UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

|

Atento S.A.

|

|

(Name of Issuer)

|

|

Ordinary Shares, no par value

|

|

(Title of Class of Securities)

|

|

L0427L105

|

|

(Cusip Number)

|

|

Michael B. Fisch

Farallon Capital Management, L.L.C.

One Maritime Plaza, Suite 2100

San Francisco, California 94111

(415) 421-2132

|

|

(Name, Address, and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

|

September 1, 2022

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of Sections 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [ ].

Note: Schedules filed in paper

format shall include a signed original and five copies of the schedule, including all exhibits. See Section 240.13d-7 for other parties to whom

copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

(Continued on following pages)

Page 1 of 24 Pages

Exhibit Index Found on Page 23

13D

|

1

|

NAMES OF REPORTING PERSONS

Taheebo Holdings LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357 Ordinary Shares (as defined in Item 1), which is

15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

OO

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Farallon Capital Management, L.L.C.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

OO, IA

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Philip D. Dreyfuss

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Michael B. Fisch

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Richard B. Fried

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Varun N. Gehani

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Nicolas Giauque

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

France

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

David T. Kim

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Michael G. Linn

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Rajiv A. Patel

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Thomas G. Roberts, Jr.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

William Seybold

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Andrew J. M. Spokes

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United Kingdom

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

John R. Warren

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

13D

|

1

|

NAMES OF REPORTING PERSONS

Mark C. Wehrly

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See

Instructions)

(a) [ ]

(b) [ X ]**

** The reporting persons making this filing hold an aggregate of 2,230,357

Ordinary Shares (as defined in Item 1), which is 15.4% of the class of securities outstanding. The reporting person on this cover page, however, is a beneficial owner only of the securities reported by it on this cover page.

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

N/A

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) OR 2(e)

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY

EACH

REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,230,357

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,230,357

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,230,357

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

[

]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

15.4% (1)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

|

(1)

|

Percentage beneficial ownership calculation is based on 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

|

Preliminary Note: This Amendment No. 1 to Schedule 13D (this “Amendment”) amends and supplements the Schedule 13D initially filed on July 2, 2020 (the “Prior Schedule 13D” and, as amended and supplemented by this Amendment, this “Schedule

13D”). Capitalized terms used without definition in this Amendment have the meanings ascribed thereto in the Prior Schedule 13D.

The aggregate number of 2,230,357 Ordinary Shares reported on each cover page of this Schedule 13D reflects the

effect of a reverse stock split effected by the Company subsequent to the filing of the Prior Schedule 13D, as reported by the Company in its Form 6-K filed with the Securities and Exchange Commission (the “SEC”) on August 6, 2020.

|

Item 2.

|

Identity and Background

|

This Amendment hereby amends and restates Item 2 of the Prior Schedule 13D in its entirety as follows:

(a) This statement is filed by Taheebo Holdings LLC, Farallon Capital Management, L.L.C. and the Farallon Individual Reporting Persons (as defined below), all of whom together are

referred to herein as the “Reporting Persons.”

Taheebo

|

(i)

|

Taheebo Holdings LLC, a Delaware limited liability company (“Taheebo”), with respect to the Ordinary Shares held by it.

|

The Management Company

|

(ii)

|

Farallon Capital Management, L.L.C., a Delaware limited liability company (the “Management Company”), which is the manager of Taheebo, with respect to the Ordinary Shares held by Taheebo.

|

The Farallon Individual Reporting Persons

|

(iii)

|

The following persons, each of whom is a managing member or senior managing member, as the case may be, of the Management

Company, with respect to the Ordinary Shares held by Taheebo: Philip D. Dreyfuss (“Dreyfuss”); Michael B. Fisch (“Fisch”); Richard B. Fried (“Fried”); Varun N. Gehani (“Gehani”); Nicolas Giauque (“Giauque”); David T. Kim (“Kim”); Michael G. Linn (“Linn”); Rajiv A. Patel (“Patel”); Thomas G. Roberts, Jr. (“Roberts”);William Seybold (“Seybold”); Andrew J. M. Spokes (“Spokes”); John R. Warren (“Warren”); and Mark C. Wehrly (“Wehrly”).

|

Dreyfuss, Fisch, Fried, Gehani, Giauque, Kim, Linn, Patel, Roberts, Seybold, Spokes, Warren and Wehrly are together

referred to herein as the “Farallon Individual Reporting Persons.”

(b) The address of the principal business office of (i) Taheebo is c/o Farallon Capital Management, L.L.C., One Maritime Plaza, Suite 2100, San Francisco, California 94111, and (ii) each of the

Management Company and the Farallon Individual Reporting Persons is set forth in Annex 1 hereto.

