NOTICE OF EXEMPT SOLICITATION

NAME OF REGISTRANT: Chevron

Corporation

NAME OF PERSON RELYING ON EXEMPTION:

General Board of Pension and Health Benefits of The United Methodist Church, Incorporated in Illinois d/b/a Wespath Benefits

and Investments

ADDRESS OF PERSON RELYING ON EXEMPTION: 1901 Chestnut Ave, Glenview,

IL 60025

| To: |

Chevron Corporation Shareholders |

| Subject: |

2023 Proxy Statement—Item No. 1: Election of Directors |

| Date: |

April 25, 2023 |

| Contact: |

Jake Barnett, Director of Sustainable Investment Stewardship, Wespath Benefits and Investments, jbarnett@wespath.org |

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934.

Wespath Benefits and Investments urges shareholders to vote AGAINST

the election of Director Austin and Director Hernandez, Jr. pursuant to Item No. 1: Election of Directors. The proposal will be voted

on at the May 31, 2023 Annual Meeting of Chevron Corporation (“Company”).

Support for Votes Against Directors Austin and Hernandez , Jr.

Wespath Benefits and Investments (Wespath) urges shareholders to vote

against Chevron’s Lead Independent Director Wanda Austin and Director Enrique Hernandez, Jr. for failing to provide proper governance

over the company’s management of climate change-related lobbying activities. As current and former chairs of the Public Policy Committee,

Directors Austin and Hernandez, Jr., respectively, bear responsibility for governance oversight of Chevron’s climate policy and

lobbying activities. The Directors failed to ensure that the company provided a meaningful response to a shareholder resolution approved

by a majority of the company’s shareholders concerning climate-related lobbying and failed to establish sufficient governance to

address risks from misalignment between the company’s lobbying practices and its stated support of the Paris Agreement.1

Wespath recognizes that climate lobbying is only one measure of Chevron’s

overall management of climate risk, and we believe that the company is lagging in other key areas of climate risk management. As an example,

Chevron does not align with the majority of best-practice assessment criteria in the Climate Action 100+ Benchmark.2 Among

key areas of climate risk management, Wespath believes that failure to address corporate climate lobbying is a heightened risk that is

material to the long-term success of companies like Chevron and of particular relevance for diversified investors.3 Clarification

on Chevron’s lobbying alignment is crucial for investors as the long-term objectives of oil and gas companies will fall under increasingly

intense public scrutiny.

_____________________________

1 https://www.chevron.com/sustainability/environment/climate-policy

2 https://www.climateaction100.org/company/chevron-corporation/

3 https://www.pionline.com/industry-voices/commentary-collaboration-key-corporate-climate-engagement

As diversified long-term investors, we recognize that Chevron and other

oil and gas companies perform an economically critical role in supplying energy resources and that removing this supply abruptly would

lead to undue social harm. However, we also recognize that climate change poses significant risks to the health of the economic system.

Major economic disruption jeopardizes investors’ ability to attain the returns required to meet investment objectives. Addressing

these risks while responsibly managing the social impacts of a transition to a Paris-aligned energy system requires a systemic approach.

This approach needs to include reducing reliance on traditional energy sources like oil and gas through innovation and efficiency efforts

and increasing alternative supplies of affordable and reliable renewable energy. In turn, these actions must be supported and enabled

by sensible and ambitious climate policy.

While Chevron continues to meet society’s current demand for

oil and gas, it also needs to demonstrate clear support for this transition approach as both public demands to address climate risk and

the physical impacts of climate change continue to rise. This includes increased transparency and accountability at the board and management

level on how Chevron aligns with the commitment to support the Paris Agreement in its lobbying and policy engagement. Our analysis finds

that the company has not made its lobbying alignment with Paris clear, despite strong investor interest and engagement. Increased attention

to and management of this issue will help Chevron avoid intense regulatory scrutiny and maintain its social license to operate.

Investors have repeatedly engaged Chevron without meaningful observable

progress. Accordingly, we must publicly state our intention to vote against Directors Austin and Hernandez, Jr. to underscore the materiality

and urgency of action to address this issue.

Furthermore, we acknowledge that the inconsistencies related to Chevron’s

lobbying activities are symptomatic of broader misalignment throughout the oil and gas sector. We are inclined to vote similarly against

directors responsible for oversight of lobbying at other Climate Action 100+ focus companies that appear to demonstrate insufficient progress

addressing climate lobbying alignment. We encourage other investors to do the same.

