As filed with the Securities and Exchange Commission on March 10, 2023

Registration No. 333- _____

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

Under

THE

SECURITIES ACT OF 1933

BP p.l.c.

(Exact name

of registrant as specified in its charter)

|

|

|

| England and Wales |

|

None |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

1 St. James’s Square

London SW1Y 4PD, England

(Address of principal executive offices)

BP p.l.c. Reinvent BP Plan

BP p.l.c. Reinvent BP Plan (B)

BP p.l.c. Restricted Share Plan II

BP p.l.c. IST Deferred Annual Bonus Plan 2015

(Full title of plan)

With a copy to:

|

|

|

| Mark Crawford

Senior Vice-President Legal, People & Culture

BP America Inc. 501

Westlake Park Boulevard Houston, Texas 77079

(281) 366-2651 |

|

Eric Nitcher

Executive Vice President, Legal

BP p.l.c. 1 St.

James’s Square London SW1Y 4PD, England

+44 (20) 7496 4452 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

|

|

|

|

|

|

|

| Large Accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

| Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Item 6. Indemnification of Directors and Officers

BP has entered into Deeds of Indemnity with the Directors and Secretary of BP by which BP agrees and confirms that the provisions of Article 137 of BP’s

Articles of Association (as the same may from time to time be amended or modified) (the “Indemnity”) shall be enforceable directly by them against BP. The Directors and Secretary must promptly give BP written notice of any matter or

circumstance which may give rise to a claim under the Indemnity and permit BP (where appropriate) to participate in and assume the defense of any action, suit or proceeding or governmental or other investigation of which they are made or threatened

to be made a party and which may give rise to a claim under the Indemnity.

Article 137 of BP’s Articles of Association currently

provides:

“Subject to the provisions of and so far as may be consistent with the Companies Acts, every current or former director,

Secretary, or other officer of the Company shall be entitled to be indemnified by the Company against all costs, charges, losses, expenses and liabilities incurred by him in the execution and/or discharge of his duties and/or the exercise of his

powers and/or otherwise in relation to or in connection with his duties, powers or office.”

The following provisions of the

Companies Act 2006 provide as follows:

“232 Provisions protecting directors from liability

| |

(1) |

Any provision that purports to exempt a director of a company (to any extent) from any liability that would

otherwise attach to him in connection with any negligence, default, breach of duty or breach of trust in relation to the company is void. |

| |

(2) |

Any provision by which a company directly or indirectly provides an indemnity (to any extent) for a director of

the company, or of an associated company, against any liability attaching to him in connection with any negligence, default, breach of duty or breach of trust in relation to the company of which he is a director is void except as permitted by –

|

| |

(a) |

section 233 (provision of insurance), |

| |

(b) |

section 234 (qualifying third party indemnity provision), or |

| |

(c) |

section 235 (qualifying pension scheme indemnity provision). |

| |

(3) |

This section applies to any provision, whether contained in a company’s articles or in any contract with

the company or otherwise. |

| |

(4) |

Nothing in this section prevents a company’s articles from making such provision as has previously been

lawful for dealing with conflicts of interest. |

3

“233 Provision of insurance

Section 232(2) (voidness of provisions for indemnifying directors) does not prevent a company from purchasing and maintaining for a

director of the company, or of an associated company, insurance against any such liability as is mentioned in that subsection.

“234 Qualifying

third party indemnity provision

| |

(1) |

Section 232(2) (voidness of provisions for indemnifying directors) does not apply to qualifying third

party indemnity provision. |

| |

(2) |

Third party indemnity provision means provision for indemnity against liability incurred by the director to a

person other than the company or an associated company. |

Such provision is qualifying third party indemnity provision if

the following requirements are met.

| |

(3) |

The provision must not provide any indemnity against - |

| |

(a) |

any liability of the director to pay - |

| |

(i) |

a fine imposed in criminal proceedings, or |

| |

(ii) |

a sum payable to a regulatory authority by way of a penalty in respect of

non-compliance with any requirement of a regulatory nature (however arising); or |

| |

(b) |

any liability incurred by the director - |

| |

(i) |

in defending criminal proceedings in which he is convicted, or |

| |

(ii) |

in defending civil proceedings brought by the company, or an associated company, in which judgment is given

against him, or |

| |

(iii) |

in connection with an application for relief (see subsection (6)) in which the court refuses to grant him

relief. |

| |

(4) |

The references in subsection (3)(b) to a conviction, judgment or refusal of relief are to the final decision in

the proceedings. |

| |

(a) |

a conviction, judgment or refusal of relief becomes final - |

| |

(i) |

if not appealed against, at the end of the period for bringing an appeal, or |

4

| |

(ii) |

if appealed against, at the time when the appeal (or any further appeal) is disposed of, and

|

| |

(b) |

an appeal is disposed of - |

| |

(i) |

if it is determined and the period of bringing any further appeal has ended, or |

| |

(ii) |

if it is abandoned or otherwise ceases to have effect. |

| |

(6) |

The reference in subsection (3)(b)(iii) to an application for relief is to an application for relief under -

|

section 661(3) or (4) (power of court to grant relief in case of acquisition of shares by innocent

nominee), or

section 1157 (general power of court to grant relief in case of honest and reasonable conduct).

