Current Report Filing (8-k)

01 Novembro 2022 - 6:17PM

Edgar (US Regulatory)

false000185602800018560282022-10-262022-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 26, 2022

Stronghold Digital Mining, Inc.

(Exact Name of registrant as specified in its charter)

| |

Delaware

|

|

| |

(State or other jurisdiction of incorporation)

|

|

| |

|

|

|

001-40931

|

|

86-2759890

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

|

|

595 Madison Avenue, 28th Floor

New York, New York

|

|

10022

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(212) 967-5294

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Name of each exchange on which registered

|

|

Class A common stock, par value $0.0001 per share

|

|

SDIG

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement.

|

WhiteHawk Refinancing Agreement

On October 27, 2022, Stronghold Digital Mining, Inc. (the “Company”) entered into a secured credit agreement (the “Credit Agreement”) with WhiteHawk Finance LLC (“WhiteHawk”) to refinance the equipment financing agreement, dated June 30, 2021 by and between Stronghold Digital Mining Equipment, LLC (“Stronghold LLC”) and WhiteHawk (the “WhiteHawk Financing Agreement”), effectively terminating the WhiteHawk

Financing Agreement. The Credit Agreement consists of $35.1 million in term loans and $23.0 million in additional commitments (such additional commitments, the “Delayed

Draw Facility”). Such loans under the Delayed Draw Facility were drawn on the closing date of the Credit Agreement. The Credit Agreement and Delayed Draw Facility together reduce monthly principal payments and added approximately $21 million

of cash to the Company’s balance sheet following the Company’s draw down on the full amount of the Delayed Draw Facility. The full amount of the WhiteHawk Financing Agreement has been drawn as of the date hereof. All capitalized words used but not

defined herein have the meanings assigned in the Credit Agreement.

The financing pursuant to the Credit Agreement (such financing, the “WhiteHawk Refinancing Agreement”) was entered into by Stronghold LLC as Borrower (the “Borrower”) and is secured by

substantially all of the assets of the Company and its subsidiaries and is guaranteed by the Company and each of its material subsidiaries. The WhiteHawk Refinancing Agreement requires equal monthly amortization payments resulting in full

amortization at maturity. The WhiteHawk Refinancing Agreement has customary representations, warranties and covenants including restrictions on indebtedness, liens, restricted payments and dividends, investments, asset sales and similar covenants and

contains customary events of default. The WhiteHawk Refinancing Agreement also contains covenants requiring the Borrower and its subsidiaries to maintain a minimum (x) of $7.5 million of liquidity at all times, (y) a minimum liquidity of $10 million

of average daily liquidity for each calendar month (rising to $20 million beginning July 1, 2023) and (z) a maximum total leverage ratio covenant of (i) 7.5:1.0 for the quarter ending December 31, 2022, (ii) 5.0:1.0 for the quarter ending March 31,

2023, (iii) 4.0:1.0 for the quarter ending June 30, 2023 and (iv) 4.0:1.0 for each quarter ending thereafter.

The borrowings under the WhiteHawk Refinancing Agreement mature

on October 26, 2025 and bear interest at a rate of either (i) the Secured

Overnight Financing Rate plus 10% or (ii) a reference rate equal to the greater of (x) 3%, (y) the federal funds rate plus 0.50% and (y) the Term SOFR rate plus 1%, plus 9%. The loan under the Delayed Draw Facility was issued with 3% closing fee on the drawn amount, paid when such amount was drawn. Amounts drawn

on the WhiteHawk Refinancing Agreement are subject to a prepayment premium such that the lenders thereunder achieve a 20% return on invested capital. The Company also issued a stock purchase warrant to WhiteHawk in conjunction with the closing of

the WhiteHawk Refinancing Agreement, which provides for the purchase of an additional 4,000,000 shares of Class A common stock at an exercise price of $0.01

per share, pursuant to an exemption from registration under Section 4(a)(2) of the Securities Act of 1933, as amended, as transactions not involving a public offering. Borrowings under the WhiteHawk Refinancing Agreement may also be accelerated in

certain circumstances.