Insufficient Response to Shareholder Request

At the 2020 Annual Meeting, Chevron shareholders delivered majority

support for Item No. 6: Stockholder Proposal Regarding report on Climate Lobbying:

Shareholders request that the Board of Directors conduct

an evaluation and issue a report within the next year (at reasonable cost, omitting proprietary information) describing if, and how, Chevron’s

lobbying activities (direct and through trade associations) align with the goal of limiting average global warming to well below 2 degrees

Celsius (the Paris Climate Agreement’s goal). The report should also address the risks presented by any misaligned lobbying and

the company’s plans, if any, to mitigate these risks. 4

_____________________________

4 https://www.chevron.com/-/media/shared-media/documents/chevron-proxy-statement-2020.pdf

This proposal received a historic 53% support level in its first year

on the ballot, signaling strong investor interest in the company’s approach to climate-related lobbying.5 In response,

Chevron issued a lobbying report later that year.6 However, in the view of Wespath, this report did not substantively address

multiple elements of the proposal. Crucial missing elements include:

| · | Lack of Explicit Clarity on Paris Alignment: The Chevron 2020 Climate Lobbying Report mentions the Paris Agreement 14 times.

However, many of these mentions referred to Chevron’s broad energy transition strategy or high-level statements made by trade associations.

Wespath’s analysis of the report concludes that not once did Chevron explicitly state if and how the company’s lobbying activities

align with the Paris Agreement, which was the central element of the resolution’s requests. |

| · | Insufficient Analysis of Trade Association Alignment: The report’s evaluation of alignment by its trade associations

consisted primarily of “select climate-related work by U.S. trade associations,” with no critical insights provided by the

company on its alignment with trade associations’ aggregate positions on climate policy. This selective approach to analysis undermines

its decision usefulness for investors. |

| · | No Clear Insight on Governance for Misalignment: Chevron acknowledged that trade associations may take positions that Chevron

“may not always agree with,” stated a general commitment to engage with trade associations and provided four brief highlights

of such engagement. However, Wespath believes these high-level statements—combined with the insufficient analysis described above—provide

insufficient insight into Chevron’s governance processes for managing the risks associated with misaligned climate-related lobbying

by trade associations. |

Continued Analysis of Misalignment in Chevron Lobbying Practices

Third-party analysis on Chevron’s ongoing climate lobbying compounds

our concerns about its insufficient response to the 2020 resolution.

For example, the Climate Action 100+ Net-Zero Company Benchmark (CA100+

Benchmark) concludes that Chevron is misaligned on multiple indicators, including climate policy engagement, where it fails to meet several

criteria.7 Many of these criteria are aligned with the shortcoming of the lobbying report mentioned above. The CA100+ Benchmark

analysis also highlights the company’s failure to publicly disclose all climate-related lobbying activities.

Likewise, InfluenceMap—a leading investor resource for analyzing

companies’ climate policy engagement—scores Chevron in the “D- ” performance band.8 While InfluenceMap

notes that “Chevron’s high-level communications appear to support climate action,” it also points out that the company’s

lobbying practices indicate opposition to multiple climate-related policies and regulations and include membership in trade associations

involved in “obstructive climate lobbying.” Furthermore, Chevron holds membership in the American Petroleum Institute (API),

which received an “F” score and was described as “broadly hostile to climate policy in the U.S.” by InfluenceMap.9

_____________________________

5 https://www.ceres.org/news-center/press-releases/annual-meeting-chevron-investors-achieve-historic-majority-vote-paris

6 https://www.chevron.com/-/media/chevron/sustainability/documents/chevron-climate-lobbying-report.pdf

7 https://www.climateaction100.org/company/chevron-corporation/

8 https://lobbymap.org/company/Chevron-f4b47c4ea77f0f6249ba7f77d4f210ff

9 https://lobbymap.org/influencer/American-Petroleum-Institute-API

Concerns about Chevron’s participation with the API are amplified

by recent examples of the association’s influence on climate policy debates in the U.S. For example, the API adopted strong rhetoric

in its opposition of the SEC’s proposed climate change disclosure rules. The association described the proposals as “a solution

in search of an information problem that doesn’t exist”10 and framed its opposition in part around “serious

First Amendment concerns”11 related to compelled speech. This opposition is in contrast to evidence that investors largely

support further disclosure on climate risk.12 Chevron Chairman and CEO Michael Wirth is current Chair of API, closely associating

the company with any positions taken by the group.

