00015948052022FYfalsehttp://fasb.org/us-gaap/2022#AccountingStandardsUpdate202006MemberP3YP2YP3YP1YP2YP2YP2YP3Y11P2YP3Y0.0006944P5D0.33330.33330.33330.25000.25000.25000.25000.250.250.250.33330.33330.333311P6YP5Y00015948052022-01-012022-12-310001594805dei:BusinessContactMember2022-01-012022-12-310001594805us-gaap:CommonClassAMember2022-12-31xbrli:shares0001594805us-gaap:CommonClassBMember2022-12-310001594805shop:FounderShareMember2022-12-3100015948052022-12-31iso4217:USD00015948052021-12-310001594805us-gaap:CommonClassAMember2021-12-310001594805us-gaap:CommonClassBMember2021-12-310001594805shop:FounderShareMember2021-12-310001594805us-gaap:CommonClassBMember2022-06-012022-06-30xbrli:pure0001594805us-gaap:CommonClassAMember2022-06-012022-06-300001594805us-gaap:SubscriptionAndCirculationMember2022-01-012022-12-310001594805us-gaap:SubscriptionAndCirculationMember2021-01-012021-12-310001594805us-gaap:ServiceMember2022-01-012022-12-310001594805us-gaap:ServiceMember2021-01-012021-12-3100015948052021-01-012021-12-310001594805us-gaap:RetainedEarningsMember2022-01-012022-12-31iso4217:USDxbrli:shares0001594805us-gaap:CommonStockMember2020-12-310001594805us-gaap:AdditionalPaidInCapitalMember2020-12-310001594805us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001594805us-gaap:RetainedEarningsMember2020-12-3100015948052020-12-3100015948052020-01-012020-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2020-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2020-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommonStockMember2020-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AdditionalPaidInCapitalMember2020-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:RetainedEarningsMember2020-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2020-12-310001594805us-gaap:CommonStockMember2021-01-012021-12-310001594805us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001594805us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001594805us-gaap:RetainedEarningsMember2021-01-012021-12-310001594805us-gaap:CommonStockMember2021-12-310001594805us-gaap:AdditionalPaidInCapitalMember2021-12-310001594805us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001594805us-gaap:RetainedEarningsMember2021-12-310001594805us-gaap:CommonStockMember2022-01-012022-12-310001594805us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001594805us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001594805us-gaap:CommonStockMember2022-12-310001594805us-gaap:AdditionalPaidInCapitalMember2022-12-310001594805us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001594805us-gaap:RetainedEarningsMember2022-12-310001594805shop:ServicePortionAttributedToEffectiveInterestRateMember2022-01-012022-12-310001594805shop:ServicePortionAttributedToEffectiveInterestRateMember2021-01-012021-12-310001594805srt:MinimumMember2022-01-012022-12-310001594805srt:MaximumMember2022-01-012022-12-310001594805us-gaap:SoftwareDevelopmentMembersrt:MinimumMember2022-01-012022-12-310001594805us-gaap:SoftwareDevelopmentMembersrt:MaximumMember2022-01-012022-12-310001594805shop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2022-12-310001594805srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2021-01-010001594805srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-01-010001594805srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2021-01-010001594805us-gaap:ComputerEquipmentMember2022-01-012022-12-310001594805us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001594805us-gaap:EquipmentMembersrt:MinimumMember2022-01-012022-12-310001594805us-gaap:EquipmentMembersrt:MaximumMember2022-01-012022-12-310001594805us-gaap:LeaseholdImprovementsMembersrt:MinimumMember2022-01-012022-12-310001594805us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2022-01-012022-12-310001594805us-gaap:ComputerSoftwareIntangibleAssetMember2022-01-012022-12-310001594805us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MinimumMember2022-01-012022-12-310001594805us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MaximumMember2022-01-012022-12-310001594805us-gaap:CustomerRelationshipsMembersrt:MinimumMember2022-01-012022-12-310001594805us-gaap:CustomerRelationshipsMembersrt:MaximumMember2022-01-012022-12-310001594805us-gaap:OtherIntangibleAssetsMembersrt:MinimumMember2022-01-012022-12-310001594805us-gaap:OtherIntangibleAssetsMembersrt:MaximumMember2022-01-012022-12-310001594805shop:ExchangeRateEffectMember2022-01-012022-12-310001594805shop:A10StrongerRateMember2022-01-012022-12-310001594805shop:ExchangeRateEffectMember2021-01-012021-12-310001594805shop:A10StrongerRateMember2021-01-012021-12-31shop:segment0001594805shop:MoneyMarketFundsandTermDepositsMember2022-12-310001594805shop:MoneyMarketFundsandTermDepositsMember2021-12-310001594805us-gaap:FairValueInputsLevel1Membershop:U.S.TermDepositsMember2022-12-310001594805us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2022-12-310001594805us-gaap:FairValueInputsLevel1Membershop:CanadaTreasuryandGovernmentMember2022-12-310001594805us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2022-12-310001594805us-gaap:FairValueInputsLevel1Memberus-gaap:RepurchaseAgreementsMember2022-12-310001594805us-gaap:FairValueInputsLevel1Member2022-12-310001594805us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001594805shop:ConvertibleNotesInPrivateCompaniesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001594805us-gaap:FairValueInputsLevel12And3Member2022-12-310001594805shop:AccruedInterestReceivableMember2022-12