“235 Qualifying pension scheme indemnity provision

| |

(1) |

Section 232(2) (voidness of provisions for indemnifying directors) does not apply to qualifying pension

scheme indemnity provision. |

| |

(2) |

Pension scheme indemnity provision means provision indemnifying a director of a company that is a trustee of an

occupational pension scheme against liability incurred in connection with the company’s activities as trustee of the scheme. |

Such provision is qualifying pension scheme indemnity provision if the following requirements are met.

| |

(3) |

The provision must not provide any indemnity against - |

| |

(a) |

any liability of the director to pay - |

| |

(i) |

a fine imposed in criminal proceedings, or |

| |

(ii) |

a sum payable to a regulatory authority by way of a penalty in respect of

non-compliance with any requirement of a regulatory nature (however arising); or |

| |

(b) |

any liability incurred by the director in defending criminal proceedings in which he is convicted.

|

5

| |

(4) |

The reference in subsection (3)(b) to a conviction is to the final decision in the proceedings.

|

| |

(a) |

a conviction becomes final - |

| |

(i) |

if not appealed against, at the end of the period for bringing an appeal, or |

| |

(ii) |

if appealed against, at the time when the appeal (or any further appeal) is disposed of, and

|

| |

(b) |

an appeal is disposed of - |

| |

(i) |

if it is determined and the period for bringing any further appeal has ended, or |

| |

(ii) |

if it is abandoned or otherwise ceases to have effect. |

| |

(6) |

In this section “occupational pension scheme” means an occupational pension scheme as defined in

section 150(5) of the Finance Act 2004 (c. 12) that is established under a trust.” |

“256 Associated bodies corporate

For the purposes of this Part –

| |

(a) |

bodies corporate are associated if one is a subsidiary of the other or both are subsidiaries of the same body

corporate, and |

| |

(b) |

companies are associated if one is a subsidiary of the other or both are subsidiaries of the same body

corporate.” |

“239 Ratification of acts of directors

| |

(1) |

This section applies to the ratification by a company of conduct by a director amounting to negligence,

default, breach of duty or breach of trust in relation to the company. |

| |

(2) |

The decision of the company to ratify such conduct must be made by resolution of the members of the company.

|

| |

(3) |

Where the resolution is proposed as a written resolution neither the director (if a member of the company) nor

any member connected with him is an eligible member. |

6

| |

(4) |

Where the resolution is proposed at a meeting, it is passed only if the necessary majority is obtained

disregarding votes in favour of the resolution by the director (if a member of the company) and any member connected with him. |

This does not prevent the director or any such member from attending, being counted towards the quorum and taking part in the proceedings at

any meeting at which the decision is considered.

| |

(5) |

For the purposes of this section – |

| |

(a) |

“conduct” includes acts and omissions; |

| |

(b) |

“director” includes a former director; |

| |

(c) |

a shadow director is treated as a director; and |

| |

(d) |

in section 252 (meaning of “connected person”), subsection (3) does not apply (exclusion of

person who is himself a director). |

| |

(6) |

Nothing in this section affects – |

| |

(a) |

the validity of a decision taken by unanimous consent of the members of the company, or |

| |

(b) |

any power of the directors to agree not to sue, or to settle or release a claim made by them on behalf of the

company. |

| |

(7) |

This section does not affect any other enactment or rule of law imposing additional requirements for valid

ratification or any rule of law as to acts that are incapable of being ratified by the company.” |

“1157 Power of court to

grant relief in certain circumstances

| |

(1) |

If in proceedings for negligence, default, breach of duty or breach of trust against –

|

| |

(a) |

an officer of a company, or |

| |

(b) |

a person employed by a company as auditor (whether he is or is not an officer of the company)

|

it appears to the court hearing the case that the officer or person is or may be liable, but that he acted honestly and

reasonably, and that having regard to all the circumstances of the case (including those connected with his appointment) he ought fairly to be excused, the court may relieve him, either wholly or partly, from his liability on such terms as it thinks

fit.

7

| |

(2) |

If any such officer or person has reason to apprehend that any claim will or might be made against him in

respect of any negligence, default, breach of duty or breach of trust – |

| |

(a) |

he may apply to the court for relief, and |

| |

(b) |

the court has the same power to relieve him as it would have had if it had been a court before which

proceedings against him for negligence, default, breach of duty or breach of trust had been brought. |

| |

(3) |

Where a case to which subsection (1) applies is being tried by a judge with a jury, the judge, after

hearing the evidence, may, if he is satisfied that the defendant (in Scotland, the defender) ought in pursuance of that subsection to be relieved either in whole or in part from the liability sought to be enforced against him, withdraw the case from

the jury and forthwith direct judgment to be entered for the defendant (in Scotland, grant decree of absolvitor) on such terms as to costs (in Scotland, expenses) or otherwise as the judge may think proper.” |

In addition, BP procures and intends to continue procuring, directors’ and officers’ liability insurance coverage for the benefit of

such directors and officers, which, subject to policy terms and conditions, provides coverage to such directors and officers in circumstances in which BP, its subsidiaries and associated entities are not permitted or are otherwise unable or

unwilling to meet by way of indemnity. No entity coverage for the benefit of BP is currently included as part of that insurance policy. While defense costs may be met, neither BP’s indemnity nor the insurance provides coverage in the event that

a director or officer is the subject of criminal or regulatory fines or penalties or is proved to have acted fraudulently or dishonestly.

