Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

24 Janeiro 2023 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

January, 2023

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on receiving earnout from Atapu

—

Rio de Janeiro, January 23, 2023 – Petróleo

Brasileiro S.A. – Petrobras, following up on the Material Facts disclosed on April 9, 2021, April 13 and 27, 2022, informs that

it received today, up front, from TotalEnergies EP Brasil Ltda (TotalEnergies), the amount of R$ 313 million, regarding the complement

of the firm compensation (earnout) for fiscal year 2022, related to the Atapu block. The amount already includes the amount of the gross-up

of taxes related to TotalEnergies' 22.5% stake in Atapu.

In the terms of the ordinance nº 08 of 04/19/2021

from the Ministry of Mines and Energy (MME) and of the public notice of the 2nd round of bidding for the Surplus of the Transfer

of Rights under the Production Sharing regime, held on 12/17/2021, earnouts values were established for the Sépia and Atapu blocks,

which will be due between 2022 and 2032, and payable as of the last business day of January of the following year, when the price of Brent

oil reaches an annual average higher than US$ 40/bbl, limited to US$ 70/bbl.

Petrobras expects to

receive the full payment related to the complement of the firm compensation (earnout) for fiscal year 2022, which is the responsibility

of the partners in the Sépia and Atapu blocks, by January 31, 2023.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS | Investor Relations

e-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares,

28 – 19th floor – 20031-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947

| 0800-282-1540

This document may contain

forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities

Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects", "aims",

"should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not

by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not

rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 23, 2023

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo Araujo Alves

Chief Financial Officer and Investor Relations

Officer

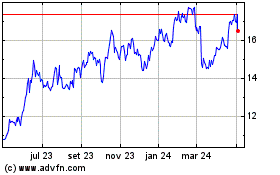

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024