(c) The principal business of Taheebo is that of a private investment entity engaging in the purchase and sale of investments for its own account. The principal business of the Management Company is

that of an investment adviser to various investment vehicles and managed accounts. The principal business of each of the Farallon Individual Reporting Persons is set forth in Annex 1 hereto.

(d) None of the Reporting Persons has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) None of the Reporting Persons has, during the last five years, been party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a

judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) The jurisdiction of organization of each of Taheebo and the Management Company is set forth above. Each of the Farallon Individual Reporting Persons, other than Spokes, is a citizen of the United States. Spokes is a

citizen of the United Kingdom.

The other information required by Item 2 relating to the identity and background of the Reporting Persons is set forth in Annex 1 hereto.

Item 5. Interest in Securities of the Issuer

This Amendment hereby amends and restates Item 5 of the Prior Schedule 13D in its entirety as follows:

Taheebo

|

(a),(b) |

The information set forth in Rows 7 through 13 of the cover page hereto for Taheebo is incorporated herein by reference. The percentage amount set forth in Row 13 for

all cover pages filed herewith is calculated based upon 14,499,710 Ordinary Shares issued and outstanding as of June 30, 2022, as reported by the Company in its Form 6-K filed with the SEC on August 12, 2022.1

|

|

(d) |

The Management Company has the power to direct the receipt of dividends relating to, or the disposition of the proceeds of the sale of, the Ordinary Shares held by

Taheebo. Each of the Farallon Individual Reporting Persons is a managing member or senior managing member, as the case may be, of the Management Company.

|

The Management Company

|

(a),(b) |

The information set forth in Rows 7 through 13 of the cover page hereto for the Management Company is incorporated herein by reference.

|

(c) None.

|

(d) |

The Management Company has the power to direct the receipt of dividends relating to, or the disposition of the proceeds of the sale of, the Ordinary Shares held by

Taheebo. Each of the Farallon Individual Reporting Persons is a managing member or senior managing member, as the case may be, of the Management Company.

|

1 Calculated as 15,451,667 Ordinary Shares issued, less 951,957 Ordinary Shares held by the Company in treasury, in each case as reported by the

Company in its Form 6-K filed with the SEC on August 12, 2022.

(e) Not applicable.

The Farallon Individual Reporting Persons

(a),(b) The information set forth in Rows 7

through 13 of the cover page hereto for each Farallon Individual Reporting Person is incorporated herein by reference for each such Farallon Individual Reporting Person.

(c) None.

|

(d) |

The Management Company has the power to direct the receipt of dividends relating to, or the disposition of the proceeds of the sale of, the Ordinary Shares held by

Taheebo. Each of the Farallon Individual Reporting Persons is a managing member or senior managing member, as the case may be, of the Management Company.

|

(e) Not applicable.

The Ordinary Shares reported hereby for Taheebo are held

directly by Taheebo. The Management Company, as the manager of Taheebo, may be deemed to be a beneficial owner of such Ordinary Shares held by Taheebo. Each of the Farallon Individual Reporting Persons, as a managing member or a senior managing

member, as the case may be, of the Management Company, in each case with the power to exercise investment discretion, may be deemed to be a beneficial owner of such Ordinary Shares held by Taheebo. Each of the Management Company and the Farallon Individual Reporting Persons hereby disclaims any beneficial ownership of any such Ordinary Shares.

Neither the filing of this Schedule 13D nor any of its contents, including, without limitation, the disclosure herein regarding the Share

Transfer Agreement, shall be deemed to constitute an admission that any of the Reporting Persons or any of the other holders of Ordinary Shares that were party to the Share Transfer Agreement (such other holders, the “Other Holders”) is a member of a “group” for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended. Each Reporting Person hereby disclaims any beneficial ownership of any of the Ordinary Shares that may be deemed to be beneficially owned by any of the Other Holders.

Item 6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer

This Amendment hereby amends Item 6 of the Prior Schedule 13D by deleting the two paragraphs immediately following the caption “Director Nomination Agreement” and inserting in lieu thereof the following:

“Pursuant to the Director Nomination Agreement, dated as of May 6, 2020, by

and between the Company and Taheebo, as amended by the letter agreement, dated September 1, 2022, by and between the Company and Taheebo (the “Amendment Agreement”)

(as so amended, the “Director Nomination Agreement”), for so long as Taheebo (including certain affiliates) beneficially owns 12.5% or more of the outstanding

Ordinary Shares, Taheebo shall have the right to nominate one individual for election to the Board as a Class II director. Pursuant to the Director Nomination Agreement, Taheebo designated Mr. Antenor Camargo, an officer of Farallon Latin America

Investimentos Ltda., which is an affiliate of the Management Company, as a nominee for election to the Board as a Class II director. The Board so elected Mr. Camargo on the Closing Date. Mr. Camargo currently remains a member of the Board.”

