Current Report Filing (8-k)

23 Setembro 2022 - 7:45AM

Edgar (US Regulatory)

0001167419

false

0001167419

2022-09-23

2022-09-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): September 23,

2022

Riot Blockchain, Inc.

(Exact name of registrant

as specified in its charter)

| Nevada |

|

001-33675 |

|

84-1553387 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| |

3855

Ambrosia Street, Suite

301

Castle Rock, CO 80109 |

|

| |

(Address of principal executive offices) |

|

| |

(303) 794-2000 |

|

| |

(Registrant’s telephone number, including area code) |

|

(Former name, former

address, and former fiscal year, if changed since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value per share |

|

RIOT |

|

Nasdaq Capital Market

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 – Other Events.

Riot Blockchain, Inc. (the “Company”)

is supplementing its disclosures regarding the material weaknesses identified by management, as set forth under Part I - Item 4. “Controls

and Procedures” of its Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2022, and June 30, 2022, as filed

on May 10, 2022, and August 15, 2022, respectively, (the “Quarterly Reports”), with the omitted material weakness set forth

below. Due to administrative oversight, the material weakness below, which was previously disclosed under Part II - Item 9A. “Controls

and Procedures” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, as filed on March 16, 2022,

was inadvertently omitted from each of the Quarterly Reports. Accordingly, the Company is filing this current report on Form 8-K to correct

this omission, and the below material weakness should be read in conjunction with the other material weaknesses set forth in the Quarterly

Reports.

Except as presented in this filing, the Company is

not updating any other information in the Quarterly Reports.

Omitted Material Weakness:

The Company did not properly design and implement

controls to ensure that certain inputs and assumptions utilized in the valuation of intangible assets identified in its accounting for

business combinations were reasonable in the circumstances. Such deficiency also resulted in material adjustments required to the Company’s

provision for income taxes.

The Company’s disclosures under Part I - Item

4. “Controls and Procedures” of its Quarterly Report for the quarter ended June 30, 2022, is hereby presented as follows,

in order to illustrate the above described correction:

Evaluation

of Disclosure Controls and Procedures

Our management, with the participation of our Chief

Executive Officer (principal executive officer) and our Chief Financial Officer (principal financial officer), has evaluated the effectiveness

of our disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of June

30, 2022 to ensure that the information required to be disclosed by the Company in the reports that it files or submits under the Exchange

Act is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and that information required

to be disclosed in the reports we file or submit under the Exchange Act is accumulated and communicated to our management, including our

Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosures. Based on this evaluation,

our management concluded that our disclosure controls and procedures were not effective at the reasonable assurance level as of June 30,

2022, due to the following material weaknesses:

| 1) | The Company did not design and/or implement user access controls to ensure

appropriate segregation of duties that would adequately restrict user and privileged access to the financially relevant systems and data

to the appropriate Company personnel. |

| 2) | The Company did not design and implement program change management controls

for certain financially relevant systems to ensure that IT program and data changes affecting the Company’s (i) financial IT applications,

(ii) digital currency cold storage wallets and mining equipment, and (iii) underlying accounting records, are identified, tested, authorized

and implemented appropriately to validate that data produced by its relevant IT system(s) were complete and accurate. Automated process-level

controls and manual controls that are dependent upon the information derived from such financially relevant systems were also determined

to be ineffective as a result of such deficiency. |

| 3) | The Company did not properly design or implement controls to ensure that

data received from third parties is complete and accurate. Such data is relied on by the Company in determining amounts pertaining to

revenue - mining and cryptocurrency assets held is complete and accurate. Automated process-level controls and manual controls that are

dependent upon the information derived from such financially relevant systems were also determined to be ineffective as a result of such

deficiency. |

| 4) | The Company did not properly design and implement controls to ensure that

certain inputs and assumptions utilized in the valuation of intangible assets identified in its accounting for business combinations were

reasonable in the circumstances. Such deficiency also resulted in material adjustments required to the Company’s provision for income

taxes. |

| 5) | During testing of procedures during 2021, the Company’s subsidiary,

Whinstone, did identify that there were material weaknesses over internal controls at Whinstone. The weaknesses noted that Whinstone did

not properly document the design of its internal controls; did not design and implement procedures to ensure proper segregation of duties

and all transactions are entered and disclosed timely and accurately in accordance with GAAP, which includes transactions with related

parties. |

|

Item 9.01.

(d) Exhibits.

|

Financial Statements and Exhibits. |

|

Exhibit Number

|

Description |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

S I G N A T U

R E

Pursuant to

the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

| |

RIOT BLOCKCHAIN, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Jeffrey

G. McGonegal |

| |

|

Name: Jeffrey G. McGonegal |

| |

|

Title: Chief Financial Officer |

Date: September 23, 2022

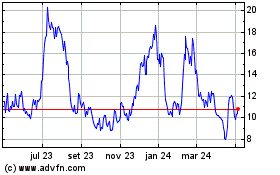

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

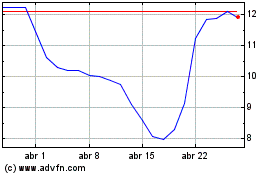

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024