authorized for issuance.

Our

Certificate of Incorporation currently authorizes the issuance of up to 32,500,000 shares of capital stock, including up to 30,000,000

shares of Common Stock and 2,500,000 shares of preferred stock, $0.001 par value per share, of which 1,850,000 shares have been designated

as Series A Convertible Preferred Stock (the “Series A Preferred Stock”). As previously disclosed in filings with the Securities

and Exchange Commission, on May 15, 2022 we entered into a securities purchase agreement (the “Securities Purchase Agreement”)

pursuant to which we agreed to sell in a private placement to the investors (the “Investors”) an aggregate of: (i) 6,182,574

shares of Common Stock, (ii) 1,120,873 shares of Series A Preferred Stock and (iii) warrants to purchase 695,645 shares of Series A Preferred

Stock (the “Warrants”).

Shares

of Series A Preferred Stock will be convertible into Common Stock, initially at a rate of 10 shares of Common Stock for each share of

Series A Preferred Stock. Assuming future conversion of all shares of Series A Preferred Stock to be sold pursuant to the Securities

Purchase Agreement or issuable upon full exercise of all Warrants to be sold pursuant to the Securities Purchase Agreement, an aggregate

24,347,754 shares of Common Stock will have been issued as a result of the transactions contemplated by the Securities Purchase Agreement.

As of July 5, 2022, 14,941,334 shares of our Common Stock were issued and outstanding and additional 3,041,125 shares of Common Stock

have been reserved for issuance pursuant to grants under our 2012 Equity Incentive Plan, Amended and Restated 2017 Stock Incentive Plan,

2017 Employee Stock Purchase Plan, and upon exercise or conversion of securities currently outstanding (collectively, the “Reserved

Shares”).

After

taking into account the Reserved Shares, the Company’s current number of authorized and unissued shares of Common Stock is insufficient

to effect the conversion into Common Stock of all shares of Series A Preferred Stock to be sold pursuant the Securities Purchase Agreement

and that may be issued upon exercise of all Warrants sold pursuant to the Securities Purchase Agreement (the shares issuable upon such

conversions or exercises, the “Conversion Shares”). Accordingly, while not a condition to the closing of the sale of the

securities under the Securities Purchase Agreement, the Company agreed to use commercially reasonable efforts to, no later than December

31, 2022, obtain stockholder approval to increase the number of authorized but unissued shares of Common Stock to allow for such conversion

and exercise.

The

Board believes it is in our best interest and that of our stockholders to increase the authorized shares of our Common Stock to ensure

there will be sufficient authorized Common Stock to: (i) issue the shares of Common Stock to be sold pursuant to the Securities Purchase

Agreement, (ii) to issue any Conversion Shares with respect to Series A Preferred Stock and Warrants to be sold pursuant to the Securities

Purchase Agreement, and (iii) to maintain an appropriate number of authorized but unissued shares of Common Stock that may be issued

in connection with other capital raising or commercial transactions, that may be issued pursuant to grants under our 2012 Equity Incentive

Plan, Amended and Restated 2017 Stock Incentive Plan and 2017 Employee Stock Purchase Plan, or upon exercise of warrants currently outstanding.

If

our stockholders approve this proposal, our Board currently intends to file an amendment to our Certificate of Incorporation (the “Certificate

of Amendment”) with the Secretary of State of the State of Delaware (substantially in the form attached as Appendix A) to increase

the number of authorized shares of our Common Stock immediately following stockholder approval. Following the filing of the Certificate

of Amendment, the Warrants sold pursuant to the Securities Purchase Agreement will be exercisable for that number of shares of Common

Stock equal to the number of shares of Common Stock that would have been received if the Warrants had been exercised in full and the

Series A Preferred Stock received thereupon had been simultaneously converted into Common Stock. If stockholders do not approve this

proposal, our Certificate of Incorporation will continue as currently in effect, the sale of Common Stock, Series A Preferred Stock and

Warrants pursuant to the Securities Purchase Agreement will still close, subject to satisfaction of certain conditions set forth in the

Securities Purchase Agreement, and the Company will continue to use commercially reasonable efforts to obtain such stockholder approval.

