Amended Tender Offer Statement by Issuer (sc To-i/a)

04 Outubro 2022 - 8:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE TO

(Amendment No. 2)

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1)

OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

Pinduoduo Inc.

(Name of Subject

Company (Issuer))

Pinduoduo Inc.

(Name of Filing

Person (Issuer))

0% Convertible Senior Notes due 2024

(Title of Class of

Securities)

722304AB8

(CUSIP Number

of Class of Securities)

Jianchong Zhu

28/F, No. 533 Loushanguan Road, Changning

District

Shanghai, 200051

People’s Republic of China

Tel: +86-21-52661300

with copy to:

|

Haiping Li, Esq.

Yuting Wu, Esq.

Skadden, Arps, Slate, Meagher & Flom

LLP

46/F, Tower II, Jing An Kerry Centre

1539 Nanjing West Road

Shanghai 200040, China

+86 (21) 6193-8200 |

(Name, address

and telephone number of person authorized to receive notices and communications on behalf of the filing person)

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| ¨ |

third-party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer: x

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

INTRODUCTORY STATEMENT

This Amendment No. 2 (this “Amendment

No. 2”) amends and supplements the Tender Offer Statement on Schedule TO filed with the U.S. Securities and Exchange Commission

(the “Commission”) on September 2, 2022, as subsequently amended and supplemented by the Amendment No. 1 filed with

the Commission on September 19, 2022 (as so amended and supplemented, the “Schedule TO”) by Pinduoduo Inc. (the “Company”)

with respect to the right of each holder (each a “Holder” and collectively the “Holders”) of the

Company’s 0% Convertible Senior Notes due 2024 (the “Notes”) to sell and the obligation of the Company to purchase

the Notes, as set forth in the Company’s Put Right Notice to the Holders dated as of September 2, 2022 (the “Put Right

Notice”) and the related notice materials filed as exhibits to the Schedule TO (which Put Right Notice and related notice materials,

as amended or supplemented from time to time, collectively constitute the “Put Right”).

This Amendment No. 2 relates to the final results

of the Company’s repurchase of the Notes that have been validly surrendered for repurchase and not withdrawn pursuant to the Put

Right. The information contained in the Schedule TO, including the Put Right, as amended and supplemented hereby, is incorporated herein

by reference. Except as specifically provided herein, this Amendment No. 2 does not modify any of the information previously reported

on the Schedule TO. Capitalized terms used and not otherwise defined in this Amendment No. 2 shall have the meanings assigned to such

terms in the Put Right or in the Schedule TO.

This Amendment No. 2 amends and supplements the

Schedule TO as set forth below and constitutes the final amendment to the Schedule TO. This Amendment No. 2 is intended to satisfy the

disclosure requirements of Rule 13e-4(c)(4) under the Securities Exchange Act of 1934, as amended.

| ITEM 11. | ADDITIONAL INFORMATION. |

Item 11 of the Schedule TO is hereby amended and

supplemented to include the following information:

The Put Right expired at 11:59 p.m., New York City

time, on Friday, September 30, 2022 (the “Expiration Date”). The Company has been advised by Deutsche Bank Trust Company

Americas, as the Paying Agent, that pursuant to the terms of the Put Right, US$1,000 aggregate principal amount of the Notes were

validly surrendered for repurchase and not withdrawn as of the Expiration Date. The Company has accepted all of the surrendered Notes

for repurchase pursuant to the terms of the Put Right and has forwarded cash in payment of the Repurchase Price to the Paying Agent for

distribution to the Holders that had exercised their Put Right. The aggregate amount of the Repurchase Price was US$1,000. Following settlement

of the Repurchase Price, US$226,252,000.00 aggregate principal amount of the Notes will remain outstanding and continue to be subject

to the existing terms of the Indenture and the Notes.

(a) Exhibits.

(b) Filing

Fee Exhibit.

* Previously filed.

† Filed herewith.

| ITEM 13. | INFORMATION REQUIRED BY SCHEDULE 13E-3. |

Not applicable.

EXHIBIT INDEX

* Previously filed

† Filed herewith.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Pinduoduo Inc. |

| |

|

| |

By: |

/s/ Jun Liu |

| |

Name: |

Jun Liu |

| |

Title: |

Vice President of Finance |

Dated: October 4, 2022

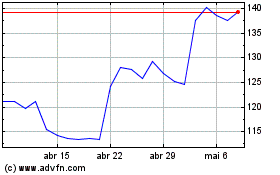

PDD (NASDAQ:PDD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

PDD (NASDAQ:PDD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024