Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269090

PROSPECTUS

CELCUITY

INC.

24,347,754

SHARES OF COMMON STOCK BY THE SELLING STOCKHOLDERS

This

prospectus relates to the resale, from time to time, of up to an aggregate of 24,347,754 shares of common stock, par value $0.001 per

share, of Celcuity Inc. (“Celcuity,” “we,” “us,” or the “Company”) by the selling stockholders

named in this prospectus, including their respective donees, pledgees, transferees, assignees or other successors-in-interest.

On

May 15, 2022, we entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with the selling stockholders

for a private placement of shares of our common stock, shares of our Series A Convertible Preferred Stock, par value $0.001 per share

(the “Series A Preferred Stock”) and warrants that were initially exercisable for shares of Series A Preferred Stock (the

“Warrants”). The Warrants were subsequently adjusted to be exercisable for shares of our common stock following satisfaction

of a condition that the Company amend its Certificate of Incorporation to increase the aggregate authorized number of shares of capital

stock and the number of shares of common stock such that the Company has available, and has reserved, such number of its duly authorized

but unissued shares of common stock as shall be sufficient to effect the conversion of all shares of Series A Preferred Stock then outstanding

or available for issuance upon the exercise of the Warrants.

The

transactions contemplated by the Securities Purchase Agreement closed on December 9, 2022. The number of shares of common stock offered

for sale by the selling stockholders consists of (i) 6,182,574 shares of common stock purchased by the selling stockholders under the

Securities Purchase Agreement, (ii) 11,208,730 shares of common stock issuable upon conversion of the Series A Preferred Stock and (iii)

6,956,450 shares of common stock issuable upon exercise of the Warrants.

We

are not selling any shares of our common stock under this prospectus and will not receive any proceeds from sales of the shares offering

by the selling stockholders, although we will incur expenses in connection with the offering. The registration of the resale of the shares

of common stock covered by this prospectus does not necessarily mean that any of the shares will be offered or sold by the selling stockholders.

The timing and amount of any sales are within the sole discretion of the selling stockholders.

The

shares of common stock offered under this prospectus may be sold by the selling stockholders through public or private transactions,

at prevailing market prices or at privately negotiated prices. For more information on the times and manner in which the selling stockholders

may sell the shares of common stock under this prospectus, please see the section entitled “Plan of Distribution,” beginning

on page 14 of this prospectus.

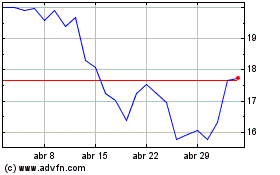

Our

common stock is traded on The Nasdaq Capital Market under the symbol “CELC.” On January 5, 2023, the closing

price of our common stock was $10.92.

Investing

in our securities involves risks. See “Risk Factors” on page 8. You should carefully read this prospectus, the documents

incorporated herein, and the applicable prospectus supplement before making any investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is January 12, 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is a part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (“SEC”),

under the Securities Act of 1933, as amended (“Securities Act”). Under this registration process, the selling stockholders

named in this prospectus may offer or sell shares of our common stock in one or more offerings from time to time. Each time the selling

stockholders named in this prospectus (or in any supplement to this prospectus) sells shares of our common stock under the registration

statement of which this prospectus is a part, such selling stockholders must provide a copy of this prospectus and any applicable prospectus

supplement, to a potential purchaser, as required by law (including by compliance with Rule 172 under the Securities Act).

In

certain circumstances we may provide a prospectus supplement that may add, update or change information contained in this prospectus.

Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by us in a prospectus

supplement. You should read both this prospectus and any prospectus supplement, including all documents incorporated herein or therein

by reference, together with additional information described under “Where You Can Find More Information” beginning on page

20 of this prospectus and “Incorporation of Certain Documents by Reference” beginning on page 20 of this prospectus.

Neither

we, nor the selling stockholders, have authorized any other person to provide you with different information. If anyone provides you

with different or inconsistent information, you should not rely on it. Neither we nor any of the selling stockholders will make an offer

to sell our common stock in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing

in this prospectus and any prospectus supplement is accurate as of the date on its respective cover, and that any information incorporated

by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial

condition, results of operations and prospects may have changed since those dates.

Unless

otherwise indicated, information contained in or incorporated by reference into this prospectus concerning our industry and the markets

in which we operate, including our general expectations and market position, market opportunity and market share, is based on information

from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted

by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions

based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s

future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, see “Risk Factors”

beginning on page 8 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions

and estimates. See “Cautionary Note Regarding Forward-Looking Statements” beginning on page 9 of this prospectus.

Unless

the context otherwise requires, “CELC,” the “Company,” “we,” “us,” “our”

and similar names refer to Celcuity Inc, and the term “common stock” refers to our common stock, par value $0.001 per share.

The phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement unless the context otherwise

requires.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering and selected information contained in this prospectus. This summary is

not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock.

For a more complete understanding of the Company and this offering, we encourage you to read and consider the more detailed information

included or incorporated by reference in this prospectus, including risk factors, see “Risk Factors” beginning on page 8

of this prospectus, and our most recent consolidated financial statements and related notes.

Company

Overview

We

are a clinical-stage biotechnology company focused on development of targeted therapies for treatment of multiple solid tumor indications.

Our lead therapeutic candidate is gedatolisib, a pan-PI3K/mTOR inhibitor. Its mechanism of action and pharmacokinetic properties are

highly differentiated from other currently approved and investigational therapies that target PI3K or mTOR alone or together. We initiated

VIKTORIA-1, a Phase 3 study evaluating gedatolisib in patients with HR+/HER2- advanced breast cancer in 2022. On December 7, 2022, the

first patient in the trial was dosed. In addition, we continue to develop our CELsignia companion diagnostic platform which is uniquely

able to analyze live patient tumor cells to identify new groups of cancer patients likely to benefit from already approved targeted therapies.

Gedatolisib

is a potent, well-tolerated, small molecule reversible dual inhibitor, administered intravenously, that selectively targets all class

I isoforms of PI3K and mammalian target of rapamycin (mTOR). In April 2021, we obtained exclusive global development and commercialization

rights to gedatolisib under a license agreement with Pfizer, Inc. We believe gedatolisib’s unique mechanism of action, differentiated

chemical structure, favorable pharmacokinetic properties, and intravenous formulation offer distinct advantages over currently approved

and investigational therapies that target PI3K or mTOR alone or together.