Whether

or not this proposal is approved by stockholders, all authorized but unissued shares of Common Stock will be available for issuance from

time to time for any proper purpose approved by our Board (including but not limited to issuances in connection with stock-based employee

benefit plans, future stock splits by means of a dividend and issuances to raise capital, effect acquisitions, or as part of commercial

transactions).

Brian

F. Sullivan, the Chairman of the Board of Directors and Chief Executive Officer, is a party to the Securities Purchase Agreement and

has agreed to purchase 260,869 shares of Common Stock and will be issued Warrants to purchase 10,434 shares of Series A Preferred Stock

for an aggregate purchase price of $1,499,996.75 on the same terms and conditions as the other Investors under the Securities Purchase

Agreement.

The

affirmative vote of the holders of a majority of the outstanding shares of our Common Stock entitled to vote on this matter at the Special

Meeting is required to approve the amendment to our Certificate of Incorporation to increase the number of authorized shares of our capital

stock.

THE

BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE PROPOSED AMENDMENT TO OUR CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK.

PROPOSAL

NO. 2

APPROVAL OF THE ADJOURNMENT OF

THE

SPECIAL MEETING

The

Board of Directors is asking shareholders to approve, if necessary, adjournment of the Special Meeting to solicit additional proxies

in favor of the Authorized Share Increase (Proposal 1). Any adjournment of the Special Meeting for the purpose of soliciting additional

proxies will allow shareholders who have already sent in their proxies to revoke them at any time prior to the time that the proxies

are used.

The

affirmative vote of the holders of a majority of the outstanding shares of our Common Stock represented at the Special Meeting, either

in person or by proxy, and entitled to vote, is required to approve the adjournment of the Special Meeting, if necessary.

THE

BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY.

BENEFICIAL

OWNERSHIP OF COMMON STOCK

The

following table contains information regarding the beneficial ownership of Celcuity’s Common Stock as of July 5, 2022 (except as

otherwise indicated) by (i) each person who is known by Celcuity to beneficially own more than 5% of the outstanding shares of our Common

Stock; (ii) each director of Celcuity; (iii) each named executive officer of Celcuity; and (iv) all executive officers and directors

as a group. Unless otherwise noted, each person or group identified possesses sole voting and investment power with respect to such shares

and the business address of each person is c/o Celcuity Inc., 16305 36th Avenue North, Suite 100, Minneapolis, MN 55446.

| Name of Beneficial Owner | |

Amount and Nature of

Beneficial Ownership (1)(2) | | |

Percent of Class (3) | |

| 5% Stockholders | |

| | | |

| | |

| Commodore Capital LP (4) | |

| 1,556,143 | | |

| 9.99 | % |

| Venrock Healthcare Capital Partners II, L.P. (5) | |

| 1,658,303 | | |

| 9.99 | % |

| Growth Equity Opportunities 18 VGE, LLC (6) | |

| 1,658,303 | | |

| 9.99 | % |

| RA Capital Management, L.P. (7) | |

| 1,658,303 | | |

| 9.99 | % |

| Soleus Private Equity Fund II, L.P. (8) | |

| 1,632,546 | | |

| 9.99 | % |

| Officers and Directors | |

| | | |

| | |

| Richard E. Buller | |

| 30,017 | | |

| * | |

| David F. Dalvey (9) | |

| 290,744 | | |

| 1.9 | % |

| Leo T. Furcht | |

| 37,231 | | |

| * | |

| Vicky Hahne | |

| 77,821 | | |

| * | |

| Lance G. Laing | |

| 1,343,367 | | |

| 8.9 | % |

| Richard J. Nigon | |

| 160,282 | | |

| 1.1 | % |

| Brian F. Sullivan (10) | |

| 3,248,748 | | |

| 21.0 | % |

| All directors and executive officers as a group (7 individuals) | |

| 5,188,510 | | |

| 32.9 | % |

| (1) | The

beneficial ownership reported in the table includes shares of Common Stock beneficially owned

as of July 5, 2022, and shares of Common Stock such person or entity has the right to acquire

within 60 days of July 5, 2022, subject to the Beneficial Ownership Limitation described

in note 2 below. |

| (2) | With

respect to 5% Stockholders, shares shown include: (a) the number of shares of Common Stock

known to be held by the stockholder as of July 5, 2022, and (b) the number of shares of Common

