Execution Version

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

VIASAT, INC.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

92552V100

(CUSIP Number)

Julie Outouchent

Triton LuxTopHolding SARL

1-3 Boulevard de la Foire

Luxembourg, L-1528

Tel: +352 26 86 87 42

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 30, 2023

(Date

of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-l(e),

240.13d-l(f) or 240.13d-l(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

| |

The information required on the remainder of this cover page shall not be deemed to be “filed” for

the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

| CUSIP No. 92552V100 |

|

13D |

|

Page

2

of 8 Pages |

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons

Triton LuxTopHolding SARL |

| 2. |

|

Check The Appropriate Box

if a Member of a Group (See Instructions) (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| 6. |

|

Citizenship or Place of

Organization

Luxembourg |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

11,356,776 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

11,356,776 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

11,356,776 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13. |

|

Percent of

Class Represented by Amount in Row (11) 9.21% (1) |

| 14. |

|

Type of Reporting Person

(See Instructions) OO |

| (1) |

Based on 123,276,396 shares of Common Stock outstanding as of May 30, 2023, based on information provided

by the Issuer. |

|

|

|

|

|

| CUSIP No. 92552V100 |

|

13D |

|

Page

3

of 8 Pages |

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons

Apax IX GP Co. Limited |

| 2. |

|

Check The Appropriate Box

if a Member of a Group (See Instructions) (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

OO |

| 5. |

|

Check if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| 6. |

|

Citizenship or Place of

Organization

Guernsey |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

11,356,776 |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

11,356,776 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

11,356,776 |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13. |

|

Percent of

Class Represented by Amount in Row (11) 9.21% (1) |

| 14. |

|

Type of Reporting Person

(See Instructions) OO |

| (1) |

Based on 123,276,396 shares of Common Stock outstanding as of May 30, 2023, based on information provided

by the Issuer. |

|

|

|

|

|

| CUSIP No. 92552V100 |

|

13D |

|

Page

4

of 8 Pages |

Item 1. Security and Issuer.

This statement relates to the common stock, par value $0.0001 per share (the “Common Stock”), of Viasat, Inc., a Delaware corporation

(“Viasat” or the “Issuer”). The principal executive offices of the Issuer are located at 6155 El Camino Real, Carlsbad, California 92009.

Item 2. Identity and Background.

(a) Names of

Persons Filing

This statement is filed on behalf of each of the following entities (collectively, the “Reporting Persons”):

| 1. |

Triton LuxTopHolding SARL (“Triton LuxTop”) |

| 2. |

Apax IX GP Co. Limited (“Apax IX”) |

The agreement among the Reporting Persons to file jointly (the “Joint Filing Agreement”) is attached as Exhibit A hereto and incorporated herein by

reference. The execution and filing of such joint filing agreement shall not be construed as an admission that the Reporting Persons are a group, or have agreed to act as a group.

(b) Residence or business address

The address of the

principal business and principal office of each of the Reporting Persons is:

1. Triton LuxTop

1-3 Boulevard de la Foire, Luxembourg, L-1528; and

2, Apax IX

Third Floor Royal Bank Place, 1 Glategny Esplanade,

St Peter Port, Guernsey GY1 2HJ.

(c) The principal business of Triton LuxTop is investing in securities. The shareholders of Triton LuxTopHolding

SARL are Triton Lux EquityCo SARL and Connect Syndication L.P. Apax IX, in its capacity as ultimate general partner of the Apax IX Fund, is the sole shareholder of Triton Lux EquityCo SARL. Apax IX is also the sole shareholder of Connect Syndication

GP Co. Limited, the General Partner of Connect Syndication L.P. Additionally, Apax IX is the investment manager of each of Apax IX EUR L.P., Apax IX EUR Co Investment L.P., Apax IX USD L.P. and Apax IX USD Co Investment L.P. (together the “Apax

IX Fund”) and is controlled by a board of directors consisting of Elizabeth Burne, Simon Cresswell, Andrew Guille, Martin Halusa, Paul Meader and Jeremy Latham.

(d) None of the Reporting Persons has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during the past

five years.

(e) None of the Reporting Persons has been a party to any civil proceeding of a judicial or administrative body of competent

jurisdiction as a result of which such person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with

respect to such laws during the last five years.

