Current Report Filing (8-k)

02 Agosto 2022 - 5:17PM

Edgar (US Regulatory)

0001783879FALSE00017838792022-07-292022-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2022

Robinhood Markets, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

|

| | | | |

| | | | | |

| Delaware | | 001-40691 | | 46-4364776 |

| | | | | |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

85 Willow Road

Menlo Park, CA 94025

(Address of principal executive offices) (Zip Code)

(844) 428-5411

(Registrant’s telephone number, including area code)

not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | HOOD | The Nasdaq Stock Market LLC |

| | | | | | | | |

|

| | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | |

| | | |

| Emerging growth company | | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Item 2.02 – Results of Operations and Financial Condition.

Financial Results for the Second Quarter of 2022

On August 2, 2022, Robinhood Markets, Inc. (“Robinhood,” the “Company,” "we," or "us") issued a press release regarding its financial results for the quarter ended June 30, 2022. A copy of the press release is furnished as Exhibit 99.1 to this report. As previously announced, Robinhood will hold an earnings conference call on August 3, 2022 at 2:00 p.m. PT/5:00 p.m. ET.

The information furnished with Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 2.05 – Costs Associated with Exit or Disposal Activities.

Workforce Reduction and Restructuring

On August 2, 2022, we announced a reduction in force involving approximately 780 employees, representing approximately 23% of our full-time employees, the planned closure of two offices, and related matters (the “August 2022 Restructuring”). These actions are part of a Company reorganization into a general manager ("GM") structure under which GMs will assume broad responsibility for our individual businesses.

In connection with the August 2022 Restructuring, we estimate that we will incur approximately $30 million to $40 million of cash restructuring and related charges primarily related to employee severance and benefits costs (excluding the impact of share-based compensation) and approximately $15 million to $20 million of charges related to the office closures and contract termination fees, substantially all of which we expect to incur in the third quarter of 2022.

With respect to share-based compensation, as part of this reduction in force we will allow impacted employees' awards to continue vesting over a transitional period (generally two months during which they remain employed but are not expected to provide active service), which we will generally account for as a modification allowing a portion of the awards to vest that otherwise would have been forfeited. However, as a result of the reversal of share-based compensation expense that had been previously recognized (under the accelerated attribution method, generally) for the forfeited portions of such employees’ stock awards, we expect the August 2022 Restructuring will result in a net reduction to share-based compensation of approximately $40 million to $50 million in the third quarter of 2022. This estimate may change due to future changes in our stock price.

If we subsequently determine that we will incur additional material restructuring costs or charges or there are material differences from the ranges provided above, we will file an amendment to this Current Report on Form 8-K (this "Current Report") to disclose any such material costs, charges, or differences.

Item 5.02 – Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Chief Product Officer

Ms. Chennapragada is stepping down as the Chief Product Officer, effective August 2, 2022, and will remain employed in an advisory role to the CEO or his designee through January 2, 2023. In connection with the August 2022 Restructuring described above, our product teams are being reorganized within the GM structure.

Ms. Chennapragada has made invaluable contributions to the Company throughout her employment, including hiring leaders and building teams to develop and launch products to serve our customers and strengthen our business. In recognition of those contributions and pursuant to a separation agreement dated August 1, 2022, Ms. Chennapragada will remain employed in an advisory role for a transitional period ending January 2, 2023 and thereafter will receive the following severance benefits (which are generally in line with the standard severance benefits for executive officers provided by Robinhood’s Change in Control and Severance Plan for Key Employees

upon an Involuntary Termination by the Company without Cause (as such terms are defined therein)): (a) the Company will pay Ms. Chennapragada $550,000, representing 12 months of her base salary, (b) Ms. Chennapragada will remain an eligible participant in the FY2022 Senior Leadership Team bonus, to be paid in the normal course in the spring of 2023 subject to Company performance against preset targets, and (c) the Company will pay Ms. Chennapragada a lump-sum amount that, on an after-tax basis, equals 12 times her then-current premium for continued group health coverage under COBRA. Provision of these severance benefits is contingent upon Ms. Chennapragada entering into (and not revoking) a separation and release of claims agreement in favor of the Company in a form satisfactory to Robinhood. We will also reimburse Ms. Chennapragada for $20,000 in legal fees. In connection with the severance benefits described above, Ms. Chennapragada has agreed to non-disparagement obligations and confirmed that her obligations in relation to intellectual property and confidentiality remain in effect. The separation and release of claims agreement does not provide for any equity acceleration and Ms. Chennapragada will forfeit all equity awards that remain unvested on her termination date.

Cautionary Note Regarding Forward-Looking Statements

This Current Report contains forward-looking statements, including with respect to our estimates and expectations in connection with the August 2022 Restructuring. Our forward-looking statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause our actual future results, performance, or achievements to differ materially from any future results expressed or implied in this Current Report. Factors that contribute to the uncertain nature of our forward-looking statements include, among others, adverse legal, reputational and financial effects on the Company resulting from the reduction in force; and potential operational disruptions as a result of the reduction in force. Because some of these risks and uncertainties cannot be predicted or quantified and some are beyond our control, you should not rely on our forward-looking statements as predictions of future events. More information about potential risks and uncertainties that could affect our business and financial results is included in Part II, Item 1A of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 as well as our other filings with the SEC, which are available on the SEC’s web site at www.sec.gov. Except as otherwise noted, all forward-looking statements are made as of the filing date of this Current Report and are based on information and estimates available to us at this time. Except as required by law, we assume no obligation to update any of the statements in this Current Report whether as a result of any new information, future events, changed circumstances, or otherwise. You should read this Current Report with the understanding that our actual future results, performance, events, and circumstances might be materially different from what we expect.

Item 9.01 Financial Statements and Exhibits.

Exhibits

| | | | | | | | |

| | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

|

| | | |

| | | | |

| | | Robinhood Markets, Inc. |

| | | | |

| Date: | August 2, 2022 | By: | /s/ Jason Warnick |

| | | | Name: Jason Warnick |

| | | | Title: Chief Financial Officer |

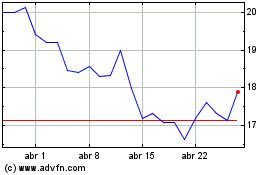

Robinhood Markets (NASDAQ:HOOD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Robinhood Markets (NASDAQ:HOOD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024