Current Report Filing (8-k)

14 Novembro 2022 - 7:52PM

Edgar (US Regulatory)

FALSE000006674000000667402022-11-102022-11-100000066740us-gaap:CommonStockMemberexch:XCHI2022-11-102022-11-100000066740us-gaap:CommonStockMemberexch:XNYS2022-11-102022-11-100000066740exch:XNYSmmm:Notes0950PercentDue2023Member2022-11-102022-11-100000066740mmm:Notes1500PercentDue2026Memberexch:XNYS2022-11-102022-11-100000066740exch:XNYSmmm:Notes1750PercentDue2030Member2022-11-102022-11-100000066740exch:XNYSmmm:Notes1.500PercentDue2031Member2022-11-102022-11-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 10, 2022

3M COMPANY

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

Delaware | | File No. 1-3285 | | 41-0417775 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

3M Center, St. Paul, Minnesota | | | | 55144-1000 |

(Address of Principal Executive Offices) | | | | (Zip Code) |

(Registrant’s Telephone Number, Including Area Code) (651) 733-1110

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, Par Value $.01 Per Share | | MMM | | New York Stock Exchange |

| | MMM | | Chicago Stock Exchange, Inc. |

0.950% Notes due 2023 | | MMM23 | | New York Stock Exchange |

1.500% Notes due 2026 | | MMM26 | | New York Stock Exchange |

1.750% Notes due 2030 | | MMM30 | | New York Stock Exchange |

1.500% Notes due 2031 | | MMM31 | | New York Stock Exchange |

Note: The common stock of the Registrant is also traded on the SWX Swiss Exchange.

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

On November 10, 2022, 3M Company entered into a $1.25 billion 364-day credit agreement (the “Credit Agreement”) with JPMorgan Chase Bank, N.A. as administrative agent, Citibank, N.A. as syndication agent, Deutsche Bank Securities Inc. and Bank of America, N.A. as documentation agents, and a syndicate of lenders as defined in the Credit Agreement.

Under the Credit Agreement, 3M pays a commitment fee of 0.025% per annum on the unused commitments. Advances denominated in U.S. Dollars carry, at 3M’s option, either the “base rate” of interest in effect plus the applicable margin, or (i) with respect to advances denominated in U.S. dollars, the “adjusted term SOFR rate” (which is the sum of the “term SOFR rate” plus 0.10%), and (ii) with respect to advances denominated in Euros, the “EURIBO rate” plus, in each of the foregoing clauses (i) and (ii), the applicable margin. The “base rate” of interest is the highest of (i) the Prime Rate as published in the Wall Street Journal, (ii) the Federal funds rate (but not less than 0%) plus 0.50%, or (iii) the “adjusted term SOFR rate” for one month (but not less than 0%) plus 1.00%. The applicable margin for advances bearing interest by reference to “adjusted term SOFR rate” or “EURIBO rate” is 0.75% per annum. The applicable margin for “base rate” advances is 0.00% per annum.

The Credit Agreement contains a provision under which 3M may, upon notice and payment of a fee equal to 0.50% of the principal amount of advances then outstanding, convert any advances outstanding on the maturity date into a term loan having a maturity one year later.

The Credit Agreement contains customary representations, warranties and covenants, including but not limited to covenants restricting 3M’s ability to incur certain liens or to merge or consolidate with another entity where 3M is not the surviving entity. Further, it contains a covenant requiring 3M to maintain an EBITDA to Interest Ratio as of the end of each quarter at not less than 3.0 to 1. This is calculated as the ratio of consolidated EBITDA for the four consecutive quarters then ended to interest payable on all funded debt for the same period.

The full terms and conditions of the credit facility are set forth in the Credit Agreement. A copy of the Credit Agreement is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

Some of the lenders named under the Credit Agreement and their affiliates have various relationships with 3M and its subsidiaries involving the provision of financial services, including cash management, investment banking, foreign exchange and trust services.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant

The information described above under “Item 1.01. Entry into a Material Definitive Agreement” with respect to the Credit Agreement is hereby incorporated by reference.

Item 8.01. Other Events

3M Company entered into Amendment No. 1, effective as of November 10, 2022, with JPMorgan Chase Bank, N.A., as administrative agent for the Banks as defined in the Amended and Restated Five-Year Credit Agreement, dated as of November 15, 2019 (the “Five-Year Credit Agreement”), to incorporate a successor rate to the LIBO Base Rate. The successor rate includes the “adjusted term SOFR rate” for advances denominated in U.S. dollars and the “EURIBO rate” for advances denominated in Euros.

A copy of Amendment No. 1 to the Five-Year Credit Agreement is filed as Exhibit 10.2 hereto and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

Exhibit Number | | Description of Exhibits |

| | |

| | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| 3M COMPANY |

| |

| By: | /s/ Michael M. Dai |

| | |

| | Michael M. Dai |

| | Vice President, Associate General Counsel & Secretary |

Dated: November 14, 2022

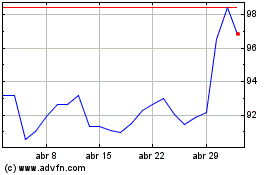

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024