| |

● |

Overcomes

limitations of therapies that only inhibit a single class I PI3K isoform or only one mTOR kinase complex |

| |

|

|

| |

|

Gedatolisib

is a pan-class I isoform PI3K and mTOR inhibitor with low nanomolar potency for the p110α, p110β, p110γ, and p110δ

isoforms and mTORC1 and mTORC2 complexes. Each PI3K isoform and mTOR complex is known to preferentially affect different signal transduction

events that involve tumor cell survival, depending upon the aberrations associated with the linked pathway. When a therapy only inhibits

a single class I isoform (e.g., alpelisib, a PI3K-α inhibitor) or only one mTOR kinase complex (e.g., everolimus, an mTORC1

inhibitor), numerous feedforward and feedback loops between the PI3K isoforms and mTOR complexes cross-activates the uninhibited

sub-units. This, in turn, induces compensatory resistance that reduces the efficacy of isoform specific PI3K or single mTOR kinase

complex inhibitors. Inhibiting all four PI3K isoforms and both mTOR complexes, as gedatolisib does, thus prevents the confounding

effect of isoform interaction that may occur with isoform-specific PI3K inhibitors and the confounding interaction between PI3K isoforms

and mTOR. |

| |

|

|

| |

● |

Better

tolerated by patients than oral PI3K and mTOR drugs |

| |

|

|

| |

|

Gedatolisib

is administered intravenously (IV) on a four-week cycle of three weeks-on, one week-off, in contrast to the orally administered pan-PI3K

or dual PI3K/mTOR inhibitors that are no longer being clinically developed. Oral pan-PI3K or PI3K/mTOR inhibitors have repeatably

been found to induce significant side effects that were not well tolerated by patients. This typically leads to a high proportion

of patients requiring dose reductions or treatment discontinuation. The challenging toxicity profile of these drug candidates ultimately

played a significant role in the decisions to halt their development, despite showing promising efficacy. By contrast, gedatolisib

stabilizes at lower concentration levels in plasma compared to orally administered PI3K inhibitors, resulting in less toxicity, while

maintaining concentrations sufficient to inhibit PI3K/mTOR signaling. |

| |

|

|

| |

|

Isoform-specific

PI3K inhibitors administered orally were developed to reduce toxicities in patients. While the range of toxicities associated with

isoform-specific inhibitors is narrower than oral pan-PI3K or PI3K/mTOR inhibitors, administering them orally on a continuous basis

still leads to challenging toxicities. The experience with an FDA approved oral p110-α specific inhibitor, Piqray, illustrates

the challenge. In its Phase 3 pivotal trial Piqray was found to induce a Grade 3 or 4 adverse event (AE) related to hyperglycemia

in 39% of patients evaluated. In addition, 26% of patients discontinued alpelisib due to treatment related adverse events. By contrast,

in the 103-patient dose expansion portion of the Phase 1b clinical trial with gedatolisib, only 7% of patients experienced Grade

3 or 4 hyperglycemia and less than 10% discontinued treatment. |

As

of September 30, 2022, 492 patients with solid tumors have received gedatolisib in eight clinical trials sponsored by Pfizer. Of the

492 patients, 129 were treated with gedatolisib as a single agent in three clinical trials. The remaining 363 patients received gedatolisib

in combination with other anti-cancer agents in five clinical trials. Additional patients received gedatolisib in combination with other

anti-cancer agents in nine investigator sponsored clinical trials.

A

Phase 1b trial (B2151009) evaluating patients with HR+/HER2- metastatic breast cancer was initiated in 2016 and subsequently enrolled

138 patients. Nine patients from this study continue to receive study treatment, as of September 30, 2022, each of whom have received

study treatment for more than three years. The B2151009 clinical trial was an open label, multiple arm Phase 1b study that evaluated

gedatolisib in combination with palbociclib (CDK4/6 inhibitor) and fulvestrant or letrozole in patients with HR+/HER2- advanced breast

cancer. Thirty-five patients were enrolled in two dose escalation arms to evaluate the safety and tolerability and to determine the maximum

tolerated dose (MTD) of gedatolisib when used in combination with the standard doses of palbociclib and endocrine therapy (letrozole

or fulvestrant). The MTD was determined to be 180 mg administered intravenously once weekly. A total of 103 patients were subsequently

enrolled in one of four expansion arms (A, B, C, D).

High

objective overall response rates (ORR) were observed in all four expansion arms and were comparable in each arm for PIK3CA WT and PIK3CA

MT patients. In treatment-naïve patients (Arm A), ORR was 85%. In patients who received prior hormonal therapy alone or in combination

with a CDK4/6 inhibitor (Arms B, C, and D), ORR ranged from 36% to 77%. Each arm achieved its primary endpoint target, which was reporting

higher ORR in the study arm than ORR from either the PALOMA-2 (ORR=55%) study that evaluated palbociclib plus letrozole for Arm A or

the PALOMA-3 study (ORR=25%) that evaluated palbociclib plus fulvestrant for Arms B, C, and D. For all enrolled patients, a clinical

benefit rate (CBR) of ≥79% was observed. Median progression-free survival (PFS) was 12.9 months for patients who received a prior

CDK4/6 inhibitor and were treated in the study with the Phase 3 dosing schedule (Arm D).

Gedatolisib

combined with palbociclib and endocrine therapy demonstrated a favorable safety profile with manageable toxicity. The majority of treatment

emergent adverse events were Grade 1 and 2. The most frequently observed adverse events included stomatitis/mucosal inflammation, the

majority of which were Grade 1 and 2. The most common Grade 4 AEs were neutropenia and neutrophil count decrease, which were assessed

as related to treatment with palbociclib. No grade 5 events were reported in this study.

We

activated VIKTORIA-1, a Phase 3, open-label, randomized clinical trial to evaluate the efficacy and safety of two regimens in adults

with HR+/HER2- advanced breast cancer whose disease has progressed after prior CDK4/6 therapy in combination with an aromatase inhibitor:

1) gedatolisib in combination with palbociclib and fulvestrant; and 2) gedatolisib in combination with fulvestrant. Two hundred clinical

sites in North America, Europe, South America, Asia, and Australia have been selected to participate in the study. The first clinical

site was activated in the third quarter of 2022. The first dosage of a patient in the trial occurred on December 7, 2022.

The

clinical trial will enable separate evaluation of subjects according to their PIK3CA status. Subjects who meet eligibility criteria and

are PIK3CA WT will be randomly assigned (1:1:1) to receive a regimen of either gedatolisib, palbociclib, and fulvestrant (Arm A), gedatolisib

and fulvestrant (Arm B), or fulvestrant (Arm C). Subjects who meet eligibility criteria and are PIK3CA MT will be randomly assigned (3:3:1)

to receive a regimen of either gedatolisib, palbociclib, and fulvestrant (Arm D), alpelisib and fulvestrant (Arm E), or gedatolisib and

fulvestrant (Arm F).

Our

proprietary CELsignia diagnostic platform is the only commercially ready technology we are aware of that uses a patient’s living

tumor cells to identify the specific abnormal cellular process driving a patient’s cancer and the targeted therapy that best treats

it. This enables us to identify patients whose tumors may respond to a targeted therapy, even though they lack a previously associated

molecular mutation. By identifying cancer patients whose tumors lack an associated genetic mutation but have abnormal cellular activity

a matching targeted therapeutic is designed to inhibit, CELsignia CDx can expand the markets for a number of already approved targeted

therapies. Our current CDx identifies breast and ovarian cancer patients whose tumors have cancer drivers potentially responsive to treatment

with human epidermal growth factor receptor 2-negative (HER2), mesenchymal-epithelial transition factor (c-MET), or phosphatidylinositol

3-kinases (PI3K) targeted therapeutics. While U.S. Food and Drug Administration (“FDA”) approval or clearance is not currently

required for CELsignia tests offered as a stand-alone laboratory developed test, if we are partnered with a drug company to launch a

CELsignia test as a companion diagnostic for a new drug indication, we would be required to obtain premarket approval, or PMA, in conjunction

with the pharmaceutical company seeking a new drug approval for the matching therapy.