The foregoing description is qualified in its entirety by

reference to the full text of the Credit Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Form 8-K”) and incorporated into this Item 1.01 by reference.

| Item 1.02 |

Termination of a Material Definitive Agreement.

|

The information under Item 1.01 of this Form 8-K is incorporated by reference into this Item 1.02.

| Item 2.01 |

Completion of Acquisition or Disposition of Assets and Extinguishment of Debt.

|

Extinguishment of Final Tranche of NYDIG Debt

As previously disclosed, the Company, its subsidiaries Stronghold Digital Mining LLC, a Delaware limited liability company (“SDM”), and Stronghold Digital Mining BT, LLC, a Delaware limited liability company (“Digital Mining BT”, and together with SDM, the “Sellers”), and the Company’s operating partnership subsidiary Stronghold Digital Mining

Holdings, LLC, a Delaware limited liability company (together with the Sellers and the Company, the “Seller Parties” and each, a “Seller Party”), entered into an Asset Purchase Agreement, dated August 16, 2022 (the “Asset Purchase

Agreement”) with NYDIG ABL LLC, a Delaware limited liability company formerly known as Arctos Credit, LLC (“NYDIG”), and The Provident Bank, a

Massachusetts savings bank (“BankProv” and together with NYDIG, “Purchasers”

and each, a “Purchaser”).

Pursuant to the master equipment financing agreement entered into between SDM and NYDIG on June 25, 2021 (the “Arctos/NYDIG Financing Agreement”) and the master equipment financing agreement entered into between Digital Mining BT and NYDIG on December 15, 2021 (the “Second NYDIG Financing Agreement” and together with the Arctos/NYDIG Financing Agreement, the “NYDIG Financing Agreements”), the Seller Parties pledged as collateral under the NYDIG Financing Agreements certain Bitcoin miners the Seller Parties purchased with borrowings under the NYDIG Financing Agreements

(together with certain related agreements to purchase miners, the “APA Collateral”). Under the Asset Purchase Agreement, the Seller Parties agreed to sell, and

the Purchasers (or their respective designee) agreed to purchase, the APA Collateral in a private disposition in exchange for the forgiveness, reduction and release of all principal, interest, and fees owing under each of the NYDIG Financing

Agreements (collectively, the “NYDIG Debt”). Upon the signing of the Asset Purchase Agreement, the amount of principal under the NYDIG Debt outstanding was

approximately $67.4 million.

As previously disclosed, the Seller Parties previously completed the sale, in two separate settlements, of six tranches of APA

Collateral to BankProv and NYDIG in exchange for the extinguishment of an aggregate of $65.3 million of principal under the NYDIG Debt and related interest.

On October 26, 2022, the Seller Parties completed the sale of the seventh and final tranche of the APA Collateral to NYDIG pursuant

to the Asset Purchase Agreement in exchange for the extinguishment of $2.1 million of principal under the NYDIG Debt and related interest (the “Final Settlement”).

Following the Final Settlement, the aggregate amount of principal under the NYDIG Debt extinguished is $67.4 million, the entire amount of the NYDIG Debt, and it will therefore no longer be reflected on the Company’s balance sheet. Please refer to

the Company’s Current Report on Form 8-K filed on October 14, 2022 for pro forma financial statements relating to the Asset Purchase Agreement and certain other adjustments.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

|

The information under Item 1.01 of this Form 8-K is incorporated by reference into this Item 2.03.

| Item 3.02 |

Unregistered Sales of Equity Securities.

|

The information under Item 1.01 of this Form 8-K is incorporated by reference into this Item 3.02.

Board Committee Composition

The Board of Directors (the “Board”) of the Company appointed Thomas R. Trowbridge, IV to the Audit Committee of the

Board. Mr. Trowbridge replaces Sarah P. James. As previously disclosed, the Company relied upon available transition relief for newly public companies during the one-year period following the completion of the Company’s initial public

offering with respect to the independence of the members of the Audit Committee. Ms. James does not meet the heightened independence standards applicable to the Audit Committee due to her position as the Chief Financial Officer of the Beard Energy

Transition Acquisition Corp. The Board determined that Mr. Trowbridge satisfies the additional independence requirements of the Nasdaq Stock Market LLC (“Nasdaq”) and the Securities and Exchange Commission (“SEC”) applicable to members of the Audit Committee. Following

the appointment of Mr. Trowbridge to the Audit Committee, the Audit Committee consists of three directors, each of whom qualifies as independent under the applicable

Nasdaq and SEC rules.

The composition of the Board committees is as follows:

Audit Committee: Indira Agarwal (chair), Thomas J. Pacchia and

Thomas R. Trowbridge, IV

Compensation Committee: Thomas J. Pacchia and Thomas R.

