Current Report Filing (8-k)

10 Novembro 2022 - 8:05AM

Edgar (US Regulatory)

0000883569

false

0000883569

2022-11-08

2022-11-08

0000883569

us-gaap:CommonStockMember

2022-11-08

2022-11-08

0000883569

fosl:Notes7.00PercentSeniorDue2026Member

2022-11-08

2022-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 8, 2022

FOSSIL GROUP,

INC.

(Exact name of registrant as specified in its charter)

Delaware |

001-41040 |

75-2018505 |

(State or other jurisdiction of

incorporation or organization) |

(Commission File

Number) |

(IRS Employer

Identification No.) |

901 S. Central Expressway

Richardson, Texas

(Address of principal executive offices) |

75080

(Zip Code) |

Registrant’s telephone number, including area code (972) 234-2525

(Former name or former address, if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

FOSL |

|

The Nasdaq Stock Market LLC |

| 7.00% Senior Notes due 2026 |

|

FOSLL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On November 8, 2022,

Fossil Group, Inc. (the “Company”) entered into Amendment No. 4 (the “Amendment”) to the Credit Agreement,

dated as of September 26, 2019 among the Company, as a U.S. borrower and borrower representative, certain subsidiaries of the Company

party thereto as borrowers and guarantors, JPMorgan Chase Bank, N.A., as administrative agent, and the other agents and lenders party

thereto. The Amendment, among other things, (i) extends the maturity date of the credit facility to November 8, 2027 (provided,

that if the Company has any indebtedness in an amount in excess of $35 million that matures prior to November 8, 2027, the maturity

date of the credit facility shall be the 91st day prior to the maturity date of such other indebtedness) and (ii) changes the calculation

methodology of the borrowing base to include the value of certain of the Company’s intellectual property in such methodology and

to provide for seasonal increases to certain advance rates.

From time to time, certain

of the lenders have provided, or may in the future provide, various investment banking, commercial banking, financial advisory, brokerage

and other services to the Company and its affiliates for which services they have received, and may in the future receive, customary fees

and expense reimbursement. The lenders and their affiliates may, from time to time, engage in transactions with and perform services for

the Company in the ordinary course of their business for which they may receive customary fees and reimbursement of expenses.

The foregoing description

of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy

of which is attached hereto as Exhibit 10.1 is incorporated by reference into this Item 1.01.

Item 9.01 Financial Statements and Exhibits.

| (d) |

Exhibits |

| |

|

| Exhibit No. |

Document Description |

| |

|

| 10.1 |

Amendment No. 4, dated as of November 8, 2022, among Fossil Group, Inc., Fossil Partners, L.P., Fossil Intermediate, Inc., Fossil Stores I, Inc., Fossil Trust, Fossil Group GmbH, Fossil Asia Pacific Limited, Fossil (Europe) GmbH, Fossil (UK) Limited, Fossil Canada Inc., Fossil France SAS, Fossil Stores France SAS, FAST Europe SARL, and JPMorgan Chase Bank, N.A., as administrative agent, and the other agents and lenders party thereto. |

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FOSSIL GROUP, INC. |

| |

|

| Date: November 10, 2022 |

By: |

/s/ Sunil M. Doshi |

| |

Name: |

Sunil M. Doshi |

| |

Title: |

Executive Vice President, Chief Financial Officer and Treasurer |

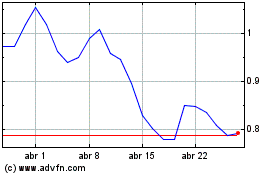

Fossil (NASDAQ:FOSL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Fossil (NASDAQ:FOSL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024