UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

T-1

STATEMENT

OF ELIGIBILITY

UNDER THE

TRUST INDENTURE ACT OF 1939 OF A

CORPORATION

DESIGNATED TO ACT AS TRUSTEE

CHECK IF AN APPLICATION

TO DETERMINE ELIGIBILITY OF A

TRUSTEE

PURSUANT TO SECTION 305(b)(2) [___]

Computershare

Trust Company,

National Association

(Exact name of

Trustee as specified in its charter)

National

Banking Association

(Jurisdiction of incorporation of organization

if not a U.S. national bank) |

04-3401714

(I.R.S. Employer

Identification Number) |

| |

|

150

Royall Street, Canton, MA

(Address of principal executive offices) |

02021

(Zip Code) |

eBay Inc.

(Issuer with

respect to the Securities)

| Delaware |

77-0430924 |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

2025

Hamilton Avenue

San Jose, CA |

95125 |

| (Address

of Principal Executive Offices) |

(Zip

Code) |

Debt Securities

(Title of the

indenture securities)

| Item 1. | General Information. Furnish

the following information as to the trustee: |

| (a) | Name

and address of each examining or supervising authority to which it is subject. |

Comptroller

of the Currency

340 Madison

Avenue, 4th Floor

New York,

NY 10017-2613

| (b) | Whether

it is authorized to exercise corporate trust powers. |

The

trustee is authorized to exercise corporate trust powers.

| Item 2. | Affiliations with the

obligor. If the obligor is an affiliate of the trustee, describe such affiliation. |

None.

| Item 16. | List of exhibits. List

below all exhibits filed as a part of this statement of eligibility. |

1. A copy of the

articles of association of the trustee (attached as Exhibit 1 to this Form T-1).

2. A copy of the

certificate of authority of the trustee to commence business (attached as Exhibit 2 to this Form T-1).

3. A copy of

the Comptroller of the Currency Certification of Fiduciary Powers for Computershare Trust Company, National Association (attached

as Exhibit 3 to this Form T-1).

4. A copy of the existing

bylaws of the trustee, as now in effect (attached as Exhibit 4 to this Form T-1).

5. Not applicable.

6. The consent of the

Trustee required by Section 321(b) of the Act (attached as Exhibit 6 to this Form T-1).

7. A

copy of the latest report of condition of the trustee published pursuant to law or the requirements of its supervising or examining

authority (attached as Exhibit 7 to this Form T-1).

8.

Not applicable.

9.

Not applicable.

SIGNATURE

Pursuant to the requirements

of the Trust Indenture Act of 1939, the trustee, Computershare Trust Company, National Association, a national banking association,

organized and existing under the laws of the United States, has duly caused this statement of eligibility to be signed on its

behalf by the undersigned, thereunto duly authorized, all in the City of Minneapolis, and State of Minnesota, on the 7th day of

November, 2022.

| |

COMPUTERSHARE TRUST COMPANY,

NATIONAL ASSOCIATION

|

| |

By: |

/s/

Maddy Hughes |

| |

Name: |

Maddy Hughes |

| |

Title: |

Vice President |

EXHIBIT 1

ARTICLES

OF ASSOCIATION OF THE TRUSTEE

| |

|

| ARTICLES

OF ASSOCIATION |

Filed |

| OF |

Comptroller of The Currency |

| BOSTON EQUISERVE TRUST COMPANY, |

Northeastern

District |

| NATIONAL

ASSOCIATION |

Date

SEP 30 1996 |

For the

purpose of organizing an Association to carry on the business of a limited purpose trust company under the laws of the United

States, the undersigned do enter into the following Articles of Association:

FIRST.

The title of this Association shall be Boston EquiServe Trust Company, National Association.

SECOND.

The Main Office of the Association shall be in the Town of Canton, County of Norfolk, Commonwealth of Massachusetts. The business

of the Association will be limited to the operations of a national trust company and to support activities incidental thereto.

The Association will not expand or alter its business beyond that stated in this Article Second without the prior approval

of the Comptroller of the Currency.

THIRD.

The Board of Directors of this Association shall consist of not less than five nor more than twenty-five shareholders, the

exact number to be fixed and determined from time to time by resolution of a majority of the full Board of Directors or by resolution

of the shareholders at any annual or special meeting thereof. Each Director shall own common or preferred stock of the Association

or of a holding company owning the Association, with an aggregate par, fair market or equity value of not less than $1,000, as

of either (i) the date of purchase, (ii) the date the person became a director, or (iii) the date of that person’s

most recent election to the Board of Directors, whichever is most recent. Any combination of common or preferred stock of the

Association or holding company may be used.

Any vacancy

in the Board of Directors may be filled by action of the Board of Directors; provided, however, that a majority of the full Board

of Directors may not increase the number of Directors to a number which: (1) exceeds by more than two the number of Directors

last elected by shareholders where the number was 15 or less; and (2) exceeds by more than four the number of Directors last

elected by shareholders where the number was 16 or more, but in no event shall the number of directors exceed 25.

Terms

of Directors, including Directors selected to fill vacancies, shall expire at the next regular meeting of shareholders at which

Directors are elected, unless the Directors resign or are removed from office. Despite the expiration of a Director’s term,

the Director shall continue to serve until his or her successor is elected and qualifies or until there is a decrease in the number

of Directors and his or her position is eliminated.

FOURTH.

There shall be an annual meeting of the shareholders to elect Directors and transact whatever other business may be brought

before the meeting. It shall be held at the main office or any other convenient place as the Board of Directors may designate,

on the day of each year specified therefore in the By-laws, but if no election is held on that day, it may be held on any subsequent

day according to such lawful rules as may be prescribed by the Board of Directors.