(f) See responses to Item 6 on each cover page.

Item 3. Source and Amount of Funds or Other Consideration

The information in Item 4 of this Schedule 13D is incorporated herein by reference.

The description of the Purchase Agreement (as defined herein) contained in this Item 3 is not intended to be complete and is qualified in its entirety by

reference to the full text of the Purchase Agreement, a copy of which was filed as Exhibit 2.1 to the Current Report on Form 8-K filed by Viasat with the Securities and Exchange Commission (“SEC”) on

November 8, 2021 and is incorporated herein by reference, and the letter agreement, dated as of April 11, 2023, by and among Viasat and the shareholders of Inmarsat party thereto, a copy of which was filed as Exhibit 2.1(A) to the Annual

Report on Form 10-K filed by Viasat with the SEC on May 22, 2023 and is incorporated herein by reference.

|

|

|

|

|

| CUSIP No. 92552V100 |

|

13D |

|

Page

5

of 8 Pages |

Item 4. Purpose of Transaction.

On May 30, 2023, Viasat purchased all of the issued and outstanding shares of Connect Topco Limited, a private company limited by shares and incorporated

in Guernsey (“Inmarsat”), pursuant to the previously announced Share Purchase Agreement, dated as of November 8, 2021 (as amended, the “Purchase Agreement”), by and among Viasat, the shareholders of Inmarsat and the other

parties thereto (collectively, including certain parties entering into any subsequent joinder or deed of adherence thereto, the “Sellers”) in exchange for (i) cash consideration equal to $550.7 million, subject to adjustments,

and (ii) approximately 46.36 million unregistered shares of Common Stock, upon the terms and subject to the conditions set forth therein (the “Acquisition”).

At the closing of the Acquisition, Viasat issued an aggregate of 46,363,636 shares of Common Stock to the Sellers as the share consideration payable under the

Purchase Agreement. Additionally, Viasat entered into a registration rights agreement with certain Inmarsat shareholders, pursuant to which Viasat has agreed to file a registration statement to register the resale of the shares issued to such

Sellers in the Acquisition.

Additionally, on May 30, 2023, effective as of the closing of the Acquisition and in accordance with the terms of the

Purchase Agreement and the Stockholders Agreement, dated as of November 8, 2021 (the “Stockholders Agreement”), among Viasat and certain sellers (Triton LuxTopHolding SARL, CPP Investment Board Private Holdings (4) Inc., 2684343

Ontario Limited, and WP Triton Co-Invest, L.P. and certain parties entering into any subsequent joinder thereto, collectively referred to herein as the “Investor Sellers”), the size of the Viasat

board of directors (the “Viasat Board”) was increased from eight to ten directors and Andrew Sukawaty and Rajeev Suri were appointed (as the Investor Sellers’ designees) to fill the vacancies created by the new directorships. Messrs.

Sukawaty and Suri serve as Class I and III directors of the Viasat Board, respectively. In addition, effective as of the closing of the Acquisition, Mr. Sukawaty was appointed to the Compensation and Human Resource Committee of the Viasat

Board.

Under the Stockholders Agreement, the Investor Sellers have the right to designate two individuals for nomination to the Viasat Board for so long

as the Investor Sellers collectively beneficially own at least 25% of the total outstanding shares of Common Stock, and one individual for nomination to the Viasat Board for so long as the Investor Sellers collectively beneficially own at least 15%

of the total outstanding shares of Common Stock. In addition, the Stockholders Agreement imposes certain transfer restrictions with respect to the consideration shares issued to the Investor Sellers, including a prohibition on transfer during an

initial 180-day lock-up period and on transfers to Viasat competitors and certain other parties for so long as the Investor Sellers collectively beneficially own at

least 10% of the total outstanding shares of Common Stock, as well as customary standstill limitations.

