United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of

June 2023

Commission File Number 001-15030

Vale S.A.

Praia de Botafogo nº 186, 18º andar, Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

INCORPORATION BY REFERENCE

This report is incorporated by reference in the registration

statements on Form F-3/A filed by us and Vale Overseas Limited with the U.S. Securities and Exchange Commission (“SEC”) on

April 25, 2023 (Nos. 333-271248 and 333-271248-01), and shall be deemed to be a part thereof from the date on which this report is furnished

to the SEC, to the extent not superseded by documents or reports subsequently filed or furnished.

This report incorporates by reference our current report on

Form 6-K furnished to the SEC on April 26, 2023 (SEC Accession No: 0001292814-23-001823), containing our unaudited consolidated interim

financial statements as of March 31, 2023 and for the three-month periods ended March 31, 2023 and March 30, 2022 (the “Interim

Financial Statements”), prepared and presented in accordance with IAS 34, Interim Financial Reporting of the International Financial

Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”), which are accordingly

incorporated by reference in the registration statements on Form F-3 referred to in the preceding paragraph.

TABLE OF CONTENTS

Page

Results

of operations for the three-month periods ended march 31, 2023 and march 31, 2022

For the three-month period ended March 31, 2023, we recorded

net income from continuing operations of US$1,878 million, compared to US$4,478 million for the same period of 2022. Our Adjusted EBITDA

from continuing operations decreased to US$3,576 million in the three-month period ended March 31, 2023, from US$6,214 million for the

same period of 2022, mainly due to lower average realized prices of iron ore fines and pellets (impact of US$1,714 million), lower iron

ore fines sales volume (impact of US$555 million) and higher costs.

Adjusted EBITDA is a non-GAAP measure, which is calculated

using operating income or loss and adding dividends received and interest from associates and joint ventures, and excluding the amounts

charged as (i) depreciation, depletion and amortization and (ii) impairment reversal (impairment and disposals) of non-current assets.

For more information and the reconciliation of our Adjusted EBITDA to our net income, see “Adjusted EBITDA” below.

Consolidated income statement data

| |

For the three-month period ended March 31, |

|

| |

2023 |

2022 |

% change |

| |

(US$ million, except for %) |

|

| Net operating revenue |

8,434 |

10,812 |

(22.0) |

| Cost of goods sold and services rendered |

(4,949) |

(4,622) |

7.1 |

| Selling, administrative and other operating expenses, net |

(337) |

(387) |

(12.9) |

| Research and development expenses |

(139) |

(121) |

14.9 |

| Pre-operating and operational stoppage |

(124) |

(154) |

(19.5) |

| Impairment reversal (impairment and disposals) of non-current assets, net |

(4) |

1,072 |

(100.4) |

| Operating income |

2,881 |

6,600 |

(56.3) |

| Non-operating income (expenses): |

|

|

|

| Financial expenses, net |

(530) |

(242) |

119.0 |

| Equity results and other results in associates and joint ventures |

(55) |

211 |

(126.1) |

| Income before income taxes |

2,296 |

6,569 |

(65.0) |

| Income taxes |

(418) |

(2,091) |

(80.0) |

| Net income from continuing operations |

1,878 |

4,478 |

(58.1) |

| Net income attributable to noncontrolling interests |

41 |

22 |

86.4 |

| Net income from continuing operations attributable to Vale’s shareholders |

1,837 |

4,456 |

(58.8) |

| |

|

|

|

|

Net income from discontinued operations |

- |

2 |

(100.0) |

| Net income attributable to non-controlling interests |

- |

- |

- |

| Net income from discontinued operations attributable to Vale’s shareholders |

- |

2 |

(100.0) |

| |

|

|

|

| Net income |

1,878 |

4,480 |

(58.1) |

| Net income attributable to non-controlling interests |

41 |

22 |

86.4 |

| Net income attributable to Vale’s shareholders |

1,837 |

4,458 |

(58.8) |

Consolidated Revenues

For the three-month period ended March 31, 2023, our net

operating revenues from continuing operations decreased by US$2,378 million or 22.0% to US$8,434 million, from US$10,812 million for

the same period of 2022. The decrease was mainly due to (i) lower average realized prices in the sale of iron ore fines and pellets,

which reflects the drop in the market reference price (impact of US$1,714 million) and (ii) lower sales volume of iron ore fines (impact

of US$803 million).

The following table summarizes, for each of the periods indicated,

the distribution of our net operating revenues based on the geographical location of our customers.