Nominations

for election to the Board of Directors may be made by the Board of Directors or by any shareholder of any outstanding class

of capital stock of this Association entitled to vote for election of Directors. Nominations other than those made by or on

behalf of the existing management shall be made in writing and be delivered or mailed to the president of this Association

and to the Comptroller of the Currency, Washington, D.C., not less than 14 days nor more than 50 days prior to any

meeting of shareholders called for the election of Directors; provided, however, that if less than 21 days notice of the

meeting is given to the shareholders, such nominations shall be mailed or delivered to the president of this Association and

to the Comptroller of the Currency not later than the close of business on the seventh day following the day on which the

notice of meeting was mailed. Such notification shall contain the following information to the extent known to the notifying

shareholder: the name and address of each proposed nominee; the principal occupation of each proposed nominee; the total

number of shares of capital stock of this Association that will be voted for each proposed nominee; the name and residence

address of the notifying shareholder; and the number of shares of capital stock of this Association owned by the notifying

shareholder. Nominations not made in accordance herewith may, in his or her discretion, be disregarded by the chairperson of

the meeting, and upon his or her instructions, the vote tellers may disregard all votes cast for each such

nominee.

FIFTH.

The authorized amount of capital stock of this Association shall be 1,000,000 shares of common stock of the par value of one dollar

($1) each; but said capital stock may be increased or decreased from time to time, in accordance with the provisions of the laws

of the United States.

No holder

of shares of the capital stock of any class of this Association shall have any preemptive or preferential right of subscription

to any shares of any class of stock of this Association, whether now or hereafter authorized, or to any obligations convertible

into stock of this Association, issued, or sold, nor any right of subscription to any thereof other than such, if any, as the

Board of Directors, in its discretion may from time to time determine and at such price as the Board of Directors may from time

to time fix.

Transfers

of the Association’s capital stock are subject to the prior approval of a federal depository institution regulatory

agency. If no other agency approval is required, the Comptroller of the Currency’s approval shall be obtained prior to the

transfers. In such cases where the Comptroller of the Currency approval is required, the Comptroller of the Currency will apply

the definitions and standards set forth in the Change in Bank Control Act and the Comptroller of the Currency’s implementing

regulation (12 U.S.C. 1817(j) and 12 C.F.R. 5.50) to ownership changes in the Association.

This

Association, at any time and from time to time, may authorize and issue debt obligations, whether or not subordinated, without

the approval of the shareholders.

SIXTH.

The Board of Directors shall appoint one of its members President of this Association, and one of its members Chairperson of the

Board. The Board of Directors shall have the power to appoint one or more Vice Presidents, a Secretary who shall keep the minutes

of the directors’ and shareholders’ meetings and be responsible for authenticating the records of this Association,

a Cashier and such other officers and employees as may be required to transact the business of this Association.

The Board

of Directors shall have the power to (i) define the duties of the officers, employees and agents of this Association; (ii) delegate

the performance of its duties, but not the responsibility for its duties, to the officers, employees and agents of this Association;

(iii) fix the compensation and enter into employment contracts with its officers and employees upon reasonable terms and

conditions consistent with applicable law; (iv) dismiss officers and employees; (v) require bonds from officers and

employees and to fix the penalty thereof; (vi) ratify written policies authorized by this Association’s management

of committees of the Board of Directors; (vii) regulate the manner in which any increase of the capital of this Association

shall be made, provided that nothing herein shall restrict the power of shareholders to increase or decrease the capital of this

Association in accordance with law, and nothing shall raise or lower from two-thirds the percentage required for shareholder approval

to increase or reduce the capital; (viii) manage and administer the business and affairs of this Association; (ix) adopt

initial By-laws, not inconsistent with law or the Articles of Association, for managing the business and regulating the affairs

of this Association; (x) amend or repeal By-laws, except to the extent that the Articles of Association reserve this power

in whole or in part to shareholders; (xi) make contracts, and (xii) generally perform all acts that it may be legal

for a Board of Directors to perform.

SEVENTH.

The Board of Directors shall have the power to change the location of the main office to any other place within the limits of

the Town of Canton, without the approval of the shareholders, and shall have the power to establish or change the location of

any branch or branches of this Association to any other location, without the approval of the shareholders.

EIGHTH.

The corporate existence of this Association shall continue until terminated in accordance with the laws of the United States.

NINTH.

The Board of Directors of this Association, or any shareholder owning, in the aggregate, not less than ten percent of the

stock of this Association, may call a special meeting of shareholders at any time. Unless otherwise provided by the

laws of the United States, a notice of the time, place, and purpose of every annual and special meeting of the shareholders

shall be given by first-class mail, postage prepaid, mailed at least ten days prior to the date of such meeting to each

shareholder of record at his address as shown upon the books of this Association.

TENTH.

This Association shall to the fullest extent legally permissible indemnify each person who is or was a director, officer, employee

or other agent of this Association and each person who is or was serving at the request of this Association as a director, trustee,

officer, employee or other agent of another organization or of any partnership, joint venture, trust, employee benefit plan or

other enterprise or organization against all liabilities, costs and expenses, including but not limited to amounts paid in satisfaction

of judgments, in settlement or as fines and penalties, and counsel fees and disbursements, reasonably incurred by him in connection

with the defense or disposition of or otherwise in connection with or resulting from any action, suit or other proceeding, whether

civil, criminal, administrative or investigative, before any court or administrative or legislative or investigative body, in

which he may be or may have been involved as a party or otherwise or with which he may be or may have been threatened, while in

office or thereafter, by reason of his being or having been such a director, officer, employee, agent or trustee, or by reason

of any action taken or not taken in any such capacity, except with respect to any matter as to which he shall have been finally

adjudicated by a court of competent jurisdiction not to have acted in good faith in the reasonable belief that his action was

in the best interests of the corporation (any person serving another organization in one or more of the indicated capacities at

the request of this Association who shall not have been adjudicated in any proceeding not to have acted in good faith in the reasonable

belief that his action was in the best interest of such other organization shall be deemed so to have acted in good faith with

respect to the National Trust Company) or to the extent that such matter relates to service with respect to an employee benefit

plan, in the best interest of the participants or beneficiaries of such employee benefit plan. Expenses, including but not limited

to counsel fees and disbursements, so incurred by any such person in defending any such action, suit or proceeding, shall be paid

from time to time by this Association in advance of the final disposition of such action, suit or proceeding upon receipt of an

undertaking by or on behalf of the person indemnified to repay the amounts so paid if it shall ultimately be determined that indemnification

of such expenses is not authorized hereunder.