-310001594805shop:ConvertibleNotesInPrivateCompaniesMember2022-01-012022-12-310001594805shop:ConvertibleNotesInPrivateCompaniesMember2021-01-012021-12-310001594805us-gaap:InterestIncomeMembershop:ConvertibleNotesInPrivateCompaniesMember2022-01-012022-12-310001594805us-gaap:InterestIncomeMembershop:ConvertibleNotesInPrivateCompaniesMember2021-01-012021-12-310001594805us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2021-12-310001594805us-gaap:FairValueInputsLevel1Membershop:U.S.TermDepositsMember2021-12-310001594805us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2021-12-310001594805us-gaap:FairValueInputsLevel1Membershop:CanadaTreasuryandGovernmentMember2021-12-310001594805us-gaap:FairValueInputsLevel1Member2021-12-310001594805us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001594805shop:ConvertibleNotesInPrivateCompaniesMemberus-gaap:FairValueInputsLevel3Member2021-12-310001594805us-gaap:FairValueInputsLevel12And3Member2021-12-310001594805shop:AccruedInterestReceivableMember2021-12-310001594805us-gaap:FairValueInputsLevel1Membershop:AffirmHoldingsIncMember2022-12-310001594805shop:AffirmHoldingsIncMemberus-gaap:FairValueInputsLevel3Member2022-12-310001594805shop:AffirmHoldingsIncMember2022-12-310001594805us-gaap:FairValueInputsLevel1Membershop:AffirmHoldingsIncMember2021-12-310001594805shop:AffirmHoldingsIncMemberus-gaap:FairValueInputsLevel3Member2021-12-310001594805shop:AffirmHoldingsIncMember2021-12-310001594805us-gaap:FairValueInputsLevel1Membershop:GlobalEOnlineLtdMember2022-12-310001594805shop:GlobalEOnlineLtdMemberus-gaap:FairValueInputsLevel3Member2022-12-310001594805shop:GlobalEOnlineLtdMember2022-12-310001594805us-gaap:FairValueInputsLevel1Membershop:GlobalEOnlineLtdMember2021-12-310001594805shop:GlobalEOnlineLtdMemberus-gaap:FairValueInputsLevel3Member2021-12-310001594805shop:GlobalEOnlineLtdMember2021-12-310001594805us-gaap:FairValueInputsLevel1Membershop:OtherInvestmentMember2022-12-310001594805shop:OtherInvestmentMemberus-gaap:FairValueInputsLevel3Member2022-12-310001594805shop:OtherInvestmentMember2022-12-310001594805us-gaap:FairValueInputsLevel1Membershop:OtherInvestmentMember2021-12-310001594805shop:OtherInvestmentMemberus-gaap:FairValueInputsLevel3Member2021-12-310001594805shop:OtherInvestmentMember2021-12-310001594805us-gaap:FairValueInputsLevel3Member2022-12-310001594805us-gaap:FairValueInputsLevel3Member2021-12-310001594805us-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001594805us-gaap:FairValueInputsLevel3Member2021-01-012021-12-310001594805us-gaap:MeasurementInputDiscountForLackOfMarketabilityMemberus-gaap:FairValueInputsLevel3Member2022-12-310001594805us-gaap:MeasurementInputDiscountForLackOfMarketabilityMemberus-gaap:FairValueInputsLevel3Member2021-12-310001594805shop:EquitySecuritiesWithReadilyDeterminableFairValueMember2021-12-310001594805shop:EquitySecuritiesWithReadilyDeterminableFairValueMember2020-12-310001594805shop:EquitySecuritiesWithReadilyDeterminableFairValueMember2022-01-012022-12-310001594805shop:EquitySecuritiesWithReadilyDeterminableFairValueMember2021-01-012021-12-310001594805shop:EquitySecuritiesWithReadilyDeterminableFairValueMember2022-12-310001594805shop:EquityInvestmentsInPrivateCompaniesMember2022-12-310001594805shop:EquityInvestmentsInPrivateCompaniesMember2021-12-310001594805shop:EquityInvestmentsInThreePrivateCompaniesMember2022-12-31shop:investment0001594805shop:EquityInvestmentsInOnePrivateCompanyMember2021-12-310001594805shop:EquitySecuritiesWithoutReadilyDeterminableFairValueMember2021-12-310001594805shop:EquitySecuritiesWithoutReadilyDeterminableFairValueMember2020-12-310001594805shop:EquitySecuritiesWithoutReadilyDeterminableFairValueMember2022-01-012022-12-310001594805shop:EquitySecuritiesWithoutReadilyDeterminableFairValueMember2021-01-012021-12-310001594805shop:EquitySecuritiesWithoutReadilyDeterminableFairValueMember2022-12-310001594805us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001594805us-gaap:ForeignExchangeForwardMember2022-12-310001594805us-gaap:ForeignExchangeForwardMember2021-12-310001594805us-gaap:ForeignExchangeForwardMemberus-gaap:FairValueInputsLevel2Member2022-12-310001594805us-gaap:ForeignExchangeForwardMemberus-gaap:FairValueInputsLevel2Member2021-12-310001594805us-gaap:ForeignExchangeForwardMember2022-01-012022-12-310001594805us-gaap:ForeignExchangeForwardMember2021-01-012021-12-310001594805us-gaap:ForeignExchangeForwardMemberus-gaap:CostOfSalesMember2022-01-012022-12-310001594805us-gaap:ForeignExchangeForwardMemberus-gaap:CostOfSalesMember2021-01-012021-12-310001594805us-gaap:ForeignExchangeForwardMemberus-gaap:OperatingExpenseMember2022-01-012022-12-310001594805us-gaap:ForeignExchangeForwardMemberus-gaap:OperatingExpenseMember2021-01-012021-12-310001594805shop:UnbilledRevenuesReceivableMember2022-12-310001594805shop:UnbilledRevenuesReceivableMember2021-12-310001594805shop:UnbilledRevenuesReceivableMember2021-01-010001594805us-gaap:TradeAccountsReceivableMember2022-12-310001594805us-gaap:TradeAccountsReceivableMember2021-12-310001594805us-gaap:TradeAccountsReceivableMember2021-01-010001594805shop:SalesTaxReceivableMember2022-12-310001594805shop:SalesTaxReceivableMember2021-12-310001594805shop:SalesTaxReceivableMember2021-01-010001594805shop:OtherReceivableMember2022-12-310001594805shop:OtherReceivableMember2021-12-310001594805shop:OtherReceivableMember2021-01-010001594805shop:AccruedInterestReceivableMember2021-01-0100015948052021-01-010001594805shop:UnbilledRevenuesandTradeReceivablesMember2021-12-