The foregoing descriptions of the Purchase

Agreement and the Stockholders Agreement do not purport to be complete and are qualified in its entirety by reference to the full text of the Purchase Agreement, a copy of which was filed as Exhibit 2.1 to the Current Report on Form 8-K filed by Viasat with the Securities and Exchange Commission (“SEC”) on November 8, 2021 (as amended by the letter agreement, dated as of April 11, 2023, by and among Viasat and the

shareholders of Inmarsat party thereto, a copy of which was filed as Exhibit 2.1(A) to the Annual Report on Form 10-K filed by Viasat with the SEC on May 22, 2023 and is incorporated herein by reference)

and is incorporated herein by reference, and the full text of the Stockholders Agreement, a copy of which was filed as Exhibit 10.3 to the Current Report on Form 8-K filed by Viasat with the SEC on

November 8, 2021 and is incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

(a) The responses to Item 7-13 on each of the cover pages of this statement on Schedule 13D are incorporated

herein by reference.

(b) After giving effect to closing of the Acquisition, as of May 30, 2023, Triton LuxTop directly holds 11,356,776 shares

of Common Stock. The shareholders of Triton LuxTop are Triton Lux EquityCo SARL and Connect Syndication L.P. Apax IX, in its capacity as ultimate general partner of the Apax IX Fund, is the sole shareholder of Triton Lux EquityCo SARL. Apax IX is

also the sole shareholder of Connect Syndication GP Co. Limited, the General Partner of Connect Syndication L.P. Apax IX is the investment manager of each of Apax IX EUR L.P., Apax IX EUR Co Investment L.P., Apax IX USD L.P. and Apax IX USD Co

Investment L.P. (together the “Apax IX Fund”) and is controlled by a board of directors consisting of Elizabeth Burne, Simon Cresswell, Andrew Guille, Martin Halusa, Paul Meader and Jeremy Latham. Each of the Reporting Persons, the Apax IX

Fund and the foregoing board members disclaim their beneficial ownership of such shares of Common Stock except to the extent of a pecuniary interest held therein.

|

|

|

|

|

| CUSIP No. 92552V100 |

|

13D |

|

Page

6

of 8 Pages |

As a result of the Stockholders Agreement and the Coordination Agreement described in Item 6, the Investor

Sellers may be deemed to be members of a “group” within the meaning of Section 13(d)(3) of the Exchange Act. Such “group” would beneficially own an aggregate of 45,427,103 shares of Common Stock, representing 36.85% shares

of Common Stock outstanding as of May 30, 2023, based on information provided by the Issuer. The securities reported herein by the Reporting Persons do not include any Common Stock beneficially owned by the other parties to the Stockholders

Agreement or the Coordination Agreement not included as Reporting Persons on this Schedule 13D (the “Other Shares” and “Other Parties,” respectively). The Other Parties have been notified that they may need to file separate

beneficial ownership reports with the SEC related to their beneficial ownership of the Other Shares and membership in the “group” described herein. Neither the filing of this Schedule 13D nor any of its contents, however, shall be deemed

to constitute an admission by the Reporting Persons that any of them is the beneficial owner of any of Other Shares for purposes of Section 13(d) of the Act or for any other purpose, and such beneficial ownership is expressly disclaimed.

(c) The information set forth in Item 3 above is incorporated by reference into this Item 5(c).

(d) No other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the

shares of the Issuer’s Common Stock covered by this statement on Schedule 13D.

(e) Not applicable.

Item 6. Contacts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Coordination Agreement

On November 8, 2021, the

Investor Sellers, entered into a Coordination Agreement (the “Coordination Agreement”). Pursuant to the Coordination Agreement, the Investor Sellers agreed that, among other things, before an Investor Seller may exercise its rights under

the Registration Rights Agreement (as defined herein), to sell shares of Common Stock pursuant to an Organized Offering (as defined in the Coordination Agreement), such Investor Seller shall notify the other Investor Sellers at least three

(3) business days prior to taking any action under or pursuant to the Registration Rights Agreement. Each Investor Seller, upon a two (2) business days’ notice, shall have the opportunity to participate in such Organized Offering on a

pro rata basis. The Investor Sellers shall discuss and agree on the information to be included in such Organized Offering.

Pursuant to the Coordination

Agreement, in advance of any annual or special meeting of the stockholders of the Company at which any Investor Seller director is to be elected, re-elected or replaced, the Investor Sellers will meet and

decide the names of the individual(s) they shall designate to serve on the board of directors pursuant to the Stockholder Agreement.

Other holders of

Common Stock may become parties to the Coordination Agreement by executing a joinder to the Coordination Agreement in the form attached as Exhibit A to the Coordination Agreement and providing written notice to the other Investor Sellers.