As

to any matter disposed of by settlement by any such person, pursuant to a consent decree or otherwise, no such

indemnification either for the amount of such settlement or for any other expenses shall be provided unless such settlement

shall be approved as in the best interests of the National Trust Company, after notice that it involves such indemnification,

(a) by vote of a majority of the disinterested directors then in office (even though the disinterested directors be less

than a quorum), or (b) by any disinterested person or persons to whom the question may be referred by vote of a majority

of such disinterested directors, or (c) by vote of the holders of a majority of the outstanding stock at the time

entitled to vote for directors, voting as a single class, exclusive of any stock owned by any interested person, or

(d) by any disinterested person or persons to whom the question may be referred by vote of the holders of a majority of

such stock. No such approval shall prevent the recovery from any such director, officer, employee, agent or trustee of any

amounts paid to him or on his behalf as indemnification in accordance with the preceding sentence if such person is

subsequently adjudicated by a court of competent jurisdiction not to have acted in good faith in the reasonable belief that

his action was in the best interests of this Association. The right of indemnification hereby provided shall not be exclusive

of or affect any other rights to which any director, officer, employee, agent or trustee may be entitled or which may

lawfully be granted to him. As used herein, the terms “director”, “officer”, “employee”,

“agent” and “trustee” include their respective executors, administrators and other legal

representatives, an “interested” person is one against whom the action, suit or other proceeding in question or

another action, suit or other proceeding on the same or similar grounds is then or had been pending or threatened, and a

“disinterested” person is a person against whom no such action, suit or other proceeding is then or had been

pending or threatened. By action of the board of directors, notwithstanding any interest of the directors in such action,

this Association may purchase and maintain insurance, in such amounts as the board of directors may from time to time deem

appropriate, on behalf of any person who is or was a director, officer, employee or other agent of this Association, or is or

was serving at the request of this Association as a director, trustee, officer, employee or other agent of another

organization or of any partnership, joint venture, trust, employee benefit plan or other enterprise or organization

against any liability incurred by him in any such capacity, or arising out of his status as such, whether or not this

Association would have the power to indemnify him against such liability.

Nothing

contained in this Article Tenth shall be construed to (i) allow the indemnification of or insurance coverage for a director,

trustee, officer, employee or agent of this Association against expenses, penalties or other payments incurred in an administrative

action instituted by an appropriate bank regulatory agency which results in a final order assessing civil money penalties or requires

the payment of money to the Association, or (ii) exceed the provisions of Massachusetts General Laws, chapter 156B, section

67, as in effect from time to time.

ELEVENTH.

These Articles of Association may be amended at any regular or special meeting of the shareholders by the affirmative vote of

the holders of a majority of the stock of this Association, unless the vote of the holders of a greater amount of stock is required

by law, and in that case by the vote of the holders of such greater amount.

TWELFTH.

This Association may be a partner in any business or enterprise which this Association would have power to conduct by itself.

IN WITNESS WHEREOF,

we have hereunto set our hands this 20th day of September, 1996.

| |

|

| |

/s/ A.

Edward Allinson |

| |

A. Edward Allinson |

| |

|

| |

/s/ Joseph

L. Hooley |

| |

Joseph L. Hooley |

| |

|

| |

/s/ John

R. Towers |

| |

John R. Towers |

| |

|

| |

/s/ Edward

A. O’Neal |

| |

Edward A. O’Neal |

| |

|

| |

/s/ Susannah

Swihart |

| |

Susannah Swihart |

| |

|

| |

/s/ Joanne

E. Nuzzo |

| |

Joanne E. Nuzzo |

Boston EquiServe

Trust Company, N.A.

Shareholder’s

Meeting

January 19,

1999

Minutes

Pursuant

to notice duly given, a meeting of the shareholders of Boston EquiServe Trust Company, N.A. (the “Trust Company”)

was held on January 19, 1999 at 3:00 p.m. (Eastern Time) at its offices located at 150 Royall Street, Canton, Massachusetts.

Attending

were Christopher Skaar, Chief Executive Officer of EquiServe Limited Partnership (formerly known as Boston EquiServe Limited Partnership)(“EquiServe”)

and Stephen Cesso, Secretary of the Trust Company.

1. Approval

of Amendment to Articles of Association. Christopher Skaar, as Chief Executive Officer of EquiServe, the sole shareholder

of the Trust Company approved the following amendment to the Articles of Association of the Trust Company to change the name of

the Trust Company:

VOTED,

that the First Article of the Articles of Association is amended to read:

The

title of this Association shall be EquiServe Trust Company, National Association.

The meeting concluded with

the approval of the above vote. There being no other items for discussion, the shareholder meeting was adjourned at approximately

3:05 p.m. (Eastern Time).

| |

|

/s/ Stephen

Cesso |

|

| Stephen Cesso |

|

| Secretary |

|

EquiServe

Trust Company, N.A.

VIA FEDERAL EXPRESS

November 22, 2005

Ms. Kathleen M. Cahill

Assistant Deputy Comptroller

The Office of the Comptroller of

the Currency

New England Field Office

20 Winthrop Square, Suite 200

Boston, MA 02110

Re: EquiServe

Trust Company, N.A.

