Current Report Filing (8-k)

01 Março 2023 - 11:06AM

Edgar (US Regulatory)

0000815097

false

0000815097

2023-02-28

2023-02-28

0000815097

CCL:CarnivalPLCMember

2023-02-28

2023-02-28

0000815097

CCL:CommonStock0.01ParValueMember

2023-02-28

2023-02-28

0000815097

CCL:OrdinarySharesEachRepresentedByAmericanDepositarySharesMember

CCL:CarnivalPLCMember

2023-02-28

2023-02-28

0000815097

CCL:Sec1.000SeniorNotesDue2029Member

CCL:CarnivalPLCMember

2023-02-28

2023-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported) March 1, 2023 (February 28, 2023)

| Carnival Corporation |

|

Carnival plc |

| (Exact

name of registrant as specified in its charter) |

|

(Exact

name of registrant as specified in its charter) |

| |

|

|

| Republic of Panama |

|

England and Wales |

| (State

or other jurisdiction of incorporation) |

|

(State

or other jurisdiction of incorporation) |

| |

|

|

| 001-9610 |

|

001-15136 |

| (Commission

File Number) |

|

(Commission

File Number) |

| |

|

|

| 59-1562976 |

|

98-0357772 |

| (I.R.S.

Employer Identification No.) |

|

(I.R.S.

Employer Identification No.) |

| |

|

|

|

3655 N.W. 87th Avenue

Miami, Florida 33178-2428 |

|

Carnival House, 100 Harbour Parade,

Southampton SO15 1ST, United Kingdom |

(Address of principal

executive offices)

(Zip code) |

|

(Address of principal

executive offices)

(Zip code) |

| |

|

|

| (305) 599-2600 |

|

011 44 23 8065 5000 |

| (Registrant’s

telephone number, including area code) |

|

(Registrant’s

telephone number, including area code) |

| |

|

|

| None |

|

None |

| (Former

name or former address, if changed since last report.) |

|

(Former

name or former address, if changed since last report.) |

| CIK |

0001125259 |

| Amendment Flag |

False |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock ($0.01 par value) |

|

CCL |

|

New York Stock Exchange, Inc. |

| Ordinary Shares each represented by American Depository Shares ($1.66 par value), Special Voting Share, GBP 1.00 par value and Trust Shares of beneficial interest in the P&O Princess Special Voting Trust |

|

CUK |

|

New York Stock Exchange, Inc. |

| 1.000% Senior Notes due 2029 |

|

CUK29 |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrants

are emerging growth companies as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2) of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

The disclosure set forth below under Item 2.03 is incorporated by

reference into this Item 1.01.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement of a Registrant. |

On February 28, 2023, Carnival Holdings (Bermuda) II Limited

(the “Borrower”), a subsidiary of Carnival Corporation, entered into a new forward starting $2.1 billion multi-currency

revolving credit agreement (the “New Facility”) with a syndicate of

financial institutions (the “Lenders”) and J.P. Morgan SE as facilities

agent. The New Facility is effective and may be utilized beginning August 6, 2024. The New Facility will replace the existing

multi-currency revolving credit agreement (the “Existing Facility”) upon

its expiration on August 6, 2024. The New Facility also contains an accordion feature, allowing for additional commitments, up to an

aggregate of $2.9 billion, which is the aggregate commitments under the Existing Facility.

Borrowings under the New Facility will bear interest at a rate of

term SOFR in relation to any loan in US Dollars, EURIBOR in relation to any loan in euros, or daily compounding SONIA in relation to any

loan in sterling, plus a margin based on the long-term credit ratings of Carnival Corporation. The New Facility also includes an emissions-linked

margin adjustment whereby, after the initial applicable margin is set per the margin pricing grid, the margin may be adjusted based on

performance in achieving certain agreed annual carbon emissions goals. While any loans are outstanding under the Existing Facility, the

New Facility will require Carnival Corporation to pay a top-up margin on such loans so that lenders participating in both the New Facility

and Existing Facility are paid a margin equal to the amount specified in the New Facility. In addition, Carnival Corporation is required

to pay certain fees on the aggregate unused commitments under the New Facility and the Existing Facility. An additional utilization fee

is payable depending on the outstanding amounts under the New Facility.

The New Facility contains representations, warranties, covenants

and events of default that are customary for a transaction of this type. Borrowings may be used for general liquidity and working capital

purposes, to support Carnival Corporation’s and Carnival plc’s commercial paper programs, and such swingline facilities, letters

of credit and bonding facilities as may be needed. Carnival Corporation and Carnival plc have each guaranteed the obligations of certain

of its respective subsidiaries under the New Facility and each of Carnival Corporation and Carnival plc have also cross guaranteed each

other’s respective obligations under the New Facility. Certain subsidiaries of Carnival Corporation and Carnival plc have also each

guaranteed the obligations of each other, Carnival Corporation, Carnival plc and the Borrower under the New Facility. In connection with

entering into the New Facility, Carnival Corporation, Carnival plc and its subsidiaries will contribute three unencumbered vessels to

the Borrower, with each of the vessels continuing to be operated under one of the Carnival Corporation & plc brands.

The New Facility will expire on August 6, 2025, subject to two one-year

extension options, at which time all outstanding amounts under the New Facility will be due and payable.

Other than as described above, the material terms of the New Facility

are substantially similar to the terms of the Existing Facility.

The New Facility was co-coordinated by Bank of America, BNP Paribas

and JP Morgan. PJT Partners served as independent financial advisor to Carnival Corporation & plc.

Some of the Lenders under the New Facility and their affiliates

have various relationships with Carnival Corporation, Carnival plc and certain of their subsidiaries involving the provision of financial

services, including cash management, investment banking and trust services. In addition, Carnival Corporation & plc have entered into

other loan arrangements as well as certain derivative arrangements with certain of the lenders and their affiliates.

A copy of Carnival Corporation & plc’s

press release announcing the new revolving credit facility is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Exhibit 99.1 is being furnished and shall

not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section. The information in Exhibit 99.1 shall not be incorporated by

reference into future filings under the Securities Act of 1933, as amended, or the Exchange Act, unless it is specifically incorporated

by reference therein.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, each of the registrants has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CARNIVAL CORPORATION |

|

CARNIVAL PLC |

| |

|

|

|

|

| By: |

/s/ David Bernstein |

|

By: |

/s/ David Bernstein |

| Name: |

David Bernstein |

|

Name: |

David Bernstein |

| Title: |

Chief Financial Officer and Chief Accounting Officer |

|

Title: |

Chief Financial Officer and Chief Accounting Officer |

| |

|

|

|

|

Date: March 1, 2023 |

|

Date: March 1, 2023 |

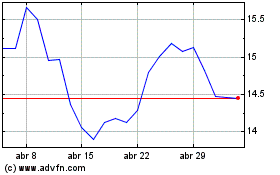

Carnival (NYSE:CCL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

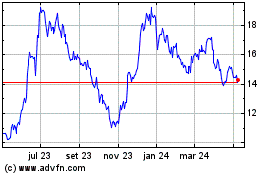

Carnival (NYSE:CCL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024