UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section 14(d)(1) or

13(e)(1)

of the Securities Exchange Act of 1934

Atento S.A.

(Name of Subject Company (Issuer))

MCI, LC

MCI Capital, LC

(Names of Filing Persons (Offeror))

Ordinary Shares, no par value per share

(Title of Class of Securities)

L0427L204

(CUSIP Number of Class of Securities)

Mark Anthony Marlowe (Anthony Marlowe)

c/o MCI Capital, LC

2937 Sierra Ct. SW

Iowa City, IA 52240

Telephone: (319) 541-9694

(Name, address, and telephone numbers of person authorized

to receive notices and communications on behalf of filing persons)

With copies to:

Peter G. Smith

Kramer Levin Naftalis & Frankel LLP

1177 Avenue of the Americas

New York, New York 10036

(212) 715-9100

CALCULATION OF FILING FEE

| Transaction

Valuation* |

Amount

of Filing Fee** |

| $7,625,000 |

$840.28 |

| * |

The transaction valuation is estimated solely for purposes of calculating

the filing fee. The calculation assumes the purchase of 1,525,000 ordinary shares, no par value per share (the “Shares”),

of Atento S.A. (the “Company”), at a purchase price of $5.00 per Share, net to the seller in cash. |

| ** |

The amount of the filing fee is calculated in accordance with Rule 0-11

of the Securities Exchange Act of 1934, as amended, and Fee Rate Advisory for Fiscal Year 2023 issued by the Securities and

Exchange Commission, by multiplying the transaction valuation by 0.00011020. |

| ☐ |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

| |

|

| |

Amount Previously Paid: N/A |

Filing Party: N/A |

| |

Form or Registration No.: N/A |

Date Filed: N/A |

| ☐ |

Check the box if the filing relates solely to preliminary communications

made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions

to which the statement relates:

| |

☒ |

third-party tender offer subject to Rule 14d-1.

|

| |

☐ |

issuer tender offer subject to Rule 13e-4. |

| |

☐ |

going-private transaction subject to Rule 13e-3.

|

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Tender Offer Statement filed under cover of Schedule TO (the “Schedule

TO”) relates to the offer by MCI Capital, LC, an Iowa limited liability company (the “Offeror”), a wholly

owned subsidiary of MCI, LC, an Iowa limited liability company, to purchase up to 1,525,000 ordinary shares, no par value per share (the

“Shares”), of Atento S.A., a public limited liability company (societe anonyme) incorporated under the laws of Luxembourg

(the “Company”), at $5.00 per Share, net to the seller in cash, without interest and less any applicable tax withholding,

and on the other terms and subject to the other conditions specified in the Offer to Purchase, dated November 18, 2022 (the “Offer

to Purchase”), and in the related Letter of Transmittal, copies of which are attached hereto as Exhibits (a)(1)(i) and (a)(1)(ii),

respectively (which, together with any amendments or supplements thereto, collectively constitute the “Offer”).

On November 18, 2022, a summary advertisement with respect to the Offer

appeared in the New York Times. A copy of the summary advertisement is filed as Exhibit (a)(1)(vi) to this Schedule TO.

The information set forth in the Offer to Purchase, including all schedules

thereto, is hereby expressly incorporated herein by reference in response to all of the items of this Schedule TO, and is supplemented

by the information specifically provided herein, except as otherwise set forth below.

Item 1. Summary Term Sheet

Item 1001 of Regulation M-A

The information set forth in the Offer to Purchase under “Summary

Term Sheet” is incorporated herein by reference.

Item 2. Subject Company Information

Item 1002(a)-(c) of Regulation M-A

(a) The information set forth in the Offer to Purchase under “The

Offer—Section 8—Certain Information Concerning the Company” is incorporated herein by reference.

(b) The information set forth in the Offer to Purchase under “Introduction”

is incorporated herein by reference.

(c) The information set forth in the Offer to Purchase under “Summary

Term Sheet” and “The Offer—Section 6—Price Range of Shares; Dividends” is incorporated herein by reference.

Item 3. Identity and Background of Filing Person

Item 1003(a)-(c) of Regulation M-A

(a) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “The Offer—Section 9—Certain Information Concerning the Offeror” and “Schedule A—Information

Concerning the Executive Officers and Directors of Offeror and Certain Related Parties” is incorporated herein by reference.