Dear Ms. Cahill:

This serves as notification

to The Office of the Comptroller of the Currency that EquiServe Trust Company, National Association has amended its Articles of

Association to change its name to Computershare Trust Company, National Association (the “Trust Company”), effective

January 1, 2006. Enclosed are minutes from the Trust Company’s shareholder meeting held on November 17, 2005 at

which the Articles of Association were amended to reflect the name change, certified by the Secretary of the Trust Company.

Please let me know if you

have any questions or need any additional information.

Very truly yours,

| |

|

/s/ Andrea

Manning |

|

| Andrea Manning |

|

| Assistant Secretary |

|

| |

|

| Enclosure |

|

cc: James Mayhew, Portfolio

Manager, OCC (w/encl.)

Stephen Cesso

(w/out encl.)

EquiServe

Trust Company, N.A., 150 Royall Street, Canton, MA 02021

EquiServe

Trust Company, N.A.

Shareholder’s

Meeting

November 17,

2005

Minutes

Pursuant

to notice duly given, a meeting of the shareholders of EquiServe Trust Company, N.A. (the “Trust Company”) was held

on November 17, 2005 at 1:20 p.m. (Eastern Time) at its offices located at 250 Royall Street, Canton, Massachusetts.

Attending

were Charles V. Rossi, President of Computershare Shareholder Services, Inc. (formerly known as EquiServe, Inc., formerly known

as EquiServe Limited Partnership, hereinafter “CSSI”), Andrea Manning, Assistant Secretary and Stephen Cesso, Secretary

of the Trust Company.

1. Approval

of Amendment to Articles of Association. Charles V. Rossi, as President of CSSI, the sole shareholder of the Trust Company

approved the following amendment to the Articles of Association of the Trust Company to change the name of the Trust Company,

to be effective January 1, 2006.

VOTED,

that the First Article of the Articles of Association is amended to read:

The

title of this Association shall be Computershare Trust Company, National Association.

The meeting concluded with

the approval of the above vote. There being no other items for discussion, the shareholder meeting was adjourned at approximately

1:25 p.m. (Eastern Time).

| |

|

|

/s/ Stephen

Cesso |

|

/s/

Andrea Manning |

| Stephen Cesso |

|

Andrea Manning |

| Secretary |

|

Assistant Secretary |

EXHIBIT 2

A copy of the Comptroller

of the Currency Certificate of Corporate Existence for Computershare Trust Company, National Association, dated October 5, 2021.

EXHIBIT 3

A copy of the Comptroller

of the Currency Certification of Fiduciary Powers for Computershare Trust Company, National Association, dated October 5, 2021.

EXHIBIT 4

BYLAWS

OF THE TRUSTEE

BOSTON EQUISERVE

TRUST COMPANY,

NATIONAL

ASSOCIATION

BY-LAWS

ARTICLE

I

Meetings

of Shareholders

Section 1.1

Annual Meeting. The regular annual meeting of the shareholders to elect directors and transact whatever other business

may properly come before the meeting, shall be held at the Main Office of the National Trust Company, in the Town of Canton, Commonwealth

of Massachusetts or such other places as the Board of Directors may designate, at 10 o’clock, on the fourth Wednesday of

May of each year. Notice of such meeting shall be mailed, postage prepaid, at least ten days prior to the date thereof, addressed

to each shareholder at his/her address appearing on the books of the National Trust Company. If, for any cause, an election of

directors is not made on that day, the Board of Directors shall order the election to be held on some subsequent day, as soon

thereafter as practicable, according to the provisions of law; and notice thereof shall be given in the manner herein provided

for the annual meeting.

Section 1.2.

Special Meetings. Except as otherwise specifically provided by statute, special meetings of the shareholders may be called

for any purpose at any time by the Board of Directors or by any shareholder owning, in the aggregate, not less than 10 percent

of the stock of the National Trust Company. Every such special meeting, unless otherwise provided by law, shall be called by mailing,

postage prepaid, not less than ten days prior to the date fixed for such meeting, to each shareholder at his address appearing

on the books of the National Trust Company a notice stating the purpose of the meeting.

Section 1.3.

Nominations for Director. Nominations for election to the Board of Directors may be made by the Board of Directors or by

any shareholder of any outstanding class of capital stock of the National Trust Company entitled to vote for the election of directors.

Nominations, other than those made by or on behalf of the existing management of the National Trust Company, shall be made in

writing and shall be delivered or mailed to the President of the National Trust Company and to the Comptroller of the Currency,

Washington, D.C., not less than 14 days nor more than 50 days prior to any meeting of shareholders called for the election

of directors, provided however, that if less than 21 days’ notice of the meeting is given to shareholders, such nomination

shall be mailed or delivered to the President of the National Trust Company and to the Comptroller of the Currency not later than

the close of business on the seventh day following the day on which the notice of meeting was mailed. Such notification shall

contain the following information to the extent known to the notifying shareholder:

(a) the

name and address of each proposed nominee; (b) the principal occupation of each proposed nominee; (c) the total number

of shares of capital stock of the National Trust Company that will be voted for each proposed nominee; (d) the name and residence

address of the notifying shareholder; and (e) the number of shares of capital stock of the National Trust Company owned by

the notifying shareholder. Nominations not made in accordance herewith may, in his/her discretion, be disregarded by the Chairperson

of the meeting, and upon his/her instructions, the vote tellers may disregard all votes cast for each such nominee.

Section 1.4.

Proxies. Shareholders may vote at any meeting of the shareholders by proxies duly authorized in writing, but no officer

or employee of this National Trust Company shall act as proxy. Proxies shall be valid only for one meeting, to be specified therein,

and any adjournments of such meeting. Proxies shall be dated and shall be filed with the records of the meeting.