Net operating revenues by destination

| |

Three-month period ended March 31, |

| |

2023 |

2022 |

| |

(US$ million) |

(% of total) |

(US$ million) |

(% of total) |

| Asia |

|

|

|

|

| China |

3,407 |

40.4 |

5,389 |

49.8 |

| Japan |

689 |

8.2 |

861 |

8.0 |

| South Korea |

312 |

3.7 |

255 |

2.4 |

| Other |

318 |

3.8 |

562 |

5.2 |

| Asia – total |

4,726 |

56.0 |

7,067 |

65.4 |

| Europe |

|

|

|

|

| Germany |

428 |

5.1 |

508 |

4.7 |

| Italy |

183 |

2.2 |

182 |

1.7 |

| Other |

952 |

11.3 |

772 |

7.1 |

| Europe – total |

1,563 |

18.5 |

1,462 |

13.5 |

| South and Central America |

|

|

|

|

| Brazil |

919 |

10.9 |

1,128 |

10.4 |

| Other |

148 |

1.8 |

179 |

1.7 |

| South and Central America - total |

1,067 |

12.7 |

1,307 |

12.1 |

| North America |

|

|

|

|

| United States of America |

511 |

6.1 |

313 |

2.9 |

| Canada |

142 |

1.7 |

166 |

1.5 |

| North America - total |

653 |

7.7 |

479 |

4.4 |

| Middle East |

238 |

2.8 |

242 |

2.2 |

| Rest of the world |

187 |

2.2 |

255 |

2.4 |

| Total |

8,434 |

100 |

10,812 |

100 |

Consolidated Operating Costs and Expenses

Our cost of goods sold and services rendered from continuing

operations increased by 7.1%, to US$4,949 million in the three-month period ended March 31, 2023 from US$4,622 million for the same period

of 2022, mainly due to (i) increase in fixed costs (US$88 million), (ii) increase in prices of bunker and fuel in the Iron Solutions segment,

resulting in higher costs with oil and gas (US$70 million), (iii) higher expenses with tax on mineral production – “TFRM”

(US$68 million) and (iv) higher costs from acquisition of iron ore fines from third parties (US$61 million).

Our research and development expenses totaled US$139 million

in the three-month period ended March 31, 2023, a 14.9% increase from US$121 million recorded for the same period of 2022, mainly due

to projects of drilling and geology exploration and mineral exploration in all segments.

Our pre-operating and operational stoppage expenses totaled

US$124 million in the three-month period ended March 31, 2023, a 19.5% decrease from the US$154 million recorded for the same period of

2022, mainly due to lower idle capacity in halted Iron Solutions operations related to the Brumadinho dam collapse.

Our selling administrative and other operating expenses, net,

totaled US$337 million in the three-month period ended March 31, 2023, a 12.9% decrease from US$387 million recorded for the same period

of 2022, mostly due to lower provisions recorded for dam de-characterization.

Results of

Operations by Segment

Net operating revenue by segment

The following table summarizes our net operating revenues

by product for the periods indicated.

| |

Three-month period ended March 31, |

|

| |

2023 |

2022 |

% change |

| |

(US$ million, except for %) |

| Iron Solutions: |

|

|

|

| Iron ore fines |

4,982 |

7,255 |

(31.3) |

| Iron ore pellets |

1,322 |

1,365 |

(3.2) |

| Other ferrous products and services |

107 |

114 |

(6.1) |

| Iron Solutions – total |

6,411 |

8,734 |

(26.6) |

| Energy Transition Metals: |

|

|

|

| Nickel and other products (1) |

1,508 |

1,458 |

3.4 |

| Copper concentrate (2) |

490 |

474 |

3.4 |

| Energy Transition Metals – total |

1,998 |

1,932 |

3.4 |

| Other products and services |

25 |

146 |

(82.9) |

| Total from continuing operations |

8,434 |

10,812 |

(22.0) |

| Discontinued operations – Coal |

- |

448 |

(100.0) |

| Net operating revenues |

8,434 |

11,260 |

(25.1) |

| |

|

|

|

| (1) | Includes nickel coproducts (copper) and byproducts (precious metals, cobalt and others). |

| (2) | Does not include copper produced in our nickel operations. |

Sales volumes

The following table sets forth our principal products and

the total volumes sold of each product in each of the periods indicated:

| |

Three-month period ended March 31, |

|

| |

2023 |

2022 |

% change |

| |

(thousand metric tons, except where indicated) |

|

| Iron Solutions: |

|

|

|

| Iron ore fines |

45,861 |

51,311 |

(10.6) |

| Iron ore pellets |

8,133 |

7,011 |

16.0 |

| ROM (run of mine) |

1,665 |

1,035 |

60.9 |

| Energy Transition Metals: |

|

|

|

| Nickel |

40 |

39 |

2.6 |

| Copper (1) |

63 |

50 |

26.0 |

| PGMs (000’ oz.) (1) |

74 |

49 |

51.0 |

| Gold (000’ oz.) (1) |

72 |

62 |

16.1 |

| Silver (000’ oz.) (1) |

406 |

341 |

19.1 |

| Cobalt (metric tons) (1) |

621 |

415 |

49.6 |

| (1) | By-product contained in our nickel and copper concentrates. |

Average realized prices

The following table sets forth our average realized prices

for our principal products for each of the periods indicated. We determine average realized prices based on our net operating revenues,

which consist of the price charged to customers, excluding certain items that we deduct in arriving at net operating revenues, mainly

value-added tax.

| |

Three-month period ended March 31, |

|

| |

2023 |

2022 |

% change |

| |

(US$ per metric ton, except where indicated) |

|

| Iron Solutions: |

|

|

|

| Iron ore fines |

108.6 |

141.4 |

(23.2) |

| Iron ore pellets |

162.5 |

194.6 |

(16.5) |

| Energy Transition Metals: |

|

|

|

| Nickel |

25,260 |

22,195 |

13.8 |

| Copper |

9,298 |

10,619 |

(12.4) |

| Gold (US$/oz) |

1,845 |

1,862 |

(0.9) |

| Silver (US$/oz) |

22.07 |

23.47 |

(6.0) |

| Cobalt |

32,830 |

78,085 |

(58.0) |

Cost of goods sold by segment (excluding depreciation, depletion and

amortization)