310001594805shop:UnbilledRevenuesandTradeReceivablesMember2020-12-310001594805shop:UnbilledRevenuesandTradeReceivablesMember2022-01-012022-12-310001594805shop:UnbilledRevenuesandTradeReceivablesMember2021-01-012021-12-310001594805shop:UnbilledRevenuesandTradeReceivablesMember2022-12-310001594805shop:MerchantCashAdvancesMember2022-12-310001594805shop:MerchantCashAdvancesMember2021-12-310001594805shop:MerchantCashAdvancesMember2021-01-010001594805us-gaap:FinanceReceivablesMember2022-12-310001594805us-gaap:FinanceReceivablesMember2021-12-310001594805us-gaap:FinanceReceivablesMember2021-01-010001594805shop:MerchantCashAdvancesMember2020-12-310001594805shop:MerchantCashAdvancesMember2022-01-012022-12-310001594805shop:MerchantCashAdvancesMember2021-01-012021-12-310001594805us-gaap:FinanceReceivablesMember2020-12-310001594805us-gaap:FinanceReceivablesMember2022-01-012022-12-310001594805us-gaap:FinanceReceivablesMember2021-01-012021-12-310001594805us-gaap:FinancialAssetNotPastDueMember2022-12-310001594805us-gaap:FinancingReceivables30To59DaysPastDueMember2022-12-310001594805us-gaap:FinancingReceivables60To89DaysPastDueMember2022-12-310001594805shop:FinancialAsset90To179DaysPastDueMember2022-12-310001594805shop:FinancialAssetEqualToOrGreaterThan180DaysPastDueMember2022-12-310001594805us-gaap:FinancialAssetNotPastDueMember2021-12-310001594805us-gaap:FinancingReceivables30To59DaysPastDueMember2021-12-310001594805us-gaap:FinancingReceivables60To89DaysPastDueMember2021-12-310001594805shop:FinancialAsset90To179DaysPastDueMember2021-12-310001594805shop:FinancialAssetEqualToOrGreaterThan180DaysPastDueMember2021-12-310001594805us-gaap:LeaseholdImprovementsMember2022-12-310001594805us-gaap:ComputerEquipmentMember2022-12-310001594805us-gaap:EquipmentMember2022-12-310001594805shop:FulfillmentRobotsMember2022-12-310001594805us-gaap:FurnitureAndFixturesMember2022-12-310001594805us-gaap:LeaseholdImprovementsMember2021-12-310001594805us-gaap:ComputerEquipmentMember2021-12-310001594805us-gaap:EquipmentMember2021-12-310001594805shop:FulfillmentRobotsMember2021-12-310001594805us-gaap:FurnitureAndFixturesMember2021-12-310001594805us-gaap:ComputerEquipmentMember2021-01-012021-12-310001594805us-gaap:CostOfSalesMember2022-01-012022-12-310001594805us-gaap:CostOfSalesMember2021-01-012021-12-310001594805us-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310001594805us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310001594805us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001594805us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001594805us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001594805us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001594805srt:MinimumMember2022-12-310001594805srt:MaximumMember2022-12-310001594805shop:OfficesMember2022-12-310001594805shop:WarehousesAndCommercialSpacesMember2022-12-310001594805us-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310001594805us-gaap:CustomerRelationshipsMember2022-12-310001594805us-gaap:OtherIntangibleAssetsMember2022-12-310001594805us-gaap:SoftwareDevelopmentMember2022-12-310001594805us-gaap:TechnologyBasedIntangibleAssetsMember2021-12-310001594805us-gaap:CustomerRelationshipsMember2021-12-310001594805us-gaap:OtherIntangibleAssetsMember2021-12-310001594805us-gaap:SoftwareDevelopmentMember2021-12-310001594805us-gaap:ComputerSoftwareIntangibleAssetMember2021-12-310001594805shop:TechnologyBasedIntangibleAssetsSoftwareDevelopmentAndComputerSoftwareIntangibleAssetMember2022-12-310001594805shop:TechnologyBasedIntangibleAssetsSoftwareDevelopmentAndComputerSoftwareIntangibleAssetMember2022-01-012022-12-3100015948052022-09-302022-12-310001594805shop:DeliverrIncMember2022-01-012022-12-310001594805shop:DeliverrIncMember2021-01-012021-12-310001594805shop:DondeFashionIncMember2022-01-012022-12-310001594805shop:DondeFashionIncMember2021-01-012021-12-310001594805shop:OtherAcquisitionsMember2022-01-012022-12-310001594805shop:OtherAcquisitionsMember2021-01-012021-12-310001594805shop:StrategicPartnershipsMembersrt:MinimumMember2022-12-310001594805shop:StrategicPartnershipsMembersrt:MaximumMember2022-12-310001594805shop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2020-09-300001594805shop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2020-09-012020-09-300001594805shop:DebtConversionTermsOneMembershop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2022-01-012022-12-31utr:D0001594805shop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMembershop:DebtConversionTermsTwoMember2022-01-012022-12-310001594805shop:DebtRedemptionTermsOneMembershop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2022-01-012022-12-310001594805shop:DebtRedemptionTermsTwoMembershop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2022-01-012022-12-310001594805shop:DebtRedemptionTermsThreeMembershop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2022-01-012022-12-310001594805shop:DebtRedemptionTermsFourMembershop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2022-01-012022-12-310001594805shop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMembershop:DebtRedemptionTermsFiveMember2022-01-012022-12-310001594805shop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Memberus-gaap:ConvertibleDebtMember2021-12-310001594805shop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Member2022-12-310001594805shop:ZeroPointOneTwoFivePercentConvertibleSeniorNotesDue2025Member2021-12-310001594805us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembershop:SiliconValleyBankMember2022-12-31iso4217:CAD0001594805us-gaap:RevolvingCreditFacilityMemberus-gaap:PrimeRateMemberus-gaap:LineOfCreditMembershop:SiliconValleyBankMember2022-01-012022-12-310001594805us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembershop:SiliconValleyBankMember2021-12-3100015948052022-08-312022-08-31shop:patent00015948052021-12-01shop:publisher00015948052021-12-012021-12-01shop:parent_company0001594805shop:StrategicPartnershipsMembersrt:AffiliatedEntityMember2022-01-012022-01-310001594805shop:StrategicPartnershipsMembersrt:AffiliatedEntityMember2022-01-012022-12-310001594805shop:FounderShareMember2022-06-070001594805us-gaap:CommonClassAMember2022-06-072022-06-070001594805us-gaap:CommonClassBMember2022-06-072022-06-070001594805us-gaap:IPOMemberus-gaap:CommonClassAMember2021-02-012021-02-2800015948052021-02-2800015948052021-02-012021-02-280001594805us-gaap:CommonClassAMember2022-01-012022-12-31shop:vote0001594805us-gaap:CommonClassBMember2022-01-012022-12-310001594805us-gaap:CommonClassBMembershop:LegacyOptionPlanMember2015-05-272015-05-270001594805shop:EmployeeandNonemployeeStockOptionMembershop:StockOptionPlanMemberus-gaap:CommonClassAMember2015-05-272015-05-270001594805us-gaap:RestrictedStockUnitsRSUMembershop:PriortoNovember2017RSUsMember2018-05-302018-05-300001594805us-gaap:RestrictedStockUnitsRSUMembershop:PriortoNovember2017RSUsMember2015-05-272015-05-270001594805shop:LongTermIncentivePlanMemberus-gaap:CommonClassAMember2018-05-302018-05-300001594805us-gaap:RestrictedStockUnitsRSUMembershop:LongTermIncentivePlanMember2015-05-272015-05-270001594805us-gaap:RestrictedStockUnitsRSUMembershop:LongTermIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2015-05-272015-05-270001594805us-gaap:RestrictedStockUnitsRSUMembershop:LongTermIncentivePlanMember2018-05-302018-05-300001594805shop:LongTermIncentivePlanMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310001594805shop:StockOptionPlanandLTIPMemberus-gaap:CommonClassAMember2015-05-270001594805shop:StockOptionPlanandLTIPMemberus-gaap:CommonClassAMember2015-05-272015-05-270001594805shop:StockOptionPlanandLTIPMemberus-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2023-01-010001594805us-gaap:RestrictedStockUnitsRSUMember2020-12-310001594805us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001594805us-gaap:RestrictedStockUnitsRSUMember2021-12-310001594805us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001594805us-gaap:RestrictedStockUnitsRSUMember2022-12-310001594805us-gaap:CommonClassBMembershop:LegacyOptionPlanMember2022-12-310001594805shop:StockOptionPlanMemberus-gaap:CommonClassAMember2022-12-310001594805shop:A6RiverSystems2016AmendedandRestatedStockOptionandGrantPlanMemberus-gaap:CommonClassAMember2022-12-310001594805us-gaap:CommonClassAMembershop:DeliverrIncMember2022-12-310001594805shop:FlexCompMember2022-09-012022-09-010001594805shop:DeliverrIncMember2022-09-012022-09-010001594805us-gaap:RestrictedStockUnitsRSUMembershop:DeliverrIncMember2022-09-012022-09-010001594805us-gaap:RestrictedStockUnitsRSUMembershop:FlexCompMember2022-09-012022-09-010001594805shop:FlexCompMember2022-01-012022-12-310001594805us-gaap:RestrictedStockUnitsRSUMembershop:FlexCompMember2022-01-012022-12-310001594805shop:LongTermIncentivePlanMembershop:DeferredSharesMember2022-01-012022-12-310001594805us-gaap:CommonClassAMembershop:A6RiverSystemsInc.Member2019-10-172019-10-170001594805us-gaap:CommonClassAMembershop:A6RiverSystemsInc.Member2022-12-310001594805us-gaap:CommonClassAMembershop:DeliverrIncMember2019-10-172019-10-170001594805us-gaap:CommonClassAMembershop:DeliverrIncMember2022-12-310001594805shop:OtherAcquisitionsMemberus-gaap:CommonClassAMember2019-10-172019-10-170001594805shop:OtherAcquisitionsMemberus-gaap:CommonClassAMember2022-12-310001594805us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001594805us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001594805shop:EmployeeandNonemployeeStockOptionMembershop:StockOptionPlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2018-05-302018-05-300001594805us-gaap:ShareBasedCompensationAwardTrancheTwoMembershop:EmployeeandNonemployeeStockOptionMembershop:StockOptionPlanMember2018-05-302018-05-300001594805shop:EmployeeandNonemployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembershop:StockOptionPlanMember2018-05-302018-05-300001594805shop:EmployeeandNonemployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembershop:LegacyOptionPlanMember2015-05-272015-05-270001594805us-gaap:ShareBasedCompensationAwardTrancheTwoMembershop:EmployeeandNonemployeeStockOptionMembershop:LegacyOptionPlanMember2015-05-272015-05-270001594805shop:EmployeeandNonemployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembershop:LegacyOptionPlanMember2015-05-272015-05-270001594805shop:EmployeeandNonemployeeStockOptionMembershop:LegacyOptionPlanMembershop:SharebasedCompensationAwardTrancheFourMember2015-05-272015-05-270001594805us-gaap:RestrictedStockUnitsRSUMembershop:PriortoNovember2017RSUsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2015-05-272015-05-270001594805us-gaap:RestrictedStockUnitsRSUMembershop:PriortoNovember2017RSUsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2015-05-272015-05-270001594805us-gaap:RestrictedStockUnitsRSUMembershop:PriortoNovember2017RSUsMembershop:SharebasedCompensationAwardTrancheFourMember2015-05-272015-05-270001594805us-gaap:RestrictedStockUnitsRSUMembershop:LongTermIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2018-05-302018-05-300001594805us