Item 8.

Exhibits.

The following Exhibits are filed herewith unless otherwise indicated

8

Item 9. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the

most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration

statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do

not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are

incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act

of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under

the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in the registration statement shall be deemed to be a

new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

9

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may

be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is

against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or

controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act will be governed by the final

adjudication of such issue.

10

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in London, England, on March 10, 2023.

|

|

|

| BP p.l.c. |

| (Registrant) |

|

|

| By: |

|

/s/ Ben J.S. Mathews |

| Name: Ben J.S. Mathews |

| Title: Company Secretary |

POWER OF ATTORNEY

Each director and officer of the Registrant whose signature appears below hereby constitutes and appoints Mark Crawford, the agent for service named in the

registration statement, and appoints each of Murray Auchincloss, Ben Mathews, and Eric Nitcher, his true and lawful attorney-in-fact and agent, with full power of

substitution and resubstitution, for him, and on his behalf and in his name, place and stead, in any and all capacities, to sign, execute and file any amendments to this registration statement on Form S-8

necessary or advisable to enable the registrant to comply with the Securities Act of 1933, as amended, and any rules, regulations and requirements of the Securities and Exchange Commission in respect thereof, which amendments may make such other

changes in this registration statement as such attorney-in-fact deems appropriate, and any subsequent registration statement for the same offering that may be filed

under Rule 462(b) under the Securities Act of 1933, as amended.

Pursuant to the requirements of the Securities Act of 1933, this registration statement

has been signed by the following persons in the capacities and on the dates indicated:

|

|

|

|

|

| Signature |

|

Titles |

|

Date |

|

|

|

| /s/ Helge Lund |

|

Non-Executive Director |

|

March 10, 2023 |

| Helge Lund |

|

(Chairman) |

|

|

|

|

|

| /s/ Bernard Looney |

|

Executive Director |

|

March 10, 2023 |

| Bernard Looney |

|

Group Chief Executive |

|

|

|

|

(Principal Executive Officer) |

|

|

11

|

|

|

|

|

| /s/ Murray Auchincloss |

|

Executive Director |

|

March 10, 2023 |

| Murray Auchincloss |

|

(Chief Financial Officer) |

|

|

|

|

|

| /s/ Karen Richardson |

|

Non-Executive Director |

|

March 10, 2023 |

| Karen Richardson |

|

|

|

|

|

|

|

| /s/ Johannes Teyssen |

|

Non-Executive Director |

|

March 10, 2023 |

| Johannes Teyssen |

|

|

|

|

|

|

|

| /s/ Pamela Daley |

|

Non-Executive Director |

|

March 10, 2023 |

| Pamela Daley |

|

|

|

|

|

|

|

| /s/ Amanda Blanc |

|

Non-Executive Director |

|

March 10, 2023 |

| Amanda Blanc |

|

|

|

|

|

|

|

| /s/ Melody Meyer |

|

Non-Executive Director |

|

March 10, 2023 |

| Melody Meyer |

|

|

|

|

|

|

|

| /s/ Tushar Morzaria |

|

Non-Executive Director |

|

March 10, 2023 |

| Tushar Morzaria |

|

|

|

|

|

|

|

| /s/ Paula Rosput Reynolds |

|

Non-Executive Director |

|

March 10, 2023 |

| Paula Rosput Reynolds |

|

|

|

|

|

|

|

| /s/ Sir John Sawers |

|

Non-Executive Director |

|

March 10, 2023 |

| Sir John Sawers |

|

|

|

|

|

|

|

| /s/ Satish Pai |

|

Non-Executive Director |

|

March 10, 2023 |

| Satish Pai |

|

|

|

|

|

|

|

| /s/ Hina Nagarajan |

|

Non-Executive Director |

|

March 10, 2023 |

| Hina Nagarajan |

|

|

|

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following

person in the capacity and on the date indicated.

Authorized Representative in the United States:

12

|

|

|

| BP America Inc. |

|

|

| By: |

|

/s/ Mark Crawford |

| Name: Mark Crawford |

| Title: Senior Vice President, Legal, People & Culture |

March 10, 2023

13

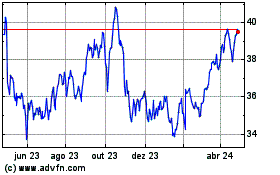

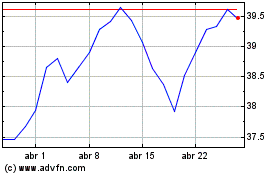

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024