We

are supporting the advancement of new potential indications for four different targeted therapies, controlled by other pharmaceutical

companies, that would rely on a CELsignia CDx to select patients. Five Phase 2 trials are underway to evaluate the efficacy and safety

of these therapies in CELsignia selected patients. These patients are not currently eligible to receive these drugs and are not identifiable

with a molecular test.

Supporting

the development of a potential first-in-class targeted therapy for breast cancer, like gedatolisib, with our CELsignia platform is a

natural extension of our strategy to use our CELsignia CDx to enable new indications for other companies’ targeted therapies. By

combining companion diagnostics designed to enable proprietary new drug indications with targeted therapies that treat signaling dysregulation

our CDx identifies, we believe we are uniquely positioned to improve the standard-of-care for many early and late-stage breast cancer

patients. Our goal is to play a key role in the multiple treatment approaches required to treat breast cancer patients at various stages

of their disease. With each program, we are:

| |

● |

Leveraging

the proprietary insights CELsignia provides into live patient tumor cell function; |

| |

● |

Using

a CELsignia CDx to identify new patients likely to respond to the paired targeted therapy; |

| |

● |

Developing

a new targeted therapeutic option for breast cancer patients; and |

| |

● |

Maximizing

the probability of getting regulatory approval to market the targeted therapy indication. |

Recent

Highlights

Below

is a summary of certain recent highlights with respect to the Company:

| |

● |

Granted

Breakthrough Therapy Designation for gedatolisib with respect to HR+/HER2- metastatic breast cancer after progression on CDK4/6 therapy; |

| |

|

|

| |

● |

Initiated

and dosed the first patient in our VIKTORIA-1, a Phase 3 study evaluating gedatolisib in patients with HR+/HER2- advanced breast

cancer in 2022; |

| |

|

|

| |

● |

Completed

a private placement resulting in gross proceeds to the Company of approximately $100 million, before deducting placement agent fees

and other estimated offering expenses payable by the Company, as further described below in “The PIPE Offering”; and |

| |

|

|

| |

● |

Received

funding of an additional $20 million term loan for a total of $35 million in term loans drawn from our $75 million debt financing

arrangement with an affiliate of Innovatus Capital Partners. |

The

PIPE Offering

On

May 15, 2022, we entered into the Securities Purchase Agreement with the selling stockholders pursuant to which we conducted a private

placement of securities, resulting in gross proceeds to the Company, before deducting placement agent fees and other estimated offering

expenses payable by the Company, of approximately $100 million (the “PIPE Offering”). The closing of the PIPE Offering occurred

on December 9, 2022 (the “Closing Date”) following satisfaction of a primary closing condition—the first dosing of

a patient enrolled in our Phase 3 clinical study (VIKTORIA-1) at a clinical site located in the United States. The Company intends to

use the net proceeds from the PIPE Offering to advance clinical development of gedatolisib, including its Phase 3 clinical study (VIKTORIA-1),

and for general corporate purposes.

Securities

Purchase Agreement

Under

the terms of the securities purchase agreement, the selling stockholders purchased from the Company: (i) 6,182,574 shares of common stock

at a purchase price of $5.75 per share, (ii) 1,120,873 shares of Series A Preferred Stock at a purchase price of $57.50 per share, and

(iii) Warrants to purchase 695,645 shares of Series A Preferred Stock, with an exercise price of $80.50 per share, or $8.05 per share

on an as converted to common stock basis, a 40% premium to the price paid by the selling

stockholders for the initial shares of common stock purchased under the Securities Purchase Agreement.

On

September 1, 2022, the Company amended its Certificate of Incorporation to increase the aggregate authorized number of shares of capital

stock and the number of shares of common stock such that the company has available, and has reserved, such number of its duly authorized

but unissued shares of common stock as shall be sufficient to effect the conversion of all shares of Series A Preferred Stock then outstanding

or available for issuance upon the exercise of the Warrants (the “Authorized Share Increase”). Following the Authorized Share

Increase, and notice to the selling stockholders, the Warrants were adjusted to become exercisable for an aggregate of 6,956,450 shares

of common stock with an exercise price of $8.05 per share.

Each

share of Series A Preferred Stock is convertible into ten (10) shares of common stock. For a summary of the rights and preferences of

the Series A Preferred Stock, see “Description of Capital Stock – Preferred Stock” beginning on page 15 of this prospectus.

Each

Warrant issued on the Closing Date is immediately exercisable and will remain exercisable until the earlier of (i) five years from the

date of issuance and (ii) seventy-five (75) days after the Company announces (x) whether the progression-free survival (“PFS”)

of gedatolisib in combination with Palbociclib and fulvestrant (Arm A) to fulvestrant (Arm C) in the Phase 3 study met its primary endpoint

target, (y) whether the PFS of gedatolisib in combination with fulvestrant (Arm B) to fulvestrant (Arm C) in the Phase 3 study met its

primary endpoint target, and (z) the associated hazard ratios and median PFS values for each of Arm A, Arm B, and Arm C.

Under

the terms of the Series A Preferred Stock and the Warrants, the Company may not effect the conversion of Series A Preferred stock into

common stock, or the exercise of any such Warrant, and a holder will not be entitled to request the conversion of shares of Series A

Preferred Stock or exercise any portion of any Warrant, if, upon giving effect to such conversion or exercise, the aggregate number of

shares of common stock (assuming the conversion of the Series A Preferred Stock into common stock with respect to the Warrants) beneficially

owned by the holder (together with any affiliates, any other person acting as a group together with the holder or any of the holder’s

affiliates, and any other persons whose beneficial ownership of common stock would or could be aggregated with the holder’s for

purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) would exceed

9.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership

is calculated in accordance with Section 13(d) of the Exchange Act and the applicable regulations of the SEC (the “Beneficial Ownership

Limitation”). A holder may reset the Beneficial Ownership Limitation percentage to a higher percentage (not to exceed 19.9%), effective

61 days after written notice to the Company, or a lower percentage, effective immediately upon written notice to the Company. Any such

increase or decrease will apply only to that holder and not to any other holder of Series A Preferred Stock or Warrants.

Brian

Sullivan, the Company’s Chief Executive Officer, participated in the PIPE Offering. Except for Mr. Sullivan, there are no material

relationships between the Company and any of the selling stockholders other than in respect of the PIPE Offering. Jeffries LLC acted

as placement agent for the PIPE Offering.

The

Securities Purchase Agreement contains customary representations, warranties and agreements by the Company, customary conditions to closing,

indemnification obligations of the Company, other obligations of the parties and termination provisions. The descriptions of the Securities

Purchase Agreement in this prospectus do not purport to be complete and are qualified in their entirety by reference to the full text

of the Securities Purchase Agreement, a copy of which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed

with the SEC on May 18, 2022.