“The Amendment Agreement extends by 12 months the “lock-up” period to which

Taheebo is subject under the Director Nomination Agreement. As amended by the Amendment Agreement, the Director Nomination Agreement provides that during the 36-month period beginning on the Closing Date, Taheebo will not, subject to certain

exceptions, sell, assign, transfer, pledge, hypothecate, encumber or otherwise dispose of any of the Ordinary Shares it holds.”

“The foregoing description of the Amendment Agreement is qualified in its

entirety by the full terms and conditions thereof. A copy of the Amendment Agreement was attached as Exhibit 10.3 to the Form 6-K filed by the

Company with the SEC on September 7, 2022, which exhibit is hereby incorporated herein by reference.”

Item 7. Materials to be Filed as Exhibits

This Amendment hereby amends and supplements Item 7 of the Prior Schedule 13D by adding the following thereto:

“Filed herewith as Exhibit 6 is a written agreement relating to the filing of joint acquisition

statements pursuant to Section 240.13d-1(k) under the Securities Exchange Act of 1934, as amended.”

“A copy of the

Amendment Agreement, dated September 1, 2022, by and between the Company and Taheebo was attached as Exhibit 10.3 to the Form 6-K filed by the Company with the SEC on

September 7, 2022. Such exhibit is hereby incorporated herein by reference.”

SIGNATURES

After reasonable inquiry and to the best of our knowledge and belief, the undersigned certify that the information

set forth in this statement is true, complete and correct.

Dated: September 7, 2022

| |

/s/ Michael B. Fisch

|

| |

FARALLON CAPITAL MANAGEMENT, L.L.C.

|

| |

On its own behalf and

|

| |

As the Manager of

|

| |

TAHEEBO HOLDINGS LLC

|

| |

By Michael B. Fisch, Managing Member

|

| |

|

| |

|

| |

/s/ Michael B. Fisch

|

| |

Michael B. Fisch, individually and as attorney-in-fact for each of Philip D. Dreyfuss, Richard B. Fried, Varun N. Gehani, Nicolas Giauque, David T.

Kim, Michael G. Linn, Rajiv A. Patel, Thomas G. Roberts, Jr., William Seybold, Andrew J. M. Spokes, John R. Warren and Mark C. Wehrly

|

The Powers of Attorney executed by each of

Dreyfuss, Fried, Kim, Linn, Patel, Roberts, Seybold, Spokes, Warren and Wehrly authorizing Fisch to sign and file this Schedule 13D on his behalf, which were filed as exhibits to the Schedule 13G filed with the SEC on February 13, 2020 by such

Reporting Persons with respect to the Common Stock of Broadmark Realty Capital Inc., are hereby incorporated by reference. The Power of Attorney executed by Gehani authorizing Fisch to sign and file this Schedule 13D on his behalf, which was filed

as an exhibit to the Schedule 13G filed with the SEC on January 27, 2022 by such Reporting Person with respect to the Class A Common Stock of Berenson Acquisition Corp. I, is hereby incorporated by reference. The Power of Attorney executed by

Giauque authorizing Fisch to sign and file this Schedule 13D on his behalf, which was filed as an exhibit to the Schedule 13G filed with the SEC on August 12, 2021 by such Reporting Person with respect to the Class A Ordinary Shares of Metals

Acquisition Corp, is hereby incorporated by reference.

ANNEX 1

Set forth below with respect to the Management Company is the following information: (a) name; (b) business address; (c) principal

business; (d) state of organization; and (e) controlling persons. Set forth below with respect to each managing member of the Management Company is the following information: (a) name; (b) business address; (c) principal occupation; and (d)

citizenship.

| |

1.

|

The Management Company

|

| |

(a)

|

Farallon Capital Management, L.L.C.

|

| |

(b)

|

One Maritime Plaza, Suite 2100

San Francisco, California 94111

|

| |

(c)

|

Serves as investment adviser to various investment vehicles and managed accounts

|

| |

(d)

|

Delaware limited liability company

|

| |

(e)

|

Managing Members: Andrew J.M. Spokes, Senior Managing Member; and Philip D. Dreyfuss, Michael B. Fisch, Richard B. Fried, Varun N. Gehani, Nicolas

Giauque, David T. Kim, Michael G. Linn, Rajiv A. Patel, David A. Posner, Thomas G. Roberts, Jr., William Seybold, John R. Warren and Mark C. Wehrly, Managing Members.

|

| |

2.

|

Managing Members of the Management Company

|

| |

(a)

|

Andrew J.M. Spokes, Senior Managing Member; and Philip D. Dreyfuss, Michael B. Fisch, Richard B. Fried, Varun N. Gehani, Nicolas Giauque, David T. Kim,

Michael G. Linn, Rajiv A. Patel, David A. Posner, Thomas G. Roberts, Jr., William Seybold, John R. Warren and Mark C. Wehrly, Managing Members.

|

| |

(b)

|

c/o Farallon Capital Management, L.L.C.