The following table presents, for each period indicated, our

cost of goods sold and services rendered (excluding depreciation, depletion and amortization) by segment and the percentage change from

period to period.

| |

Three-month period ended March 31, |

| |

2023 |

2022 |

% change |

| |

(US$ million, except for %) |

| Iron Solutions: |

|

|

|

| Iron ore fines |

2,197 |

2,119 |

3.7 |

| Iron ore pellets |

648 |

526 |

23.2 |

| Other ferrous products and services |

73 |

78 |

(6.4) |

| Iron Solutions – total |

2,918 |

2,723 |

7.2 |

| Energy Transition Metals: |

|

|

|

| Nickel and other products (1) |

1,112 |

909 |

22.3 |

| Copper (2) |

270 |

227 |

18.9 |

| Energy Transition Metals – total |

1,382 |

1,136 |

21.7 |

| Others |

36 |

118 |

(69.5) |

| Total of continuing operations (excluding depreciation, depletion and amortization) |

4,336 |

3,977 |

9.0 |

| Depreciation, depletion and amortization |

613 |

645 |

(5.0) |

| Total of continuing operations (including depreciation, depletion and amortization) |

4,949 |

4,622 |

7.1 |

| (1) | Includes nickel coproducts (copper) and byproducts (precious metals, cobalt and others). |

| (2) | Does not include copper produced in our nickel operations. |

Expenses by segment (excluding depreciation, depletion and amortization)

The following table

summarizes, for each period indicated, our expenses (consisting of selling, general and administrative, research and evaluation, pre-operating,

stoppage and other expenses, net of other revenues) by operating segment (excluding depreciation, depletion and amortization) and the

percentage change from period to period.

| |

Three-month period ended March 31, |

|

| |

2023 |

2022 |

% change |

| |

(US$ million, except for %) |

| Iron Solutions: |

|

|

|

| Iron ore fines |

147 |

202 |

(27.2) |

| Iron ore pellets |

7 |

1 |

600.0 |

| Other ferrous products and services |

19 |

6 |

216.7 |

| Iron Solutions – total |

173 |

209 |

(17.2) |

| Energy Transition Metals: |

|

|

|

| Nickel and other products (1) |

44 |

24 |

83.3 |

| Copper (2) |

34 |

21 |

61.9 |

| Energy Transition Metals -total |

78 |

45 |

73.3 |

| Others |

306 |

367 |

(16.6) |

| Total from continuing operations (excluding depreciation, depletion and amortization) |

557 |

621 |

(10.3) |

| Depreciation, depletion and amortization |

43 |

41 |

4.9 |

| Total from continuing operations (including depreciation, depletion and amortization) |

600 |

662 |

(9.4) |

| |

|

|

|

| (1) | Includes nickel coproducts (copper) and byproducts (precious metals, cobalt and others). |

| (2) | Does not include copper produced in our nickel operations. |

Adjusted EBITDA by segment

The following table summarizes our Adjusted EBITDA for each of our segments.

| |

Three-month period ended March 31, |

| |

2023

Adjusted EBITDA |

2022

Adjusted EBITDA |

| |

(US$ million) |

| Iron Solutions: |

|

|

| Iron ore fines |

2,638 |

4,934 |

| Iron ore pellets |

667 |

837 |

| Other ferrous products and services |

15 |

31 |

| Iron Solutions – total |

3,320 |

5,802 |

| Energy Transition Metals: |

|

|

| Nickel and other products (1) |

353 |

525 |

| Copper (2) |

220 |

226 |

| Energy Transition Metals – total |

573 |

751 |

| Other (3) |

(317) |

(339) |

| Adjusted EBITDA from continuing operations |

3,576 |

6,214 |

| Adjusted EBITDA from discontinued operations (coal) |

- |

171 |

| Adjusted EBITDA |

3,576 |

6,385 |

| (1) | Includes nickel coproducts (copper) and byproducts (precious metals, cobalt and others). |

| (2) | Does not include copper produced in our nickel operations. |

| (3) | Includes sales and expenses of other products, services, research and development, investments in joint

ventures and associates of other business and unallocated corporate expenses. |

The table below shows a reconciliation of our Adjusted EBITDA

with our net income for the periods indicated. Our management uses Adjusted EBITDA as the measure to assess the contribution of each segment

to our performance and to support decision-making in allocating resources. Adjusted

EBITDA is a non-GAAP measure, which is calculated for each segment using operating income or loss from continuing operations plus dividends

received and interest from associates and joint ventures and adding back the amounts charged as (i) depreciation, depletion and amortization

and (ii) impairment reversal (impairment and disposals) of non-current assets. For more information, see note 4 to our Interim Financial

Statements.

| |

Three-month period ended March 31, |

| |

2023 |

2022 |

| |

(US$ million) |

| Net income from continuing operations attributable to Vale’s shareholders |

1,837 |

4,456 |

| Net income attributable to non-controlling interests |

41 |

22 |

| Net income from continuing operations |

1,878 |

4,478 |

| Depreciation, depletion and amortization |

656 |

686 |

| Income taxes |

418 |

2,091 |

| Financial results, net |

530 |

242 |

| Equity results and other results in associates and joint ventures |

55 |

(211) |

| Impairment and disposals (impairment reversal) of non-current assets (1) |

39 |

(1,072) |

| Adjusted EBITDA from continuing operations |

3,576 |

6,214 |

| Adjusted EBITDA from discontinued operations (coal) |

- |

171 |

| Adjusted EBITDA |

3,576 |

6,385 |

| (1) | Includes adjustment of US$35 in the three-month period ended March 31, 2023, to reflect the performance

of the streaming transactions at market prices. |

We discuss below, for each segment, the changes in our net

operating revenues, cost of goods sold and services rendered (excluding depreciation, depletion and amortization), expenses (excluding

depreciation, depletion and amortization and excluding impairment charges) and Adjusted EBITDA. The expenses incurred in connection with

remediation, indemnification and donations in respect of the collapse of the Brumadinho dam are not directly related to our operating

activities and are therefore not allocated to any operating segment.