Stock to be acquired upon closing of the transactions contemplated by the Securities Purchase

Agreement and that may be acquired upon subsequent conversion of shares of Series A Preferred

Stock to also be acquired upon the closing of such transactions, assuming such closing and

any such conversions occur within 60 days of July 5, 2022; provided, however, in the case

of subclause (b), the maximum number of shares of Common Stock that may be acquired upon

such purchases and conversions is limited such that the beneficial ownership of such stockholder

and its affiliates will not exceed 9.99% (the “Beneficial Ownership Limitation”). |

| | | |

| | | With

respect to officer and directors, the number of shares of Common Stock shown include: (a) the number of shares of Common Stock held by

such stockholder as of July 5, 2022, (b) shares of Common Stock issuable upon exercise of stock options or warrants held by such stockholder

that have vested or will vest within the 60 days of July 5, 2022, as follows: Dr. Buller, 19,519 shares; Mr. Dalvey, 31,419 shares; Dr.

Furcht, 37,231 shares; Ms. Hahne, 64,918 shares; Dr. Laing, 93,367 shares; Mr. Nigon, 69,250 shares; Mr. Sullivan, 232,105 shares, and,

(c) for Mr. Sullivan, 260,869 shares of Common Stock which he has the right to purchase upon closing of the transactions contemplated

by the Securities Purchase Agreement. |

| (3) | Calculated

based on 14,941,334 issued and outstanding shares of Common Stock as of July 5, 2022, plus,

for each listed stockholder or group, any securities that such stockholder or group has the

right to acquire within 60 days of July 5, 2022, subject to the Beneficial Ownership Limitation

described in note 2 above. |

| (4) | The

address of Commodore Capital Master LP is 767 Fifth Avenue, Floor 12, New York, NY 10153.

In a Schedule 13G/A filed on February 14, 2022, Commodore Capital Master LP reported shared

voting power over 920,464 shares of Common Stock, and shared dispositive power over 920,464

shares of Common Stock. In addition to such shares, the reporting stockholder may acquire

450,001 shares of Common Stock upon closing of the transactions contemplated by the Securities

Purchase Agreement and up to an additional 185,678 shares of Common Stock upon subsequent

conversion of shares of Series A Preferred Stock also to be acquired upon the closing of

such transactions, after applying the Beneficial Ownership Limitation described in note 2

above. |

| (5) | The

address of Venrock Healthcare Capital Partners II, L.P. is 7 Bryant Park, 23rd

Floor, New York, NY 100118. In a Schedule 13G filed on May 25, 2022, Venrock Healthcare Capital

Partners II, L.P. reported shared voting power over 1,657,733 shares of Common Stock, and

shared dispositive power over 1,657,733 shares of Common Stock, which number of shares may

be acquired pursuant to the Securities Purchase Agreement after applying the Beneficial Ownership

Limitation described in note 2 above, based on 14,936,190 issued and outstanding shares of

Common Stock as of May 9, 2022. The number of shares of Common Stock shown in the table above

has been determined by the Company based on outstanding Common Stock as of July 5, 2022. |

| (6) | The

address of Growth Equity Opportunities 18 VGE, LLC is New Enterprise Associates, 1954 Greenspring

Drive, Timonium, MD 21093. In a Schedule 13D filed on May 24, 2022, Growth Equity Opportunities