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembershop:LongTermIncentivePlanMember2018-05-302018-05-300001594805us-gaap:RestrictedStockUnitsRSUMembershop:LongTermIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2018-05-302018-05-300001594805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001594805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001594805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001594805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001594805us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembershop:CostOfGoodsAndServicesSoldMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001594805us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMembershop:CostOfGoodsAndServicesSoldMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001594805us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:SellingAndMarketingExpenseMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001594805us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:SellingAndMarketingExpenseMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001594805us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001594805us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001594805us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001594805us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001594805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001594805country:CA2022-01-012022-12-310001594805country:CA2021-01-012021-12-310001594805us-gaap:ForeignCountryMember2022-01-012022-12-310001594805us-gaap:ForeignCountryMember2021-01-012021-12-310001594805us-gaap:CanadaRevenueAgencyMember2022-01-012022-12-310001594805us-gaap:CanadaRevenueAgencyMember2021-01-012021-12-310001594805us-gaap:ForeignCountryMember2022-12-310001594805us-gaap:ForeignCountryMember2021-12-310001594805us-gaap:StateAndLocalJurisdictionMember2022-12-310001594805us-gaap:StateAndLocalJurisdictionMember2021-12-310001594805us-gaap:DomesticCountryMember2022-12-310001594805us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001594805us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001594805us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001594805us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001594805shop:ConvertibleSeniorNotesMember2022-01-012022-12-310001594805shop:ConvertibleSeniorNotesMember2021-01-012021-12-310001594805shop:DeferredShareUnitsDSUsMember2022-01-012022-12-310001594805shop:DeferredShareUnitsDSUsMember2021-01-012021-12-310001594805country:CAus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805country:CAus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805country:USus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805country:USus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805us-gaap:SalesRevenueNetMemberus-gaap:EMEAMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805us-gaap:SalesRevenueNetMemberus-gaap:EMEAMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805shop:APACMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805shop:APACMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805srt:LatinAmericaMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805srt:LatinAmericaMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805country:CAus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2022-12-310001594805country:CAus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805country:CAus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2021-12-310001594805country:CAus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805country:USus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2022-12-310001594805country:USus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805country:USus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2021-12-310001594805country:USus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805shop:OtherCountriesMemberus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2022-12-310001594805shop:OtherCountriesMemberus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805shop:OtherCountriesMemberus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2021-12-310001594805shop:OtherCountriesMemberus-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805us-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2022-12-310001594805us-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310001594805us-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2021-12-310001594805us-gaap:NetAssetsGeographicAreaMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001594805shop:DeliverrIncMember2022-07-080001594805shop:DeliverrIncMember2022-07-082022-07-080001594805us-gaap:CommonClassAMembershop:DeliverrIncMember2022-07-082022-07-080001594805us-gaap:TechnologyBasedIntangibleAssetsMembershop:DeliverrIncMember2022-07-080001594805us-gaap:CustomerRelationshipsMembershop:DeliverrIncMember2022-07-080001594805us-gaap:OtherIntangibleAssetsMembershop:DeliverrIncMember2022-07-080001594805us-gaap:TechnologyBasedIntangibleAssetsMembershop:DeliverrIncMember2022-07-082022-07-080001594805us-gaap:CustomerRelationshipsMembershop:DeliverrIncMember2022-07-082022-07-080001594805us-gaap:OtherIntangibleAssetsMembershop:DeliverrIncMember2022-07-082022-07-080001594805shop:DondeFashionIncMember2021-07-200001594805shop:DondeFashionIncMember2021-07-202021-07-200001594805us-gaap:TechnologyBasedIntangibleAssetsMembershop:DondeFashionIncMember2021-07-200001594805us-gaap:TechnologyBasedIntangibleAssetsMembershop:DondeFashionIncMember2021-07-202021-07-20

| | | | | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

|

FORM 40-F

| | | | | | | | | | | | | | |

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022 Commission File Number 001-37400

SHOPIFY INC.

(Exact name of Registrant as specified in its charter)

Canada

(Province or other jurisdiction of incorporation or organization)

7372

(Primary Standard Industrial Classification Code Number (if applicable))

98-0486686

(I.R.S. Employer Identification Number (if applicable))

151 O'Connor Street, Ground Floor Ottawa, Ontario, Canada K2P 2L8

Attention: Jessica Hertz, General Counsel and Corporate Secretary

613-241-2828

(Address and telephone number of Registrant's principal executive offices)

Corporation Service Company

251 Little Falls Drive, Wilmington, DE 19808-1674

(302) 636-5400

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies of all correspondence should be sent to:

Jessica Hertz

General Counsel and Corporate Secretary

Shopify Inc.

151 O'Connor Street, Ground Floor

Ottawa, ON K2P 2L8

Canada

Tel: (613) 241-2828

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Subordinate Voting Shares | SHOP | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Class B Multiple Voting Shares

0.125% Convertible Senior Notes Due 2025

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

☒ Annual Information Form ☒ Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

The Registrant had 1,195,697,614 Class A Subordinate Voting Shares, 79,430,952 Class B Restricted Voting Shares and 1 Founder Share issued and outstanding as of December 31, 2022.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report: ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

PRIOR FILINGS MODIFIED AND SUPERSEDED

This Annual Report on Form 40-F of Shopify Inc. ("Shopify", "we", "our", the "Company" or the "Registrant") for the year ended December 31, 2022, at the time of filing with the U.S. Securities and Exchange Commission (the "SEC" or the "Commission"), modifies and supersedes all prior documents filed pursuant to Sections 13, 14 and 15(d) of the U.S. Securities Exchange Act of 1934 (as amended, the "Exchange Act") for purposes of any offers or sales of any securities after the date of this filing pursuant to any registration statement or prospectus filed pursuant to the U.S. Securities Act of 1933 (as amended, the "Securities Act") which incorporates by reference this Annual Report on Form 40-F (or any of the documents filed as Exhibits to this Annual Report on Form 40-F).

FORWARD-LOOKING STATEMENTS

Shopify has made in this Annual Report on Form 40-F and the documents filed as Exhibits hereto, and from time to time may otherwise make, forward-looking statements under the provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act, and forward-looking information within the meaning of applicable Canadian securities legislation.

The Company's actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

The forward-looking statements represent the Company's views as of the date of this Annual Report on Form 40-F. The Company anticipates that subsequent events and developments may cause these views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company has no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent the Company's views as of any date other than the date of this Annual Report on Form 40-F.

See Shopify's annual information form for the year ended December 31, 2022, attached as Exhibit 1.1 to this Annual Report on Form 40-F, under the heading "Forward-Looking Information" and Shopify's management's discussion and analysis for the year ended December 31, 2022, attached as Exhibit 1.3 to this Annual Report on Form 40-F (the "Shopify 2022 MD&A"), under the heading "Forward-looking Statements", for a discussion of forward-looking statements.

A. Disclosure Controls and Procedures and Internal Control Over Financial Reporting

All control systems, no matter how well designed, have inherent limitations. Accordingly, even disclosure controls and procedures and internal controls over financial reporting determined to be effective can only provide reasonable assurance of achieving their control objectives with respect to financial statement preparation and presentation.

