Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

02 Fevereiro 2023 - 6:11PM

Edgar (US Regulatory)

Morgan Stanley Finance LLC

Structured Investments

|

Free Writing Prospectus

to Preliminary Terms No. 7,879

Filed pursuant to

Rule 433

Registration Statement

Nos. 333-250103; 333-250103-01

February 2, 2023

|

| Market

Linked Securities—Leveraged Upside Participation and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the

S&P 500® Index due February 15, 2028

Fully and Unconditionally Guaranteed

by Morgan Stanley

|

Summary of terms

| Issuer and guarantor |

Morgan Stanley Finance LLC (issuer) and Morgan Stanley (guarantor) |

| Market measure |

S&P 500® Index (the “underlying index”) |

| Pricing date* |

February 10, 2023 |

| Original issue date* |

February 15, 2023 |

| Face amount |

$1,000 per security |

| Maturity payment amount (per security) |

·

If

the ending level is greater than the starting level:

$1,000 plus

[$1,000 × [ ] ]

× ] ]

·

If

the ending level is less than or equal to the starting level, but greater than or equal to the threshold level:

$1,000

·

If

the ending level is less than the threshold level:

$1,000 minus

[$1,000 ×  ] ]

|

| Maturity date* |

February 15, 2028 |

| Starting level |

The closing level of the underlying index on the pricing date |

| Ending level |

The closing level of the underlying index on the calculation day |

| Threshold level |

90% of the starting level |

| Participation rate |

At least 112%, to be determined on the pricing date |

| Calculation day* |

February 8, 2028 |

| Calculation agent |

Morgan Stanley & Co. LLC, an affiliate of the issuer |

| Denominations |

$1,000 and any integral multiple of $1,000 |

| Agent discount** |

Morgan Stanley & Co. LLC and Wells Fargo Securities, LLC will act as the agents for this offering. Wells Fargo Securities, LLC will receive a commission of up to $36.20 for each security it sells. Dealers, including Wells Fargo Advisors (“WFA”), may receive a selling concession of up to $25.00 per security, and WFA may receive a distribution expense fee of $1.20 for each security sold by WFA. |

| CUSIP |

61774TXB3 |

| Tax considerations |

See preliminary terms |

Hypothetical payout profile

If the ending level is less than the threshold level, you will have

1-to-1 downside exposure to the decrease in the level of the underlying index in excess of 10% and will lose some, and possibly up to

90%, of the face amount of your securities at maturity.

The face amount of each security is $1,000. This price

includes costs associated with issuing, selling, structuring and hedging the securities, which are borne by you, and, consequently, the

estimated value of the securities on the pricing date will be less than $1,000 per security. We estimate that the value of each security

on the pricing date will be approximately $936.80, or within $36.80 of that estimate. Our estimate of the value of the securities as determined

on the pricing date will be set forth in the final pricing supplement. See “Estimated Value of the Securities” in the accompanying

preliminary terms for further information.

This document provides a summary of the terms of the

securities. Investors should carefully review the accompanying preliminary terms referenced below, product supplement for principal at

risk securities, index supplement and prospectus, and the “Selected risk considerations” on the following page, before making

a decision to invest in the securities.

Preliminary Terms:

https://www.sec.gov/Archives/edgar/data/895421/000095010323001720/dp188065_fwp-ps7879.htm

*subject to change

**In addition, selected dealers may receive a fee of

up to 0.5% for marketing and other services.

The securities have complex features

and investing in the securities involves risks not associated with an investment in ordinary debt securities. See “Selected risk

considerations” in this term sheet and “Risk Factors” in the accompanying preliminary terms and product supplement.

All payments on the securities are subject to our credit risk.

This introductory

term sheet does not provide all of the information that an investor should consider prior to making an investment decision.

The securities are not deposits

or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality,

nor are they obligations of, or guaranteed by, a bank.

Selected risk considerations

The risks set forth below are discussed in more detail in

the “Risk Factors” section in the accompanying preliminary terms, product supplement for principal at risk securities, index

supplement and prospectus. Please review those risk factors carefully.

Risks Relating to an Investment in the Securities

| |

· |

The securities do not pay interest, and you will receive less, and up to 90% less, than the face amount of your securities at maturity if the ending level is less than the threshold level. |

| |

· |

The market price will be influenced by many unpredictable factors. |

| |

· |

The securities are subject to our credit risk, and any actual or anticipated changes to our credit ratings or credit spreads may adversely affect the market value of the securities. |

| |

· |

As a finance subsidiary, MSFL has no independent operations and will have no independent assets. |

| |

· |

The amount payable on the securities is not linked to the value of the underlying index at any time other than the calculation day. |

| |

· |

Investing in the securities is not equivalent to investing in the underlying index. |

| |

· |

The rate we are willing to pay for securities of this type, maturity and issuance size is likely to be lower than the rate implied by our secondary market credit spreads and advantageous to us. Both the lower rate and the inclusion of costs associated with issuing, selling, structuring and hedging the securities in the face amount reduce the economic terms of the securities, cause the estimated value of the securities to be less than the face amount and will adversely affect secondary market prices. |

| |

· |

The estimated value of the securities is determined by reference to our pricing and valuation models, which may differ from those of other dealers and is not a maximum or minimum secondary market price. |

| |

· |

The securities will not be listed on any securities exchange and secondary trading may be limited. |

| |

· |

The calculation agent, which is a subsidiary of Morgan Stanley and an affiliate of MSFL, will make determinations with respect to the securities. |

| |

· |

Hedging and trading activity by our affiliates could potentially adversely affect the value of the securities. |

| |

· |

The maturity date may be postponed if the calculation day is postponed. |

| |

· |

Potentially inconsistent research, opinions or recommendations by Morgan Stanley, MSFL, WFS or our or their respective affiliates. |

| |

· |

The U.S. federal income tax consequences of an investment in the securities are uncertain. |

Risks Relating to the Underlying Index

| |

· |

Adjustments to the underlying index could adversely affect the value of the securities. |

| |

· |

Historical levels of the underlying index should not be taken as an indication of the future performance of the underlying index during the term of the securities. |

For more information about the underlying index, including

historical performance information, see the accompanying preliminary terms.

Morgan Stanley and MSFL have filed a registration

statement (including a prospectus, as supplemented by the applicable product supplement and the index supplement) with the Securities

and Exchange Commission, or SEC, for the offering to which this communication relates. You should read the prospectus in that registration

statement, the applicable product supplement, the index supplement and any other documents relating to this offering that Morgan Stanley

and MSFL have filed with the SEC for more complete information about Morgan Stanley, MSFL and this offering. You may get these documents

without cost by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, Morgan Stanley, MSFL, any underwriter or any dealer

participating in the offering will arrange to send you the applicable product supplement, index supplement and prospectus if you so request

by calling toll-free 1-(800)-584-6837.

Wells Fargo Advisors is a trade name used

by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers

and non-bank affiliates of Wells Fargo Finance LLC and Wells Fargo & Company.

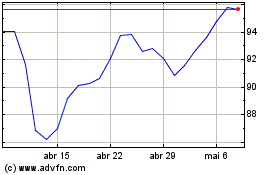

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

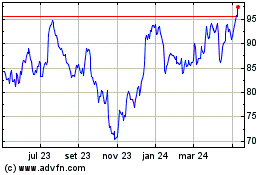

Morgan Stanley (NYSE:MS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024