18 VGE, LLC reported shared voting power over 1,250,001 shares of Common Stock and shared

dispositive power over 1,250,001 shares of Common Stock, which number of shares may be acquired

pursuant to the Securities Purchase Agreement. The number of shares of Common Stock shown

in the table above has been determined by the Company based on outstanding Common Stock as

of July 5, 2022, and includes up to an additional 408,302 shares of Common Stock the reporting

person may acquire upon subsequent conversion of shares of Series A Preferred Stock also

to be acquired upon the closing of such transactions, after applying the Beneficial Ownership

Limitation described in note 2 above. |

| (7) | The

address of RA Capital Management, L.P. is 200 Berkeley Street, 18th Floor, Boston,

MA 02116. In a Schedule 13G filed on May 25, 2022, RA Capital Management, L.P. reported shared

voting power over 1,486,471 shares of Common Stock and shared dispositive power over 1,486,471

shares of Common Stock, which number of shares may be acquired pursuant to the Securities

Purchase Agreement after applying the Beneficial Ownership Limitation described in note 2

above, based on 14,936,190 issued and outstanding shares of Common Stock as of May 9, 2022.

The number of shares of Common Stock shown in the table above has been determined by the

Company based on outstanding Common Stock as of July 5, 2022, and includes 1,400,001 shares

of Common Stock the reporting person may acquire upon closing of the transactions contemplated

by the Securities Purchase Agreement and up to an additional 258,302 shares of Common Stock

the reporting person may acquire upon subsequent conversion of shares of Series A Preferred

Stock also to be acquired upon the closing of such transactions, after applying the Beneficial

Ownership Limitation described in note 2 above. |

| (8) | Soleus

Private Equity Fund II, L.P. is 104 Field Point Road, 2nd Floor, Greenwich, CT

06830. In a Schedule 13G filed on May 18, 2022, Soleus Private Equity Fund II, L.P. reported

shared voting power over 948,389 shares of Common Stock and has shared dispositive voting

power over 948,389 shares of Common Stock, including 232,073 shares then held by the reporting

stockholder and an additional 716,316 shares of Common Stock that may be acquired pursuant

to the Securities Purchase Agreement. The number of shares of Common Stock shown in the table

above has been determined by the Company based on outstanding Common Stock as of July 5,

2022, and includes up to an additional 684,157 shares of Common Stock the reporting person

may acquire upon subsequent conversion of shares of Series A Preferred Stock also to be acquired

upon the closing of such transactions, after applying the Beneficial Ownership Limitation

described in note 2 above. |

| (9) | Mr.

Dalvey’s beneficial ownership includes 250,000 shares of Common Stock owned by Brightstone

Venture Capital Fund, LP, of which Mr. Dalvey is the General Partner. |

| (10) | Mr.

Sullivan’s beneficial ownership includes: (i) 2,755,774 shares of Common Stock owned

by Mr. Sullivan, (ii) 260,869 shares of Common Stock Mr. Sullivan has the right to acquire

within 60 days of July 5, 2022 upon the closing of the Securities Purchase Agreement, and

(ii) options to purchase 232,105 shares of Common Stock that are vested or may vest within

60 days of July 5, 2022. |

STOCKHOLDER

PROPOSALS

Any

stockholder desiring to submit a proposal for action by the stockholders at our next annual meeting, which will be our 2023 annual meeting,

must satisfy the requirements set for in the advance notice provision under our bylaws. To be timely submitted for our 2023 annual meeting,

any such proposal must be delivered in writing to our Corporate Secretary at the principal executive offices of the Company between the

close of business on January 12, 2023 and the close of business on February 11, 2023. If the date of the 2023 annual meeting is advanced

more than 30 days prior to or delayed by more than 60 days after the first anniversary of the 2022 Annual Meeting, notice by the stockholder

must be delivered not earlier than the close of business on the 120th day prior to the 2023 annual meeting and not later than

the close of business on the later of the 90th day prior to the 2023 annual meeting or, if the first public announcement of

the date of the 2023 annual meeting is less than 100 days prior to the date of the 2023 annual meeting, the 10th day following

the day on which public announcement of the date of the 2023 annual meeting is first made.