Disclosure Controls and Procedures

Management of the Company, under the supervision of the Chief Executive Officer and Chief Financial Officer, is responsible for establishing and maintaining disclosure controls and procedures (as defined by the Commission in Rule 13a-15(e) under the Exchange Act) for the Company to ensure that material information relating to the Company, including its consolidated subsidiaries, that is required to be made known to the Chief Executive Officer and Chief Financial Officer by others within the Company and disclosed by the Company in reports filed or submitted by it under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in the Commission's rules and forms; and (ii) accumulated and communicated to the Company's management, including its Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

We, including the Chief Executive Officer and Chief Financial Officer, have evaluated the effectiveness of the Company's disclosure controls and procedures as of December 31, 2022 and have concluded that the Company’s disclosure controls and procedures were effective as of December 31, 2022. See “Disclosure Controls and Procedures and Internal Control Over Financial Reporting” in the Shopify 2022 MD&A, filed as Exhibit 1.3 to this Annual Report on Form 40-F.

Management's Annual Report on Internal Control over Financial Reporting

Management of the Company, under the supervision of the Chief Executive Officer and the Chief Financial Officer, is responsible for establishing and maintaining adequate internal control over the Company’s financial reporting. Internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with United States generally accepted accounting principles.

We, including the Chief Executive Officer and Chief Financial Officer, have assessed the effectiveness of the Company’s internal control over financial reporting in accordance with Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO"). Based on this assessment, we, including the Chief Executive Officer and Chief Financial Officer, have determined that the Company’s internal control over financial reporting was effective as at December 31, 2022. Additionally, based on our assessment, we determined that there were no material weaknesses in the Company's internal control over financial reporting as at December 31, 2022. See "Management's Annual Report on Internal Control Over Financial Reporting", which accompanies Shopify's audited consolidated financial statements as at December 31, 2022 and 2021 and for the years then ended (the "Shopify 2022 Financial Statements"), filed as Exhibit 1.2 to this Annual Report on Form 40-F.

We have excluded Deliverr Inc. from our assessment of internal control over financial reporting as at December 31, 2022 because they were acquired by the Company in a purchase business combination during 2022. Deliverr Inc. is a wholly-owned subsidiary whose total assets and total revenues represent 1% and 2%, respectively, of the related consolidated financial statement amounts as at and for the year ended December 31, 2022.

Attestation Report of the Independent Registered Public Accounting Firm

The effectiveness of the Company's internal control over financial reporting as at December 31, 2022 has been audited by PricewaterhouseCoopers LLP (PCAOB ID No. 271), an independent registered public

accounting firm, as stated in their report, which accompanies the Shopify 2022 Financial Statements, and is filed as Exhibit 1.2 to this Annual Report on Form 40-F.

Changes in Internal Control over Financial Reporting

In the year ended December 31, 2022, we migrated certain financial reporting systems and their accompanying financial information between cloud environments, which included changes to our underlying information technology infrastructure and internal controls over financial reporting.

Other than the system migration as described above, there were no changes in the Company's internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.

B. Identification of the Audit Committee

The board of directors of the Company (the "Board") has a separately designated standing audit committee (the "Audit Committee") established in accordance with section 3(a)(58)(A) of the Exchange Act. The Board has appointed three independent directors, Colleen Johnston (Chair), Robert Ashe, and Gail Goodman, to the Audit Committee.

C. Audit Committee Financial Expert

The Board has determined that Colleen Johnston, the Chair of the Audit Committee, is qualified as an "audit committee financial expert" within the meaning of Item 407 of Regulation S-K. The Board has further determined that all members of the Audit Committee are "independent" within the meaning of applicable Commission regulations and the listing standards of the New York Stock Exchange (the "NYSE").

The Commission has indicated that the designation of a person as an audit committee financial expert does not make such person an "expert" for any purpose, or impose any duties, obligations or liability on such person that are greater than those imposed on members of the Audit Committee and the Board who do not carry this designation, or affect the duties, obligations or liability of any other member of the Audit Committee or Board.

D. Code of Ethics

The Company's code of ethics, the Shopify Code of Conduct, is applicable to all of its directors, officers and employees, including the Chief Executive Officer, Chief Financial Officer, Controller, and persons performing similar functions. The Shopify Code of Conduct, as amended, is available on the Company's website at https://investors.shopify.com/governance/governance-documents/default.aspx. Except for the Shopify Code of Conduct, and notwithstanding any reference to Shopify's website or other websites in this Annual Report on Form 40-F or in the documents incorporated by reference herein or attached as Exhibits hereto, no information contained on the Company's website or any other site shall be incorporated by reference in this Annual Report on Form 40-F or in the documents incorporated by reference herein or attached as Exhibits hereto.

E. Principal Accountant Fees and Services

The aggregate amounts paid or accrued by the Company with respect to fees payable to PricewaterhouseCoopers LLP, the independent registered public accounting firm of the Company, for audit (including separate audits of wholly-owned and non-wholly owned entities, financings, regulatory reporting requirements and SOX related services), audit-related, tax and other services in the years ended December 31, 2022 and 2021 were as follows:

| | | | | | | | | | | | | | |

| Fiscal 2022

US$ | Fiscal 2021

US$ |

| (in thousands) |

| Audit Fees | 3,549 | | 1,664 | |

| Audit-related Fees | — | | — | |

| Tax Fees | 106 | | 53 | |

| All Other Fees | 32 | | 7 | |

| Total | 3,687 | | 1,724 | |

Audit Fees

Audit fees relate to the audit of our annual consolidated financial statements, the review of our unaudited interim condensed consolidated financial statements, statutory audits of certain of our wholly-owned subsidiaries' financial statements, and services in connection with regulatory prospectus filings in Canada, and our Registration Statements on Form F-10 (related to our 2021 public offering of Class A subordinate voting shares) and Form S-8.