Registration

Rights Agreement

In

connection with the PIPE Offering, the Company entered into a registration rights agreement (the “Registration Rights Agreement”)

with the selling stockholders, pursuant to which the Company agreed to register for resale (i) the common stock, (ii) the shares of common

stock then issued or issuable upon conversion of the Series A Preferred Stock (assuming on such date the shares of Series A Preferred

Stock are convertible in full without regard to any conversion limitations in the Certificate of Designations), and (iii) the common

stock then issued or issuable upon exercise of the Warrants (assuming the Warrants are exercisable in full without regard to any exercise

limitations therein) (collectively, the “Registrable Securities”).

Under

the Registration Rights Agreement, the Company agreed to file the registration statement to which this prospectus relates

covering the resale by the selling stockholders of the Registrable Securities no later than 30 days following (i) the Closing Date and

(ii) the date the Company obtains the necessary stockholder approval to effect the Authorized Share Increase. The Company agreed to use

commercially reasonable efforts to cause the registration statement to which this prospectus relates to become effective

and to keep such registration statement effective until such time as there are no longer Registrable Securities held by the selling

stockholders. The Company has also agreed to be responsible for all fees and expenses incurred in connection with the registration

of the Registrable Securities.

In

the event (i) the registration statement to which this prospectus relates had not been filed within the time period specified

above, (ii) the registration statement to which this prospectus relates, as may be amended, had not been declared effective (A)

by February 7, 2023 (the 60th day after the Closing Date) (or, in the event of a review by the SEC, March 9, 2023 (the

90th day after the Closing Date)) or (B) within ten business days following the date the Company was notified by the

SEC that the registration statement will not be reviewed or is no longer subject to further review and comments, or (iii) after such

registration statement was declared effective by the SEC, sales cannot be made pursuant to such registration statement for

any reason (including without limitation by reason of a stop order, or the Company’s failure to update such registration statement),

but excluding any Allowed Delay (as defined in the Registration Rights Agreement) or, if the registration statement would have instead

been on Form S-1, for a period of twenty (20) days following the date on which the Company files a post-effective amendment to incorporate

the Company’s Annual Report on Form 10-K, then the Company agreed to make pro rata payments to each holder as liquidated damages

in an amount equal to 1.0% of the aggregate amount invested by each such holder in the Registrable Securities then held by the holder

per 30-day period or pro rata for any portion thereof for each such month during which such event continues, provided that the maximum

aggregate amounts payable as liquidated damages shall not exceed 5.0% of the aggregate amount invested by each such holder in the Registrable

Securities then held by the holder.

The

Company has granted the selling stockholders customary indemnification rights in connection with the registration statement, including

for liabilities arising under the Securities Act. The selling stockholders have also granted the Company customary indemnification rights

in connection with the registration statement. The representations, warranties and covenants contained in the Warrants, the Securities

Purchase Agreement and the Registration Rights Agreement were made solely for the benefit of the parties thereto and may be subject to

limitations agreed upon by the contracting parties.

The

descriptions of the Registration Rights Agreement in this prospectus do not purport to be complete and are qualified in their entirety

by reference to the full text of the Registration Rights Agreement, a copy of which is filed as Exhibit 10.2 to the Company’s Current

Report on Form 8-K filed with the SEC on May 18, 2022.

The

Offering

| Common

stock outstanding prior to this offering: |

|

21,667,250

shares of common stock, which includes 6,182,574 shares of common stock issued in the PIPE Offering that are Registrable Securities

and are being registered for sale pursuant to the registration statement to which this prospectus relates. |

| |

|

|

| Common

stock to be offered by the selling stockholders: |

|

Up

to 24,347,754 shares of common stock (assuming conversion of all outstanding shares of Series A Preferred Stock and exercise of all

outstanding Warrants). |

| Common

stock to be outstanding after the offering: |

|

39,832,430

shares of common stock, assuming that: |

| |

|

|

|

| |

|

● |

Celcuity

issues 11,208,730 shares of its common stock upon conversion of the Series A Preferred Stock sold pursuant to the Securities Purchase

Agreement; and |

| |

|

|

|

| |

|

● |

Celcuity

issues 6,956,450 shares its common stock upon the exercise of the Warrants sold pursuant to the Securities Purchase Agreement. |

| Offering

price per share: |

|

The

selling stockholders identified in this prospectus may sell all or a portion of the shares being offered pursuant to this prospectus

at fixed prices and prevailing market prices at the time of sale, at varying prices or at negotiated prices. |

| |

|

|

| Use

of proceeds: |

|

We

will not receive any proceeds from the sale of shares in this offering. See “Use of Proceeds” beginning on page 10 of

this prospectus. |

| |

|

|

| Risk

factors: |

|

Investing

in our common stock involves a high degree of risk, and the purchasers of our common stock may lose all or part of their investment.

Before deciding to invest in our securities, please carefully read the section entitled “Risk Factors” beginning on page

8 of this prospectus. |

| |

|

|

| Stock

exchange listing: |

|

Our

common stock is listed on The Nasdaq Capital Market under the symbol “CELC”. |

Additional

Information

Our

principal executive office is located at 16305 36th Avenue North, Suite 100, Minneapolis, Minnesota. Our telephone number is (763) 392-0123,

and our website is www.celcuity.com. The information contained on or accessible through our website is not incorporated by reference

into, and should not be considered part of, this prospectus supplement, the accompanying prospectus or the information incorporated herein

by reference.

Change

of Emerging Growth Company Status

As

of January 1, 2023, we are no longer an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act

of 2012, or the JOBS Act. We were previously an “emerging growth company” through December 31, 2022, which was the end of

the first five fiscal years after we completed our initial public offering.

RISK

FACTORS

Investing

in our securities involves risk. You should consider the risks, uncertainties and assumptions discussed under the heading “Risk

Factors” in our Quarterly Report on Form 10-Q for the period ended September 30, 2022, filed on November 10, 2022 with the Securities

and Exchange Commission (“SEC”), which is incorporated herein by reference, and may be amended, supplemented or superseded

from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have described are not the only

ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations.

If any of these risks were to occur, our business, financial condition, and results of operations could be severely harmed. This could

cause the trading price of our common stock to decline, and you could lose all or part of your investment.

FORWARD-LOOKING

STATEMENTS

This

prospectus and the documents incorporated herein by reference contain forward-looking statements and information within the meaning of

Section 27A of the Securities Act of 1933, as amended, or the “Securities Act”, and Section 21E of the Securities Exchange

Act of 1934, as amended, or the “Exchange Act”, which are subject to the safe harbor created by those sections. These forward-looking

statements and information regarding us, our business prospects and our results of operations are subject to certain risks and uncertainties

that could cause our actual business, prospects and results of operations to differ materially from those that may be anticipated by

such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those described

under “Risk Factors” herein and in our other filings with the SEC. You should not place undue reliance on these forward-looking

statements. You should assume that the information contained in or incorporated by reference in this prospectus is accurate only as of

the date on the front cover of this prospectus or as of the date of the documents incorporated by reference herein or therein, as applicable.

We expressly disclaim any intent or obligation to update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise. You are urged to carefully review and consider the various disclosures made by us in this prospectus and

the documents incorporated herein by reference and in our other reports filed with the SEC that advise interested parties of the risks

and uncertainties that may affect our business.