Iron Solutions

Net

operating revenues from sales of Iron Solutions. Total of US$6,411 million for the three-month period ended March 31, 2023, a 26.6%

decrease from US$8,734 million for the same period of 2022, mainly due to (i) lower realized average prices from iron ore fines and pellets,

reflecting the drop by 11.4% of the Platts IODEX 62%, with an impact of US$1,714 million, and (ii) lower iron ore fines sales volumes,

with an impact of US$803 million.

Cost

of goods sold and services rendered from Iron Solutions. Excluding depreciation, depletion and amortization, increased by US$195

million or 7.2% to US$2,918 million for the three-month period ended March 31, 2023, from US$2,723 million for the same period of 2022.

This increase primarily reflects (i) increase in fixed costs (US$88 million), (ii) increase in prices of bunker and fuel in the Iron Solutions

segment, resulting in higher costs with oil and gas (US$70 million), (iii) higher expenses with mineral resources inspection fare (US$68

million) and (iv) higher costs related with acquisition of iron ore fines from third parties (US$61 million).

Net

expenses from Iron Solutions. Total of US$173 million for the three-month period ended March 31, 2023, a decrease of US$36

million or 17.2% from US$209 million recorded for the same period of 2022, mainly due to lower expenses with operational stoppages.

Adjusted

EBITDA from Iron Solutions. Total of US$3,320 million for the three-month period ended March 31, 2023, a decrease of US$2,482

million or 42.8%, when compared to our Adjusted EBITDA of US$5,802 million for the same period of 2022. This decrease mainly reflects

the reduction in the average realized price and sales volume. Our Adjusted EBITDA was also affected by higher unit costs mainly driven

by one-off cost effects, including anticipation of maintenance activities and lower production from Northern System.

Energy Transition Metals

Net

operating revenues from sales of Energy Transition Metals. Total of US$1,998 million for the three-month period ended March

31, 2023, in line with the US$1,932 million recorded for the same period of 2022.

Cost of goods sold from Energy Transition Metals. Excluding depreciation, amortization and depletion, increased by US$246 million

or 21.7% for the three-month period ended March 31, 2023 to US$1,382 million in the three-month period ended March 31, 2023 from US$1,136

million for the same period of 2022, mainly due to higher costs associated with acquisition of third party products (US$129 million).

Net

expenses from Energy Transition Metals. Total of US$78 million for the three-month period ended March 31, 2023, an increase

of US$33 million from US$45 million for the same period of 2022. This increase mainly reflects an increase of research and development

activities.

Adjusted

EBITDA from Energy Transition Metals. Total of US$573 million in the three-month period ended March 31, 2023, a decrease of

US$178 million or 23.7%, when compared to our Adjusted EBITDA of US$751 million for the same period of 2022. This decrease primarily reflects

higher costs with acquisition of third-party products, which were partially offset by higher average realized prices of nickel products.

Financial

results, net

The following table details our financial results, net, for

the periods indicated.

| |

Three-month period ended March 31, |

| |

2023 |

2022 |

| |

(US$ million) |

| Financial income (1) |

121 |

150 |

| Financial expenses (2) |

(320) |

(319) |

| Derivatives financial instruments |

192 |

861 |

| Net foreign exchange losses, net |

(152) |

(817) |

| Indexation gain (losses), net |

(324) |

9 |

| Financial guarantees |

- |

123 |

| Participative shareholders' debentures |

(47) |

(249) |

| Financial results, net |

(530) |

(242) |

| (1) | Includes short-term investments and other financial income (see note 6 to our Interim Financial Statements). |

| (2) | Includes loans and borrowings gross interest, capitalized loans and borrowing costs, interest expenses

of REFIS (a tax settlement program), interest on lease liabilities and others financial expenses (see note 6 to our Interim Financial

Statements). |

For the three-month period ended March 31, 2023, our financial

results, net, was a loss of US$530 million compared to a loss of US$242 million for the same period of 2022. Our financial results were

mostly impacted by (i) higher indexation losses related to the present value adjustments to our provisions, and (ii) lower gain on derivatives,

which decreased to US$192 million for the three-month period ended March 31, 2023, from US$861 million for the same period of 2022, which

was partially offset by foreign exchange loss. This effect is mainly due to our currency and interest rate swaps, following the Brazilian

real appreciation by 2.6% against the U.S. dollar in 2023, compared to a 15.1% appreciation of the Brazilian real in the

same period of 2022. These swaps are primarily used to convert debt denominated in Brazilian reais into U.S. dollars to protect

our cash flow from exchange rate volatility.

Equity results

and other results in associates and joint ventures

For the three-month period ended March 31, 2023, the equity

results and other results in associates and joint ventures totaled a loss of US$55 million, compared to a gain of US$211 million for the

same period of 2022, representing a negative impact of R$266 million, mainly due to the impairment loss of US$121 million recorded by

our associate VLI S.A.