Section 1.5.

Quorum. A majority of the outstanding capital stock, represented in person or by proxy, shall constitute a quorum at any

meeting of shareholders, unless otherwise provided by law; but less than a quorum may adjourn any meeting, from time to time,

and the meeting may be held, as adjourned, without further notice. A majority of the votes cast shall decide every question or

matter submitted to the shareholders at any meeting, unless otherwise provided by law or by the Articles of Association.

ARTICLE II

Directors

Section 2.1

Board of Directors. The Board of Directors shall have the power to manage and administer the business and affairs of the

National Trust Company. Except as expressly limited by law, all corporate powers of the National Trust Company shall be vested

in and may be exercised by the Board of Directors.

Section 2.2

Number. The Board of Directors shall consist of not less than five nor more than twenty-five shareholders, the exact number

within such minimum and maximum limits to be fixed and determined from time to time by resolution of a majority of the full Board

or by resolution of the shareholders at any meeting thereof.

Section 2.3.

Organization Meeting. The Cashier, upon receiving the results of any election, shall notify the directors-elect of their

election and of the time at which they are required to meet at the Main Office of the National Trust Company to organize the new

Board and elect and appoint officers of the National Trust Company for the succeeding year. Such meeting shall be held on the

day of the election or as soon thereafter as practicable, and, in any event, within thirty days thereof. If, at the time fixed

for such meeting, there shall not be a quorum present, the Directors present may adjourn the meeting, from time to time, until

a quorum is obtained.

Section 2.4.

Regular Meetings. Regular Meetings of the Board of Directors shall be held, without notice, at least once in each quarter

on such days and at such hours as the Directors may from time to time determine. When any regular meeting of the Board falls upon

a holiday, the meeting shall be held on the next banking business day unless the Board shall designate some other day.

Section 2.5.

Special Meetings. Special meetings of the Board of Directors may be called by the Chairman of the Board of the National

Trust Company, or at the request of three or more directors. Each member of the Board of Directors shall be given notice stating

the time and place, by telegram, letter, or in person, of each such special meeting.

Section 2.6.

Quorum. A majority of the directors shall constitute a quorum at any meeting, except when otherwise provided by law; but

a less number may adjourn any meeting, from time to time, and the meeting may be held, as adjourned, without further notice.

Section 2.7.

Vacancies. When any vacancy occurs among the directors, the remaining members of the Board, in accordance with the laws

of the United States, may appoint a director to fill such vacancy at any regular meeting of the Board, or at a special meeting

called for that purpose in conformance with Section 2.2 of this Article.

Section 2.8.

Action Without a Meeting. Any action required or permitted to be taken at any meeting of the Directors may be taken without

a meeting if all the Directors consent to the action in writing and the written consents are filed with the records of the meetings

of the Directors. Such consents shall be treated for all purposes as a vote at a meeting.

Section 2.9.

Meeting by Telecommunications. Members of the Board of Directors or any committee elected thereby may participate in a

meeting of such Board or committee by means of a conference telephone or similar communications equipment by means of which all

persons participating in a meeting can hear each other at the time and participation by such means shall constitute presence in

person at the meeting.

ARTICLE

III

Committees

of the Board

Section 3.1. Investment

Committee. There shall be an Investment Committee composed of not less than two Directors, appointed by the Board

annually or more often. The Investment Committee shall have the power to insure adherence to Investment Policy, to

recommend amendments thereto, to purchase and sell securities, to exercise authority regarding investments and to

exercise, when the Board is not in session, all other powers of the Board regarding investment securities that may be

lawfully delegated. The Investment Committee shall keep minutes of its meetings, and such minutes shall be submitted at the

next regular meeting of the Board of Directors at which a quorum is present, and any action taken by the Board with respect

thereto shall be entered in the minutes of the Board.

Section 3.2.

Examining Committee. There shall be an Examining Committee composed of not less than two directors, exclusive of any active

officers, appointed by the Board annually or more often, whose duty it shall be to make an examination at least once during each

calendar year and within 15 months of the last such examination into the affairs of the National Trust Company or cause suitable

examinations to be made by auditors responsible only to the Board of Directors and to report the result of such examination in

writing to the Board at the next regular meeting thereafter. Such report shall state whether the National Trust Company is in

a sound condition, and whether adequate internal controls and procedures are being maintained and shall recommend to the Board

of Directors such changes in the manner of conducting the affairs of the National Trust Company as shall be deemed advisable.

Section

3.3. Other Committees. The Board of Directors may appoint, from time to time, from its own members, other committees of

one or more persons, for such purposes and with such powers as the Board may determine. However, a committee may not authorize

distribution of assets or dividends; approve action required to be approved by shareholders; fill vacancies on the board of directors

or any of its committees; amend articles of association; adopt, amend or repeal by-laws; or authorize or approve issuance or sale

or contract for sale of shares, or determine the designation and relative rights, preferences and limitations of a class or series

of shares.

ARTICLE

IV

Officers

and Employees

Section 4.1.

Chairperson of the Board. The Board of Directors shall appoint one of its members to be Chairperson of the Board to serve

at its pleasure. Such person shall preside at all meetings of the Board of Directors. The Chairperson of the Board shall supervise

the carrying out of the policies adopted or approved by the Board; shall have general executive powers, as well as the specific

powers conferred by these Bylaws; and shall also have and may exercise such further powers and duties as from time to time may

be conferred upon, or assigned by the Board of Directors.

Section 4.2.

President. The Board of Directors shall appoint one of its members to be President of the National Trust Company. In the

absence of the Chairperson, the President shall preside at any meeting of the Board. The President shall have general executive

powers, and shall have and may exercise any and all other powers and duties pertaining by law, regulations, or practice, to the

Office of President, or imposed by these Bylaws. The President shall also have and may exercise such further powers and duties

as from time to time may be conferred, or assigned by the Board of Directors.