All

statements, other than statements of historical facts, contained in this prospectus and the documents incorporated herein by reference,

including statements regarding our plans, objectives and expectations for our business, operations and financial performance and condition,

are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “target,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” “would,” or the negative of these terms or other comparable

terminology, although not all forward-looking statements contain these words. Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our results, performance or achievements to be materially different from the information

expressed or implied by the forward-looking statements in this prospectus and the documents incorporated herein by reference. Additionally,

our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures

or investments that we may make. Forward-looking statements may include, among other things, statements relating to:

| |

● |

our

clinical trial plans and the estimated timelines and costs for such trials; |

| |

● |

our

expectations with respect to the development, validation, required approvals, costs and timelines of gedatolisib and our CELsignia

tests; |

| |

● |

our

expectations with respect to the potential efficacy of gedatolisib in various patient types alone or in combination with other treatments; |

| |

● |

our

expectations regarding the timeline of patient enrollment and results from clinical trials, including our existing Phase 3 VIKTORIA-1

clinical trial for gedatolisib; |

| |

● |

our

beliefs related to the potential benefits resulting from Breakthrough Therapy designation for gedatolisib; |

| |

● |

our

beliefs related to the perceived advantages of our CELsignia tests compared to traditional molecular or other diagnostic tests; |

| |

● |

our

plans with respect to research and development and related expenses for the foreseeable future; |

| |

● |

the

future payments that may be owed to Pfizer under our license agreement with them; |

| |

● |

our

expectations regarding partnering with pharmaceutical companies and other third parties; |

| |

● |

our

expectations regarding revenue from sales of CELsignia tests and revenue from milestone or other payment sources; |

| |

● |

our

expectations regarding business development activities, including companion diagnostic related activities with pharmaceutical companies; |

| |

● |

our

expectations as to the use of proceeds from the PIPE Offering; |

| |

● |

our

expectations with respect to accessing our current debt facility or any other debt facility or other capital source in the future; |

| |

● |

our

beliefs regarding the adequacy of our cash on hand to fund our research and development expenses, capital expenditures, working capital,

sales and marketing expenses, and other general corporate expenses, as well as the increased costs associated with being a public

company; and |

| |

● |

our

expectations regarding the impact that the COVID-19 pandemic and related economic effects will have on our business and results of

operations. |

These

statements involve known and unknown risks, uncertainties and other factors that may cause our results or our industry’s actual

results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these

forward-looking statements. Certain risks, uncertainties and other factors include, but are not limited to, our limited operating history;

the potential impact of COVID-19 and any resurgence thereof on our business and clinical study activities; our potential inability to

develop, validate and commercialize gedatolisib on a timely basis or at all; the uncertainties and costs associated with clinical studies

and with developing and commercializing biopharmaceuticals; the complexity and difficulty of demonstrating the safety and sufficient

magnitude of benefit to support regulatory approval of gedatolisib and other products we may develop; challenges we may face in developing

and maintaining relationships with pharmaceutical company partners; the complexity and timeline for development of our CELsignia tests;

the uncertainty regarding market acceptance of our products and services by physicians, patients, third-party payors and others in the

medical community, uncertainty with respect to the size of market opportunities available to us; uncertainty regarding the pricing of

drug products and molecular and other diagnostic products and services that compete or may compete with us; uncertainty with insurance

coverage and reimbursement for our products and services; difficulties we may face in managing growth, such as hiring and retaining key

personnel; changes in government regulations; and obtaining and maintaining intellectual property protection for our technology and time

and expense associated with defending third-party claims of intellectual property infringement, investigations or litigation threatened

or initiated against us. See “Risk Factors” beginning on page 8 of this prospectus

for additional risks, uncertainties and other factors applicable to the Company.

USE

OF PROCEEDS

We

are filing the registration statement, of which this prospectus is a part, to permit the selling stockholders described in the section

entitled “Selling Stockholders,” beginning on page 11 of this prospectus, to resell shares of our common stock. We are not

selling any securities under this prospectus and will not receive any proceeds from the sale of shares by the selling stockholders. However,

we received proceeds from our initial sale of shares of common stock, shares of Series A Preferred Stock and Warrants to the selling

stockholders pursuant to the PIPE Offering. Additionally, we may receive proceeds from the exercise of Warrants to purchase 6,956,450

shares of common stock issued under the Securities Purchase Agreement and held by the selling stockholders. The Warrants have an exercise

price of $8.05 per share. We plan to use the net proceeds from the PIPE Offering to advance clinical development of gedatolisib, including

our Phase 3 clinical study (VIKTORIA-1), and for general corporate purposes.

SELLING

STOCKHOLDERS

The

common stock being offered by the selling stockholders consists of the following securities purchased by the selling stockholders under

the Securities Purchase Agreement: (i) 6,182,574 shares of common stock, (ii) 11,208,730 shares of common stock issuable upon conversion

of the Series A Preferred Stock and (iii) 6,956,450 shares of common stock issuable upon exercise of the Warrants at an initial exercise

price of $8.05 per share. We are registering these shares of common stock in order to permit the selling stockholders to offer for resale

from time to time the shares of common stock acquired under the Securities Purchase Agreement and the shares of common stock issuable

upon conversion of the Series A Preferred Stock and upon the exercise of the Warrants. For more information regarding the issuances to

the selling stockholders of shares of common stock, shares of Series A Preferred Stock and the Warrants under the Securities Purchase

Agreement, see “Prospectus Summary—The PIPE Offering” above. When we refer to the “selling stockholders”

in this prospectus, or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, we

mean the selling stockholders, as well as any of their respective pledgees, assignees and successors-in-interest. The selling stockholders

may sell all, some or none of the shares of common stock subject to this prospectus. See “Plan of Distribution” below as

it may be supplemented and amended from time to time.

Under

the terms of the Series A Preferred Stock and the Warrants, the Company may not effect the conversion of the Series A Preferred Stock

into common stock, or the exercise of any such Warrant, and a selling stockholder will not be entitled to request the conversion of shares

of Series A Preferred Stock or exercise any portion of any Warrant, if, upon giving effect to such conversion or exercise, the aggregate

number of shares of common stock beneficially owned by the selling stockholder (together with its affiliates, any other persons acting

as a group together with the selling stockholder or any of the selling stockholder’s affiliates, and any other persons whose beneficial

ownership of common stock would or could be aggregated with the holder’s for purposes of Section 13(d) or Section 16 of the Exchange

Act) would exceed the Beneficial Ownership Limitation, which is 9.99% of the number of shares of common stock outstanding immediately

after giving effect to any conversion or exercise, as such percentage ownership is calculated in accordance with Section 13(d) of the

Exchange Act and the applicable regulations of the SEC. A selling stockholder may reset the Beneficial Ownership Limitation percentage

to a higher percentage (not to exceed 19.9%), effective 61 days after written notice to the Company, or a lower percentage, effective

immediately upon written notice to the Company. Any such increase or decrease will apply only to that selling stockholder and not to

any other holder of Series A Preferred Stock or Warrants.

