UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

(Rule 13d-102)

Information Statement Pursuant to Rules 13d-1 and 13d-2

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Pinduoduo

Inc.

(Name of Issuer)

Class A Ordinary Shares, par value $0.000005 per share

(Title of Class of Securities)

722304102**

(CUSIP

Number)

December 31, 2022

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this schedule is filed:

☐ Rule 13d-1(b)

☐ Rule 13d-1(c)

☒ Rule 13d-1(d)

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

| ** |

This CUSIP number applies to the Issuer’s American depositary shares, each representing four Class A

Ordinary Shares. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the

purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SCC GROWTH IV HOLDCO A, LTD. (“SCCG HOLDCO IV-A”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN ISLANDS |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

67,817,696 |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

67,817,696 |

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

67,817,696 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.3%1 |

| 12 |

|

TYPE OF REPORTING

PERSON OO |

| 1 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL CHINA GROWTH FUND V, L.P. (“SCCGF V”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

5,803,744 |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

5,803,744 |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,803,7441 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0.1%2 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Represented by 1,450,936 American Depositary Shares. |

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL CHINA GROWTH PARTNERS FUND V, L.P. (“SCCGPF V”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

317,868 |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

317,868 |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

317,8681 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 Less than 0.1%2 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Represented by 79,467 American Depositary Shares. |

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL CHINA GROWTH V PRINCIPALS FUND, L.P. (“SCCG V PF”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

248,428 |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

248,428 |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

248,4281 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 Less than 0.1%2 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Represented by 62,107 American Depositary Shares. |

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL CHINA GROWTH FUND IV, L.P. (“SCCGF IV”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

|

| |

6 |

|

SHARED VOTING POWER

67,817,696 shares, of which 67,817,696 shares are directly owned by

SCCG HOLDCO IV-A. SCCG HOLDCO IV-A is wholly owned by SCCGF IV. |

| |

7 |

|

SOLE DISPOSITIVE POWER

|

| |

8 |

|

SHARED DISPOSITIVE POWER

67,817,696 shares, of which 67,817,696 shares are directly owned by

SCCG HOLDCO IV-A. SCCG HOLDCO IV-A is wholly owned by SCCGF IV. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

67,817,696 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.3%1 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SC CHINA GROWTH V MANAGEMENT, L.P. (“SCCG V MGMT”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

6,370,0401

shares, of which 5,803,744 shares are directly owned by SCCGF V, 317,868 shares are directly owned by SCCGPF V and 248,428 shares are directly owned by SCCG V PF. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V

MGMT. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

6,370,0401

shares, of which 5,803,744 shares are directly owned by SCCGF V, 317,868 shares are directly owned by SCCGPF V and 248,428 shares are directly owned by SCCG V PF. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V

MGMT. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,370,0401 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0.1%2 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Represented by 1,592,510 American Depositary Shares. |

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SC CHINA GROWTH IV MANAGEMENT, L.P. (“SCCG IV MGMT”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

67,817,696 shares, of which 67,817,696 shares are directly owned by

SCCG HOLDCO IV-A. SCCG HOLDCO IV-A is wholly owned by SCCGF IV. The General Partner of SCCGF IV is SCCG IV MGMT. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

67,817,696 shares, of which 67,817,696 shares are directly owned by

SCCG HOLDCO IV-A. SCCG HOLDCO IV-A is wholly owned by SCCGF IV. The General Partner of SCCGF IV is SCCG IV

MGMT. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

67,817,696 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.3%1 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SC CHINA HOLDING LIMITED (“SCC HOLD”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

74,187,7361

shares, of which 67,817,696 shares are directly owned by SCCG HOLDCO IV-A, 5,803,744 are directly owned by SCCGF V, 317,868 shares are directly owned by SCCGPF V and 248,428 shares are directly owned by SCCG V

PF. SCCG HOLDCO IV-A is wholly owned by SCCGF IV. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V MGMT. The General Partner of SCCGF IV is SCCG IV MGMT. SCC HOLD is the General Partner

of each of SCCG V MGMT and SCCG IV MGMT. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