The Coordination Agreement shall no longer apply to any Investor Seller when such Investor Seller ceases to hold at least three percent (3%) of the

outstanding shares of Common Stock of the Company. It shall also be terminated when the sellers own less than ten percent (10%) of the outstanding shares of Common Stock of the Company.

The foregoing description of the Coordination Agreement does not purport to be complete and is qualified in its entirety by reference to

the Coordination Agreement, a copy of which is filed as Exhibit B to this Schedule 13D and is incorporated by reference herein.

The filing of this

Schedule 13D shall not be deemed an admission that the Reporting Persons are members of a “group” for purposes of Section 13(d) of the Act, and the Reporting Persons expressly disclaim beneficial ownership of all securities held or

otherwise beneficially owned by the other parties to the Coordination Agreement. Upon information and belief, the Sellers acquired Common Stock pursuant to the Purchase Agreement and, as of May 30, 2023, beneficially own an aggregate of

45,427,103 shares of Common Stock.

Registration Rights Agreement

On May 30, 2023, the Sellers, entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with Viasat. Pursuant to the

Registration Rights Agreement, among other things and subject to certain restrictions, Viasat is required to file with the SEC a registration statement registering for resale the

|

|

|

|

|

| CUSIP No. 92552V100 |

|

13D |

|

Page

7

of 8 Pages |

shares of Viasat common stock issuable to the Sellers upon the completion of the transactions contemplated by the Purchase Agreement and to conduct certain underwritten offerings or facilitate

certain block trade transactions upon the request of holders of Registrable Securities (as defined in the Registration Rights Agreement). The Registration Rights Agreement also provides holders of Registrable Securities (as defined in the

Registration Rights Agreement) with certain customary piggyback registration rights.

The description of the Registration Rights Agreement contained in

this Item 6 is not intended to be complete and is qualified in its entirety by reference to the full text of the Registration Rights Agreement, a form of which was filed as Annex D to the definitive proxy statement filed by Viasat with the SEC on

May 20, 2022 and is incorporated herein by reference.

Item 7. Material to Be Filed as Exhibits

Exhibit A: Joint Filing Agreement, dated as of June 9, 2023, by and among the Reporting Persons.

Exhibit B: Coordination Agreement, dated as of November 8, 2021, by and among the Reporting Persons and the Issuer.

Exhibit C: Share Purchase Agreement, dated as of November 8, 2021, by and among Issuer and the shareholders of Connect Topco Limited party thereto

(incorporated by reference to the Issuer’s Exhibit 2.1 to the Issuer’s Current Report on Form 8-K filed on November 8, 2021).

Exhibit D: Stockholders Agreement, dated as of November 8, 2021, by and among Issuer and the shareholders of Connect Topco Limited party thereto

(incorporated by reference to the Issuer’s Exhibit 10.3 to the Issuer’s Current Report on Form 8-K filed on November 8, 2021).

Exhibit E: Registration Rights Agreement, dated as of May 30, 2023, by and among Triton LuxTopHolding SARL, CPP Investment Board Private Holdings

(4) Inc., Ontario Teachers’ Pension Plan Board, WP Triton Co-Invest, L.P., Pretzel Logic BV and the Issuer (incorporated by reference to the Issuer’s Annex D to the Issuer’s Definitive

Proxy Statement filed on May 20, 2022).

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: June 9, 2023

|

|

|

| Triton LuxTopHolding SARL |

|

|

| By: |

|

/s/ Julie Outouchent |

| Name: |

|

Julie Outouchent |

| Title: |

|

Authorised signatory |

|

|

| By: |

|

/s/ Laurent Thailly |

| Name: |

|

Laurent Thailly |

| Title: |

|

Authorised signatory |

|

| Apax IX GP Co. Limited |

|

|

| By: |

|

/s/ Jeremy Latham |

| Name: |

|

Jeremy Latham |

| Title: |

|

Director |

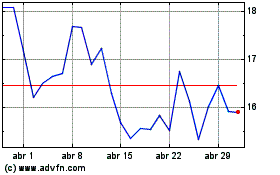

ViaSat (NASDAQ:VSAT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

ViaSat (NASDAQ:VSAT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024