Income taxes

For the three-month period ended March 31, 2023, we recorded

an income tax net expense of US$418 million, when compared to US$2,091 million for the same period of 2022. Our effective tax rate differed

from our statutory tax rate of 34%, principally due to tax incentives resulting from our iron ore, copper and nickel operations in the

North and Northeast regions of Brazil (impact of US$405 million), resulting in an effective tax rate of 18%. The reconciliation from statutory

tax rate to our effective tax rate is presented in note 7 to our Interim Financial Statements.

Liquidity and Capital

Resources

Our principal funding requirements are for capital expenditures,

dividends payments, share buybacks, debt service, tax payments, dam de-characterization and satisfaction of our obligations relating to

the remediation and compensation of damages in connection with the Brumadinho dam collapse and any contribution we may be required to

make in connection with the remediation obligations related to the collapse of Fundão dam owned by Samarco, pursuant to the Framework

Agreement. We expect to meet these requirements, in line with our historical practice, by using cash generated from operating activities

and financing activities.

We are constantly evaluating opportunities for additional

cash generation. Finally, we are committed to continue the reduction in our costs and expenses, maintain sound leverage levels and discipline

in capital allocation.

Sources of

funds

Our principal sources of funds are our operating cash flow

and financing activities. The amount of operating cash flow is strongly affected by global prices for our products. In the three-month

period ended March 31, 2023, net cash flow generated by operating activities amounted to US$3,610 million, compared to US$2,607 million

for the same period of 2022. As of March 31, 2023, our cash, cash equivalents and short-term investments totaled US$4,758 million, compared

to US$4,797 million as of December 31, 2022.

In the three-month period ended March 31, 2023, we borrowed

US$300 million with the Industrial and Commercial Bank of China indexed to SOFR and maturing in 2028, compared to US$425 million for the

same period of 2022.

Uses of funds

In the ordinary course of business, our principal funding

requirements are for capital expenditures, dividend payments, taxes and debt service. In addition, in the three-month period ended March

31, 2023, we used a total amount of cash of US$235 million (US$187 million for the same period of 2022) in matters related to the collapse

of our dam in Brumadinho, of which US$70 million (US$8 million for the same period of 2022) in connection with obligations assumed under

settlement agreements, US$54 million (US$56 million for the same period of 2022) in tailings containment and geotechnical safety, individual

indemnification and other commitments and US$111 million (US$123 million for the same period of 2022) was in connection with tailing management,

humanitarian assistance, payroll, legal services, water supply, among others. In the three-month period ended March 31, 2023, we also

used a total amount of cash of US$78 million in matters related to the de-characterization of dams, compared to US$69 million for the

same period of 2022.

In the three-month period ended March 31, 2023, we also used

a total amount of cash of US$77 million in matters related to the collapse of Samarco’s dam, which has been entirely contributed

to Fundação Renova to be used in the reparation programs, in accordance with the Framework Agreement.

Capital expenditures

Our capital expenditures in the three-month period ended March

31, 2023 amounted to US$1,130 million, including US$804 million dedicated to sustaining our existing operations and US$326 million for

project execution (construction in progress).

Distributions and repurchases

Distributions.

In the three-month period ended March 31, 2023,

we paid dividends and interest on shareholders’ equity in the total amount of US$1,823 million, of which US$1,386 million was minimum

mandatory remuneration, and US$437 million as additional remuneration.

Repurchases.

In the three-month period ended March 31, 2023,

we repurchased 44,538,571 common shares and their respective ADRs, corresponding to the total amount of US$763 million.

Tax payments

We paid US$243 million in income tax in the three-month period

ended March 31, 2023, excluding the payments in connection with REFIS (a tax settlement program), compared to US$2,490 million in income

tax for the same period of 2022. In the three-month period ended March 31, 2023, we paid a total of US$94 million in connection with the

REFIS, compared to US$87 million for the same period of 2022.

Liability Management

In the three-month period ended March 31, 2023, we repaid

US$39 million (US$395 million for the same period of 2022) under our financing agreements.

Debt

As of March 31, 2023, our total outstanding debt was

US$11,464 million (including US$11,312 million of principal and US$152 million of accrued interest), compared with US$11,181 million

as of December 31, 2022. As of March 31, 2023, the weighted average of the remaining term of our debt was 8.4 years, compared

to 8.7 years as of December 31, 2022.

As of March 31, 2022, our short-term debt and the current

portion of long-term debt was US$355 million, compared to US$307 million as of December 31, 2022, including accrued interest.

Our major categories of long-term indebtedness are described

below. The principal amounts shown below, excluding accrued interest.

| |

· |

U.S. dollar-denominated loans and financings (US$4,512

million as of March 31, 2023 and US$4,212 million as of December

31, 2022). This category includes export financing lines, loans from export credit agencies, and loans from commercial banks and multilateral

organizations; |

| |

· |

U.S. dollar-denominated fixed rate notes (US$6,157

million as of March 31, 2023 and US$6,157 million as of December

31, 2022). Our subsidiary Vale Overseas Limited has outstanding debt securities guaranteed by Vale totaling US$5,593 million,

compared to US$5,878 million as of December 31, 2022. Our subsidiary Vale Canada has outstanding

fixed rate note in the amount of US$279 million as of March 31, 2023, compared to US$279

million as of December 31, 2022; |

| |

· |

Other debt (US$440

million as of March 31, 2023 and US$505 million as of December

31, 2022). We have outstanding debt, principally owed to BNDES, Brazilian commercial banks and holders of infrastructure debentures,

denominated in Brazilian reais and other currencies. |

As of March 31, 2023, we have two revolving credit facilities

with syndicates of international banks, which will mature in 2024 and 2026. The revolving credit lines, which are committed, allow more

efficient cash management, consistent with our strategic focus on reducing cost of capital. We currently have US$5 billion available under

these two revolving credit lines which can be drawn by Vale, Vale Canada and Vale International.