74,187,7361

shares, of which 67,817,696 shares are directly owned by SCCG HOLDCO IV-A, 5,803,744 are directly owned by SCCGF V, 317,868 shares are directly owned by SCCGPF V and 248,428 shares are directly owned by SCCG V

PF. SCCG HOLDCO IV-A is wholly owned by SCCGF IV. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V MGMT. The General Partner of SCCGF IV is SCCG IV MGMT. SCC HOLD is the General Partner

of each of SCCG V MGMT and SCCG IV MGMT. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

74,187,7361 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.5%2 |

| 12 |

|

TYPE OF REPORTING

PERSON OO |

| 1 |

Represented by 1,592,510 American Depositary Shares and 67,817,696 Class A ordinary shares.

|

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SNP CHINA ENTERPRISES LIMITED (“SNP”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION BRITISH VIRGIN ISLANDS |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

74,187,736 shares, of which 67,817,696 shares are directly owned by

SCCG HOLDCO IV-A, 5,803,744 are directly owned by SCCGF V, 317,868 shares are directly owned by SCCGPF V and 248,428 shares are directly owned by SCCG V PF. SCCG HOLDCO

IV-A is wholly owned by SCCGF IV. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V MGMT. The General Partner of SCCGF IV is SCCG IV MGMT. SCC HOLD is the General Partner of each of SCCG

V MGMT and SCCG IV MGMT. SNP wholly owns SCC HOLD. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

74,187,736 shares, of which 67,817,696 shares are directly owned by

SCCG HOLDCO IV-A, 5,803,744 are directly owned by SCCGF V, 317,868 shares are directly owned by SCCGPF V and 248,428 shares are directly owned by SCCG V PF. SCCG HOLDCO

IV-A is wholly owned by SCCGF IV. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V MGMT. The General Partner of SCCGF IV is SCCG IV MGMT. SCC HOLD is the General Partner of each of SCCG

V MGMT and SCCG IV MGMT. SNP wholly owns SCC HOLD. |

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

74,187,736 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.5%1 |

| 12 |

|

TYPE OF REPORTING

PERSON OO |

| 1 |

Represented by 1,592,510 American Depositary Shares and 67,817,696 Class A ordinary shares.

|

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

URM MANAGEMENT LIMITED (“URM MANAGEMENT”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

0 |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0% |

| 12 |

|

TYPE OF REPORTING

PERSON OO |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SC GGFII HOLDCO, LTD. (“SC GGFII HOLD”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

45,048,300 |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

45,048,300 |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,048,300 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0.9%1 |

| 12 |

|

TYPE OF REPORTING

PERSON OO |

| 1 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL GLOBAL GROWTH FUND III - ENDURANCE PARTNERS, L.P. (“SC GGF III”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

12,476,3641 |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

12,476,3641 |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12,476,3641 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0.2%2 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Represented by 3,119,091 American Depositary Shares. |

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL GLOBAL GROWTH FUND III - ENDURANCE PARTNERS PRINCIPALS FUND, L.P. (“SC GGPF III”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

263,7241 |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

263,7241 |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

263,7241 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 Less than 0.1%2 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Represented by 65,931 American Depositary Shares. |

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL GLOBAL GROWTH FUND II, L.P. (“SC GGF II”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

45,048,300 shares, of which 45,048,300 shares are directly owned by

SC GGFII HOLD. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

45,048,300 shares, of which 45,048,300 shares are directly owned by

SC GGFII HOLD. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,048,300 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0.9%1 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL GLOBAL GROWTH II PRINCIPALS FUND, L.P. (“SC GGPF II”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

45,048,300 shares, of which 45,048,300 shares are directly owned by

SC GGFII HOLD. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

45,048,300 shares, of which 45,048,300 shares are directly owned by

SC GGFII HOLD. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,048,300 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0.9%1 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SEQUOIA CAPITAL GLOBAL GROWTH FUND III - ENDURANCE PARTNERS MANAGEMENT, L.P. (“SC GGF III MGMT”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

12,740,0881 shares, of which 12,476,364 shares are directly owned

by SC GGF III and 263,724 shares are directly owned by SC GGPF III. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