Brian

Sullivan, our Chairman and Chief Executive Officer, participated in the PIPE Offering and is a selling stockholder hereunder. Except

for the PIPE Offering and ownership of common stock, the selling stockholders, other than Mr. Sullivan, have not had any material relationship

within the past three years with Celcuity or any of its affiliates. For purposes of the table below,

the Beneficial Ownership Limitation is not applied with respect to Mr. Sullivan as he is an affiliate of the Company and his beneficial

ownership already exceeded the Beneficial Ownership Limitation both prior to and after the purchase of common stock and Warrants under

the PIPE Offering.

The

information in the table below with respect to the selling stockholders has been obtained from the selling stockholders and sets forth,

to our knowledge, information concerning the beneficial ownership of shares of our common stock by the selling stockholders. Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our common stock.

Generally, a person “beneficially owns” shares of our common stock if the person has or shares with others the right to vote

those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights with respect to such shares

within 60 days. In computing the number of shares of our common stock beneficially owned by each selling stockholder and the percentage

ownership of each selling stockholder, we excluded (except with respect to Mr. Sullivan) any shares for which the Series A Preferred

Stock and Warrants held by a selling stockholder that may not be converted or exercised, respectively, due to the Beneficial Ownership

Limitations because such shares may not be acquired by such selling stockholders within 60 days of December 30, 2022. The inclusion

of any shares in this table does not constitute an admission of beneficial ownership by the selling stockholders.

| | |

Shares of Common Stock Beneficially Owned Prior to Offering | | |

Maximum Number of Shares of Common Stock to be Sold Pursuant to this | | |

Number of Shares of Common Stock Owned After Offering | |

| Name of Selling Stockholder | |

Number | | |

Percentage | | |

Prospectus(1) | | |

Number | | |

Percentage | |

| Entities associated with Venrock Entities(2) | |

| 2,171,126 | | |

| 9.99 | % | |

| 6,086,906 | | |

| - | | |

| - | |

| Entities associated with Soleus Entities(3) | |

| 2,299,538 | | |

| 9.99 | % | |

| 6,086,946 | | |

| 232,073 | | |

| 1 | % |

| Growth Equity Opportunities 18 VGE, LLC(4) | |

| 2,266,063 | | |

| 9.99 | % | |

| 4,869,561 | | |

| - | | |

| - | |

| RA Capital Healthcare Fund, L.P.(5) | |

| 2,249,415 | | |

| 9.99 | % | |

| 4,504,351 | | |

| - | | |

| - | |

| Commodore Capital Master LP(6) | |

| 2,252,691 | | |

| 9.99 | % | |

| 2,434,781 | | |

| 920,464 | | |

| 4.3 | % |

| Brian F. Sullivan(7) | |

| 3,459,384 | | |

| 15.99 | % | |

| 365,209 | | |

| 3,094,175 | | |

| 14.3 | % |

| (1) |

The

number of shares of our common stock in the column “Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus”

represents all of the shares of our common stock that the selling stockholders may offer and sell from time to time under this prospectus

without giving effect to the Beneficial Ownership Limitation described above. |

| |

|

| (2) |

Shares

held by Venrock Healthcare Capital Partners EG, L.P. (“VHCP EG”), Venrock Healthcare

Capital Partners III, L.P. (“VHCP III”), and VHCP Co-Investment Holdings III,

LLC (“VHCP III Co”), which we refer to collectively as the Venrock Entities,

consist of: (i) 1,496,508 shares of our common stock, 159,392 shares of our Series A Preferred

Stock convertible into 1,593,920 shares of our common stock and Warrants to purchase 1,236,140

shares of common stock, in each case held by VHCP EG, (ii) 553,506 shares of our common stock,

58,954 shares of our Series A Preferred Stock convertible into 589,540 shares of our common

stock and Warrants to purchase 457,200 shares of our common stock, in each case held

by VHCP III and (iii) 55,372 shares of our common stock, 5,898 shares of our Series A Preferred

Stock convertible into 58,980 shares of our common stock and Warrants to purchase 45,740

shares of our common stock, in each case held by VHCP III Co.

The

ability of the Venrock Entities to convert their Series A Preferred Stock and exercise of their Warrants is subject to the Beneficial

Ownership Limitation as described above. The shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering”

consist of 2,105,386 shares of our common stock and 65,740 shares of common stock issuable to the Venrock Entities upon conversion

of their Series A Preferred Stock or exercise of their Warrants. The shares reported under “Shares of Common Stock Beneficially

Owned Prior to Offering” do not include the remaining 3,915,780 shares of common stock issuable to the Venrock Entities upon

conversion of their Series A Preferred Stock and exercise of their Warrants due to the application of the applicable Beneficial Ownership

Limitation. VHCP Management III, LLC (“VHCPM III”) is the sole general partner of VHCP III and the sole manager of VHCP

Co. VHCP Management EG, LLC (“VHCPM EG”) is the sole general partner of VHCP EG. Dr. Bong Koh and Nimish Shah are the

voting members of VHCPM III and VHCPM EG. Dr. Koh, Mr. Shah, VHCPM III and VHCPM EG disclaim beneficial ownership over all shares

held by VHCP III, VHCP III Co, and VHCP EG, except to the extent of their respective indirect pecuniary interests therein. The address

of the entities and individuals listed above is 7 Bryant Park, 23rd Floor, New York, NY 10018. |

| |

|

| (3) |

Shares

held by Soleus Private Equity Fund II, L.P. (“Soleus PE”) and Soleus Capital

Master Fund, L.P. (“Soleus Cap MF”), which we refer to collectively as the Soleus

Entities, consist of: (i) 343,832 shares of our common stock, 174,313 shares of our Series

A Preferred Stock convertible into 1,743,130 shares of our common stock and Warrants to purchase

834,780 shares of our common stock, in each case held by Soleus PE and (ii) 604,557

shares of our common stock (including 372,484 shares of common stock purchased under the

Securities Purchase Agreement and 232,073 shares of common stock acquired prior to the PIPE

Offering), 188,838 shares of our Series A Preferred Stock convertible into 1,888,380

shares of our common stock and Warrants to purchase 904,340 shares of our common stock, in

each case held by Soleus Cap MF.

The

ability of the Soleus Entities to convert their Series A Preferred Stock and exercise of their Warrants is subject to the Beneficial

Ownership Limitation as described above. The shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering”

consist of 948,349 shares of our common stock and 1,351,149 shares of common stock issuable to the Soleus Entities upon conversion

of their Series A Preferred Stock or exercise of their Warrants. The shares reported under “Shares of Common Stock Beneficially

Owned Prior to Offering” do not include the remaining 4,161,541 shares of common stock issuable to the Soleus Entities upon

conversion of their Series A Preferred Stock and exercise of their Warrants due to the application of the Beneficial Ownership Limitation.

