Current Report Filing (8-k)

03 Agosto 2022 - 12:48PM

Edgar (US Regulatory)

0001688476false00016884762022-08-032022-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 1, 2022

NexTier Oilfield Solutions Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37988 | | 38-4016639 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

| 3990 Rogerdale Rd | | | | |

Houston, | | Texas | | 77042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(713) 325-6000

(Registrant’s telephone number, including area code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01, par value | NEX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

On August 3, 2022, NexTier Oilfield Solutions Inc. (the “Company”) issued a press release announcing the

completion of the Acquisition (as defined herein) described in Item 8.01 of this Current Report on Form 8-K. A copy of the presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K. In addition, a copy of an investor presentation made available in connection with the Acquisition is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

Coil Tubing Sale

On August 1, 2022, NexTier Completion Solutions Inc., a wholly owned subsidiary of the Company (“NexTier Completion Solutions”), completed its previously announced sale of the Company’s Coiled Tubing assets to Gladiator Energy LLC for a cash purchase price of $21.55 million (the “Coiled Tubing Sale”).

CIG Logistics Acquisition

On August 3, 2022, the Company and NexTier Completion Solutions entered into and closed a definitive agreement to purchase substantially all assets (and assume certain related liabilities) of the sand hauling, wellsite storage and last mile logistics businesses of Continental Intermodal Group LP (“CIG”) and its subsidiaries (the “Acquisition”) from CIG, Continental Intermodal Group – Trucking, LLC (“Trucking”) and CIG Logistics LLC (together with Trucking and CIG, “Sellers”) for an aggregate purchase price of (i) approximately $27 million in cash paid at closing to the Sellers plus (ii) 500,000 shares of common stock, par value $.01 per share (the “Shares”) issued to CIG. Through the Acquisition, NexTier Completion Solutions now owns all of the rights and interests in the SANDSTORM® Wellsite Storage Technology, and related intellectual property, as well as in certain other assets, that were previously owned by the Sellers.

The proceeds of the Coiled Tubing Sale were used to fund a portion of the cash consideration for the Acquisition. The divestiture of non-core assets through the Coiled Tubing Sale and repurposing of capital to fund the Acquisition is consistent with the Company’s strategy to repurpose capital towards the highest return projects that fit the Company’s strategy around wellsite integration.

In connection with the issuance of the Shares, the Company entered into a registration rights agreement (the “Registration Rights Agreement”) with CIG pursuant to which the Company has an obligation to file a registration statement (or a supplement or amendment to an existing registration statement) with the Securities and Exchange Commission registering the resale of the Shares prior to the end of the Lock-Up Period (as defined herein). The Registration Rights Agreement also contains certain lock-up provisions which require CIG to continue to own (subject to customary exceptions) the Shares from the issue date until November 1, 2022 (the “Lock-Up Period”). The Shares were issued to CIG without registration under the Securities Act in reliance on the private offering exemption provided by Section 4(a)(2) thereof, pursuant to CIG’s status as an “accredited investor,” as such term is defined in Rule 501 under the Securities Act.

The foregoing summary of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the terms and conditions of the Registration Rights Agreement, a copy of which was filed as Exhibit 10.1 to this Current Report on Form 8-K and which is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| | Press Release, dated August 3, 2022 |

| | Investor Presentation Materials |

| | Registration Rights Agreement, dated August 3, 2022, between the Company and CIG. |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| |

| NEXTIER OILFIELD SOLUTIONS INC. |

Dated: August 3, 2022 | /s/ KEVIN MCDONALD |

| Name: Kevin McDonald |

| Title: Executive Vice President, Chief Administrative Officer & General Counsel |

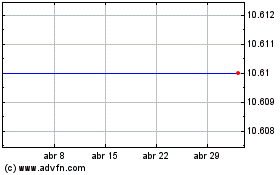

NexTier Oilfield Solutions (NYSE:NEX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

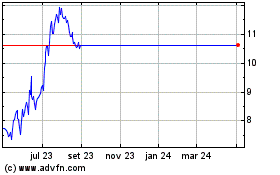

NexTier Oilfield Solutions (NYSE:NEX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024