(b) The information set forth in the Offer to Purchase under “The

Offer—Section 9—Certain Information Concerning the Offeror” is incorporated herein by reference.

(c) The information set forth in the Offer to Purchase under “The

Offer—Section 9—Certain Information Concerning the Offeror” and “Schedule A—Information Concerning the Executive

Officers and Directors of Offeror and Certain Related Parties” is incorporated herein by reference.

Item 4. Terms of the Transaction

Item 1004(a) of Regulation M-A

(a)(1)(i) The information set forth in the Offer to Purchase under “Summary

Term Sheet” and “Introduction” is incorporated herein by reference.

(a)(1)(ii) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction” and “The Offer—Section 10—Source and Amounts of Funds” is incorporated

herein by reference.

(a)(1)(iii) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction” and “The Offer—Section 1—Terms of the Offer” is incorporated herein

by reference.

(a)(1)(iv) The information set forth in the Offer to Purchase under “Summary

Term Sheet” is incorporated herein by reference.

(a)(1)(v) The information set forth in the Offer to Purchase under “Summary

Term Sheet” and “The Offer—Section 1—Terms of the Offer” is incorporated herein by reference.

(a)(1)(vi) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction” and “The Offer—Section 4—Withdrawal Rights” is incorporated herein

by reference.

(a)(1)(vii) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction,” “The Offer—Section 3—Procedure for Tendering Shares” and “The

Offer—Section 4—Withdrawal Rights” are incorporated herein by reference.

(a)(1)(viii) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction,” “The Offer—Section 1—Terms of the Offer,” “The Offer—Section

2—Acceptance for Payment and Payment for Shares” and “The Offer—Section 14—Conditions of the Offer”

is incorporated herein by reference.

(a)(1)(ix) Not applicable.

(a)(1)(x) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “The Offer—Section 12—Purpose of the Offer; Plans for the Company” and “The Offer—Section

7—Possible Effects of the Offer on the Market for the Shares” is incorporated herein by reference.

(a)(1)(xi) Not applicable.

(a)(1)(xii) The information set forth in the Offer to Purchase under “Summary

Term Sheet” and “The Offer—Section 5—Certain U.S. Federal Income Tax Consequences” is incorporated herein

by reference.

(a)(2)(i) The information set forth in the Offer to Purchase under “Summary

Term Sheet” and “Introduction” is incorporated herein by reference.

(a)(2)(ii) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction” and “The Offer—Section 2—Acceptance for Payment and Payment of Shares”

is incorporated herein by reference.

(a)(2)(iii) The information set forth in the Offer to Purchase under “The

Offer—Section 12—Purpose of the Offer; Plans for the Company” is incorporated herein by reference.

(a)(2)(iv) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction” and “The Offer—Section 11—Background of the Offer; Contacts with the Company”

is incorporated herein by reference.

(a)(2)(v) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “The Offer—Section 12—Purpose of the Offer; Plans for the Company” and “The Offer—Section

7—Possible Effects of the Offer on the Market for the Shares” is incorporated herein by reference.

(a)(2)(vi) Not applicable.

(a)(2)(vii) The information set forth in the Offer to Purchase under “Summary

Term Sheet” and “The Offer—Section 5—Certain U.S. Federal Income Tax Consequences” is incorporated herein

by reference.

Item 5. Past Contacts, Transactions, Negotiations and Agreements

Item 1005(a)-(b) of Regulation M-A

(a) The information set forth in the Offer to Purchase under “The

Offer—Section 11—Background of the Offer; Contacts with the Company” is incorporated herein by reference.

(b) The information set forth in the Offer to Purchase under “The

Offer—Section 11—Background of the Offer; Contacts with the Company” is incorporated herein by reference.

Item 6. Purposes of the Transaction and Plans or Proposals

Item 1006(a) and (c)(1)-(7)

(a) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction” and “The Offer—Section 12—Purpose of the Offer; Plans for the Company”

is incorporated herein by reference.

(c)(1) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction,” “The Offer—Section 11—Background of the Offer; Contacts with the Company”

and “The Offer—Section 12—Purpose of the Offer; Plans for the Company” is incorporated herein by reference.

(c)(2) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction” and “The Offer—Section 12—Purpose of the Offer; Plans for the Company”

is incorporated herein by reference.

(c)(3) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “The Offer—Section 12—Purpose of the Offer; Plans for the Company,” “The Offer—Section

6—Price Range of Shares; Dividends” and “The Offer—Section 13—Dividends and Distributions” is incorporated

herein by reference.