Notwithstanding

the foregoing, if the number of directors to be elected to our Board is increased and no public announcement naming all of the nominees

for director or specifying the size of the increased Board is made by the Company at least 100 days prior to the first anniversary of

the 2022 Annual Meeting, a stockholder’s notice will be considered timely, but only with respect to nominees for any new positions

created by such increase, if the stockholder delivers such notice to our Corporate Secretary at the principal executive offices of the

Company not later than the close of business on the 10th day following the day on which a public announcement naming all of

the nominees for director or specifying the size of the increased Board is first made by the Company. Notice sent to the Company must

comply with the requirements set forth in the Company’s bylaws. You are advised to review the Company’s bylaws, and due to

the complexity of the respective rights of the stockholders and the Company in this area, you are advised to consult with your legal

counsel with respect to such rights.

In

addition, any stockholder proposal intended to be included in the proxy statement for the 2023 annual meeting must also satisfy Rule

14a-8 of the Exchange Act and be received no later than December 12, 2022. If the date of the 2023 annual meeting is moved by more than

30 days from the first anniversary of the 2022 Annual Meeting, then notice must be received within a reasonable time before we begin

to print and send proxy materials.

| |

By Order of the Board of Directors: |

| |

|

| |

/s/ Brian F. Sullivan |

| |

Chairman of the Board of Directors and |

| Dated: July 19, 2022 |

Chief Executive Officer |

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 1, 2022.

The

Notice and this Proxy Statement are available at www.proxyvote.com and on the Investor Relations section of Celcuity’s website

at www.celcuity.com/home/investors/.

Appendix

A

CERTIFICATE

OF AMENDMENT

OF

CERTIFICATE

OF INCORPORATION

OF

CELCUITY

INC.

Celcuity

Inc., a corporation organized and existing under and by the virtue of the Delaware General Corporation Law, as amended, through its duly

authorized officer and by the authority of its Board of Directors does hereby certify that:

FIRST: The

name of the corporation is Celcuity Inc. (the “Corporation”).

SECOND:

The Corporation’s certificate of incorporation was originally filed with the Delaware Secretary of State on September 15, 2017

and was amended on May 11, 2018 and May 12, 2022 (as amended, the “Certificate of Incorporation”).

THIRD:

This amendment to the Certificate of Incorporation has been duly authorized by the directors and the requisite stockholders of the

Corporation in accordance with the provisions of Sections 228 and 242 of the Delaware General Corporation Law.

FOURTH:

The Certificate of Incorporation is hereby amended by deleting the text of Section 4.1

of Article 4 in its entirety and replacing such text with the following:

4.1

The aggregate number of shares the corporation has authority to issue is 67,500,000 shares, par value of $0.001 per share,

consisting of 65,000,000 shares of Common Stock and 2,500,000 shares of Preferred Stock, which includes 1,850,000 shares that have

been designated as Series A Convertible Preferred Stock and 650,000 shares of undesignated Preferred Stock. The Board of Directors

of the Corporation has the authority, without first obtaining approval of the stockholders of the corporation or any class thereof,

to establish from the undesignated shares of Preferred Stock, by resolution adopted and filed in the manner provided by law, one or

more series of Preferred Stock and to fix the number of shares, the voting powers, designations, preferences and relative,

participating, optional or other special rights, and the qualifications, limitations or restrictions of such class or

series.

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed on September __, 2022.

| |

CELCUITY INC. |

| |

|

| |

By: |

|

| |

Name: |

Brian F. Sullivan |

| |

Title: |

Chief Executive Officer |

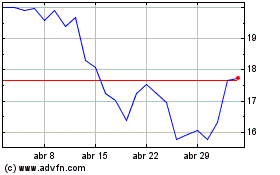

Celcuity (NASDAQ:CELC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Celcuity (NASDAQ:CELC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024