Current Report Filing (8-k)

03 Janeiro 2023 - 6:46PM

Edgar (US Regulatory)

0001167419

false

--12-31

0001167419

2022-12-30

2022-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): January 3, 2023 (December

30, 2022)

Riot

Platforms, Inc.

(Exact name of registrant

as specified in its charter)

| Nevada |

|

001-33675 |

|

84-1553387 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| |

3855

Ambrosia Street, Suite

301

Castle Rock, CO 80109 |

|

| |

(Address of principal executive offices) |

|

| |

(303) 794-2000 |

|

| |

(Registrant’s telephone number, including area code) |

|

Riot

Blockchain, Inc.

(Former name, former

address, and former fiscal year, if changed since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value per share |

|

RIOT |

|

Nasdaq Capital Market

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 – Entry into a Material Definitive Agreement

On December 30, 2022, Riot Blockchain, Inc. (the “Parent”)

entered into a plan of merger, (the “Plan of Merger”), with its recently formed wholly owned subsidiary, Riot Platforms, Inc.,

a Nevada corporation, (the “Merger Sub”), pursuant to which it was agreed that the Merger Sub would merge with and into the

Parent, (the “Merger”). Following the consummation of the Merger, the separate existence of Merger Sub would cease, and the

Parent would continue as the surviving corporation with the Parent’s name changed to Riot Platforms, Inc. (the “Company”).

Pursuant to the Plan of Merger, (i) the Parent’s

articles of incorporation in effect at the effective time of the Merger, as amended pursuant to the Articles of Merger (as defined below)

to change the name of the surviving corporation to Riot Platforms, Inc., remain the articles of incorporation of the surviving corporation,

(ii) the bylaws in effect at the effective time of the Merger remain the bylaws of the surviving corporation, and (iii) the directors

and officers of the Parent immediately prior to the effective time of the Merger remain the directors and officers of the surviving corporation.

The foregoing is a summary only and does not purport

to be a complete description of all terms, provisions, covenants, and agreements contained in the Plan of Merger, and is subject to and

qualified in its entirety by reference to the full text of the Plan of Merger, which is attached hereto as Exhibit 2.1 and incorporated

by reference herein.

Item 5.03 – Amendments to Articles of Incorporation.

Effective December 30, 2022, we filed articles of

merger (the “Articles of Merger”) with the Secretary of the state of Nevada to effect the Merger. The Articles of Merger provided

that Article I of our articles of incorporation was amended to change our name to Riot Platforms, Inc.

Pursuant to Nevada law, stockholder approval was not

required for the foregoing corporate actions.

The Company’s common stock will continue to

trade on the Nasdaq Capital Market under its existing symbol “RIOT”.

The foregoing is a summary only and does not purport

to be a complete description of all of the terms, provisions, covenants, and agreements contained in the Articles of Merger, and is subject

to and qualified in its entirety by reference to the full text of the Articles of Merger, which are attached hereto as Exhibit 3.1 and

incorporated by reference herein.

Item 7.01. – Regulation FD Disclosure.

We are furnishing the disclosure in this Item 7.01

in connection with the disclosure of information in the form of the textual information from a press release on January 3, 2023, announcing

our name change. The press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

The information in this Item 7.01 (including Exhibit

99.1) is furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This Current Report on Form 8-K will not be

deemed an admission as to the materiality of any information in the Report that is required to be disclosed solely by Regulation FD.

Cautionary Note Regarding Forward-Looking

Statements

Statements in this Report, including those made in

the Press Release attached as Exhibit 99.1 to this Report, that are not statements of historical fact may be forward-looking statements

that reflect management’s current expectations, assumptions and estimates of future performance and economic conditions. Such statements

are made in reliance on the safe harbor provisions of Section 27A of the Securities Act and Section 21E of the Exchange Act. Words such

as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,”

“potential,” “hope” and similar expressions are intended to identify forward-looking statements. The assumptions

and expectations expressed in these forward-looking statements are subject to various risks and uncertainties and, therefore, may never

materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such

forward-looking statements as a result of various risks and uncertainties. These forward-looking statements may include, but are not limited

to, statements about the benefits of our acquisitions, including our financial and operating results following these acquisitions, and

Riot’s plans, objectives, expectations and intentions for the future. Among the risks and uncertainties that could cause actual

results to differ from those expressed in forward-looking statements, include, without limitation, risks related to: our estimates of

bitcoin mining production are not audited; our future hash rate growth (expressed in terms of hashes per second); our anticipated benefits

of immersion-cooling, our expected schedule of new miner deliveries; our ability to successfully deploy the new bitcoin mining computers

we acquire; the timely completion of our expanded megawatt capacity under development; the integration of acquired businesses may not

be successful, or such integration may take longer or be more difficult, time-consuming or costly to accomplish than anticipated; failure

to otherwise realize anticipated efficiencies and strategic and financial benefits from our acquisitions; and the impact of COVID-19 on

us, our customers, or on our suppliers in connection with our estimated timelines. Detailed information regarding other factors that may

cause actual results to differ materially from those expressed or implied by statements in this Report, including the documents incorporated

by reference herein, may be found in The Company’s filings with the Securities Exchange Commission (the “SEC”), including

under sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of Riot’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and the additional risk factors set forth in Riot’s Current

Report on Form 8-K filed with the SEC on May 26, 2021, as well as the our other filings with the SEC, copies of which may be obtained

from the SEC’s website, www.sec.gov. All forward-looking statements included in this Report, including those made in the Press Release

attached as Exhibit 99.1 to this Report and in the other documents we file with the SEC, are made only as of the date of this Report and,

as applicable, the date of the other documents we file with the SEC. Riot disclaims any intention or obligation to update or revise any

forward-looking statements to reflect events or circumstances that subsequently occur, or of which Riot hereafter becomes aware, except

as required by law. Persons reading this Report, the Press Release, and the other documents we file with the SEC are cautioned not to

place undue reliance on such forward-looking statements.

Item 9.01– Financial Statements and

Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to

the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

| |

RIOT PLATFORMS, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Colin Yee |

| |

|

Name: Colin Yee |

| |

|

Title: Chief Financial Officer |

Date: January 3, 2023

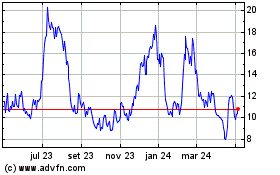

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

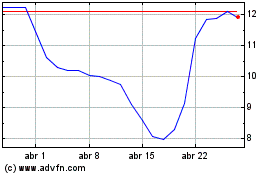

De Mar 2024 até Abr 2024

Riot Platforms (NASDAQ:RIOT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024