Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

03 Maio 2023 - 7:02AM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

May 2023

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One)

Form 20-F x Form 40-F ¨

(Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One)

Yes ¨ No x

(Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check

One) Yes ¨ No

x

(Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.)

(Check One)

Yes ¨ No x

(If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b). 82- .)

Vale clarifies on divestment of MRN

Rio de Janeiro, May 2, 2023 - In response to the Official

Letter 135/2023 from CVM, Vale S.A. (“Vale” or “Company”) hereby provides additional details about the divestment

of Mineração Rio do Norte S.A. (“MRN”).

On April 27, 2023, Vale signed a binding agreement

with Ananke Alumina S.A., a company affiliated with Norsk Hydro ASA (“Hydro”), to sell its 40% stake in MRN, including all

associated obligations and rights, upon Vale’s disbursement of US$ 67.9 million. The transaction is subject to regulatory approvals.

The envisioned transaction completes the full divestment

of Vale’s aluminum assets to Hydro, as disclosed in April 2010, whereby the bauxite offtake rights of Vale at MRN were directed

to Hydro's affiliates under certain long-term commercial agreements.

This transaction also marks the completion of Vale's

major divestment program, which involved selling more than 10 non-core assets across several continents since 2019. Through this program,

Vale has been able to simplify and de-risk its business exposure, resulting in the elimination of expenditures of up to US$ 2.0 billion

per year. This reinforces Vale's strategy of portfolio simplification and enables the company to focus on its core businesses and growth

opportunities through a disciplined capital allocation.

For the moment, we remain at your disposal to provide

further clarification as needed.

Gustavo Duarte Pimenta

Executive Vice President, Finance and Investor

Relations

For further information, please contact:

Vale.RI@vale.com

Ivan Fadel: ivan.fadel@vale.com

Mariana Rocha: mariana.rocha@vale.com

Luciana Oliveti: luciana.oliveti@vale.com

This press release may include statements

that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future,

involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties

include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c)

the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature;

and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different

from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian

Comissão de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements”

and “Risk Factors” in Vale’s annual report on Form 20-F.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Vale S.A.

(Registrant) |

| |

|

| |

By: |

/s/ Ivan Fadel |

| Date: May 2, 2023 |

|

Head of Investor Relations |

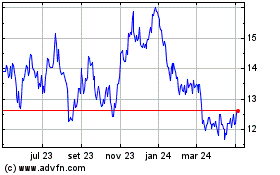

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

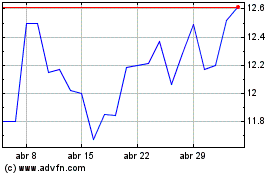

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024