Soleus Private Equity GP II, LLC (“Soleus GP”) is the sole general partner of Soleus PE and Soleus PE GP II, LLC. (“Soleus

PE GP”) is the sole manager of Soleus GP. Soleus Capital, LLC (“Soleus Cap”) is the sole general partner of Soleus

Cap MF and Soleus Capital Group, LLC (“Soleus CG”) is the sole managing member of Soleus Cap. Mr. Guy Levy is the sole

manager of Soleus PE GP and sole managing member of Soleus CG. Mr. Levy, Soleus GP, Soleus PE GP, Soleus Cap and Soleus CG disclaim

beneficial ownership over all shares held by Soleus PE and Soleus Cap MF, except to the extent of their respective indirect pecuniary

interests therein. The address of the entities and individual listed above is 104 Field Point Road, 2nd Floor, Greenwich, CT 06830. |

| (4) |

Shares

held by Growth Equity Opportunities 18 VGE, LLC (“GEO”) consist of 1,250,001 shares of our common stock, 222,826 shares

of our Series A Preferred Stock convertible into 2,228,260 shares of our common stock and Warrants to purchase 1,391,300 shares of

our common stock. The ability of the selling stockholder to convert its Series A Preferred Stock and exercise of their Warrants is

subject to the Beneficial Ownership Limitation as described above. The shares reported under “Shares of Common Stock Beneficially

Owned Prior to Offering” consist of 1,250,001 shares of our common stock and 1,016,062 shares of common stock issuable to the

selling stockholder upon conversion of its Series A Preferred Stock or exercise of its Warrants. The shares reported under “Shares

of Common Stock Beneficially Owned Prior to Offering” do not include the remaining 2,603,498 shares of common stock issuable

to the selling stockholder upon conversion of its Series A Preferred Stock and exercise of its Warrants due to the application of

the Beneficial Ownership Limitation. NEA 18 Venture Growth Equity, L.P. (“NEA 18 VGE”) is the sole member of GEO. NEA

Partners 18 VGE, L.P. (“NEA Partners 18 VGE”) is the sole general partner of NEA 18 VGE; and NEA 18 VGE GP, LLC (“NEA

18 VGE LLC”) is the sole general partner of NEA Partners 18 VGE. The managers (collectively, the “Managers”) of

NEA 18 VGE LLC are Ali Behbahani (“Behbahani”), Carmen Chang (“Chang”), Anthony A. Florence, Jr. (“Florence”),

Liza Landsman (“Landsman”), Mohamad H. Makhzoumi (“Makhzoumi”), Edward T. Mathers (“Mathers”),

Scott D. Sandell (“Sandell”), Peter W. Sonsini (“Sonsini”), Paul Walker (“Walker”) and Rick Yang

(“Yang”). NEA 18 VGE, NEA Partners 18 VGE, NEA 18 VGE LLC and each of the Managers expressly disclaim beneficial ownership

over all shares held by GEO, except to the extent of their respective indirect pecuniary interests therein. The address of entities

listed above and Sandell is New Enterprise Associates, 1954 Greenspring Drive, Suite 600, Timonium, MD 21093. The address of Behbahani

and Mathers is New Enterprise Associates, 5425 Wisconsin Avenue, Suite 800, Chevy Chase, MD 20815. The address of Chang, Makhzoumi,

Sonsini, Walker and Yang is New Enterprise Associates, 2855 Sand Hill Road, Menlo Park, California 94025. The address of Florence

and Landsman is New Enterprise Associates, 104 5th Avenue, 19th Floor, New York, NY 10001. |

| (5) |

Shares

held by RA Capital Healthcare Fund, L.P. (“RACHF”) consist of 1,400,001 shares of our common stock, 181,739 shares of

our Series A Preferred Stock convertible into 1,817,390 shares of our common stock and Warrants to purchase 1,286,960 shares of our

common stock. The ability of the selling stockholder to convert its Series A Preferred Stock and exercise of their Warrants is subject

to the Beneficial Ownership Limitation as described above. The shares reported under “Shares of Common Stock Beneficially Owned

Prior to Offering” consist of 1,400,001 shares of our common stock and 849,414 shares of our common stock issuable to the selling

stockholder upon conversion of its Series A Preferred Stock or exercise of its Warrants. The shares reported under “Shares

of Common Stock Beneficially Owned Prior to Offering” do not include the remaining 2,254,936 shares of our common stock issuable

to the selling stockholder upon conversion of its Series A Preferred Stock and exercise of its Warrants due to the application of

the Beneficial Ownership Limitation. RA Capital Management, L.P. is the investment manager for RACHF. The general partner of RA Capital

Management, L.P. is RA Capital Management GP, LLC, of which Peter Kolchinsky and Rajeev Shah are the managing members. Each of Mr.

Kolchinsky and Mr. Shah may be deemed to have voting and investment power over the shares held by RACHF. Mr. Kolchinsky and Mr. Shah

disclaim beneficial ownership of such shares, except to the extent of any pecuniary interest therein. The address of the entities

and persons listed above is 200 Berkeley Street, 18th Floor, Boston, Massachusetts 02116. |

| |

|

| (6) |

Shares

held by Commodore Capital Master LP (“Commodore Master”) consist of 1,370,465 shares of our common stock (including

450,001 shares of common stock purchased under the Securities Purchase Agreement and 920,464 shares of common stock acquired prior

to the PIPE Offering), 128,913 shares of our Series A Preferred Stock convertible into 1,289,130 shares of our common stock and

Warrants to purchase 695,650 shares of our common stock. The ability of the selling stockholder to convert its Series A Preferred

Stock and exercise its Warrants is subject to the Beneficial Ownership Limitation as described above. The shares reported under “Shares

of Common Stock Beneficially Owned Prior to Offering” consist of 1,370,465 shares of our common stock and 882,226 shares of

our common stock issuable to the selling stockholder upon conversion of its Series A Preferred Stock or exercise of its Warrants.

The shares reported under “Shares of Common Stock Beneficially Owned Prior to Offering” do not include the remaining

1,102,554 shares of our common stock issuable to the selling stockholder upon conversion of its Series A Preferred Stock and exercise

of its Warrants due to the application of the Beneficial Ownership Limitation. Commodore Capital LP (the “Firm”) is the

investment manager to Commodore Master. Messrs. Michael Kramarz and Robert Egen Atkinson are the managing partners of the Firm. The

address of the entities and persons listed above is 767 Fifth Avenue, FL 12, New York, NY 10153 |

| |

|

| (7) |

Shares

held by Mr. Sullivan consist of 3,016,643 shares of our common stock, Warrants to purchase 104,340 shares of our common stock, and

options to purchase 338,401 shares of our common stock. Mr. Sullivan is the Chief Executive Officer of the Company and is a member

of the Company’s board of directors. The share numbers and percentages reported in the table for Mr. Sullivan do no not include

application of the Beneficial Ownership Limit. Stock options included in the reported numbers for Mr. Sullivan include those that

are currently vested or will vest within 60 days of December 30, 2022. Mr. Sullivan’s address is 16305 36th Avenue North,

Suite 100, Minneapolis, MN 55446. |

PLAN

OF DISTRIBUTION

Each

selling stockholder (the “Selling Stockholders”) of the securities and any of their pledgees, assignees and successors-in-interest

may, from time to time, sell any or all of their securities covered hereby on The Nasdaq Capital Market or any other stock exchange,

market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices.