Some of our long-term debt instruments contain financial covenants

and most include cross acceleration provisions. 21.8% of the aggregate principal amount of our total debt require that we maintain, as

of the end of each quarter, (i) a consolidated ratio of total debt to adjusted EBITDA for the past 12 months not exceeding 4.5

to one and (ii) a consolidated interest coverage ratio of at least 2.0 to one. These covenants appear in our financing agreements

with BNDES, with other export and development agencies and with some other lenders. As of March 31, 2023, we were in compliance with our

financial covenants.

As of March 31, 2023, the corporate financial guarantees we

provided (within the limit of our direct or indirect interest) for certain associates and joint ventures totaled US$264 million, compared

to US$1,522 million as of December 31, 2022.

In a broader view, the sum of our net debt, with other

commitments with respect to leases, currency swaps, and provisions for Brumadinho and Mariana reparations, increased in the three-month

period ended March 31, 2023 by US$218 million to US$14,358 million as of March 31, 2023, from US$14,140 million as of December 31, 2022.

Recent Developments

Sale of interest in Mineração Rio do Norte

S.A.

On April 27, 2023, we entered into an agreement with Ananke

Alumina S.A., a subsidiary of Norsk Hydro ASA, to sell our 40% equity interest in Mineração Rio do Norte S.A. (“MRN”),

along with all obligations and rights associated with our equity interest. The completion of this transaction is subject to regulatory

approvals. MRN, situated in the state of Pará, Brazil, is the country's largest producer and exporter of bauxite.

Recent Changes in our Board of Directors and Fiscal Council

On April 28, 2023, we held our Annual and Extraordinary Shareholders’

Meeting, during which we elected the following members to our Board of Directors and Fiscal Council, all of whom will serve a term of

office until our Annual Shareholders’ Meeting in 2025:

Board of Directors:

| · | Mr. Daniel André Stieler; |

| · | Mr. Marcelo Gasparino da Silva; |

| · | Mr. Andre Viana Madeira; |

| · | Mr. Douglas James Upton; |

| · | Mr. Fernando Jorge Buso Gomes; |

| · | Mr. José Luciano Duarte Penido; |

| · | Mr. Luis Henrique Cals de Beauclair Guimarães; |

| · | Mr. Manuel Lino Silva de Sousa Oliveira; |

| · | Mr. Paulo Cesar Hartung Gomes; |

| · | Ms. Rachel de Oliveira Maia; |

Mr. Daniel André Stieler has been appointed Chairman

of our Board of Directors, and Mr. Marcelo Gasparino da Silva has been appointed Deputy Chairman of our Board of Directors. Mr. Wagner

Vasconcelos Xavier has been elected an alternate member of Mr. Andre Viana Madeira, and both were elected by Vale’s employees.

Mr. Douglas James Upton, Mr. José Luciano Duarte Penido,

Mr. Luis Henrique Cals de Beauclair Guimarães, Mr. Manuel Lino Silva de Sousa Olivera, Mr. Marcelo Gasparino da Silva, Mr. Paulo

Cesar Hartung Gomes, Ms. Rachel de Oliveira Maia, and Ms. Vera Marie Inkster satisfy the independence criteria provided for by the Novo

Mercado Regulations of B3 S.A. - Brasil, Bolsa, Balcão, CVM Resolution No. 80/2022, and our bylaws.

Below are the biographies of the members of our Board of Directors:

Daniel André Stieler

For information on the biography of Mr. Daniel André

Stieler, please refer to page 151 of our 2022 annual report on Form 20-F.

Marcelo Gasparino da Silva

For information on the biography of Mr. Marcelo Gasparino

da Silva, please refer to page 152 of our 2022 annual report on Form 20-F.

Andre Viana Madeira

Position: Member of the Board of Directors elected by Vale's

employees (where he has held the position of Alternate Member of Vale's Board of Directors since May 2021), where he also holds the position

of Non-Independent Member of the Innovation Committee (since May 2022). Main experiences in the last five years: (i) non-independent

member of the defunct Vale Operational Excellence and Risk Committee (from May 2021 to December 2022); and (ii) Member of the Deliberative

Council of PASA/AMS (since 2022). Education: Graduated in Law at the Centro de Ensino Superior de ltabira, in December 2009, and in Theology

at Escola Bíblica Permanente Sião - EBPS, in July 2006, and is studying Law at Centro Universitario FUNCESI in the city

of Itabira.

Douglas James Upton

Position: Independent member of Vale's Board of Directors.

Main experience in last five years: worked as: (i) partner responsible for investments in metals and mining at Capital Research Company

(August 2004 to January 2023). Education: Undergraduate degree in Science from University of Western Australia. 1981: Master's in Business

Administration from University of Western Australia, 1988.

Fernando Jorge Buso Gomes

For information on the biography of Mr. Fernando Jorge Buso

Gomes, please refer to page 150 of our 2022 annual report on Form 20-F.