Section 4.3.

Vice President. The Board of Directors may appoint one or more Vice Presidents. Each Vice President shall have such powers

and duties as may be assigned by the Board of Directors. One Vice President shall be designated by the Board of Directors, in

the absence of the President, to perform all the duties of the President.

Section 4.4.

Secretary. The Board of Directors shall appoint a Secretary, Cashier, or other designated officer who shall be Secretary

of the Board and of the National Trust Company, and shall keep accurate minutes of all meetings. The Secretary shall attend to

the giving of all notices required by these Bylaws to be given; shall be custodian of the corporate seal, records, documents and

papers of the National Trust Company; shall provide for the keeping of proper records of all transactions of the National Trust

Company; shall have and may exercise any and all other powers and duties pertaining by law, regulation or practice, to the Office

of Cashier, or imposed by these Bylaws; and shall also perform such other duties as may be assigned from time to time, by the

Board of Directors.

Section 4.5.

Other Officers. The Board of Directors may appoint one or more Executive Vice Presidents, Senior Vice Presidents, Assistant

Vice Presidents, one or more Assistant Secretaries, one or more Assistant Cashiers, one or more Managers and Assistant Managers

of offices and such other officers and attorneys in fact as from time to time may appear to the Board of Directors to be required

or desirable to transact the business of the National Trust Company. Such officers shall respectively exercise such powers and

perform such duties as pertain to the several offices, or as may be conferred upon, or assigned to, them by the Board of Directors,

the Chairperson of the Board, or the President. The Board of Directors may authorize an officer to appoint one or more officers

or assistant officers.

Section 4.6.

Tenure of Office. The President and all other officers shall hold office for the current year for which the Board was elected,

unless they shall resign, become disqualified, or be removed; and any vacancy occurring in the Office of President shall be filled

promptly by the Board of Directors.

Section 4.7.

Resignation. An officer may resign at any time by delivering notice to the National Trust Company. A resignation is effective

when the notice is given unless the notice specifies a later effective date.

ARTICLE

V

Fiduciary

Activities

Section 5.1.

Trust Department. There shall be a department of the National Trust Company known as the Trust Department that shall perform

the fiduciary responsibilities of the National Trust Company.

Section 5.2.

Trust Officer. There shall be a Trust Officer of this National Trust Company whose duties shall be to manage, supervise

and direct all the activities of the Trust Department. Such persons shall do or cause to be done all things necessary or proper

in carrying on the business of the Trust Department according to provisions of law and applicable regulations; and shall act pursuant

to opinion of counsel where such opinion is deemed necessary. Opinions of counsel shall be retained on file in connection with

all important matters pertaining to fiduciary activities. The Trust Officer shall be responsible for all assets and documents

held by the National Trust Company in connection with fiduciary matters.

The Board

of Directors may appoint other trust officers of the Trust Department, as it may deem necessary, with such duties as may be assigned.

Section 5.3.

Trust Investment Committee. There shall be a Trust Investment Committee of this National Trust Company composed of not

less than two members, who shall be capable and experienced officers or directors of the National Trust Company. All investments

of funds held in a fiduciary capacity shall be made, retained or disposed of only with the approval of the Trust Investment Committee,

and the Committee shall keep minutes of all its meetings, showing the disposition of all matters considered and passed upon by

it. The Committee shall, promptly after the acceptance of an account for which the National Trust Company has investment responsibilities,

review the assets thereof, to determine the advisability of retaining or disposing of such assets. The Committee shall conduct

a similar review at least once during each calendar year thereafter and within 15 months of the last such review. A report

of all such reviews, together with the action taken as a result thereof, shall be noted in the minutes of the Committee.

Section 5.4.

Trust Audit Committee. The Board of Directors shall appoint a committee of not less than two directors, exclusive of any

active officer of the National Trust Company, which shall, at least once during each calendar year and within 15 months of

the last such audit make suitable audits of the Trust Department or cause suitable audits to be made by auditors responsible only

to the Board of Directors, and at such time shall ascertain whether the Department has been administered according to law, Part 9

of the Regulations of the Comptroller of the Currency, and sound fiduciary principles.

Section 5.5.

Fiduciary Files. There shall be maintained in the Trust Department files all fiduciary records necessary to assure that

its fiduciary responsibilities have been properly undertaken and discharged.

Section 5.6. Trust

Investments. Funds held in a fiduciary capacity shall be invested according to the instrument establishing the

fiduciary relationship and local law. Where such instrument does not specify the character and class of investments to

be made and does not vest in the National Trust Company a discretion in the matter, funds held pursuant to such instrument

shall be invested in investments in which corporate fiduciaries may invest under local law.

ARTICLE

VI

Stock

and Stock Certificates

Section 6.1.

Transfers. Shares of stock shall be transferable on the books of the National Trust Company, and a transfer book shall

be kept in which all transfers of stock shall be recorded. Every person becoming a shareholder by such transfer shall, in proportion

to his shares, succeed to all rights of the prior holder of such shares.

Section 6.2.

Stock Certificates. Certificates of stock shall bear the signature of the President (which may be engraved, printed or

impressed), and shall be signed manually or by facsimile process by the Secretary, Assistant Secretary, Cashier, Assistant Cashier,

or any other officer appointed by the Board of Directors for that purpose, to be known as an Authorized Officer, and the seal

of the National Trust Company shall be engraved thereon. Each certificate shall recite on its face that the stock represented

thereby is transferable only upon the books of the National Trust Company properly endorsed.

ARTICLE

VII

Corporate

Seal

The President,

the Cashier, the Secretary or any Assistant Cashier or Assistant Secretary, or other officer thereunto designated by the Board

of Directors, shall have authority to affix the corporate seal to any document requiring such seal, and to attest the same. Such

seal shall be substantially in the following form:

ARTICLE

VIII

Miscellaneous

Provisions

Section 8.1.