A Selling Stockholder may use any one or more of the following methods when selling securities:

| ● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| ● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| ● |

privately

negotiated transactions; |

| ● |

settlement

of short sales entered into after the effective date of the registration statement of which this prospectus is a part; |

| ● |

in

transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated

price per security; |

| ● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| ● |

a

combination of any such methods of sale; or |

| ● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933,

as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers

engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA IM 2121.01.

In

connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

The

Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities; provided,

however, that each Selling Stockholder will pay all underwriting discounts and selling commissions, if any, and any related legal

expenses incurred by it. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities,

including liabilities under the Securities Act. The Company may be indemnified by the Selling Stockholders against civil liabilities,

including liabilities under the Securities Act, that may arise from any written information furnished to the Company by the Selling Stockholders

specifically for use in this prospectus in accordance with the related Registration Rights Agreement, or the Company may be entitled

to contribution.

We

agreed to keep the registration to which this prospectus relates effective until such time as there are no longer Registrable Securities

held by the selling stockholders. The resale securities

will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition,

in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the

applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

DESCRIPTION

OF CAPITAL STOCK

The

following summary of the terms of our capital stock is subject to and qualified in its entirety by reference to our certificate of incorporation,

as amended, and bylaws, copies of which are on file with the SEC as exhibits to previous SEC filings. Please refer to “Where You

Can Find More Information” below for directions on obtaining these documents.

As

of December 30, 2022, we were authorized to issue 65,000,000 shares of common stock, $0.001 par value per share, and 2,500,000

shares of preferred stock, $0.001 par value per share. As of December 30, 2022, we had 21,667,250 shares of common stock outstanding,

1,120,873 shares of Series A Preferred Stock outstanding and Warrants to purchase 6,956,450 shares of common stock outstanding.

Common

Stock

Voting

Rights

Each

holder of common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders.

Dividend

Rights

Holders

of our common stock are entitled to receive ratably any dividends that our board of directors may declare out of funds legally available

for that purpose.

Rights

and Preferences

Holders

of our common stock have no preemptive, conversion, subscription or other rights, and there are no redemption or sinking fund provisions

applicable to our common stock.

Right

to Liquidation Distributions

Upon

our liquidation, dissolution or winding-up, the assets legally available for distribution to our stockholders would be distributable

ratably among the holders of our common stock and any participating preferred stock outstanding at that time, subject to prior satisfaction

of all outstanding debt and liabilities and the preferential rights of and the payment of liquidation preferences, if any, on any outstanding

shares of preferred stock, including the liquidation preference of our Series A Preferred Stock.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company. The transfer agent and registrar’s

address is One State Street Plaza, 30th Floor, New York, NY 10004.

The

Nasdaq Capital Market

Our

common stock is listed for quotation on The Nasdaq Capital Market under the symbol “CELC”.

Preferred

Stock

Our

board or directors is authorized, without action by the stockholders, to designate and issue up to an aggregate of 2,500,000 shares of

preferred stock in one or more series. Our board of directors is authorized to designate the rights, preferences and privileges of the

shares of each series and any of its qualifications, limitations or restrictions. Our board of directors is able to authorize the issuance

of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of common

stock. The issuance of preferred stock, while providing flexibility in connection with possible future financings and acquisitions and

other corporate purposes could, under certain circumstances, have the effect of restricting dividends on our common stock, diluting the

voting power of our common stock, impairing the liquidation rights of our common stock, or delaying, deferring or preventing a change

in control of the Company, which might harm the market price of our common stock. See also “Anti-Takeover Effect of Delaware Law

and Certain Charter and Bylaw Provisions” below.

On

May 16, 2022, in connection with the PIPE Offering, the Company filed a Certificate of Designations (the “Certificate of Designations”)

with the Secretary of State of the State of Delaware, designating 1,850,000 shares out of the authorized but unissued shares of its preferred

stock as Series A Convertible Preferred Stock. The following is a summary of the principal terms of the Series A Preferred Stock:

Dividend

Rights

Holders

of Series A Preferred Stock shall be entitled to receive dividends or distributions on shares of Series A Preferred Stock equal (on an

as-if-converted-to-common stock basis) to and in the same form as dividends or distributions actually paid on shares of the common stock

when, as and if such dividends or distributions are paid on shares of the common stock. No other dividends or distributions shall be

paid on shares of Series A Preferred Stock.

Right

to Liquidation Distributions

In

the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of shares of Series A Preferred

Stock then outstanding shall be entitled to be paid out of the assets of the Company available for distribution to its stockholders,

and in the event of a Deemed Liquidation Event (as defined in the Certificate of Designations) the holders of shares of Series A Preferred

Stock then outstanding shall be entitled to be paid out of the consideration payable to stockholders in such Deemed Liquidation Event

or out of the Available Proceeds (as defined in the Certificate of Designations), as applicable, before any payment shall be made to

the holders of common stock by reason of their ownership thereof, an amount per share equal to the greater of (i) the Series A Original

Issue Price (as defined in the Certificate of Designations), plus any dividends declared but unpaid thereon, or (ii) such amount per

share as would have been payable had all shares of Series A Preferred Stock been converted into common stock pursuant to the Certificate

of Designations immediately prior to such liquidation, dissolution, winding up or Deemed Liquidation Event (the “Series A Liquidation

Amount”).

Voting

Rights

The

Series A Preferred Stock is non-voting stock and does not entitle the holder thereof to vote on any matter submitted to the stockholders

of the Company for their action or consideration, except as otherwise provided by the General Corporation Law of the State of Delaware

or the other provisions of the Certificate of Incorporation or the Certificate of Designations.

As

long as any shares of Series A Preferred Stock are outstanding, the Company may not, without the approval of the holders of a majority

of the outstanding shares of Series A Preferred Stock, take the following actions: (i) amend, alter or repeal any provision of the Certificate

of Incorporation, the Certificate of Designations or Bylaws of the Company in a manner that adversely affects the powers, preferences

or rights of the Series A Preferred Stock; (ii) create, or authorize the creation of, or issue or obligate itself to issue shares of,

any additional class or series of capital stock unless the same ranks junior to the Series A Preferred Stock with respect to the distribution

of assets on the liquidation, dissolution or winding up of the Company, the payment of dividends and rights of redemption, or increase

the authorized number of shares of Series A Preferred Stock or increase the authorized number of shares of any additional class or series

of capital stock of the Company unless the same ranks junior to the Series A Preferred Stock with respect to the distribution of assets

on the liquidation, dissolution or winding up of the Company, the payment of dividends and rights of redemption; (iii) (A) reclassify,

alter or amend any existing security of the Company that is pari passu with the Series A Preferred Stock in respect of the distribution

of assets on the liquidation, dissolution or winding up of the Company, the payment of dividends or rights of redemption, if such reclassification,

alteration or amendment would render such other security senior to the Series A Preferred Stock in respect of any such right, preference,

or privilege or (B) reclassify, alter or amend any existing security of the Company that is junior to the Series A Preferred Stock in

respect of the distribution of assets on the liquidation, dissolution or winding up of the Company, the payment of dividends or rights

of redemption, if such reclassification, alteration or amendment would render such other security senior to or pari passu with the Series