João Luiz Fukunaga

Position: Member of Vale's Board of Directors. Main experience

in last five years: Worked as: (i) President of PREVI - Banco do Brasil Employees Pension Fund (since February/2023); (ii) Officer (2012

to February/2023), National Coordinator of the BB Employee Trading Commission (since 2019); Secretary of Legal Affairs since (2017), responsible

for the Organization and Administrative Support area (from 2020 to February/2023) and Union Auditor of the Bank Workers Union of São

Paulo (2022 to February /2023). Education: Undergraduate degree in History from Pontifical Catholic University of São Paulo - PUCSP,

2007; Master's in Social History from Pontifical Catholic University of São Paulo - PUC-SP, 2009.

José Luciano Duarte Penido

For information on the biography of Mr. José Luciano

Duarte Penido, please refer to page 150 of our 2022 annual report on Form 20-F.

Luis Henrique Cals de Beauclair Guimarães

Position: Independent member of Vale’s Board of Directors.

Main experiences in the last five years: Worked as: (i) Chief Executive Officer (since April/ 2020), member of the Board of Directors

(since July/2020) of Cosan S.A.; (ii) member of the Board of Directors (since April/2020), Chief Executive Officer (April/2016 to April/2020)

of Raizen S.A.; (iii) member of the Board of Directors of Compass Gase Energia S.A. (July/2020 to March/2023); (iv) member of the Board

of Directors of Companhia de Gas São Paulo – Comgas (December/2012 to March 2023); (v) Deputy Chairman of the Board of Directors

of Rumo S.A. (November/2020 to March/2023); (vi) member of the Board of Directors of Cosan Luber Invested Limited (since August /2020);

(vi) member of the Board of Directors of Cosan Lubrificantes e Especialidades S.A. (since October/ 2020); (viii) member of the Board of

Directors of Logum Logistica S.A. (since June/ 2016): (ix) Chief Executive Officer of the Brazilian Association of Listed Companies (ABRASCA):

(x) member of the Board of Directors of Radar Property Agrfco las S.A. (June/2020 to February/2023): (x i) member of the Board of Directors

of Radar II Property Agricolas S.A. (June/2020 to February/2023): (xii) member of the Board of Directors of Janus Brasil Participações

S.A. (June/2020 to February/2023); (xiii) member of the Board of Directors of Tellus Brasil Participações S.A. (June/ 2020

to February/2023); (xiv) member of the Board of Directors of Duguetiapar Empreendimentos e Participações S.A. (October/2020

to February/2023); (xv) member of the Board of Directors of Gamiovapar Empreendimentos e Participações S.A. (October/2020

to February/2023); (xvi) member of the Board of Directors of Rede lntegrada de Lojas de Conveniencia e Proximidade S.A. (October/2019

to February/2023); and (xvii) Chief Executive Officer (April/2016 to April/2020) and member of the Board of Directors (April /2020 to

June/ 2021) of Raizen Energia S.A. Education: Graduation in Statistical Sciences from the Brazilian Institute of Geography and Statistics

(IBGE) in 1987; MBA in Business Administration from Coppead Institute for Graduate Studies and Research in Business Administration - UFRJ

in 1993.

Manuel Lino Silva de Sousa Oliveira

For information on the biography of Mr. Manuel Lino Silva

de Sousa Oliveira, please refer to page 152 of our 2022 annual report on Form 20-F.

Paulo Cesar Hartung Gomes

Position: Independent member of Vale's Board of Directors.

Main experience in last five years: Worked as: (i) Executive president of Iba - lndustria Brasileira de Arvores (since March 2019). Education:

Undergraduate degree in Economics from Espirito Santo Federal University, 1978.

Rachel de Oliveira Maia

For information on the biography of Ms. Rachel de Oliveira

Maia, please refer to page 153 of our 2022 annual report on Form 20-F.

Shunji Komai

Position: Member of Vale's Board of Directors. Main experience

in last five years: Worked as: (i) Senior Director, Vale businesses (since February 2023), deputy General Manager, new metals and aluminum

(July 2021 to October 2021) and General Manager, Brazilian business department (April 2012 to August 2020) at Mitsui & CO. LTD.; (ii)

Vice president of Mitsui & CO. (Brasil) S.A. (since February 2023); and (iii) CEO and President of Mitsui & CO. Mineral Resources

Development (Asia) (November 2021 to January 2023). Education: Undergraduate degree in Arts, Foreign Languages from Dokkyo University,

1994.

Vera Marie Inkster

Position: Independent member of Vale's Board of Directors.

Main experience in last five years: Worked as: (i) member of Board of Directors, Chairwoman of Audit Committee and member of Remuneration

Committee at Lucara Diamond Corp (since June 2014); (ii) President (September 2018 to September 2021) and CEO (September 2018 to September

2021), Director (September 2018 to December 2021) and Chief Financial Officer (May 2009 to September 2018) of Lundin Mining Corp; and

(iii) President (November 2020 to January 2022) and Director (October 2018 to January 2022) of International Zinc Association. Education:

Undergraduate degree in Business Administration from St. Francis Xavier University, Canada, 1993; Chartered Professional Accountant graduate

qualification from Institute of Chartered Accountants of Ontario, 1998.