In addition to potential trade association misalignment, Chevron has

contributed over the last decade to the American Legislative Exchange Council (ALEC),13 which is currently modelling and encouraging

passage of legislation such as the “Energy Discrimination Elimination Boycott Act.” Tom Sanzillo, director

of financial analysis at the Institute for Energy Economics and Financial Analysis, describes this proposed legislation as “bringing

a social cost — the survival of fossil fuels — into the investment process, because left to their own devices the markets

would be choosing other than fossil fuels. You’re asking [the markets] to perform financial malpractice.”14 Wespath

and many other investors believe strongly that such legislation does not align with the interests of institutional investors and

can act as a distortion of capital markets.

Despite these examples of strong misalignment, Chevron does not include

any discussion of this misalignment between stated company policy on the Paris Agreement and lobbying activities by either API or ALEC

in its current disclosures.

Increasing Regulatory and Reputational Risk

Policymakers have been paying increasing attention to the activities

of oil and gas companies in influencing public discourse and conducting lobbying activities. As of August 2022, there were at least 20

pending lawsuits in the U.S. filed by cities and states alleging that oil and gas companies have misled the public on climate change.15

This concern around the role of oil and gas companies in influencing public discourse is also prominent globally, as evidenced by elevated

focus on this topic at the recent COP27 negotiations.16

Wespath believes that both public scrutiny of and government attention

to the role of oil and gas companies in addressing the increasingly prominent effects of climate change will only continue to grow. In

turn, the regulatory and reputational risks associated with actual and/or perceived misalignment in climate lobbying will continue to

increase. This underscores the imperative for companies to maintain strong governance and procedures that address misalignment and mitigate

risk.

_____________________________

10 https://www.api.org/news-policy-and-issues/news/2022/06/17/api-urges-sec-to-consider-alternative-approaches-to-climate-related-reporting

11 https://api.org/~/media/Files/misc/API-Comments-SEC-Climate-Disclosure-Rule-6-17-2022?_gl=1*w6m3ns*_ga*Mzc5NDg1MDU0LjE2NzUzNDg1OTg.*_ga_

4GE2RKSLYW*MTY3NTY5MzEzMS4yLjEuMTY3NTY5MzU0NC4zNy4wLjA.

12 https://www.ceres.org/news-center/blog/analysis-shows-investors-strongly-support-secs-proposed-climate-disclosure-rule

13 https://www.chevron.com/sustainability/governance/lobbying-and-trade-associations

14 https://www.maplecroft.com/esg-weekly/us-anti-esg-laws-risk-falling-victim-to-market-forces/

15 https://www.pbs.org/wgbh/frontline/article/us-cities-states-sue-big-oil-climate-change-lawsuits/

16 https://www.theguardian.com/environment/2022/nov/10/big-rise-in-number-of-fossil-fuel-lobbyists-at-cop27-climate-summit

Conclusion

According to Chevron’s governance documents, oversight of climate

policy and lobbying activities is the responsibility of the Public Policy Committee. Lead Independent Director Austin was Chair of this

committee in 2020 when the resolution in question was filed, and Director Hernandez, Jr. is the Chair today. Thus, both Directors bear

responsibility for the past and ongoing shortcomings of Chevron’s lobbying disclosure and the lack of transparency to investors

about the management of lobbying misalignment. We encourage investors to vote against both Directors.

THE PURPOSE OF THIS COMMUNICATION IS TO GIVE

SHAREHOLDERS INFORMATION FOR WHEN THEY REVIEW CHEVRON CORPORATION’S PROXY STATEMENT. THE FOREGOING INFORMATION MAY BE DISSEMINATED

TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, EMAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT

ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING

BORNE ENTIRELY BY WESPATH BENEFITS AND INVESTMENTS.

PROXY CARDS WILL NOT BE ACCEPTED. PLEASE DO

NOT SEND YOUR PROXY TO WESPATH BENEFITS AND INVESTMENTS. WESPATH BENEFITS AND INVESTMENTS IS NOT ABLE TO VOTE YOUR PROXY, NOR DOES THIS

COMMUNICATION CONTEMPLATE SUCH AN EVENT. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

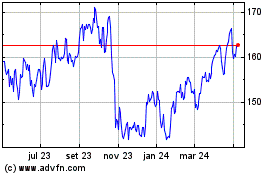

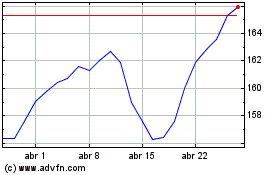

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024