(c)(4) The information set forth in the Offer to Purchase under “The

Offer—Section 12—Purpose of the Offer; Plans for the Company” is incorporated herein by reference.

(c)(5) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction,” “The Offer—Section 12—Purpose of the Offer; Plans for the Company”

and “The Offer—Section 7—Possible Effects of the Offer on the Market for the Shares” is incorporated herein by

reference.

(c)(6) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction,” “The Offer—Section 12—Purpose of the Offer; Plans for the Company”

and “The Offer—Section 7—Possible Effects of the Offer on the Market for the Shares” is incorporated herein by

reference.

(c)(7) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction,” “The Offer—Section 12—Purpose of the Offer; Plans for the Company”

and “The Offer—Section 7—Possible Effects of the Offer on the Market for the Shares” is incorporated herein by

reference.

Item 7. Source and Amount of Funds or Other Consideration

Item 1007(a), (b) and (d) of Regulation M-A

(a) The information set forth in the Offer to Purchase under “Summary

Term Sheet” and “The Offer—Section 10—Source and Amount of Funds” is incorporated herein by reference.

(b) The information set forth in the Offer to Purchase under “The

Offer—Section 10—Source and Amounts of Funds” is incorporated herein by reference.

(d) The information set forth in the Offer to Purchase under “The

Offer—Section 10—Source and Amounts of Funds” is incorporated herein by reference.

Item 8. Interest in Securities of the Subject Company

Item 1008 of Regulation M-A

(a) The information set forth in the Offer to Purchase under “Introduction”

is incorporated herein by reference.

(b) The information set forth in the Offer to Purchase under “Introduction”

is incorporated herein by reference.

Item 9. Persons/Assets, Retained, Employed, Compensated or Used

Item 1009(a) of Regulation M-A

(a) The information set forth in the Offer to Purchase under “The

Offer—Section 16—Fees and Expenses” is incorporated herein by reference.

Item 10. Financial Statements.

Item 1010(a) and (b) of Regulation M-A

Not applicable.

Item 11. Additional Information

Item 1011 (a) and (c) of Regulation M-A

(a)(1) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction,” “The Offer—Section 12—Purpose of the Offer; Plans for the Company”

and “The Offer—Section 14—Conditions of the Offer” is incorporated herein by reference.

(a)(2) The information set forth in the Offer to Purchase under “Summary

Term Sheet,” “Introduction” and “The Offer—Section 15—Certain Legal Matters; Regulatory Approvals”

is incorporated herein by reference.

(a)(3) The information set forth in the Offer to Purchase under “Introduction,”

“The Offer—Section 15—Certain Legal Matters; Regulatory Approvals” is incorporated herein by reference.

(a)(4) The information set forth in the Offer to Purchase under “The

Offer—Section 7—Possible Effects of the Offer on the Market for the Shares” is incorporated herein by reference.

(a)(5) Not applicable.

(c) Not applicable.

Item 12. Exhibits

Item 1016(a), (b), (d), (g) and (h) of Regulation M-A

| (a)(1)(i) |

Offer to Purchase, dated November 18, 2022. |

| |

|

| (a)(1)(ii) |

Form of Letter of Transmittal. |

| |

|

| (a)(1)(iii) |

Form of Notice of Guaranteed Delivery. |

| |

|

| (a)(1)(iv) |

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| |

|

| (a)(1)(v) |

Form of Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| |

|

| (a)(1)(vi) |

Form of summary advertisement, published on November 18, 2022, in The New York Times. |

| |

|

| (a)(5)(i) |

Press release, issued on November 18, 2022. |

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: November 18, 2022

| |

MCI, LC |

| |

|

|

| |

By: |

/s/

Mark Anthony Marlowe |

| |

Name:

Title: |

Mark Anthony Marlowe

President and Chief Executive Officer |

| |

MCI CAPITAL, LC |

| |

|

| |

By: |

/s/

Mark Anthony Marlowe |

| |

Name:

Title: |

Mark Anthony Marlowe

President and Chief Executive Officer |

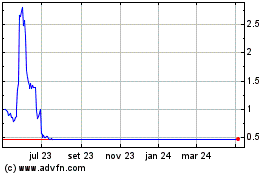

Atento (NYSE:ATTO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Atento (NYSE:ATTO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024