One Maritime Plaza, Suite 2100

San Francisco, California 94111

|

| |

(c)

|

The principal occupation of Andrew J.M. Spokes is serving as Senior Managing Member of each of the Management Company and Farallon Partners, L.L.C. The

principal occupation of each other Managing Member of the Management Company is serving as a Managing Member of each of the Management Company and Farallon Partners, L.L.C.

|

| |

(d)

|

Each of the Managing Members of the Management Company, other than Andrew J.M. Spokes and Nicolas Giauque, is a citizen of the United States. Mr. Spokes

is a citizen of the United Kingdom. Mr. Giauque is a citizen of France.

|

None of the Management Company and its Managing Members has any additional information to disclose with respect to Items 2-6 of this

Schedule 13D that is not otherwise disclosed in this Schedule 13D.

EXHIBIT INDEX

|

1.

|

Joint Acquisition Statement pursuant to Section 240.13d-1(k), dated July 2, 2020*

|

|

|

|

|

2.

|

Share Transfer Agreement, dated as of May 6, 2020, by and among Atalaya Luxco PIKco S.C.A, Chesham Investment Pte Ltd, Mezzanine Partners II Onshore Lux

Sarl II, Mezzanine Partners II Offshore Lux Sarl II, Mezzanine Partners II Institutional Lux Sarl II, Mezzanine Partners II AP Lux Sarl II, Taheebo Holdings LLC and Atento S.A.*

|

|

|

|

|

3.

|

Registration Rights Agreement, dated as of May 6, 2020, by and among Atento S.A., Chesham Investment Pte Ltd, Mezzanine Partners II Onshore Lux Sarl II,

Mezzanine Partners II Offshore Lux Sarl II, Mezzanine Partners II Institutional Lux Sarl II, Mezzanine Partners II AP Lux Sarl II, and Taheebo Holdings LLC*

|

|

|

|

|

4.

|

Share Pledge Agreement, dated as of June 22, 2020, by and among Atalaya Luxco PIKco S.C.A., Chesham Investment Pte Ltd, Mezzanine Partners II Onshore

Lux Sarl II, Mezzanine Partners II Offshore Lux Sarl II, Mezzanine Partners II Institutional Lux Sarl II, Mezzanine Partners II AP Lux Sarl II, Taheebo Holdings LLC and Atento S.A.*

|

|

|

|

|

5.

|

Director Nomination Agreement, dated as of May 6, 2020, by and between Atento S.A. and Taheebo Holdings LLC.*

|

| |

|

|

6.

|

Joint Acquisition Statement Pursuant to Section 240.13d-1(k), dated September 7, 2022

|

| |

|

|

7.

|

Amendment Agreement, dated September 1, 2022, by and between

Atento S.A. and Taheebo Holdings LLC**

|

*Attached as an exhibit to the Schedule 13D filed on July 2, 2020

** Incorporated by reference to Exhibit 10.3 to the Form 6-K filed by Atento S.A. with the SEC on September 7, 2022

EXHIBIT 6

to

SCHEDULE 13D

JOINT ACQUISITION STATEMENT

PURSUANT TO SECTION 240.13d-1(k)

The undersigned acknowledge and agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that

all subsequent amendments to this statement on Schedule 13D shall be filed on behalf of each of the undersigned without the necessity of filing additional joint acquisition statements. The undersigned acknowledge that each shall be responsible for the

timely filing of such amendments, and for the completeness and accuracy of the information concerning him, her or it contained therein, but shall not be responsible for the completeness and accuracy of the information concerning the other entities or

persons, except to the extent that he, she or it knows or has reason to believe that such information is inaccurate.

Dated: September 7, 2022

| |

/s/ Michael B. Fisch

|

| |

FARALLON CAPITAL MANAGEMENT, L.L.C.

|

| |

On its own behalf and

|

| |

As the Manager of

|

| |

TAHEEBO HOLDINGS LLC

|

| |

By Michael B. Fisch, Managing Member

|

| |

|

| |

|

| |

/s/ Michael B. Fisch

|

| |

Michael B. Fisch, individually and as attorney-in-fact for each of Philip D. Dreyfuss, Richard B. Fried, Varun N. Gehani, Nicolas Giauque, David T.

Kim, Michael G. Linn, Rajiv A. Patel, Thomas G. Roberts, Jr., William Seybold, Andrew J. M. Spokes, John R. Warren and Mark C. Wehrly

|

Page 24 of 24

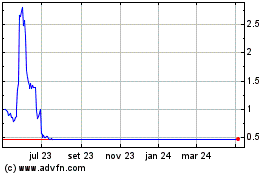

Atento (NYSE:ATTO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Atento (NYSE:ATTO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024