Fiscal Council:

| · | Mr. Gabriel Muricca Galípolo (with Mr. Adriano Pereira de Paula as alternate member); |

| · | Mr. Márcio de Souza (with Ms. Ana Maria Loureiro Recart as alternate member); |

| · | Mr. Paulo Clovis Ayres Filho (with Mr. Guilherme José de Vasconcelos Cerqueira as alternate member); |

| · | Mr. Raphael Manhães Martins (with Ms. Adriana de Andrade Solé as alternate member); and |

| · | Ms. Heloísa Belotti Bedicks (with Ms. Jandaraci Ferreira de Araujo as alternate member). |

Below are the biographies of the members of our Fiscal Council:

Gabriel Muricca Galípolo

Position: Member of the Audit Committee. Main experiences

in the last five years: Professor of the PPPs and Concessions MBA at the São Paulo School of Sociology and Politics Foundation

(since 2007); Chairman of Banco Fator S.A. (2017 to 2021); Executive Secretary (since January 2023) of the Ministry of finance (Federal

Public Administration). Education: Graduated in Economic Sciences from PUC/SP in December 2004, completed a Master's/Specialization in

Political Economy from PUC/SP in December 2008.

Márcio de Souza

For information on the biography of Mr. Márcio de Souza,

please refer to page 161 of our 2022 annual report on Form 20-F.

Paulo Clovis Ayres Filho

Position: Member of the Audit Committee. Main experiences

in the last five years: He has held a number of roles at the British American Tobacco Company, both in Brazil and in the UK, where he

held duties from 1985 to 2019, going through areas like financial, controllership, treasury, investor relations, governance relations

and auditing. He also held the position of CEO and was responsible for the company's global strategy. Education: Graduated in Engineering

and Economics from University of São Paulo.

Raphael Manhães Martins

For information on the biography of Mr. Raphael Manhães

Martins, please refer to page 161 of our 2022 annual report on Form 20-F.

Heloísa Belotti Bedicks

For information on the biography of Ms. Heloísa Belotti

Bedicks, please refer to page 160 of our 2022 annual report on Form 20-F.

Recent Changes in our Advisory Committees

On May 15, 2023, our Board of Directors approved the

appointment or reappointment, as the case may be, of the following members to compose the Advisory Committees of our Board of Directors,

all of whom will serve a term of office until our Annual Shareholders’ Meeting in 2025:

| · | Audit and Risks Committee: Manuel Lino Silva de Sousa Oliveira (Coordinator and Financial Specialist),

Rachel de Oliveira Maia and Vera Marie Inkster; |

| · | Capital Allocation and Projects Committee: Luis Henrique Cals de Beauclair Guimarães (Coordinator),

Daniel André Stieler, Fernando Jorge Buso Gomes, José Luciano Duarte Penido and Marcelo Gasparino da Silva; |

| · | Innovation Committee: José Luciano Duarte Penido (Coordinator), Fernando Jorge Buso Gomes,

Paulo Cesar Hartung Gomes, Shunji Komai and Wagner Vasconcelos Xavier; |

| · | Nomination and Governance Committee: Daniel André Stieler (Coordinator), Marcelo Gasparino

da Silva and Vera Marie Inkster; |

| · | People and Compensation Committee: João Luiz Fukunaga (Coordinator), Luis Henrique Cals

de Beauclair Guimarães, Manuel Lino Silva de Sousa Oliveira and Shunji Komai; and |

| · | Sustainability Committee: Rachel de Oliveira Maia (Coordinator), João Luiz Fukunaga, Paulo

Cesar Hartung Gomes and Andre Viana Madeira. |

Updates on legal proceedings

As reported in our annual report on Form 20-F, in March 2023,

as part of a proceeding related to a potential increase on the number of territories recognized as affected by the collapse of Samarco's

Fundão dam and covered by the TTAC, a federal court issued a decision ordering BHP Brasil and us to make judicial deposits in the

total amount of R$10.3 billion, to be divided between the companies. On April 28th, as requested in our appeal, the court granted

us an injunction suspending the deposit order. Authorities may appeal this decision. We will continue to vigorously contest this action,

which we believe is without merit.

As described in our annual report on Form 20-F, we have entered

into an agreement to settle a public civil action brought by the labor prosecutor's office of the state of Pará before the labor

court of Marabá, related to work safety measures and access to Self-Rescue Zone of the Mirim dam, in Carajás. Although we

have complied with most of the obligations assumed in this settlement agreement, we have not yet concluded some of the measures required

under the agreement. Under the settlement agreement, we are subject to monetary penalties in case the breach persists after a cure period

established therein, but we cannot guarantee that authorities would not seek measures to suspend our operations at the Mirim dam, which

could cause the suspension of our Salobo operations. This dam has all licenses required to operate, and we expect to conclude all work

safety measures required under the agreement within the next months.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VALE S.A.

|

| |

|

| |

|

|

| |

By: |

/s/ Ivan Fadel |

| |

|

Name: Ivan Fadel

Title: Head of Investor Relations |

| |

|

|

| |

|

|

| |

|

|

| Date: June 7, 2023 |

|

|

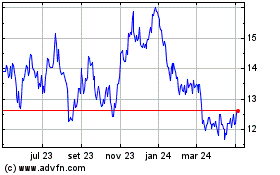

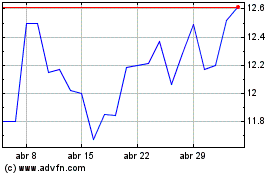

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Vale (NYSE:VALE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024