Trowbridge, IV

Nominating and Corporate Governance Committee: Sarah P. James

(chair) and Thomas R. Trowbridge, IV

Liquidity Update

As of November 1, 2022, the current

liquidity of the Company is approximately $30 million, comprised of cash and Bitcoin. Such liquidity gives effect to the additional borrowings under the Delayed Draw Facility, $3.5 million of payments (out of $4.5 million total) already made to Northern Data PA LLC (“NDPA”) and 1277963 B.C. Ltd. (“Bitfield”, and together with NDPA, “Northern Data”) related to the termination and settlement of the

Northern Data hosting agreement, and approximately $3.7 million in new miner acquisitions.

On November 1, 2022, the Company issued a press release regarding the extinguishment of debt and the closing of the

WhiteHawk Refinancing Agreement. A copy of the press release is attached as Exhibit 99.1 hereto.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements contained in this current report on Form 8-K constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or

“anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements and the business

prospects of the Company are subject to a number of risks and uncertainties that may cause the Company’s actual results in future periods to differ materially from the forward-looking statements. These risks and uncertainties include, among other

things: the recent restructuring of the Company’s debt and the performance and satisfaction of various obligations under the agreements entered into in order to effect such restructuring of debt; the hybrid nature of our business model, which is

highly dependent on the price of Bitcoin; our dependence on the level of demand and financial performance of the crypto asset industry; our ability to manage growth, business, financial results and results of operations; uncertainty regarding our

evolving business model; our ability to retain management and key personnel and the integration of new management; our ability to raise capital to fund business growth; our ability to maintain sufficient liquidity to fund operations, growth and

acquisitions; our substantial indebtedness and its effect on our results of operations and our financial condition; uncertainty regarding the outcomes of any investigations or proceedings; our ability to enter into purchase agreements, acquisitions

and financing transactions; public health crises, epidemics, and pandemics such as the coronavirus pandemic; our ability to procure crypto asset mining equipment from foreign-based suppliers; our ability to maintain our relationships with our third

party brokers and our dependence on their performance; our ability to procure crypto asset mining equipment; developments and changes in laws and regulations, including increased regulation of the crypto asset industry through legislative action

and revised rules and standards applied by The Financial Crimes Enforcement Network under the authority of the U.S. Bank Secrecy Act and the Investment Company Act; the future acceptance and/or widespread use of, and demand for, Bitcoin and other

crypto assets; our ability to respond to price fluctuations and rapidly changing technology; our ability to operate our coal refuse power generation facilities as planned; our ability to avail ourselves of tax credits for the clean-up of coal

refuse piles; and legislative or regulatory changes, and liability under, or any future inability to comply with, existing or future energy regulations or requirements. More information on these risks and other potential factors that could affect

our financial results is included in the Company’s filings with the Securities and Exchange Commission, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of its

Annual Report on Form 10-K filed on March 29, 2022 and our Quarterly Reports on Form 10-Q filed on May 16, 2022 and August 18, 2022, and in its Current Report on Form 8-K. Any forward-looking statement speaks only as of the date as of which such

statement is made, and, except as required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise.

| Item 9.01 |

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

Credit Agreement, dated as of October 27, 2022, by and among Stronghold Digital Mining Holdings LLC as Borrower, Stronghold Digital Mining, Inc. as Holdings and

a Guarantor, each subsidiary of the Borrower listed as a Guarantor therein, WhiteHawk Finance LLC and the other lenders from time-to-time party thereto as Lenders and WhiteHawk Capital Partners LP, as Collateral Agent and Administrative

Agent.

|

|

|

|

Press release dated November 1, 2022

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

_____________

| ¥ |

Certain schedules and exhibits to this agreement have been omitted in accordance with Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit

will be furnished to the SEC on request.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

STRONGHOLD DIGITAL MINING, INC.

|

| |

|

|

|

Date: November 1, 2022

|

By:

|

/s/ Gregory A. Beard

|

| |

Name:

|

Gregory A. Beard

|

| |

Title:

|

Chief Executive Officer and Co-Chairman

|

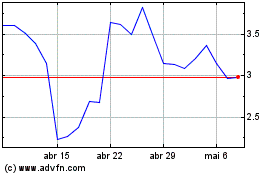

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Stronghold Digital Mining (NASDAQ:SDIG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024