Fiscal Year. The Fiscal Year of the National Trust Company shall be the calendar year.

Section 8.2.

Execution of Instruments. All agreements, indentures, mortgages, deeds, conveyances, transfers, certificates, declarations,

receipts, discharges, releases, satisfactions, settlements, petitions, schedules, accounts, affidavits, bonds, undertakings, proxies

and other instruments or documents may be signed, executed, acknowledged, verified, delivered or accepted in behalf of the National

Trust Company by the Chairperson of the Board, or the President, or any Executive Vice President, or any Vice President, or the

Secretary, or the Cashier. Any such instruments may also be executed, acknowledged, verified, delivered or accepted in behalf

of the National Trust Company in such other manner and by such other officers as the Board of Directors may from time to time

direct. The provisions of this Section 8.2. are supplementary to any other provision of these Bylaws.

Section 8.3.

Records. The Articles of Association, the By-laws and the proceedings of all meetings of the shareholders, the Board of

Directors, and standing committees of the Board, shall be recorded in appropriate minute books provided for the purpose. The minutes

of each meeting shall be signed by the Secretary, Cashier or other Officer appointed to act as Secretary of the meeting.

ARTICLE

IX

By-laws

Section 9.1

Inspection. A copy of the By-laws, with all amendments thereto, shall at all times be kept in a convenient place at the

Main Office of the National Trust Company, and shall be open for inspection to all shareholders, during banking hours.

Section 9.2.

Amendments. The By-laws may be amended, altered or repealed, at any regular meeting of the Board of Directors, by a vote

of a majority of the total number of the Directors.

I, Evalyn

Lipton Fishbein, CERTIFY that: (1) I am the duly constituted Secretary of Boston EquiServe Trust Company, National Association

and Secretary of its Board of Directors, and as such officer am the official custodian of its records; (2) the foregoing

By-laws are the By-laws of said National Trust Company, and all of them are now lawfully in force and effect.

I have

hereunto affixed my official signature and the seal of the said National Trust Company, in the City of Boston on this 18th day

of December, 1996.

| |

|

| |

/s/

Evalyn Lipton Fishbein |

| |

Secretary |

EQUISERVE

TRUST COMPANY, N.A. (THE “TRUST COMPANY”)

ACTION BY

THE BOARD OF DIRECTORS

May 14,

2003

RESOLVED, that the

Trust Company hereby deletes Section 3.2 and Section 5.4 of the By-Laws and replaces such sections with the following

Section 3.2, and renumbers Section 5.5 and 5.6 as Section 5.4 and 5.5, respectively:

Section 3.2. Audit

Committee. The Board of Directors shall appoint an Audit Committee composed of not less than two directors, exclusive of any

active officers of the National Trust Company, whose duty it shall be to make an examination at least once during each calendar

year and within 15 months of the last such examination into the affairs of the National Trust Company, including the Trust

Department, or cause suitable examinations to be made by auditors responsible only to the Board of Directors and to report the

result of such examination in writing to the Board at the next regular meeting thereafter. Such report shall state whether adequate

internal controls and procedures are being maintained, whether the Trust Department has been administered according to law, Part 9

of the Regulations of the Comptroller of the Currency, and sound fiduciary principles, and shall recommend to the Board of Directors

such changes in the manner of conduct of the affairs of the National Trust Company as shall be deemed advisable.

I, Andrea Manning, Assistant

Secretary of EquiServe Trust Company, N.A., a national banking association do hereby certify that the foregoing is a true and

correct copy of a resolution approved by the Board of Directors at a meeting held on May 14, 2003. I further certify that

the resolution is in full force and effect and has not been revoked.

| |

|

|

|

| |

/s/ Andrea Manning |

|

June 11, 2003 |

| |

Andrea Manning |

|

|

Computershare

Trust Company, N.A.

ACTION BY

THE BOARD OF DIRECTORS

December 7,

2011

RESOLVED, that the

Board of Directors hereby approves amending section 3.2. of the By-Laws of the Trust Company as follows:

Changing the title

of Section 3.2. from “Audit Committee” to “Audit and Risk Committee,” and changing

all references to the “Audit Committee” in Section 3.2. to the “Audit and Risk Committee.”

I, Andrea Manning, Assistant

Secretary of Computershare Trust Company, N.A., a national banking association do hereby certify that the foregoing is a true

and correct copy of a resolution approved by the Board of Directors at a meeting held on December 7, 2011. I further certify

that the resolution is in full force and effect and has not been revoked.

| |

|

|

|

| |

/s/

Andrea Manning |

|

Date: December 8, 2011 |

| |

Andrea Manning |

|

|

| |

Assistant Secretary |

|

|

Computershare

Trust Company, N.A.

ACTION BY

THE BOARD OF DIRECTORS

June 29, 2022

RESOLVED, that the

Board of Directors hereby approves amending the By-Laws of the Trust Company as follows:

Changing the title

of Section 3.1. from “Investment Committee” to “Finance Committee”; and

Changing the title

of Section 5.3 from “Trust Investment Committee” to “Trust and Investment Committee.”

I, Andrea Manning, Assistant

Secretary of Computershare Trust Company, N.A., a national banking association do hereby certify that the foregoing is a true

and correct copy of a resolution approved by the Board of Directors at a meeting held on June 29, 2022. I further certify that

the resolution is in full force and effect and has not been revoked.

| |

|

|

|

| |

/s/

Andrea Manning |

|

Date: June 30, 2022 |

| |

Andrea Manning |

|

|

| |

Assistant Secretary |

|

|

Computershare

Trust Company, N.A.