12,740,0881 shares, of which 12,476,364 shares are directly owned

by SC GGF III and 263,724 shares are directly owned by SC GGPF III. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12,740,0881 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0.3%2 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Represented by 3,185,022 American Depositary Shares. |

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SC GLOBAL GROWTH II MANAGEMENT, L.P. (“SC GG II MGMT”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

45,048,300 shares, of which 45,048,300 shares are directly owned by

SC GGFII HOLD. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The General Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

45,048,300 shares, of which 45,048,300 shares are directly owned by

SC GGFII HOLD. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The General Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,048,300 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 0.9%1 |

| 12 |

|

TYPE OF REPORTING

PERSON PN |

| 1 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

SC US (TTGP), LTD. (“SC US TTGP”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION CAYMAN

ISLANDS |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

57,788,3881

shares, of which 45,048,300 shares are directly owned by SC GGFII HOLD, 12,476,364 shares are directly owned by SC GGF III and 263,724 shares are directly owned by SC GGPF III. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The General

Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. SC US TTGP is the General Partner of each of SC GG II MGMT and SC GGF III MGMT. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

57,788,3881

shares, of which 45,048,300 shares are directly owned by SC GGFII HOLD, 12,476,364 shares are directly owned by SC GGF III and 263,724 shares are directly owned by SC GGPF III. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The General

Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. SC US TTGP is the General Partner of each of SC GG II MGMT and SC GGF III

MGMT. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

57,788,3881 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.1%2 |

| 12 |

|

TYPE OF REPORTING

PERSON OO |

| 1 |

Represented by 3,185,022 American Depositary Shares and 45,048,300 Class A ordinary shares.

|

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

NEIL NANPENG SHEN (“NS”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION HONG KONG

SAR |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

4,693,2401 |

| |

6 |

|

SHARED VOTING POWER

74,187,7362

shares, of which 67,817,696 shares are directly owned by SCCG HOLDCO IV-A, 5,803,744 are directly owned by SCCGF V, 317,868 shares are directly owned by SCCGPF V and 248,428 shares are directly owned by SCCG V

PF. SCCG HOLDCO IV-A is wholly owned by SCCGF IV. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V MGMT. The General Partner of SCCGF IV is SCCG IV MGMT. SCC HOLD is the General Partner

of each of SCCG V MGMT and SCCG IV MGMT. SNP wholly owns SCC HOLD. NS wholly owns SNP. |

| |

7 |

|

SOLE DISPOSITIVE POWER

4,693,2401 |

| |

8 |

|

SHARED DISPOSITIVE POWER

74,187,7362

shares, of which 67,817,696 shares are directly owned by SCCG HOLDCO IV-A, 5,803,744 are directly owned by SCCGF V, 317,868 shares are directly owned by SCCGPF V and 248,428 shares are directly owned by SCCG V

PF. SCCG HOLDCO IV-A is wholly owned by SCCGF IV. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V MGMT. The General Partner of SCCGF IV is SCCG IV MGMT. SCC HOLD is the General Partner

of each of SCCG V MGMT and SCCG IV MGMT. SNP wholly owns SCC HOLD. NS wholly owns SNP. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

78,880,9763 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.6%4 |

| 12 |

|

TYPE OF REPORTING

PERSON IN |

| 1 |

Represented by 15,468 American Depositary Shares and 4,631,368 Class A ordinary shares.

|

| 2 |

Represented by 1,592,510 American Depositary Shares and 67,817,696 Class A ordinary shares.

|

| 3 |

Represented by 1,607,978 American Depositary Shares and 72,449,064 Class A ordinary shares.

|

| 4 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

ROELOF BOTHA (“RB”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

USA |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

346,3021 |

| |

6 |

|

SHARED VOTING POWER

57,788,3882

shares, of which 45,048,300 shares are directly owned by SC GGFII HOLD, 12,476,364 shares are directly owned by SC GGF III and 263,724 shares are directly owned by SC GGPF III. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The General

Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. SC US TTGP is the General Partner of each of SC GG II MGMT and SC GGF III MGMT. The directors and

stockholders of SC US TTGP who exercise voting and investment discretion with respect to the shares held by SC GGFII HOLD, SC GGF III and SC GGPF III are Messrs. RB and DL. |

| |

7 |

|

SOLE DISPOSITIVE POWER

346,3021 |

| |

8 |

|

SHARED DISPOSITIVE POWER

57,788,3882

shares, of which 45,048,300 shares are directly owned by SC GGFII HOLD, 12,476,364 shares are directly owned by SC GGF III and 263,724 shares are directly owned by SC GGPF III. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The General

Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. SC US TTGP is the General Partner of each of SC GG II MGMT and SC GGF III MGMT. The directors and

stockholders of SC US TTGP who exercise voting and investment discretion with respect to the shares held by SC GGFII HOLD, SC GGF III and SC GGPF III are Messrs. RB and DL. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

58,134,6903 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.1%4 |

| 12 |

|

TYPE OF REPORTING

PERSON IN |

| 1 |

Represented by 23,747 American Depositary Shares and 251,314 Class A ordinary shares.

|

| 2 |

Represented by 3,185,022 American Depositary Shares and 45,048,300 Class A ordinary shares.

|

| 3 |

Represented by 3,208,769 American Depositary Shares and 45,299,614 Class A ordinary shares.

|

| 4 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

DOUGLAS LEONE (“DL”) |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

USA |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

5 |

|

SOLE VOTING POWER

0 |

| |

6 |

|

SHARED VOTING POWER

57,788,3881

shares, of which 45,048,300 shares are directly owned by SC GGFII HOLD, 12,476,364 shares are directly owned by SC GGF III and 263,724 shares are directly owned by SC GGPF III. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The General

Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. SC US TTGP is the General Partner of each of SC GG II MGMT and SC GGF III MGMT. The directors and

stockholders of SC US TTGP who exercise voting and investment discretion with respect to the shares held by SC GGFII HOLD, SC GGF III and SC GGPF III are Messrs. RB and DL. |

| |

7 |

|

SOLE DISPOSITIVE POWER

0 |

| |

8 |

|

SHARED DISPOSITIVE POWER

57,788,3881

shares, of which 45,048,300 shares are directly owned by SC GGFII HOLD, 12,476,364 shares are directly owned by SC GGF III and 263,724 shares are directly owned by SC GGPF III. SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The General

Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. SC US TTGP is the General Partner of each of SC GG II MGMT and SC GGF III MGMT. The directors and

stockholders of SC US TTGP who exercise voting and investment discretion with respect to the shares held by SC GGFII HOLD, SC GGF III and SC GGPF III are Messrs. RB and DL. |

|

|

|

|

|

|

|

| 9 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

57,788,3881 |

| 10 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ |

| 11 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW 9 1.1%2 |

| 12 |

|

TYPE OF REPORTING

PERSON IN |

| 1 |

Represented by 3,185,022 American Depositary Shares and 45,048,300 Class A ordinary shares.

|

| 2 |

Based on a total of 5,057,542,676 Class A ordinary shares outstanding as of December 31, 2021, as

reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 25, 2022. |

(a) Name of Issuer:

Pinduoduo Inc.

(b) Address of Issuer’s Principal Executive Offices:

28/F, No. 533 Loushanguan Road

Changning District, Shanghai

200051

People’s Republic of China

(a) Name of Persons Filing:

SCC Growth IV

Holdco A, Ltd.

Sequoia Capital China Growth Fund V, L.P.

Sequoia Capital China Growth Partners Fund V, L.P.

Sequoia

Capital China Growth V Principals Fund, L.P.

Sequoia Capital China Growth Fund IV, L.P.

SC China Growth V Management, L.P.

SC China Growth IV

Management, L.P.

SC China Holding Limited

SNP China

Enterprises Limited

URM Management Limited

SC GGFII Holdco,

Ltd.

Sequoia Capital Global Growth Fund III - Endurance Partners, L.P.

Sequoia Capital Global Growth Fund III - Endurance Partners Principals Fund, L.P.

Sequoia Capital Global Growth Fund II, L.P.