Audit-Related Fees

Audit-related fees consist of aggregate fees for accounting consultations and other services that were reasonably related to the performance of audits or reviews of our consolidated financial statements and were not reported above under "Audit Fees."

Tax Fees

Tax fees relate to assistance with tax compliance, expatriate tax return preparation, tax planning and various tax advisory services.

All Other Fees

Other fees are any additional amounts for products and services provided by the principal accountants, other than the services reported above under "Audit Fees,", "Audit-Related Fees" and "Tax Fees".

Audit Committee Pre-Approval Policies and Procedures

From time to time, management recommends to and requests approval from the Audit Committee for audit and non-audit services to be provided by the Company's independent registered public accounting firm. The Audit Committee considers such requests, if applicable, on a quarterly basis, and if acceptable, pre-approves such audit and non-audit services. During such deliberations, the Audit Committee assesses, among other factors, whether the services requested would be considered "prohibited services" as contemplated by the SEC, and whether the services requested and the fees related to such services could

impair the independence of the Company's registered public accounting firm.

The Audit Committee considered and agreed that the fees paid to the Company's independent registered public accounting firm in the years ended December 31, 2022 and 2021 are compatible with maintaining the independence of the Company's registered public accounting firm. The Audit Committee determined that, in order to ensure the continued independence of the registered public accounting firm, only limited non-audit services will be provided to the Company by our independent registered public accounting firm, PricewaterhouseCoopers LLP.

Since the implementation of the Audit Committee pre-approval process in November 2015, all audit and non-audit services rendered by our independent registered public accounting firm have been pre-approved by the Audit Committee.

F. Off-Balance Sheet Arrangements

We have no material off-balance sheet arrangements, other than operating leases and other unconditional purchase obligations (which have been disclosed under "Contractual Obligations" in the Shopify 2022 MD&A).

G. Tabular Disclosure of Contractual Obligations

See the Shopify 2022 MD&A, under the heading "Contractual Obligations", which section is incorporated by reference in this Annual Report on Form 40-F, for a tabular disclosure and discussion of contractual obligations.

H. NYSE Exemptions

Section 310.00 of the NYSE Listed Company Manual generally requires that a listed company's by-laws provide for a quorum for any meeting of the holders of the company's common shares that is sufficiently high to ensure a representative vote. Pursuant to the NYSE corporate governance rules we, as a foreign private issuer, have elected to comply with practices that are permitted under Canadian law in lieu of the provisions of Section 310.00. Our by-laws provide that the holders of at least 25% of the shares entitled to vote at the meeting, present in person or represented by proxy, and at least two persons entitled to vote at the meeting, present in person or represented by proxy, constitutes a quorum.

Except as stated above, we are in compliance with the rules generally applicable to U.S. domestic companies listed on the NYSE. We may in the future decide to use other foreign private issuer exemptions with respect to some of the other NYSE listing requirements. Following our home country governance practices, as opposed to the requirements that would otherwise apply to a company listed on the NYSE, may provide less protection than is accorded to investors under the NYSE listing requirements applicable to U.S. domestic issuers.

I. Undertaking

Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

EXHIBITS

The following documents are filed as Exhibits to this Annual Report on Form 40-F:

| | | | | | | | | | | | | | |

| Exhibit No. | Document |

| 1.1 | Annual Information Form for the year ended December 31, 2022 |

| 1.2 | Audited Consolidated Financial Statements as at and for the years ended December 31, 2022 and 2021 |

| 1.3 | Management's Discussion and Analysis for the year ended December 31, 2022 |

| 23.1 | Consent of PricewaterhouseCoopers LLP |

| 31.1 | Certification of the Chief Executive Officer and the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of the Chief Executive Officer and the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101 | Interactive Data File (formatted as Inline XBRL) |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

Exhibits 1.1, 1.2 and 1.3 of this Annual Report on Form 40-F are incorporated by reference into the Registration Statement on Form F-10 of the Registrant, which was originally filed with the Commission on September 9, 2022 (File No. 333‐267353), the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Securities and Exchange Commission on May 29, 2015 (File No. 333-204568), the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Commission on May 12, 2016 (File No. 333-211305), the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Commission on October 17, 2019 (File No. 333-234241), the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Commission on July 28, 2021 (File No. 333-258230), the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Commission on July 20, 2022 (File No. 333-266243) and the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Commission on September 9, 2022 (File No. 333-267364) (together, the "Registration Statements"). Exhibit 23.1 is incorporated by reference as an exhibit to the Registration Statements.

____________________________________________________________________________________

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

| | | | | | | | | | | | | | | | | |

| Shopify Inc. |

| (Registrant) |

| Date: February 16, 2023 | | By: | /s/ Jessica Hertz |

| Name: Jessica Hertz

Title: General Counsel and Corporate Secretary |

____________________________________________________________________________________

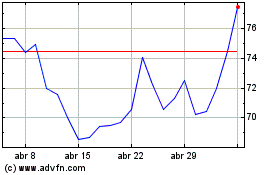

Shopify (NYSE:SHOP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Shopify (NYSE:SHOP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024