ACTION BY

THE BOARD OF DIRECTORS

October 12,

2022

RESOLVED, that the

Board of Directors hereby approves amending the By-Laws of the Trust Company as follows:

Removing Section 3.1.

entitled “Finance Committee”; and

Renumbering Section

3.2 and 3.3, to 3.1 and 3.2 respectively.

Changing the title

of Section 3.1 from “Audit and Risk Committee” to “Audit Committee” and adding the following

to Section 3.1:

The

Audit Committee shall have the power to ensure adherence to the Investment Policy, to recommend amendments thereto, to purchase

and sell securities, to exercise authority regarding investments and to exercise, when the Board is not in session, all other

powers of the Board regarding investment securities that may be lawfully delegated. The Audit Committee shall keep minutes of

its meetings, and such minutes shall be submitted at the next regular meeting of the Board of Directors at which a quorum is present,

and any action taken by the Board with respect thereto shall be entered in the minutes of the Board.

I, Andrea Manning, Assistant

Secretary of Computershare Trust Company, N.A., a national banking association do hereby certify that the foregoing is a true

and correct copy of a resolution approved by the Board of Directors at a meeting held on October 12, 2022. I further certify that

the resolution is in full force and effect and has not been revoked.

| |

|

|

|

| |

/s/

Andrea Manning |

|

Date: October

13, 2022 |

| |

Andrea Manning |

|

|

| |

Assistant Secretary |

|

|

EXHIBIT 6

CONSENT

OF THE TRUSTEE

Pursuant to

the requirements of Section 321 (b) of the Trust Indenture Act of 1939, and in connection with the proposed issue of

debt securities, Computershare Trust Company, National Association, hereby consents that reports of examinations by Federal, State,

Territorial or District authorities may be furnished by such authorities to the Securities and Exchange Commission upon request

therefore.

| |

COMPUTERSHARE TRUST COMPANY,

NATIONAL ASSOCIATION

|

| |

By: |

/s/ Maddy

Hughes |

| |

Name: |

Maddy Hughes |

| |

Title: |

Vice President |

| |

|

|

Minneapolis, Minnesota

November 7, 2022

EXHIBIT 7

Consolidated Report of Condition of

Computershare

TRUST COMPANY, NATIONAL ASSOCIATION

150 Royall Street,

Canton, MA 02021

at the close

of business June 30, 2022.

| ASSETS | |

Dollar Amounts

In Thousands | |

| | |

| |

| Cash and balances due from depository institutions: | |

| | |

| Noninterest-bearing balances and currency and coin | |

| -0- | |

| Interest-bearing balances | |

| -0- | |

| Securities: | |

| | |

| Held-to-maturity securities | |

| -0- | |

| Available-for-sale securities | |

| 288,298 | |

| Federal funds sold and securities purchased under agreements to resell: | |

| | |

| Federal funds sold in domestic offices | |

| -0- | |

| Securities purchased under agreements to resell | |

| -0- | |

| Loans and lease financing receivables: | |

| | |

| Loans and leases held for sale | |

| -0- | |

| Loans and leases, net of unearned income | |

| -0- | |

| LESS: Allowance for loan and lease losses | |

| -0- | |

| Loans and leases, net of unearned income and

allowance | |

| -0- | |

| Trading assets | |

| -0- | |

| Premises and fixed assets (including capitalized leases) | |

| 23,841 | |

| Other real estate owned | |

| -0- | |

| Investments in unconsolidated subsidiaries and associated companies | |

| -0- | |

| Direct and indirect investments in real estate ventures | |

| -0- | |

| Intangible assets: | |

| | |

| Goodwill | |

| 134,625 | |

| Other intangible assets | |

| 562,813 | |

| Other assets | |

| 101,542 | |

| Total assets | |

| 1,111,119 | |

| LIABILITIES | |

| | |

| Deposits: | |

| | |

| In domestic offices | |

| -0- | |

| Noninterest-bearing | |

| -0- | |

| Interest-bearing | |

| -0- | |

| Federal funds purchased and securities sold under agreements to repurchase: | |

| | |

| Federal funds purchased in domestic offices | |

| -0- | |

| Securities sold under agreements to repurchase | |

| -0- | |

| Trading liabilities | |

| -0- | |

Other borrowed money:

(includes mortgage indebtedness and obligations under capitalized leases) | |

| -0- | |

| Not applicable | |

| | |

| Not applicable | |

| | |

| Subordinated notes and debentures | |

| -0- | |

| Other liabilities | |

| 179,762 | |

| Total liabilities | |

| 179,762 | |

| EQUITY CAPITAL | |

| | |

| Perpetual preferred stock and related surplus | |

| 0 | |

| Common stock | |

| 500 | |

| Surplus (exclude all surplus related to preferred stock) | |

| 827,224 | |

| Retained earnings | |

| 103,633 | |

| Accumulated other comprehensive income | |

| -0- | |

| Other equity capital components | |

| -0- | |

| Total bank equity capital | |

| 931,357 | |

| Noncontrolling (minority) interests in consolidated subsidiaries | |

| -0- | |

| Total equity capital | |

| 931,357 | |

| Total liabilities and equity capital | |

| 1,111,119 | |

I, Robert G. Marshall,

Assistant Controller of the above-named bank do hereby declare that this Report of Condition is true and correct to the best of

my knowledge and belief.

| |

Robert

G. Marshall |

| |

|

| |

Robert

G. Marshall |

| |

Assistant Controller |

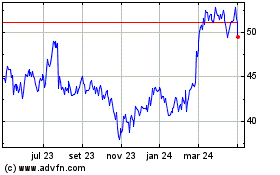

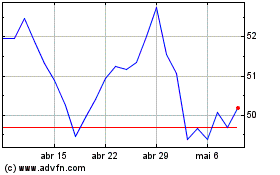

eBay (NASDAQ:EBAY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

eBay (NASDAQ:EBAY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024