Sequoia Capital

Global Growth II Principals Fund, L.P.

Sequoia Capital Global Growth Fund III - Endurance Partners Management, L.P.

SC Global Growth II Management, L.P.

SC US (TTGP), Ltd.

Neil Nanpeng Shen

Roelof Botha

Douglas Leone

SCCG HOLDCO

IV-A is wholly owned by SCCGF IV. The General Partner of each of SCCGF V, SCCGPF V and SCCG V PF is SCCG V MGMT. The General Partner of SCCGF IV is SCCG IV MGMT. SCC HOLD is the General Partner of each of SCCG

V MGMT and SCCG IV MGMT. SNP wholly owns SCC HOLD. NS wholly owns SNP and URM MANAGEMENT

SC GGFII HOLD is wholly owned by SC GGF II and SC GGPF II. The

General Partner of each of SC GGF II and SC GGPF II is SC GG II MGMT. The General Partner of each of SC GGF III and SC GGPF III is SC GGF III MGMT. SC US TTGP is the General Partner of each of SC GG II MGMT and SC GGF III MGMT. The directors and

stockholders of SC US TTGP who exercise voting and investment discretion with respect to the shares held by SC GGFII HOLD, SC GGF III and SC GGPF III are Messrs. RB and DL.

(b) Address of Principal Business Office or, if none, Residence:

2800 Sand Hill Road, Suite 101

Menlo Park, CA 94025

(c) Citizenship:

SCCG HOLDCO IV-A, SCCGF V, SCCGPF V, SCCG V PF, SCCGF IV, SCCG V MGMT, SCCG IV MGMT, SCC HOLD, URM MANAGEMENT, SC GGFII HOLD, SC GGF III, SC GGPF III, SC GGF II, SC GGPF II, SC GGF III MGMT, SC GG II MGMT and SC US TTGP: Cayman

Islands

SNP: British Virgin Islands

NS: Hong Kong SAR

RB, DL: USA

(d) CUSIP Number:

722304102

| ITEM 3. |

If this statement is filed pursuant to §§240.13d-1(b) or 240.13d-2(b) or (c), check whether the person filing is a: |

NOT APPLICABLE

SEE ROWS 5 THROUGH 11 OF COVER PAGES

| ITEM 5. |

OWNERSHIP OF FIVE PERCENT OR LESS OF A CLASS |

If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five

percent of the class of securities, check the following ☒.

| ITEM 6. |

OWNERSHIP OF MORE THAN FIVE PERCENT ON BEHALF OF ANOTHER PERSON |

NOT APPLICABLE

| ITEM 7. |

IDENTIFICATION AND CLASSIFICATION OF THE SUBSIDIARY WHICH ACQUIRED THE SECURITY BEING REPORTED ON BY THE PARENT

HOLDING COMPANY. |

NOT APPLICABLE

| ITEM 8. |

IDENTIFICATION AND CLASSIFICATION OF MEMBERS OF THE GROUP. |

NOT APPLICABLE

| ITEM 9. |

NOTICE OF DISSOLUTION OF GROUP. |

NOT APPLICABLE

NOT APPLICABLE

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: February 14, 2023

|

|

|

| SCC Growth IV Holdco A, Ltd. |

|

|

| By: |

|

Sequoia Capital China Growth Fund IV, L.P. |

|

|

its Member |

|

|

| By: |

|

SC China Growth IV Management, L.P. |

|

|

its General Partner |

|

|

| By: |

|

SC China Holding Limited |

|

|

its General Partner |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen, Authorized

Signatory |

|

| Sequoia Capital China Growth Fund V, L.P. |

| Sequoia Capital China Growth Partners Fund V, L.P. |

| Sequoia Capital China Growth V Principals Fund, L.P. |

|

|

| By: |

|

SC China Growth V Management, L.P. |

|

|

General Partner of each |

|

|

| By: |

|

SC China Holding Limited |

|

|

its General Partner |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen, Authorized |

|

|

Signatory |

|

| Sequoia Capital China Growth Fund IV, L.P. |

|

|

| By: |

|

SC China Growth IV Management, L.P. |

|

|

its General Partner |

|

|

| By: |

|

SC China Holding Limited |

|

|

its General Partner |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen, Authorized

Signatory |

|

| SC China Growth V Management, L.P. |

|

|

| By: |

|

SC China Holding Limited |

|

|

its General Partner |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen, Authorized |

|

|

Signatory |

|

|

|

| SC China Growth IV Management, L.P. |

|

|

| By: |

|

SC China Holding Limited |

|

|

its General Partner |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen, Authorized |

|

|

Signatory |

|

| SC China Holding Limited |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen, Authorized |

|

|

Signatory |

|

| SNP China Enterprises Limited |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen, Authorized |

|

|

Signatory |

|

| URM Management Limited |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen, Authorized

Signatory |

|

| SC GGFII Holdco, Ltd. |

|

|

| By: |

|

Sequoia Capital Growth Fund II, L.P. |

|

|

Sequoia Capital Global Growth II |

|

|

Principals Fund, L.P. |

|

|

its Members |

|

|

| By: |

|

Sequoia Capital Global Growth II |

|

|

Management, L.P. |

|

|

its General Partner |

|

|

| By: |

|

SC US (TTGP), Ltd. |

|

|

its General Partner |

|

|

| By: |

|

/s/ Roelof Botha |

|

|

Roelof Botha, Authorized Signatory |

Sequoia Capital Global Growth Fund III - Endurance Partners, L.P.

By: Sequoia Capital Global Growth Fund III - Endurance Partners Management, L.P.

its General Partner

|

|

|

|

|

| By: |

|

SC US (TTGP), Ltd. |

|

|

its General Partner |

|

|

| By: |

|

/s/ Roelof Botha |

|

|

Roelof Botha, Authorized Signatory

Signatory |

|

|

|

|

| Sequoia Capital Global Growth Fund III - Endurance Partners Principals Fund, L.P. |

|

|

|

|

|

| By: |

|

SC US (TTGP), Ltd. |

|

|

its General Partner |

|

|

| By: |

|

/s/ Roelof Botha |

|

|

Roelof Botha, Authorized Signatory |

|

|

|

|

| Sequoia Capital Growth Fund II, L.P. |

| Sequoia Capital Global Growth II Principals Fund, L.P. |

|

|

|

|

|

| By: |

|

Sequoia Capital Global Growth II Management, L.P. |

|

|

Its General Partner |

|

|

| By: |

|

SC US (TTGP), Ltd. |

|

|

its General Partner |

|

|

| By: |

|

/s/ Roelof Botha |

|

|

Roelof Botha, Authorized Signatory |

|

|

|

|

| Sequoia Capital Global Growth Fund III - Endurance Partners Management, L.P. |

|

|

|

|

|

| By: |

|

SC US (TTGP), Ltd. |

|

|

its General Partner |

|

|

| By: |

|

/s/ Roelof Botha |

|

|

Roelof Botha, Authorized Signatory |

|

|

|

|

| Sequoia Capital Global Growth II Management, L.P. |

|

|

|

|

|

| By: |

|

SC US (TTGP), Ltd. |

|

|

its General Partner |

|

|

| By: |

|

/s/ Roelof Botha |

|

|

Roelof Botha, Authorized Signatory |

|

|

|

| SC US (TTGP), Ltd. |

|

|

| By: |

|

/s/ Roelof Botha |

|

|

Roelof Botha, Authorized Signatory |

|

| Neil Nanpeng Shen |

|

|

| By: |

|

/s/ Neil Nanpeng Shen |

|

|

Neil Nanpeng Shen |

|

| Douglas Leone |

|

|

| By: |

|

/s/ Douglas Leone |

|

|

Douglas Leone |

|

| Roelof Botha |

|

|

| By: |

|

/s/ Roelof Botha |

|

|

Roelof Botha |

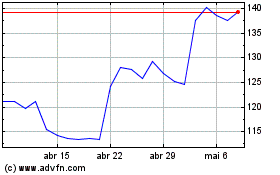

PDD (NASDAQ:PDD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

PDD (NASDAQ:PDD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024